Georgia Income Tax Rate 2020

This page has the latest georgia brackets and tax rates plus a georgia income tax calculator.

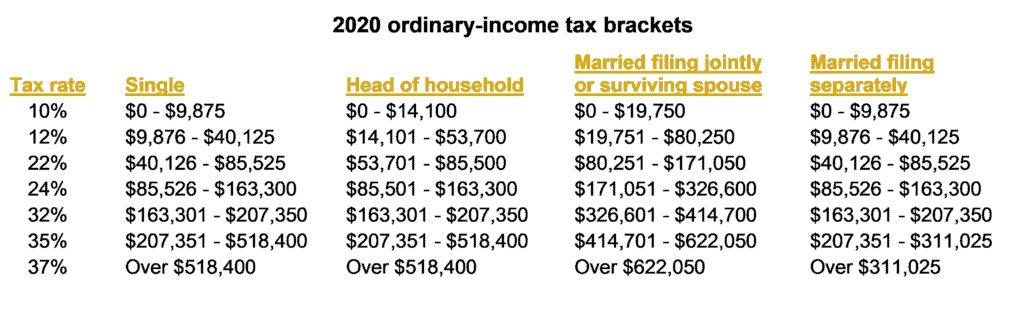

Georgia income tax rate 2020. Looking at the tax rate and tax brackets shown in the tables above for georgia we can see that georgia collects individual income taxes differently for single versus married filing statuses for example. Filing requirements for full and part year residents and military personnel. Popular online tax services.

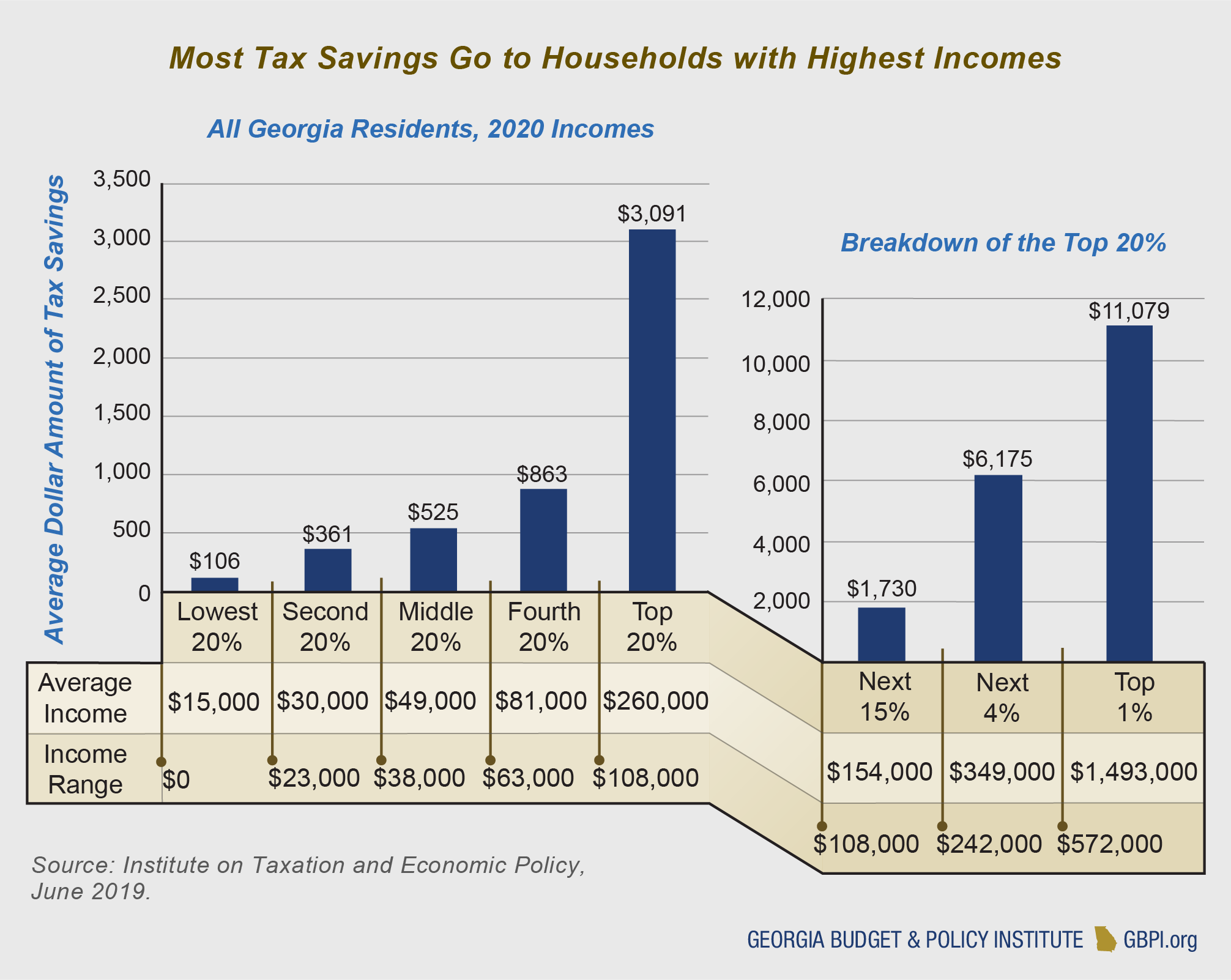

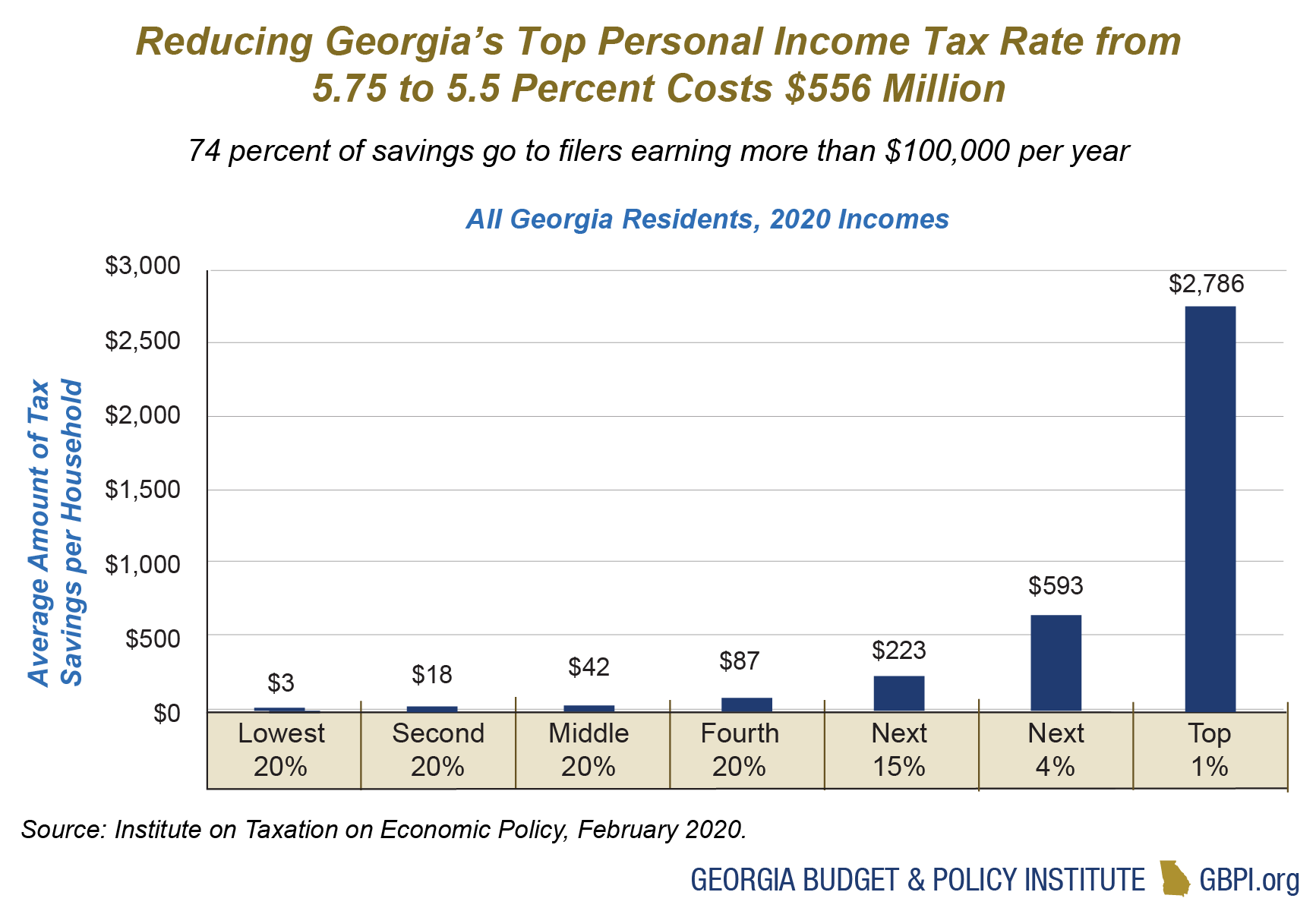

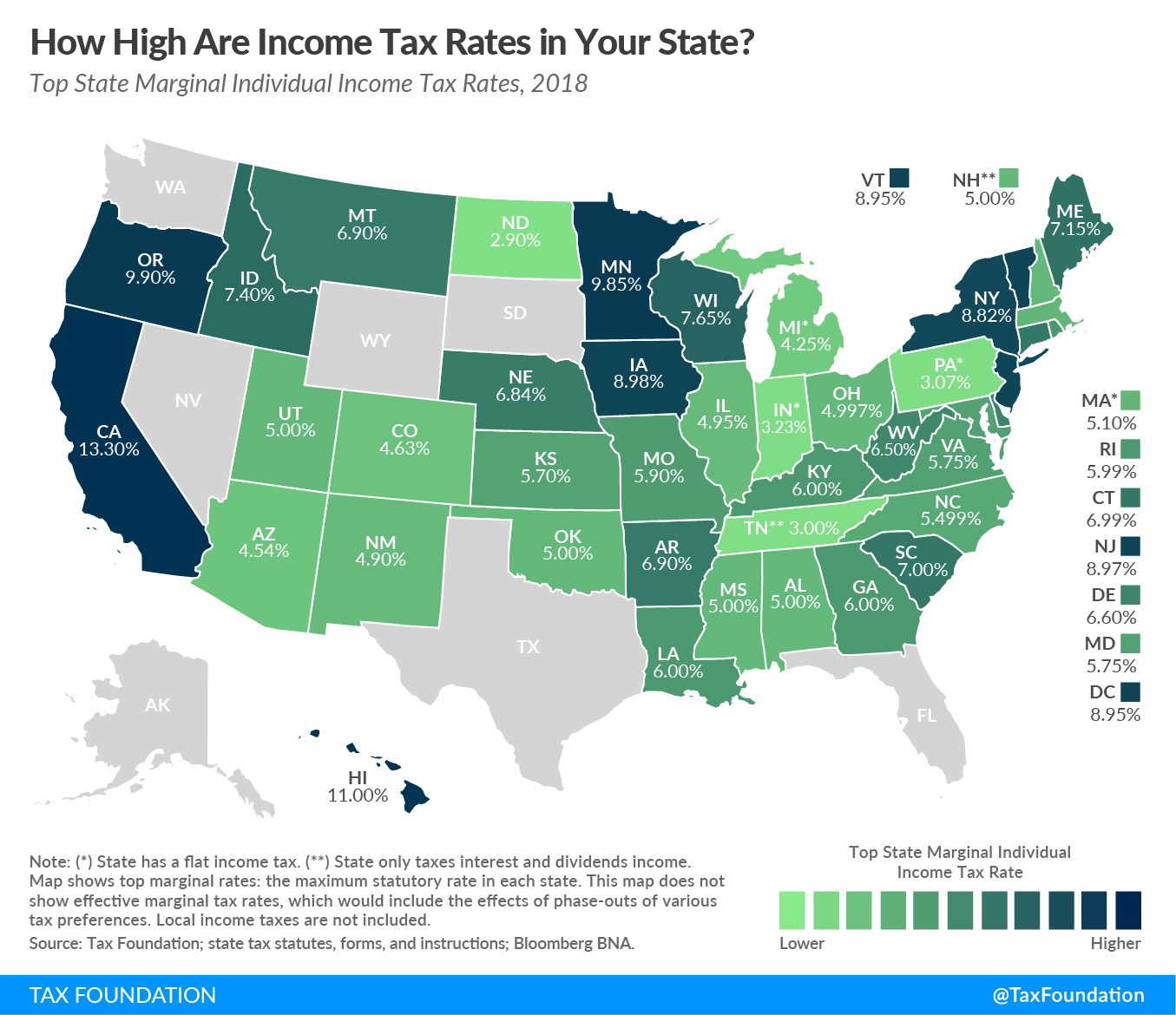

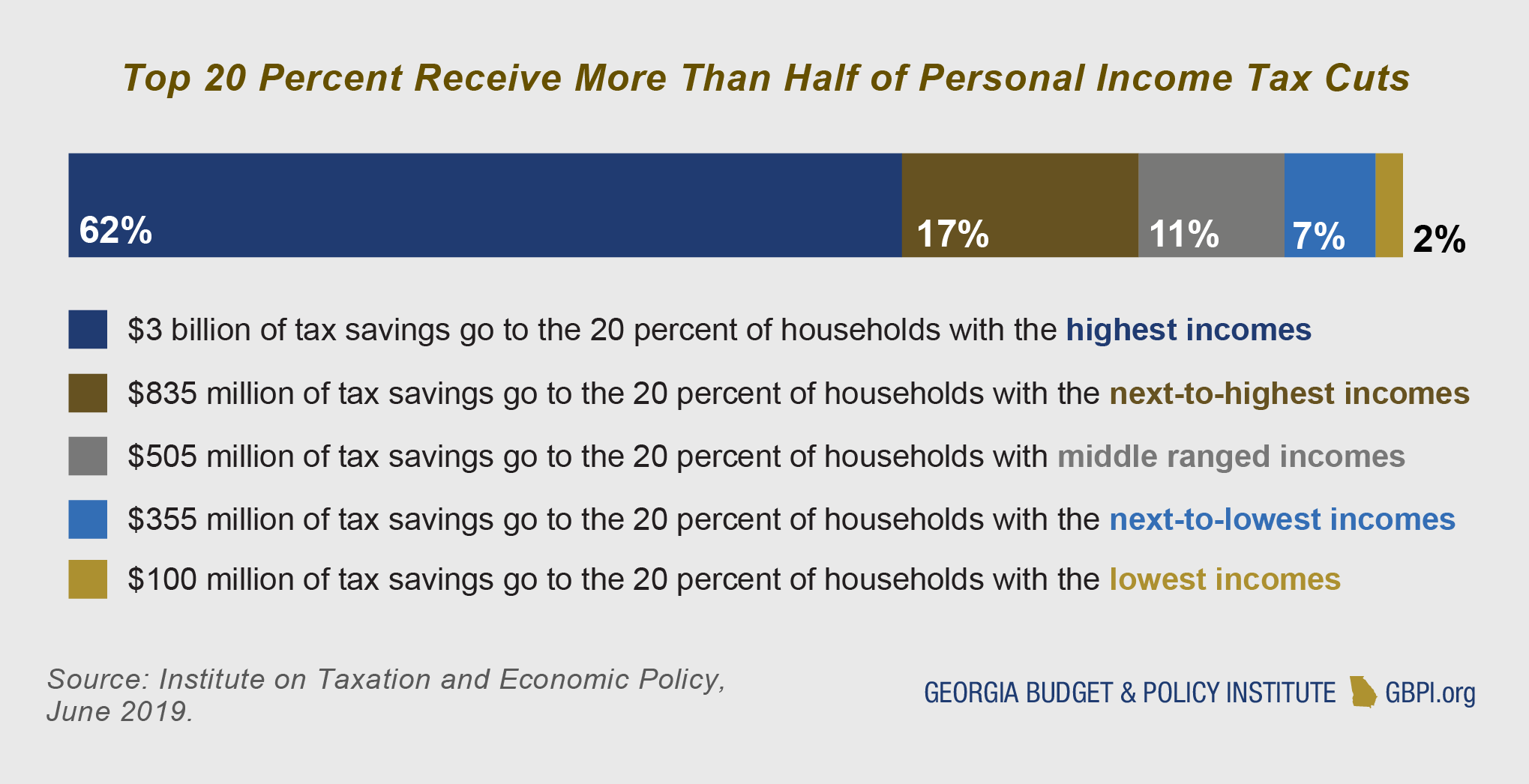

For tax year 2020 arkansass individual income tax rate schedule for high earners has been consolidated from six brackets into four and the top marginal rate dropped from 69 to 66 percent. Higher earners pay higher rates although georgias brackets top out at 7000 for single filers which means the majority of full time workers will pay the top rate. We can also see the progressive nature of georgia state income tax rates from the lowest ga tax rate bracket of 1 to the highest ga tax rate bracket of 575.

For those subject to the middle rate schedule the top rate has dropped from 60 to 59 percent. Georgia tax brackets 2019 2020. The tax rate for the first.

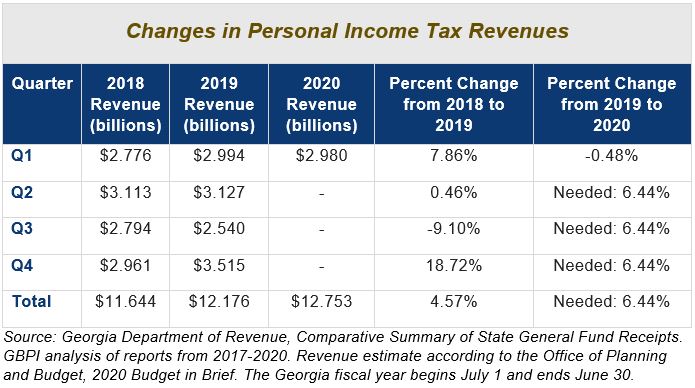

2020 georgia tax tables with 2020 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. Search for income tax statutes by keyword in the official code of georgia. Filing state taxes the basics.

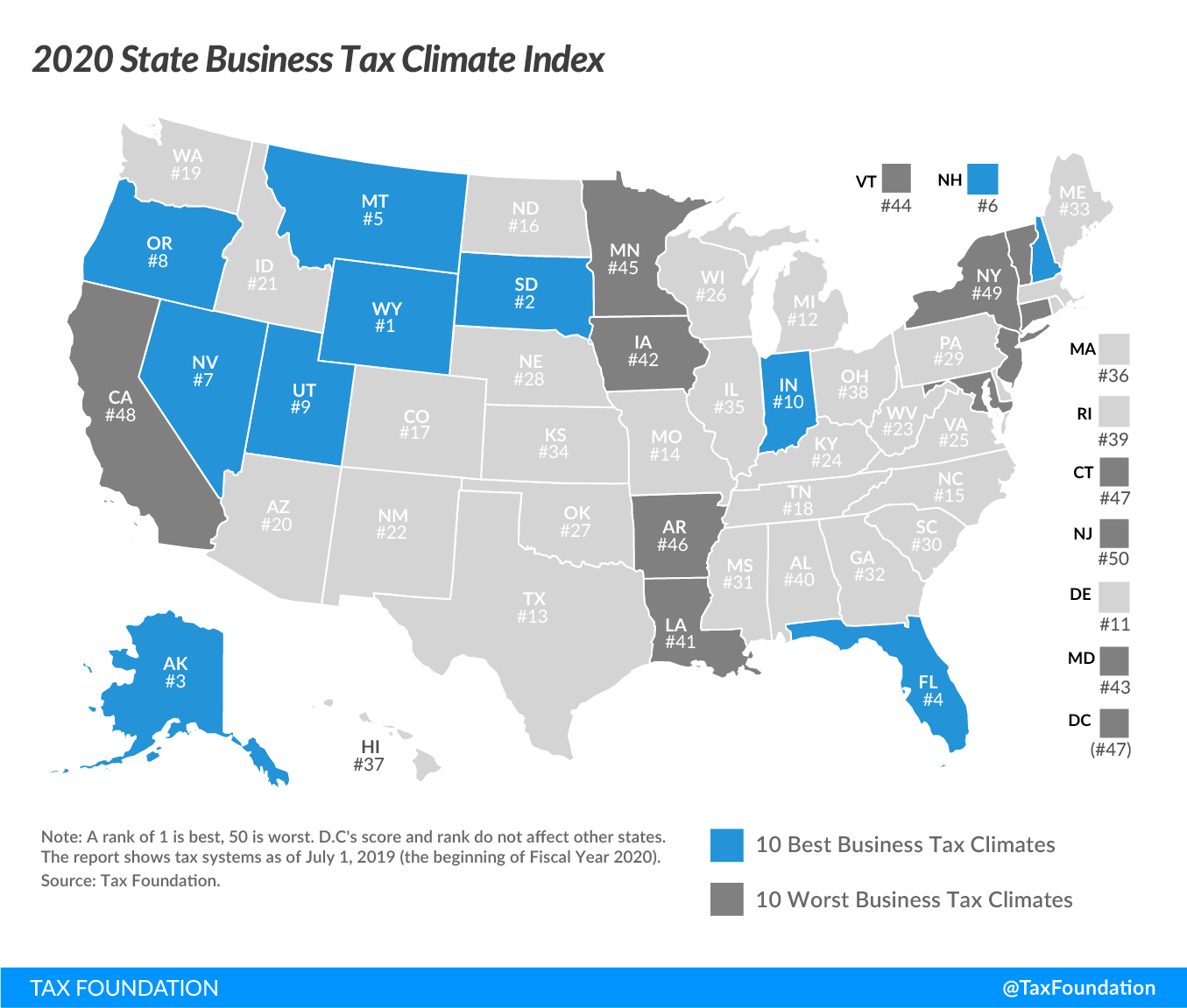

Georgias 2020 income tax ranges from 1 to 575. Effective october 1 2018 the generally applicable tax rate in ware county is 9 state sales tax at the statewide rate of 4 plus 5 local sales taxes at a rate of 1 each. Detailed georgia state income tax rates and brackets are available on this page.

The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 6 because the 1 2nd lost and the 1 tsplost do not apply. Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575. Sales tax rates general general rate chart effective beginning july 1 2020 6704 kb general rate chart effective april 1 2020 through june 30 2020 2202 kb.

Income tax tables and other tax information is sourced from the georgia department of revenue.

/best-and-worst-states-for-sales-taxes-3193296_final-5833bed0517f402abab0d55179d65e7d.png)

/2020-federal-state-minimum-wage-rates-2061043-final-d82d14b0792c49c8a7b85e3666d8b6b2.png)

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3.png)