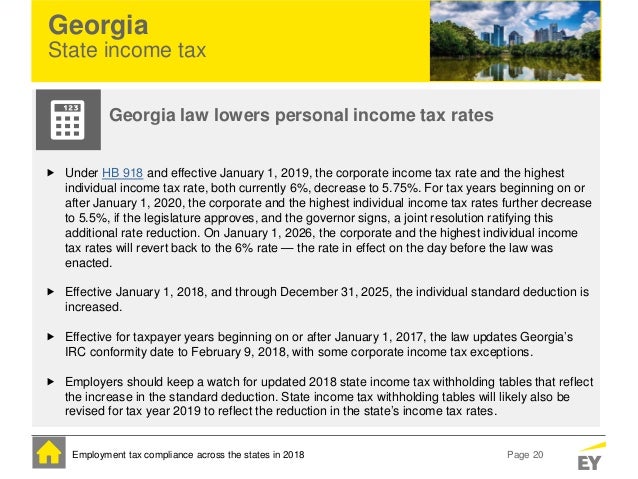

Georgia Income Tax Rate 2019

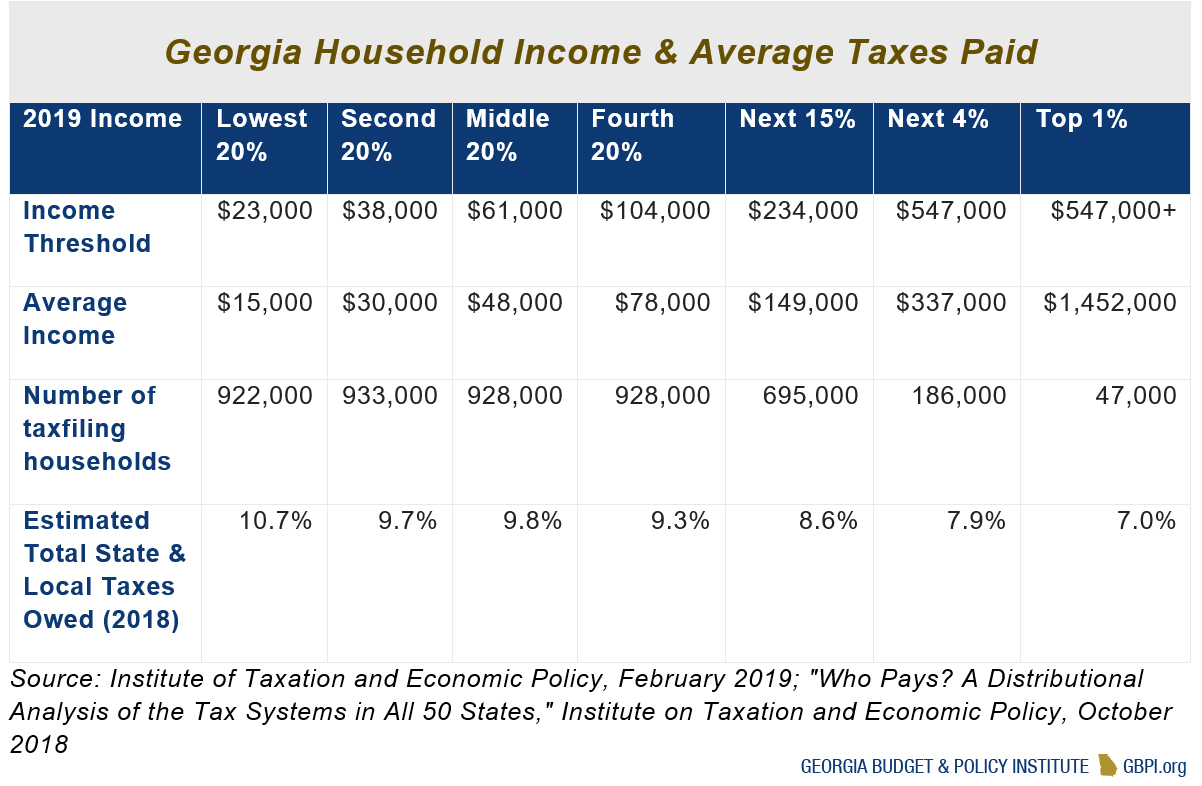

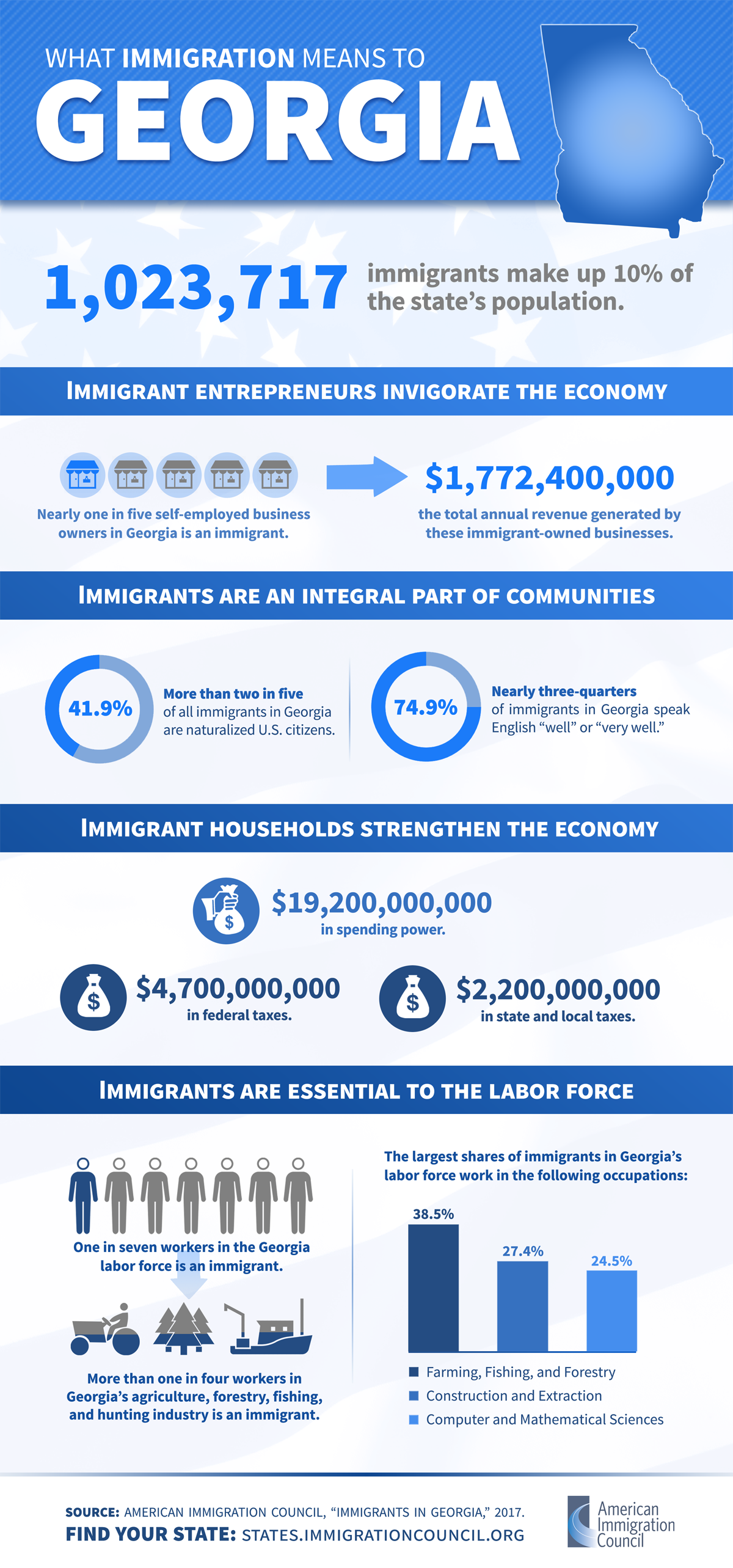

We can also see the progressive nature of georgia state income tax rates from the lowest ga tax rate bracket of 1 to the highest ga tax rate bracket of 575.

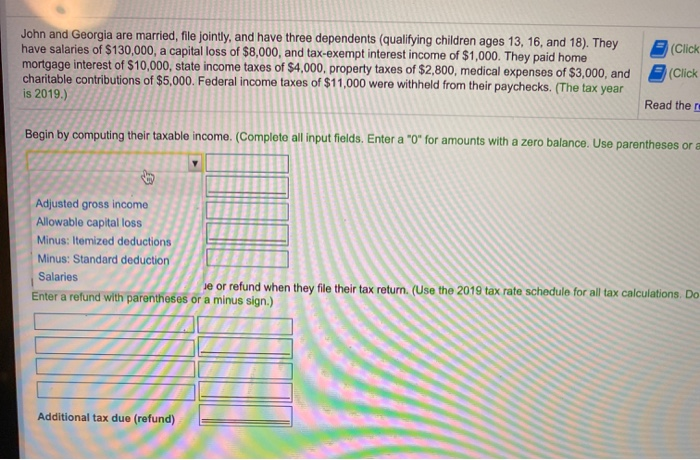

Georgia income tax rate 2019. Filing requirements for full and part year residents and military personnel. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 510300 and higher for single filers and 612350 and higher for married couples filing jointly. Product download purchase support deals online cart.

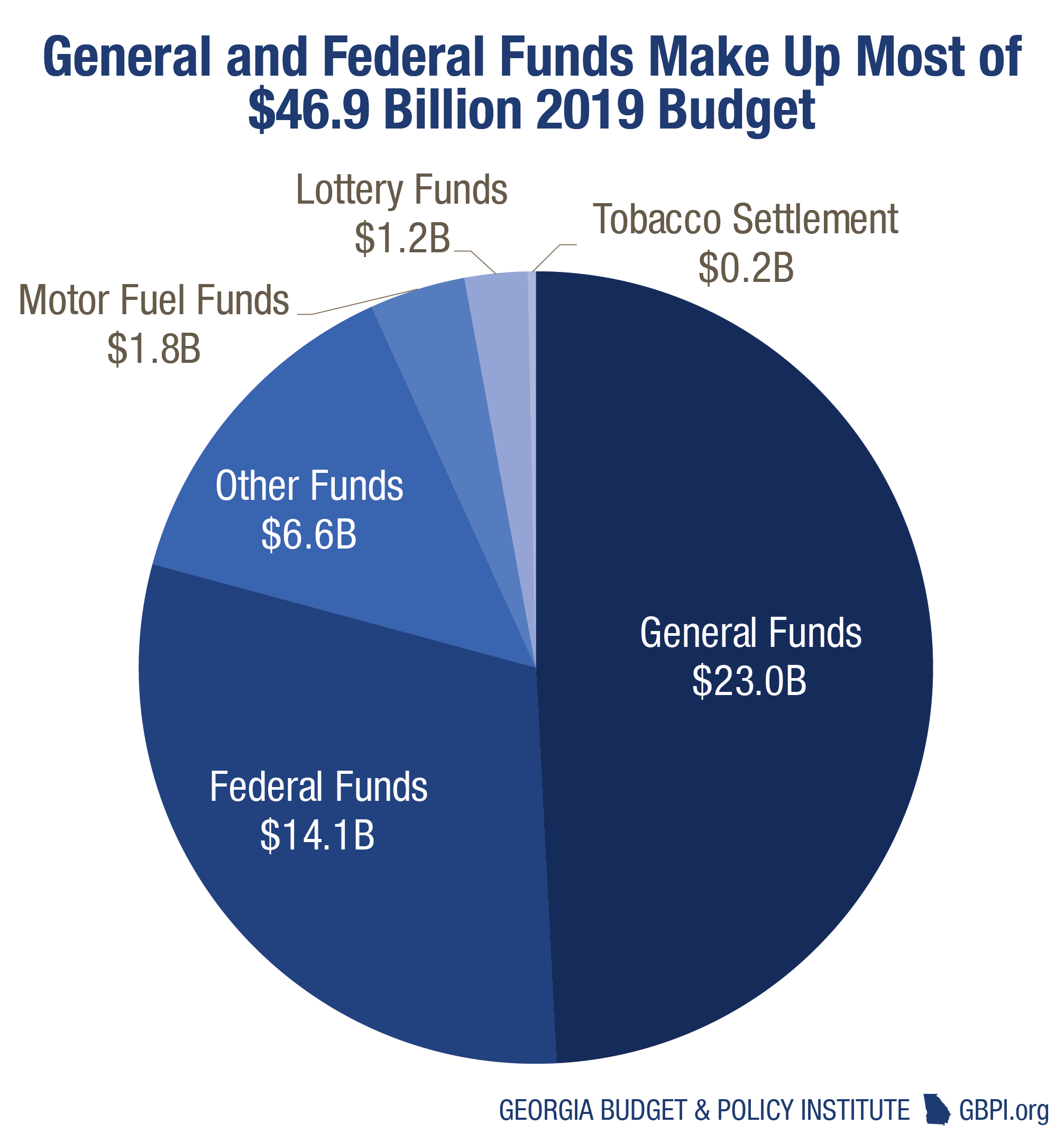

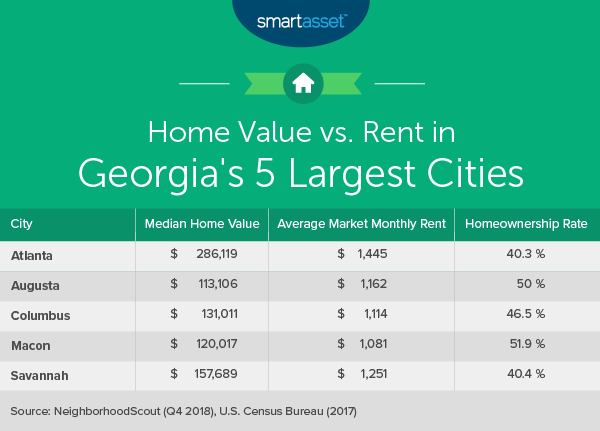

Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575. In 2019 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1. The 2020 state personal income tax brackets are updated from the georgia and tax foundation data.

Georgia has six marginal tax brackets ranging from 1 the lowest georgia tax bracket to 575 the highest georgia tax bracket. W2 1099 1095 software. Overview of georgia retirement tax friendliness.

The states sales tax rates and property tax rates are both relatively moderate. Georgia tax tables tax year. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

In georgia different tax brackets are. Before the official 2020 georgia income tax rates are released provisional 2020 tax rates are based on georgias 2019 income tax brackets. Looking at the tax rate and tax brackets shown in the tables above for georgia we can see that georgia collects individual income taxes differently for single versus married filing statuses for example.

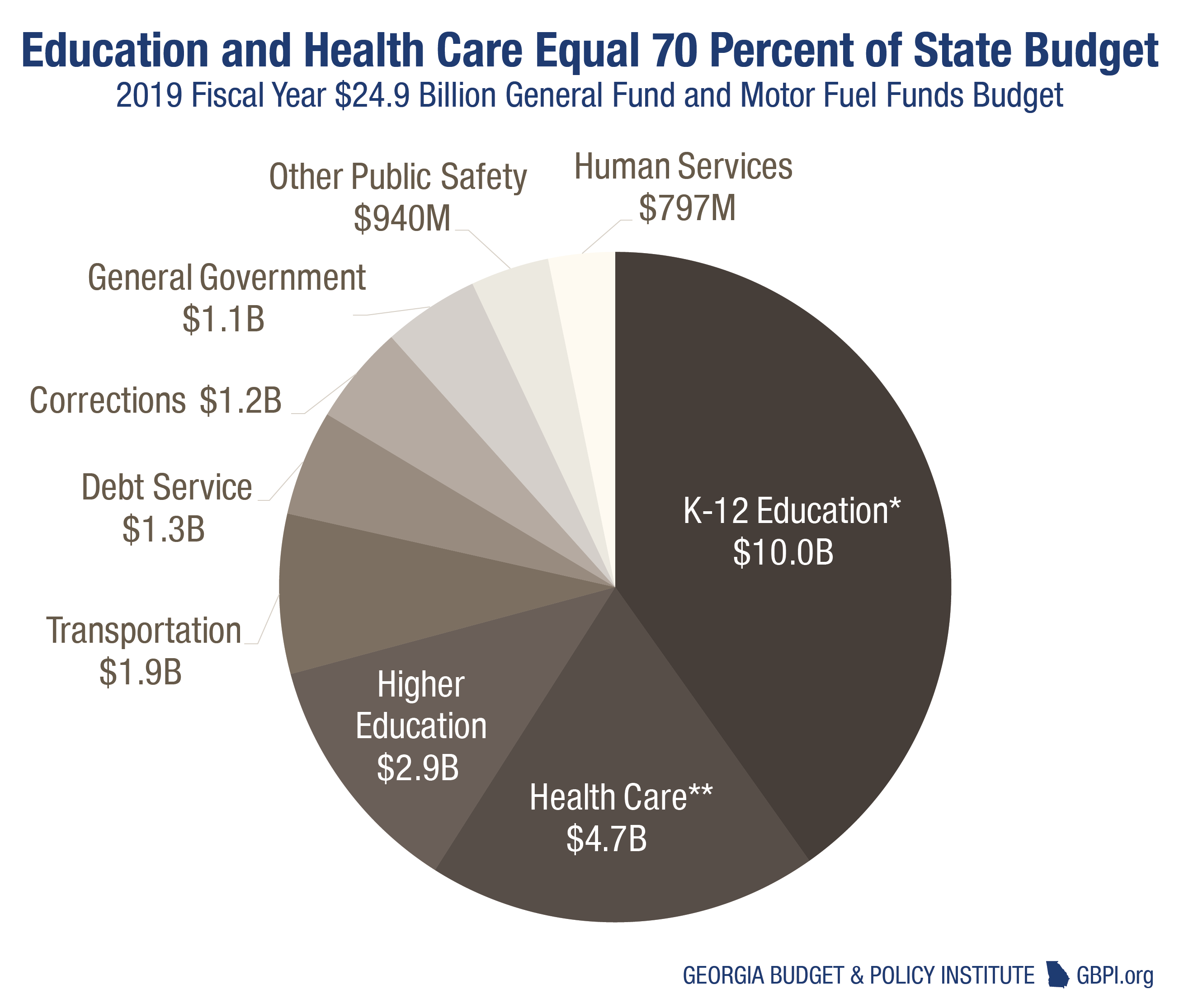

The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 6 because the 1 2nd lost and the 1 tsplost do not apply. Georgia tax forms are sourced from the georgia income tax forms page and are updated on a yearly basis. Georgia tax brackets 2019 2020.

Income tax brackets and rates. Georgia has no inheritance or estate taxes. Each marginal rate only applies to earnings within the applicable marginal tax bracket.

Georgias income tax rates were last changed two years ago for tax year 2018 and the tax brackets were previously changed in 2009. Georgia does not tax social security retirement benefits and provides a maximum deduction of 65000 per person on all types of retirement income for anyone 65 or older. The tax rate for the first.

2019 georgia tax tables with 2020 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. This years individual income tax forms. Higher earners pay higher rates although georgias brackets top out at 7000 for single filers which means the majority of full time workers will pay the top rate.

Popular online tax services. Filing state taxes the basics.