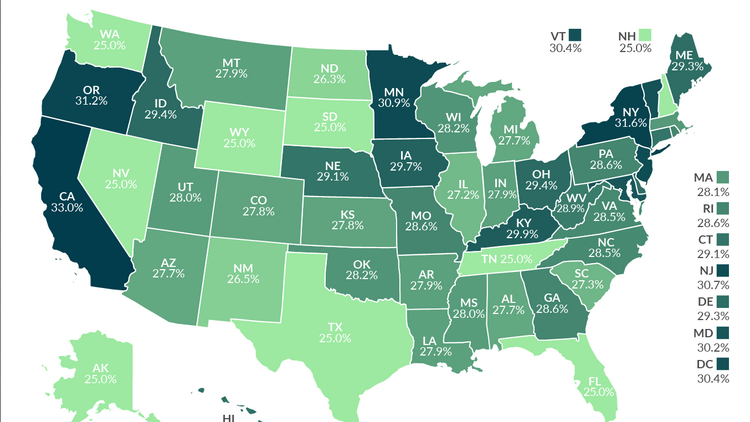

Georgia Income Tax Rate

Corporations may also have to pay a net worth tax.

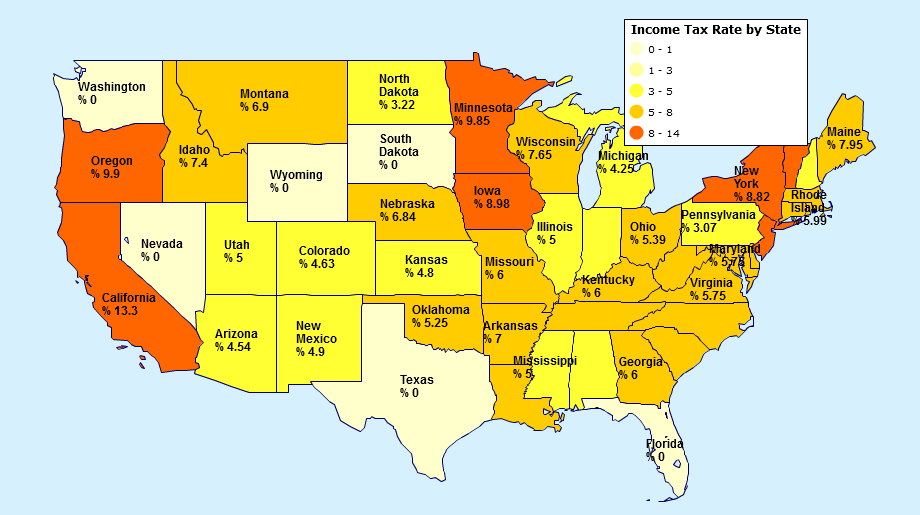

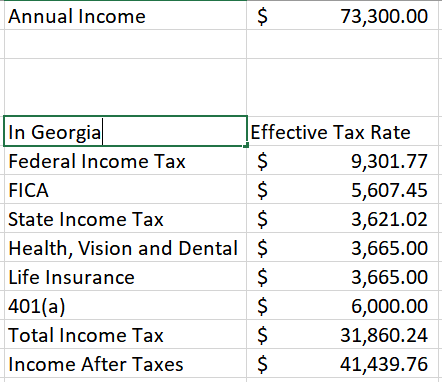

Georgia income tax rate. State employers in georgia withhold a certain amount of federal and fica taxes from each of your paychecks to send to the irs. This years individual income tax forms. The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 6.

Popular online tax services. Georgia has no inheritance or estate taxes. In georgia different tax brackets are.

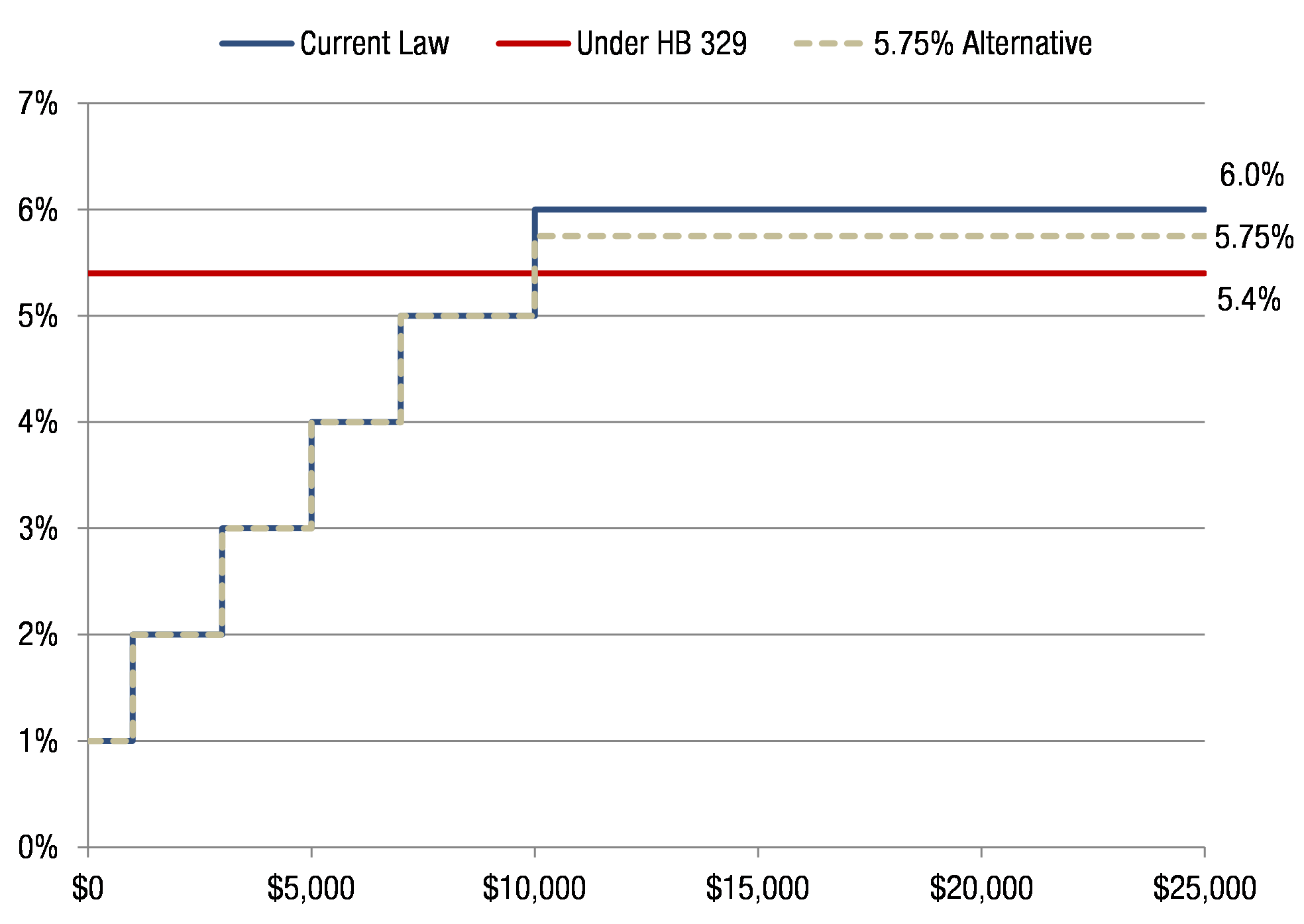

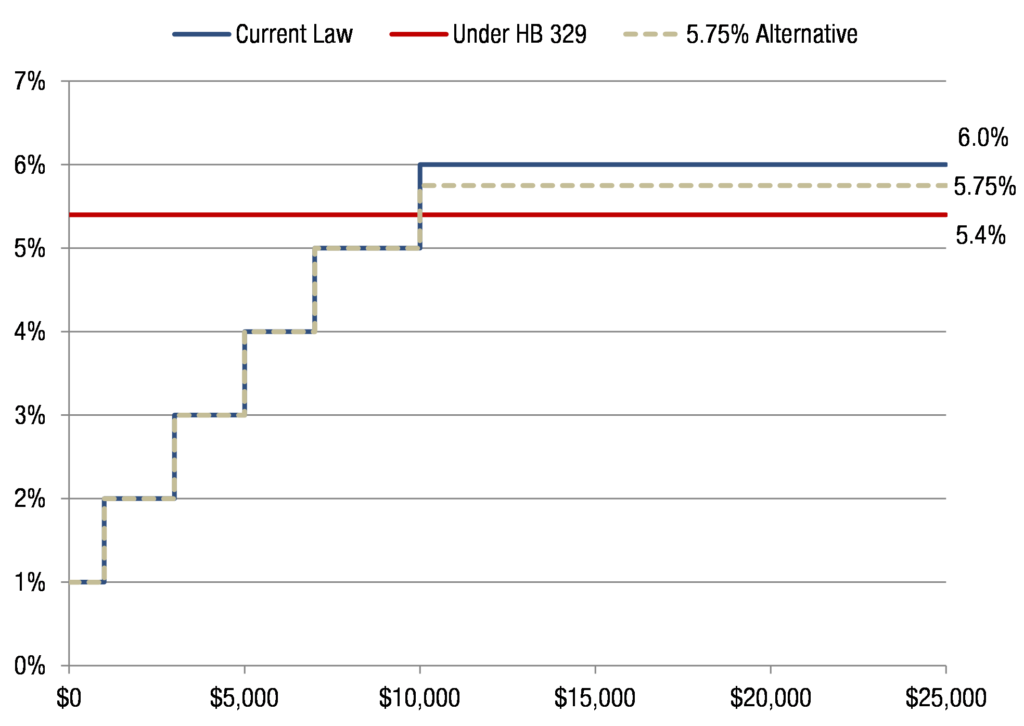

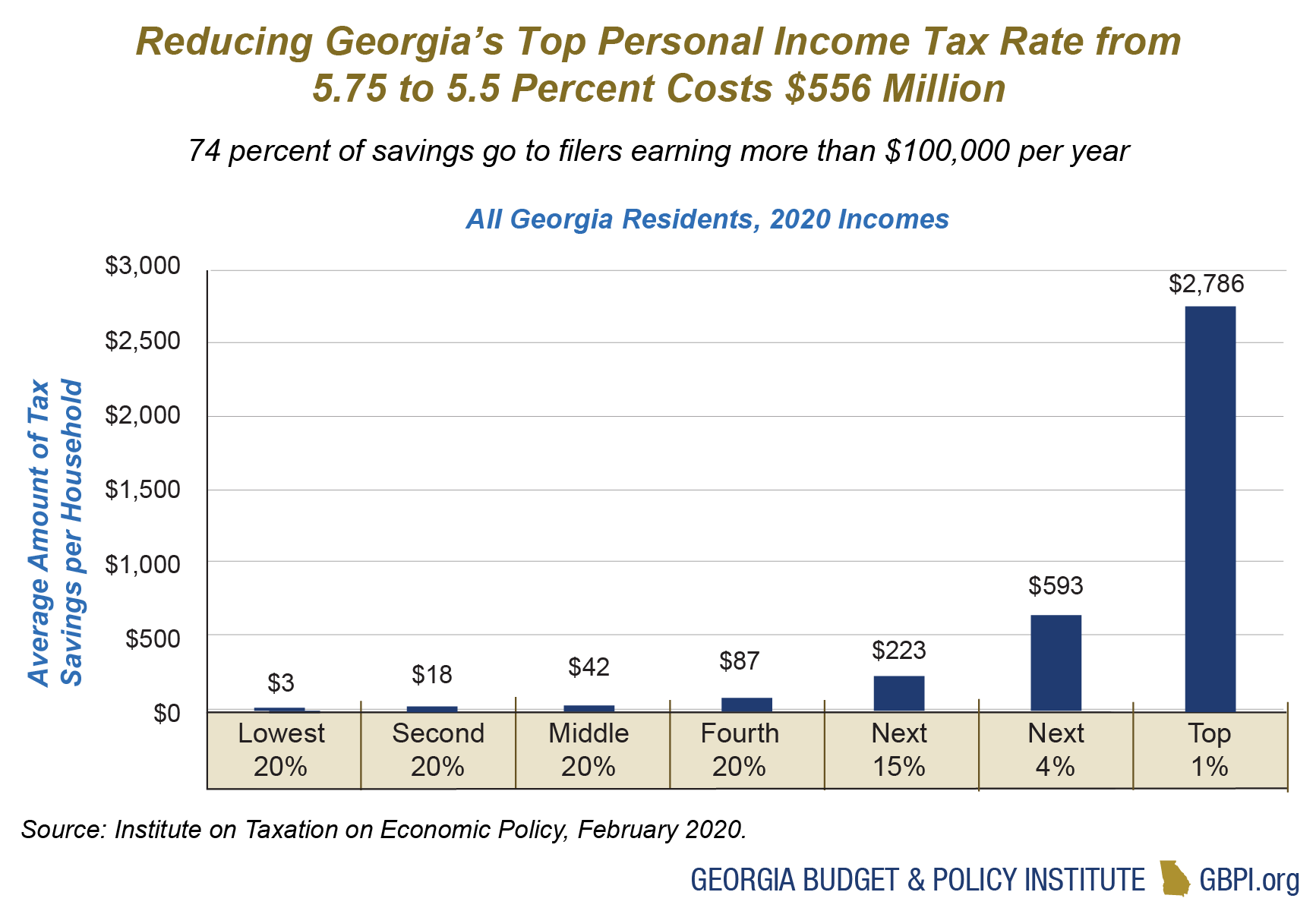

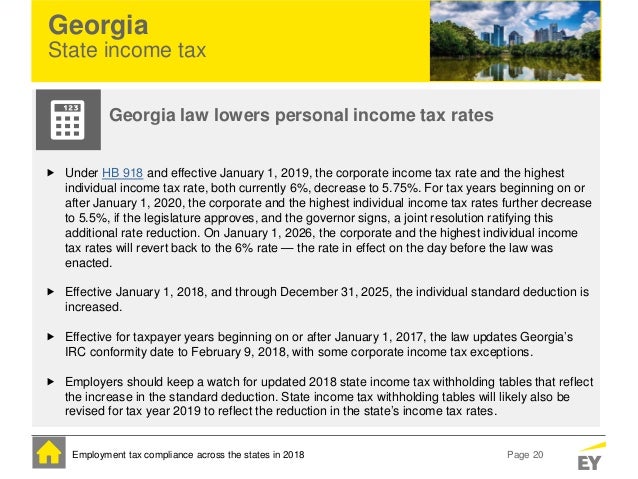

The rate of taxation is five and three quarters percent 575 of a corporations georgia taxable net income. The top georgia tax rate has decreased from 6 to 575 while the tax brackets are unchanged from last year. The generally applicable tax rate in muscogee county is 8 state sales tax at the statewide rate of 4 plus 4 local sales taxes at a rate of 1 each.

Detailed georgia state income tax rates and brackets are available on this page. The tax rate for the first 500000 of a motor vehicle sale is 7 because the 1 2nd lost does not apply. Corporations that own property do business in georgia or receive income from georgia sources are subject to corporate income tax.

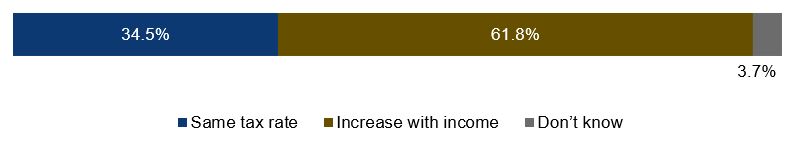

As is the case in every us. Each marginal rate only applies to earnings within the applicable marginal tax bracket. Income tax income tax federal tax changes.

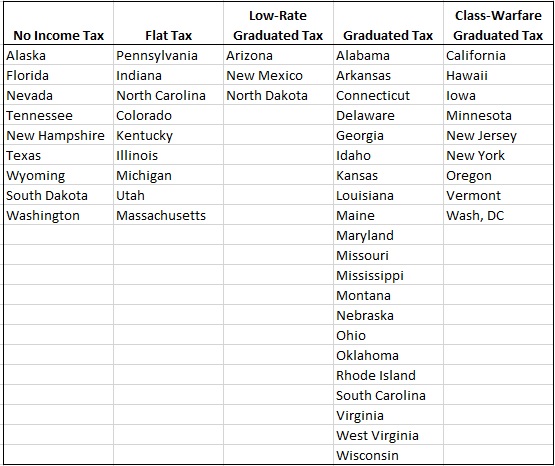

The georgia income tax has six tax brackets with a maximum marginal income tax of 575 as of 2020. Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575. The states sales tax rates and property tax rates are both relatively moderate.

The irs puts. Outlook for the 2020 georgia income tax rate is for the top tax rate to decrease further from. Georgia income tax rate.

Search for income tax statutes by keyword in the official code of georgia. Filing state taxes the basics. Georgia income tax rate and tax brackets shown in the table below are based on income earned between january 1 2019 through december 31 2019.

Higher earners pay higher rates although georgias brackets top out at 7000 for single filers which means the majority of full time workers will pay the top rate. Census bureau number of cities that have local income taxes. How your georgia paycheck works.

Georgia has six marginal tax brackets ranging from 1 the lowest georgia tax bracket to 575 the highest georgia tax bracket. Georgias income tax rates were last changed two years ago for tax year 2018 and the tax brackets were previously changed in 2009.