Georgia State Income Tax Rate 2020

Georgia tax brackets 2019 2020.

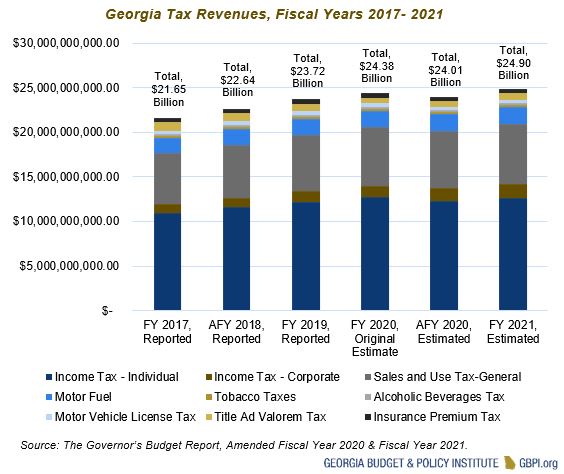

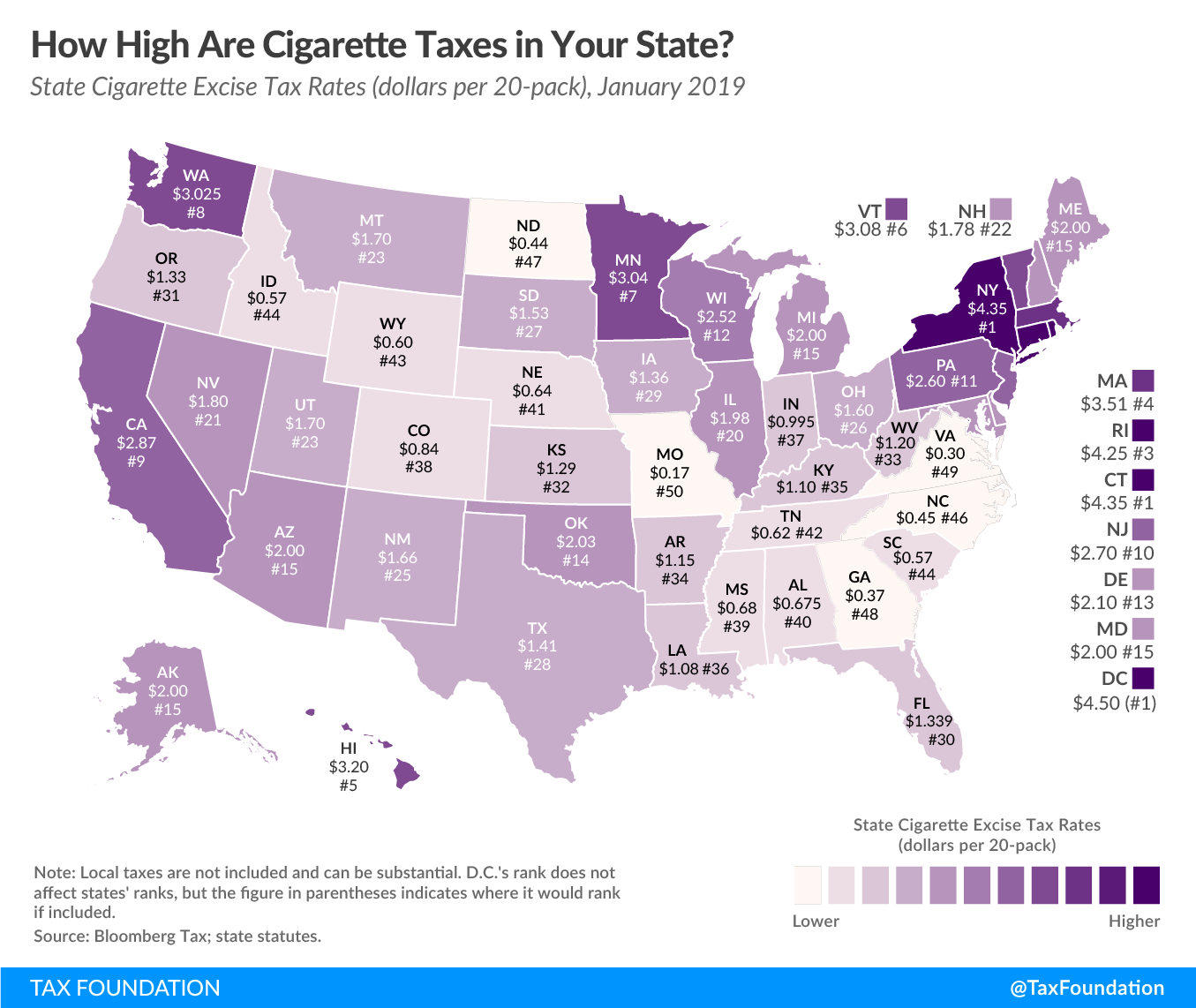

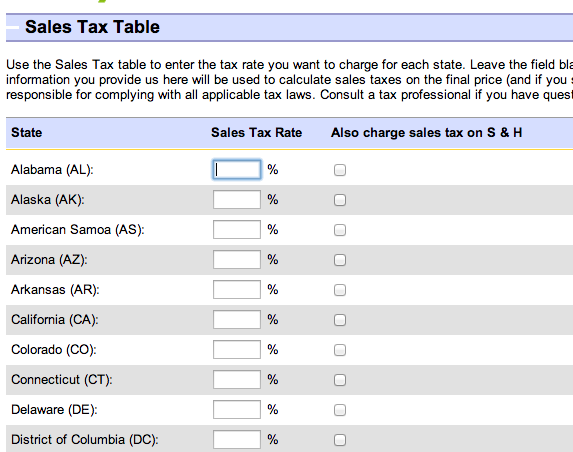

Georgia state income tax rate 2020. Sales tax rates general general rate chart effective beginning july 1 2020 6704 kb general rate chart effective april 1 2020 through june 30 2020 2202 kb. Income tax tables and other tax information is sourced from the georgia department of revenue. If you want to compare all of the state tax rates on one page visit.

There are 30 days left until taxes are due. Many state pages also provide direct links to selected income tax return forms and other resources. The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 6 because the 1 2nd lost and the 1 tsplost do not apply.

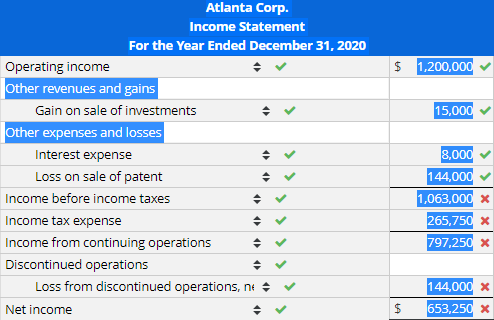

The georgia income tax has six tax brackets with a maximum marginal income tax of 575 as of 2020. Start filing your tax return now. Detailed georgia state income tax rates and brackets are available on this page.

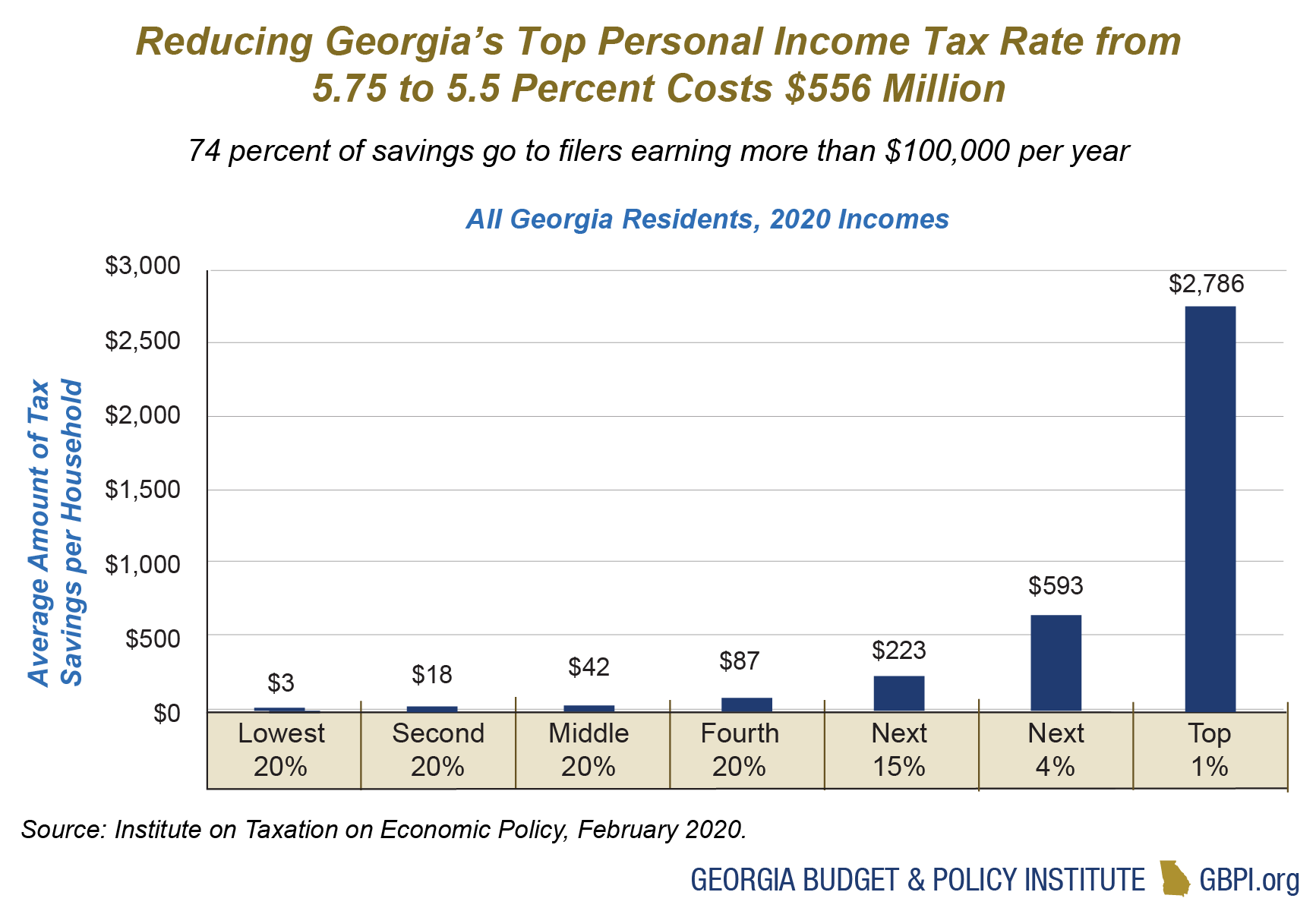

The georgia state legislature will determine during its 2020 session whether to temporarily reduce the top income tax rate to 55 for 2020. Georgias 2020 income tax ranges from 1 to 575. Choose any state from the list above for detailed state income tax information including 2020 income tax tables state tax deductions and state specific income tax calculators.

For tax year 2020 arkansass individual income tax rate schedule for high earners has been consolidated from six brackets into four and the top marginal rate dropped from 69 to 66 percent. As we previously reported the maximum georgia income tax rate was temporarily reduced to 575 effective for tax year 2019 down from 60. For those subject to the middle rate schedule the top rate has dropped from 60 to 59 percent.

Effective october 1 2018 the generally applicable tax rate in ware county is 9 state sales tax at the statewide rate of 4 plus 5 local sales taxes at a rate of 1 each. Looking at the tax rate and tax brackets shown in the tables above for georgia we can see that georgia collects individual income taxes differently for single versus married filing statuses for example. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

This page has the latest georgia brackets and tax rates plus a georgia income tax calculator. Ey payroll newsflash vol. The tax rate for the first.

Higher earners pay higher rates although georgias brackets top out at 7000 for single filers which means the majority of full time workers will pay the top rate.

/2020-federal-state-minimum-wage-rates-2061043-final-d82d14b0792c49c8a7b85e3666d8b6b2.png)

/best-and-worst-states-for-sales-taxes-3193296_final-5833bed0517f402abab0d55179d65e7d.png)

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3.png)