Georgia Income Tax Rate For Seniors

Have you used turbotax or some other means to file your state tax return.

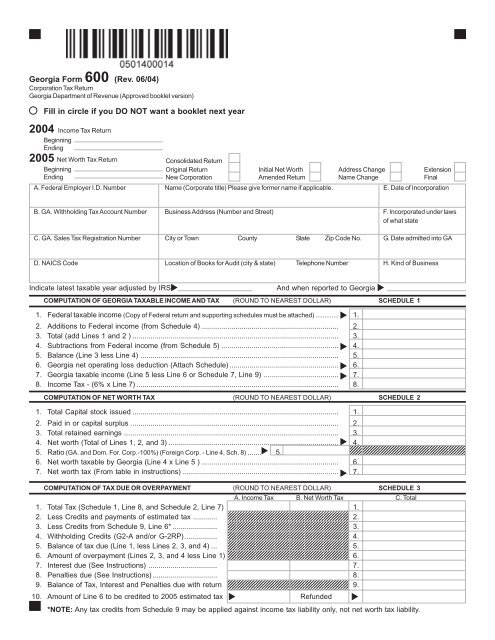

Georgia income tax rate for seniors. See form it 511 for the retirement income exclusion worksheet to calculate the maximum allowable adjustment for this year. Detailed georgia state income tax rates and brackets are available on this page. Tax benefits in georgia.

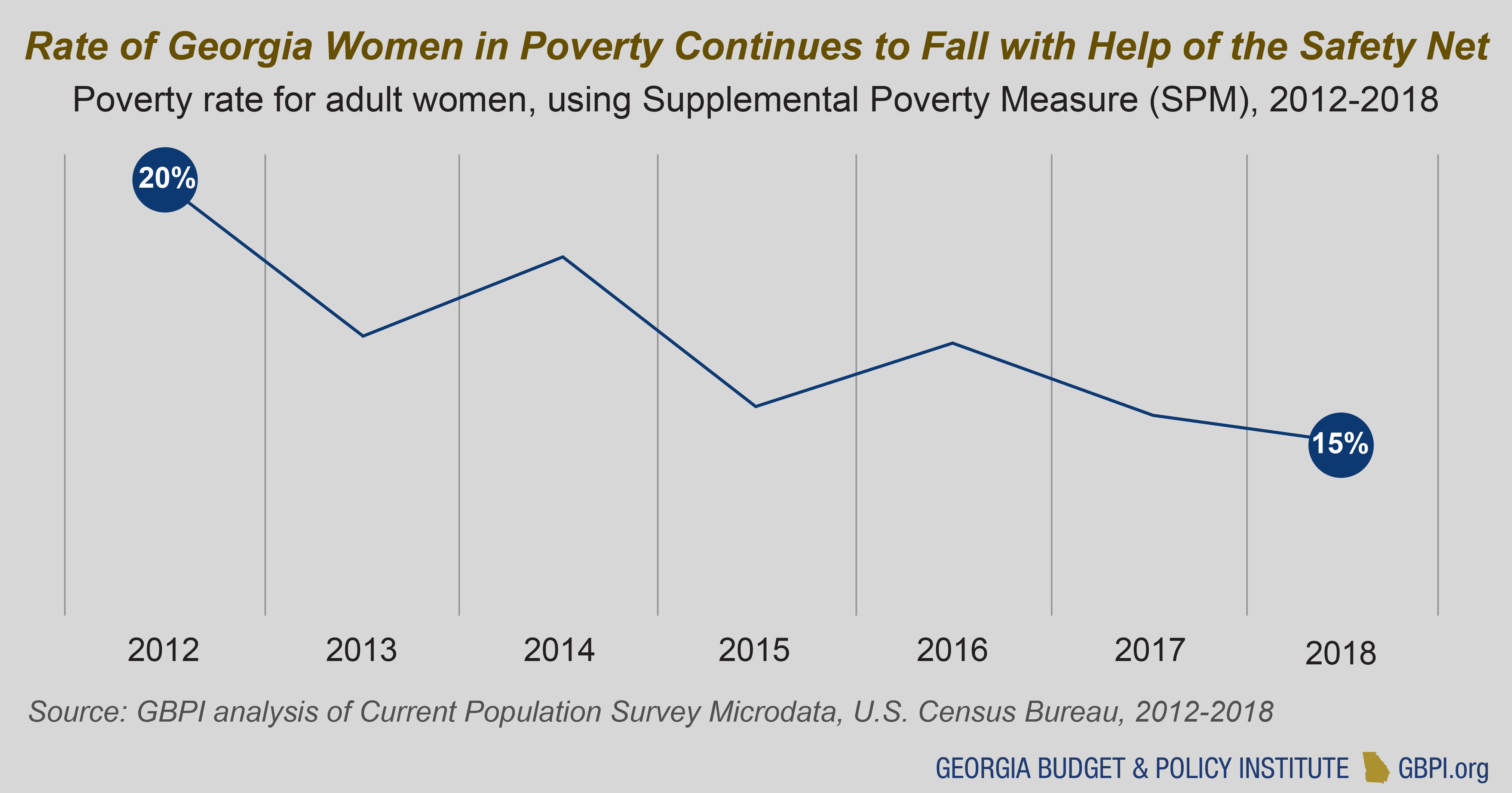

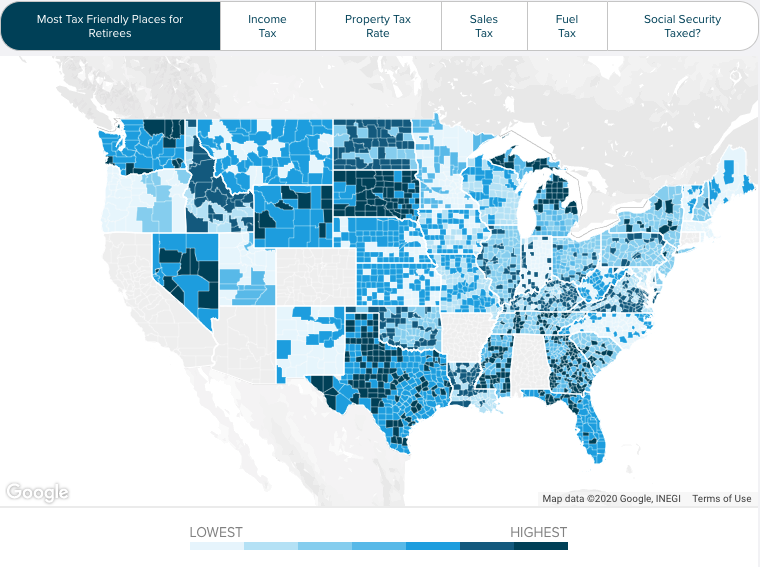

At age 65 or older you are eligible to exclude up to. However georgia remains among the top 10 tax friendly states for retirees as ranked by kiplinger in 2017. Interest dividends net rentals capital gains royalties pensions annuities and the first 400000 of.

On your georgia state income tax return form 500. Each marginal rate only applies to earnings within the applicable marginal tax bracket. Georgia has no inheritance or estate taxes.

State of georgia income tax retirement income exclusion for 2018 currently in georgia at age 62 citizens may exempt all retirement income from state income tax. You dont have to be retired just have retirement income which is defined as follows. Retirement income includes items such as.

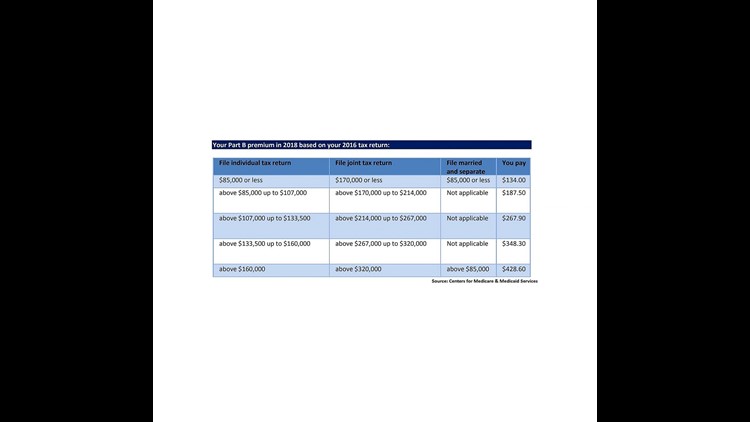

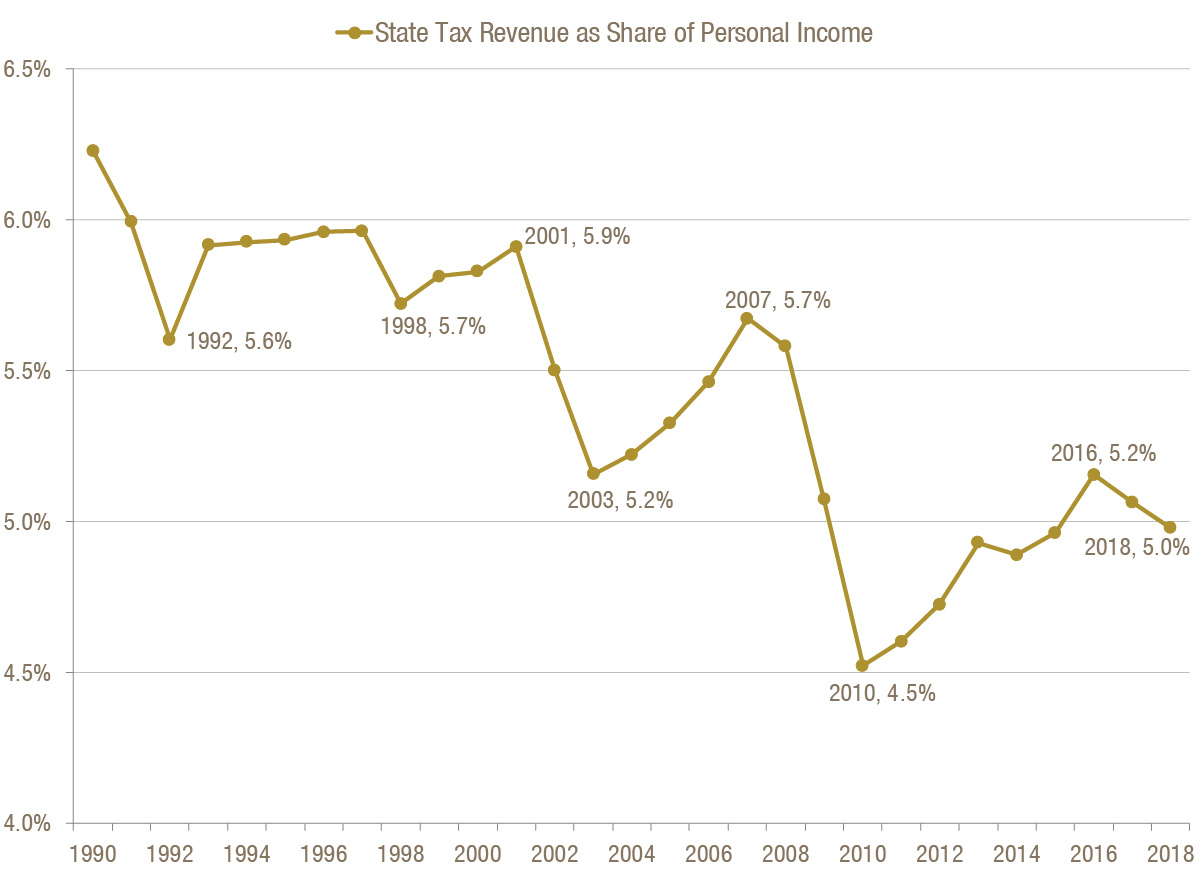

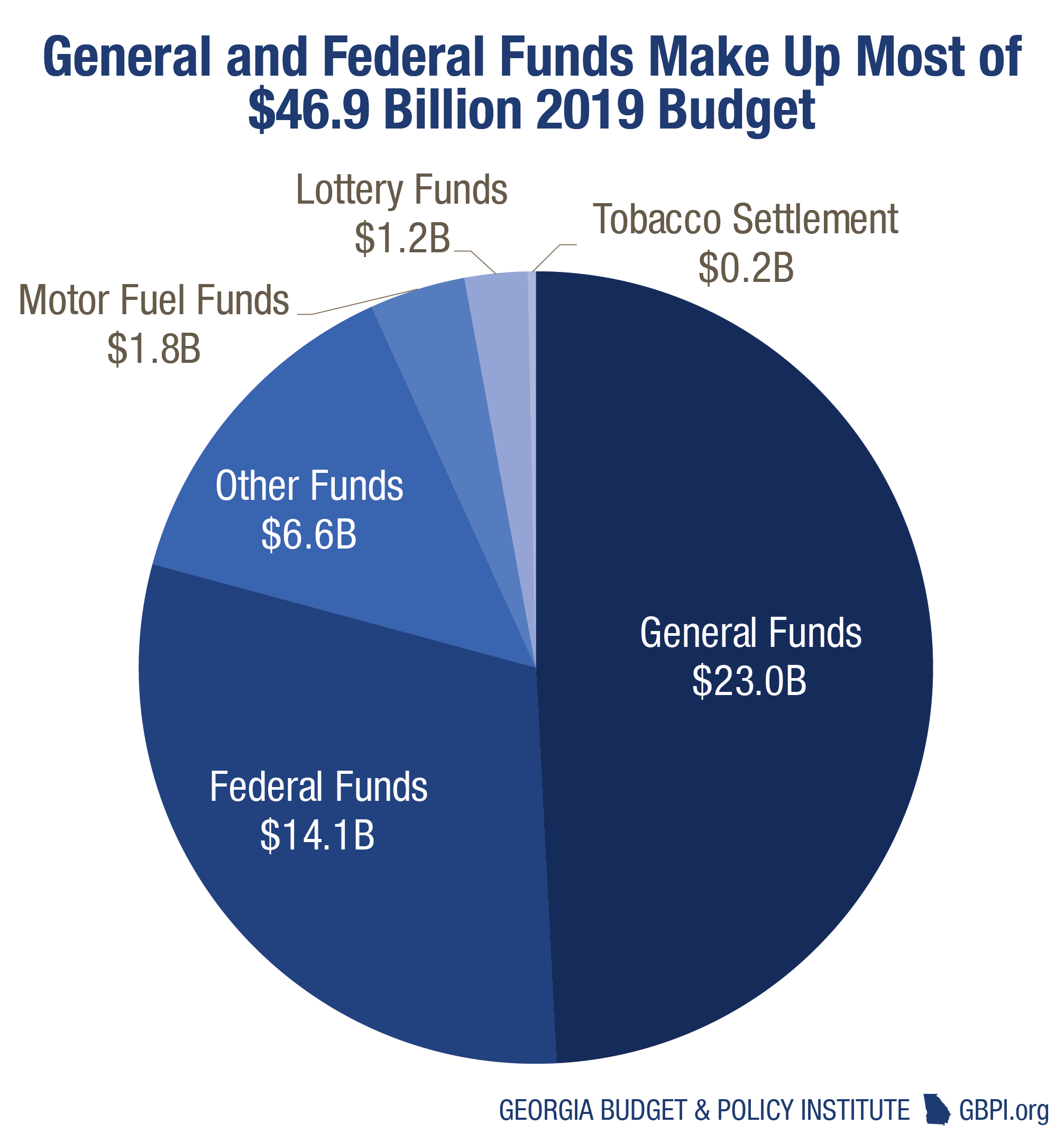

Georgia does not tax social security retirement benefits and provides a maximum deduction of 65000 per person on all types of retirement income for anyone 65 or older. The georgia retirement income exclusion is available to any georgia resident age 62 or older when completing a state tax return. Georgias income tax rates were last changed two years ago for tax year 2018 and the tax brackets were previously changed in 2009.

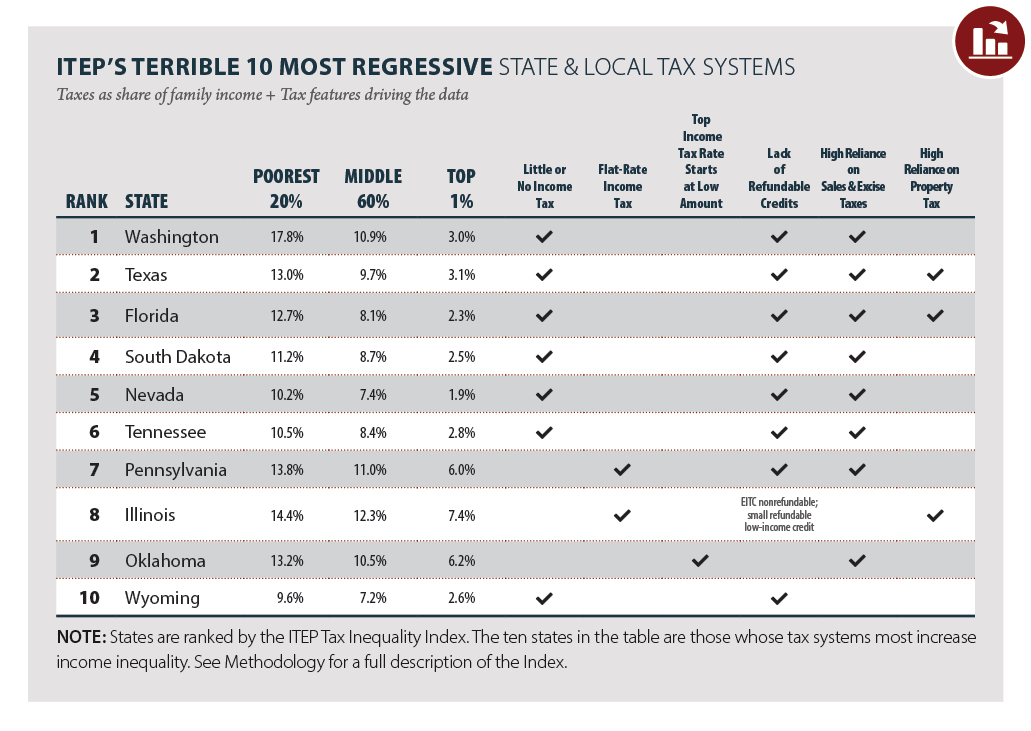

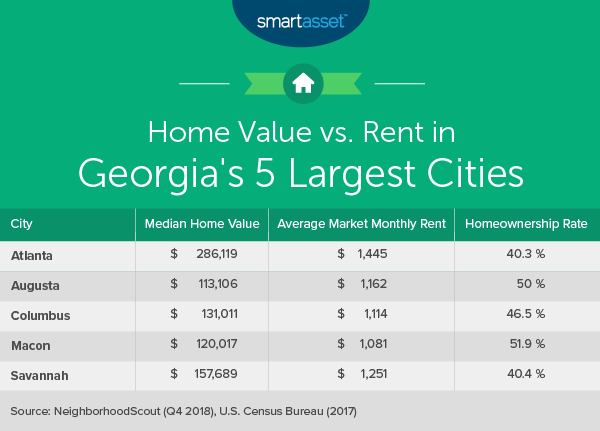

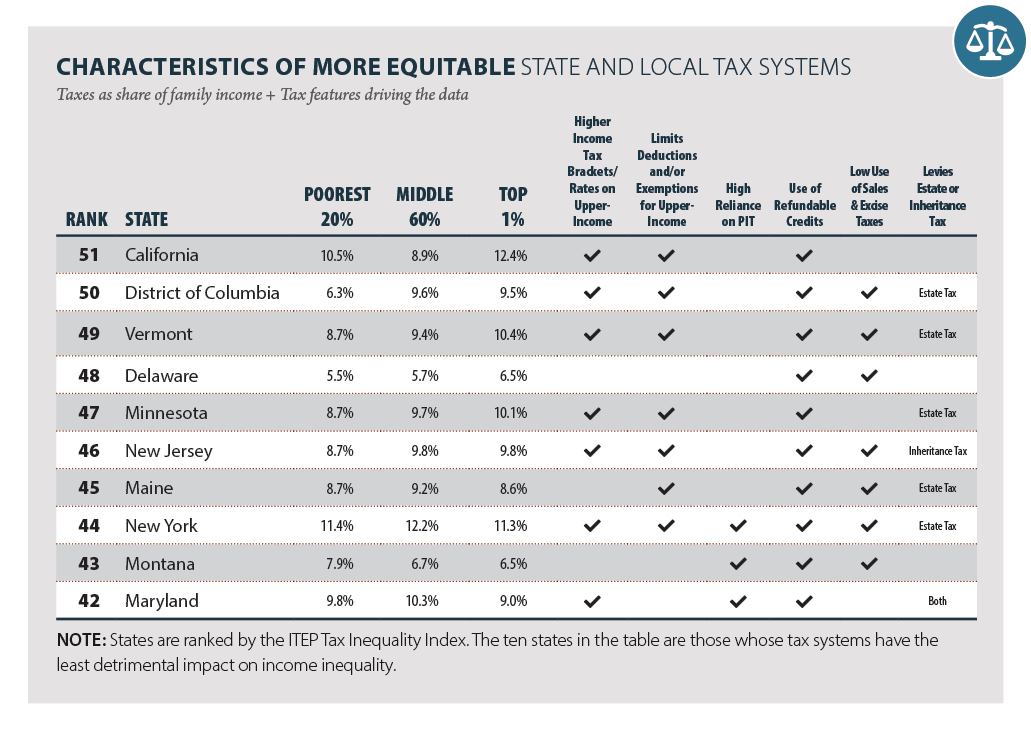

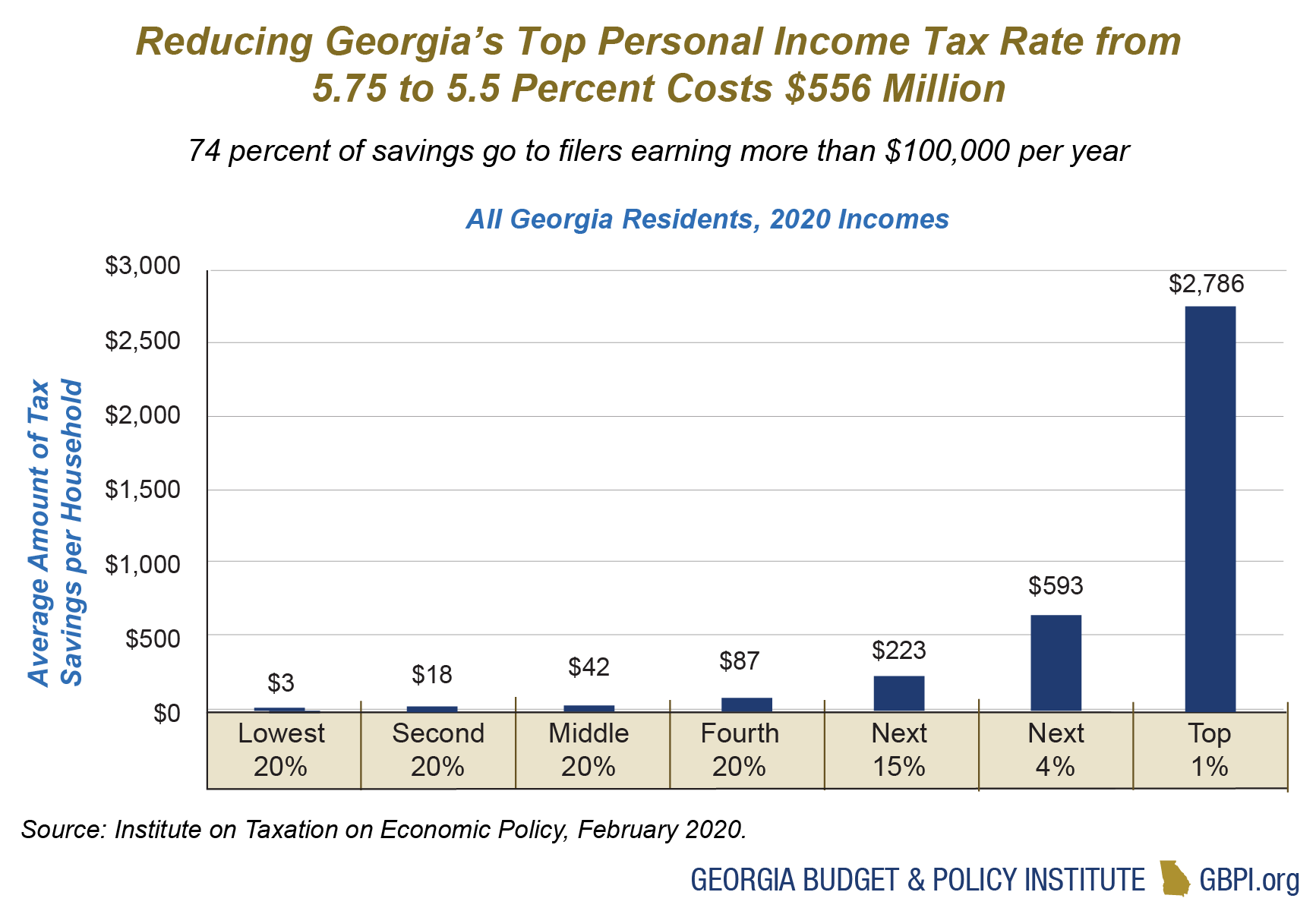

The states sales tax rates and property tax rates are both relatively moderate. Georgia has six marginal tax brackets ranging from 1 the lowest georgia tax bracket to 575 the highest georgia tax bracket. We can also see the progressive nature of georgia state income tax rates from the lowest ga tax rate bracket of 1 to the highest ga tax rate bracket of 575.

However this was further increased in 2012 to 130000. It is stated by 2016 all senior retirement income will be exempt. The georgia income tax has six tax brackets with a maximum marginal income tax of 575 as of 2020.

In georgia different tax brackets are. Looking at the tax rate and tax brackets shown in the tables above for georgia we can see that georgia collects individual income taxes differently for single versus married filing statuses for example. Social security income is exempt from state taxes as is up to 35000 of most types of.

Georgia tax brackets 2019 2020. Residents of georgia aged 62 years and older are exempt from its 6 tax all social security and 70000 per a couple of income on pensions interest dividends and retirement accounts etc. A retirement exclusion is allowed provided the taxpayer is 62 years of age or older or the taxpayer is totally and permanently disabled.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/105880417-F-56a938613df78cf772a4e2eb.jpg)