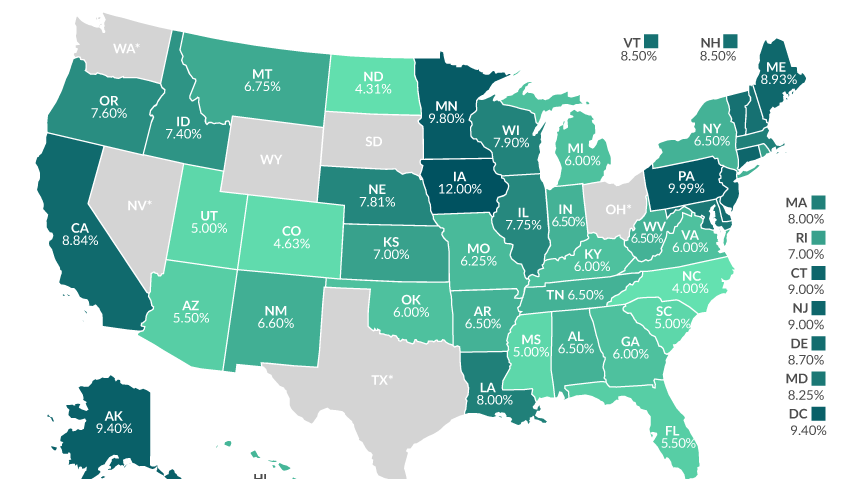

Georgia State Income Tax Rate

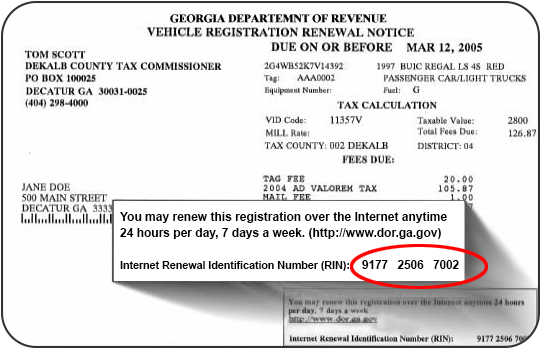

The tax rate for the first 500000 of a motor vehicle sale is 7 because the 1 2nd lost does not apply.

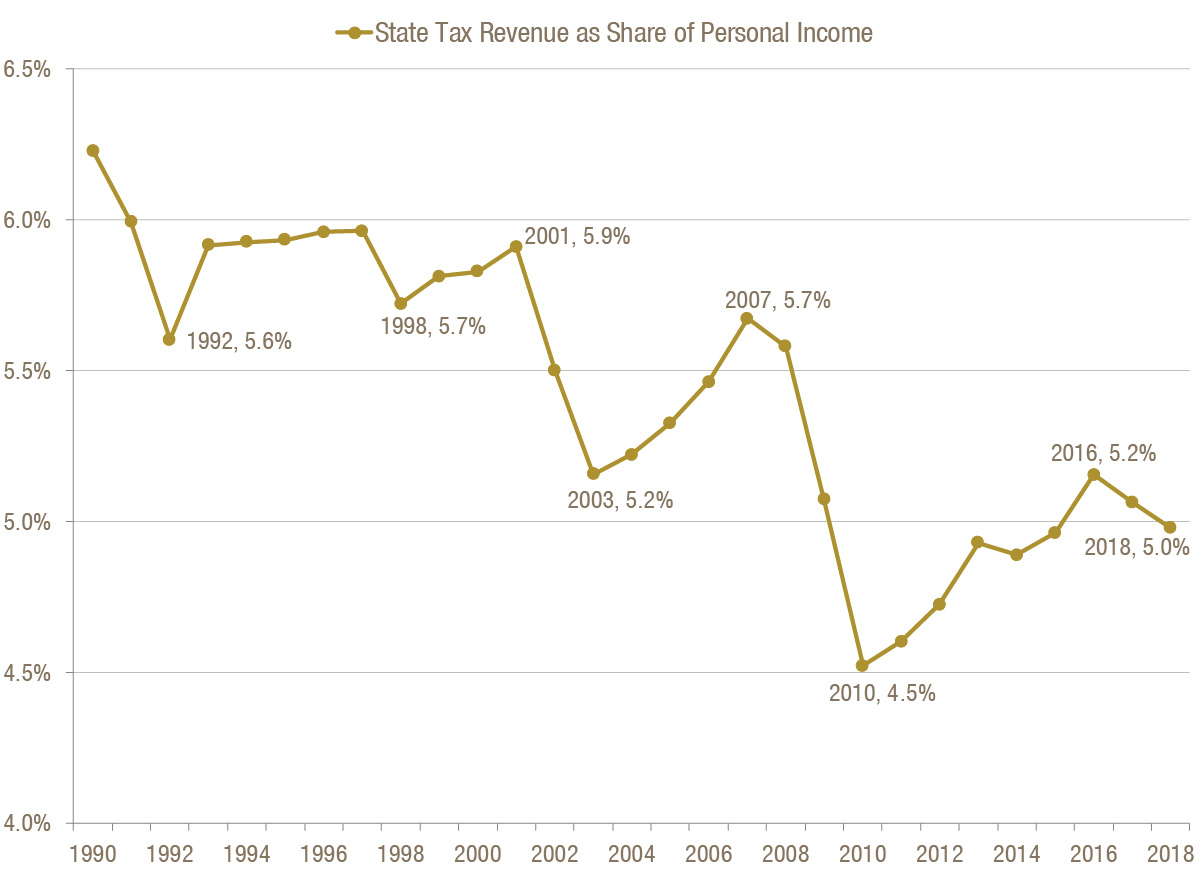

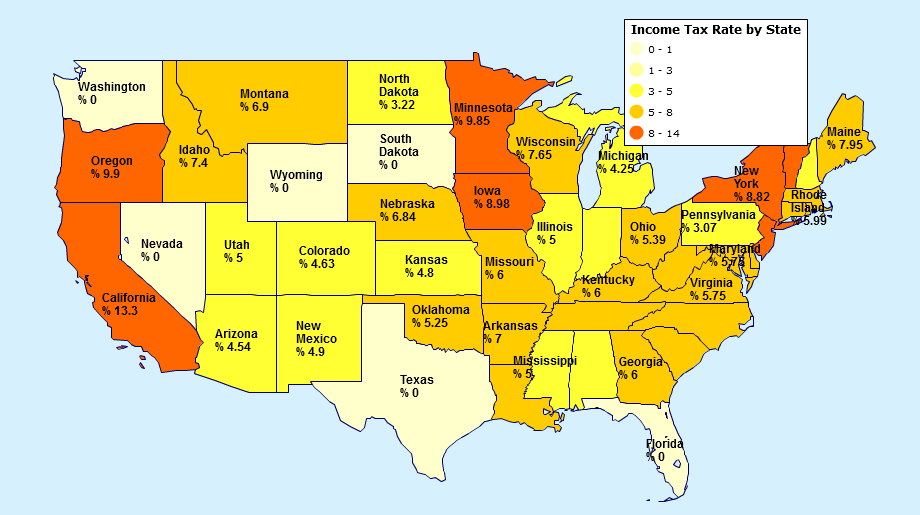

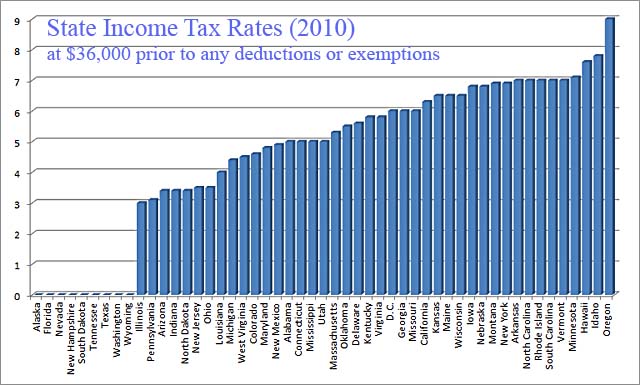

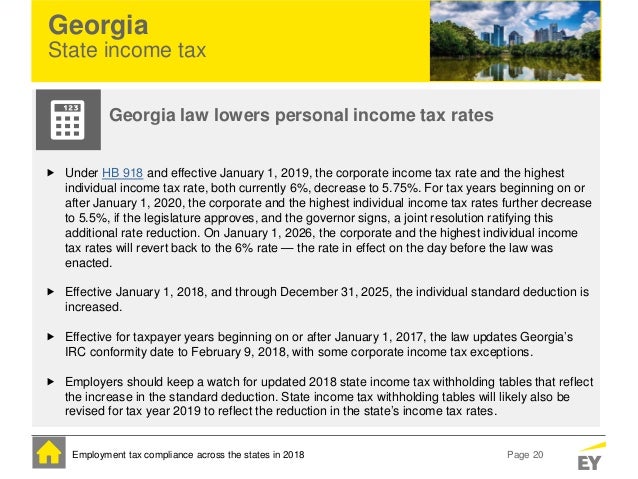

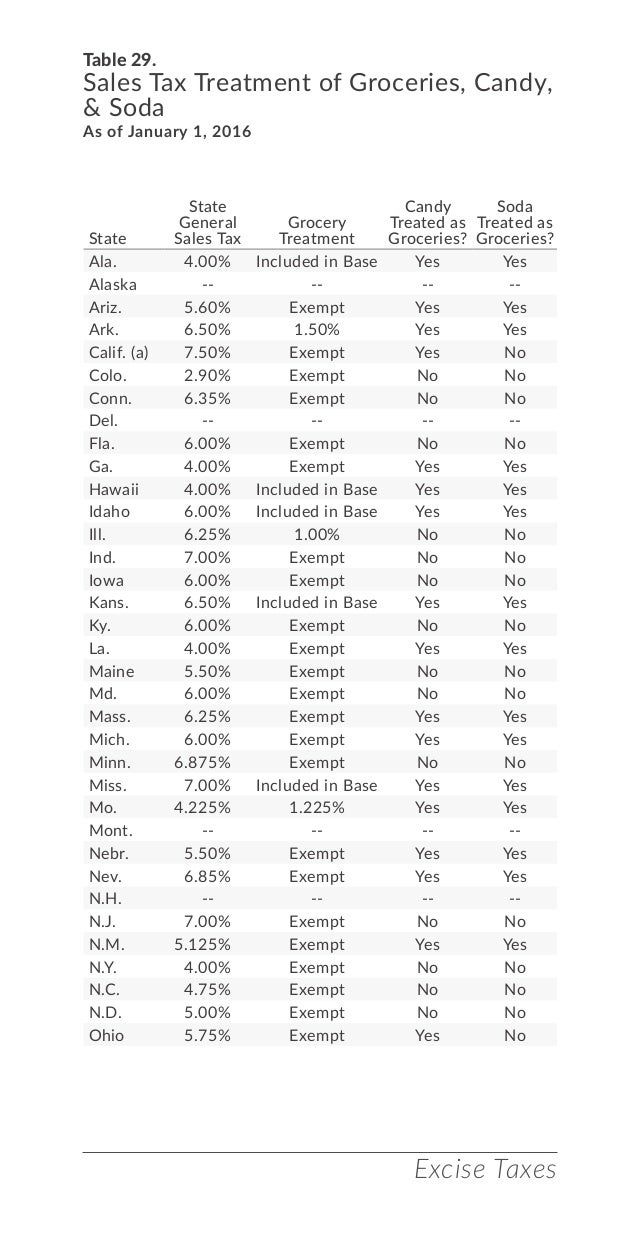

Georgia state income tax rate. Local state and federal government websites often end in gov. The georgia income tax has six tax brackets with a maximum marginal income tax of 575 as of 2020. Popular online tax services.

State of georgia government websites and email systems use georgiagov or gagov at the end of the address. Filing state taxes the basics. Search for income tax statutes by keyword in the official code of georgia.

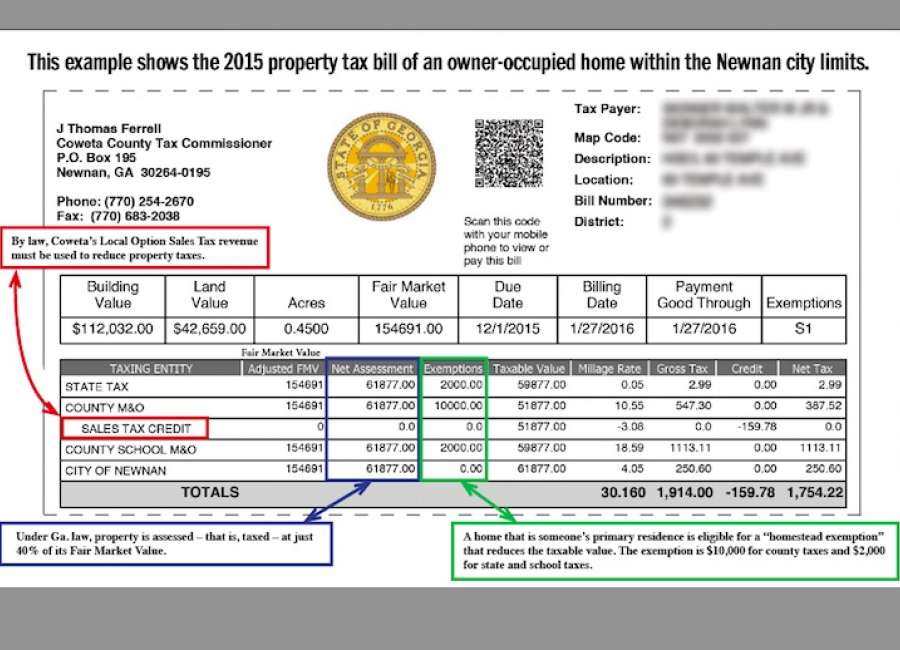

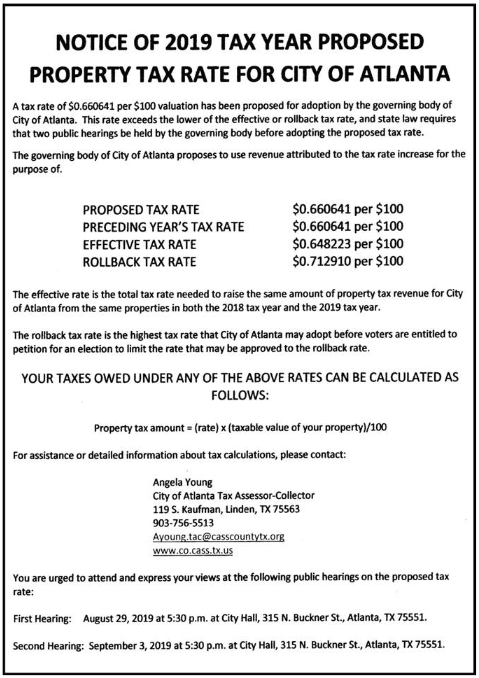

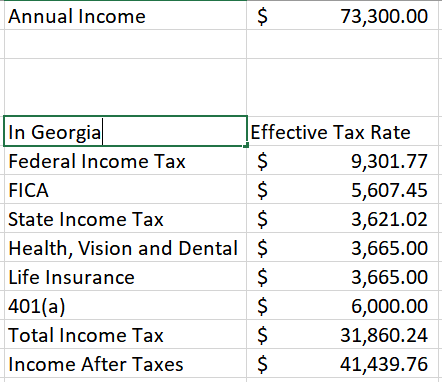

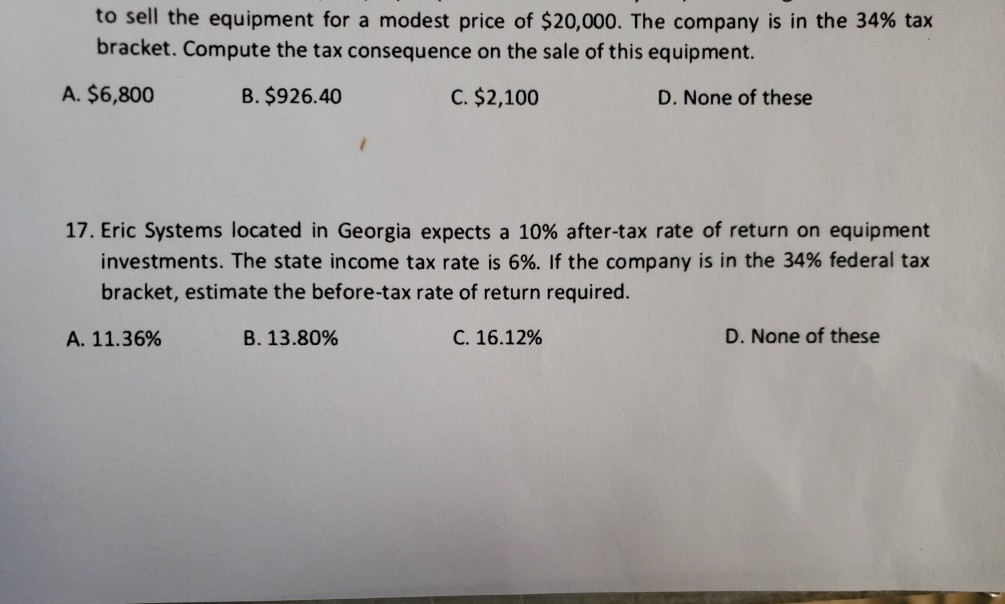

To illustrate we calculated relative income tax obligations by applying the effective income tax rates in each state and locality to the average americans income. Filing requirements for full and part year residents and military personnel. The generally applicable tax rate in muscogee county is 8 state sales tax at the statewide rate of 4 plus 4 local sales taxes at a rate of 1 each.

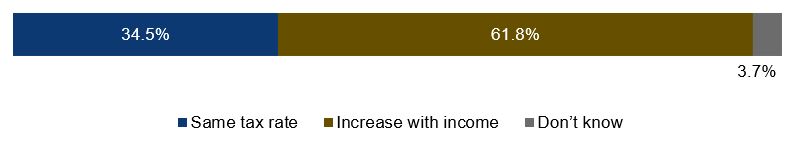

Georgia has six marginal tax brackets ranging from 1 the lowest georgia tax bracket to 575 the highest georgia tax bracket. In georgia different tax brackets are. Higher earners pay higher rates although georgias brackets top out at 7000 for single filers which means the majority of full time workers will pay the top rate.

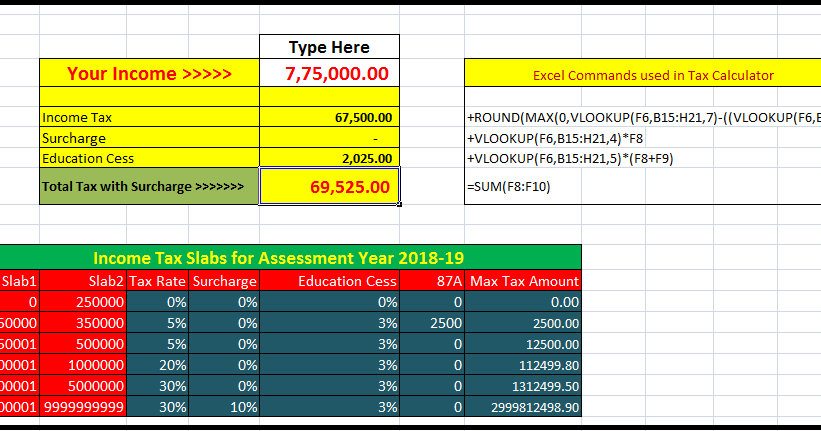

Each marginal rate only applies to earnings within the applicable marginal tax bracket. This years individual income tax forms. Looking at the tax rate and tax brackets shown in the tables above for georgia we can see that georgia collects individual income taxes differently for single versus married filing statuses for example.

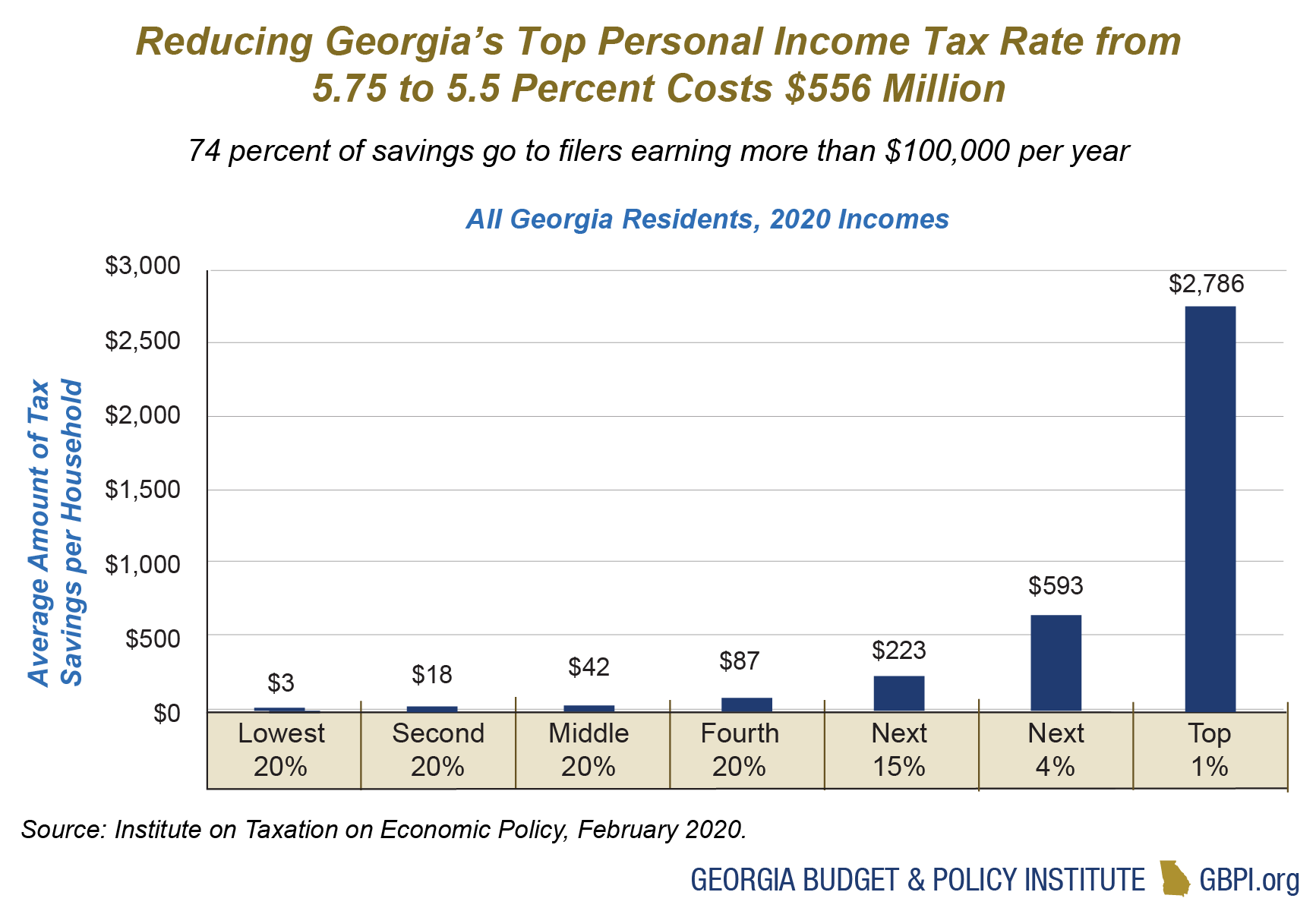

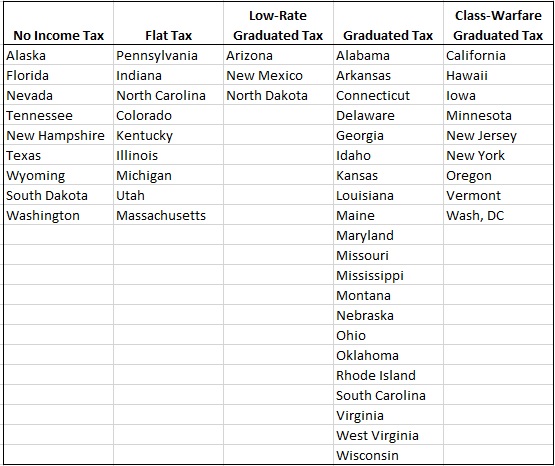

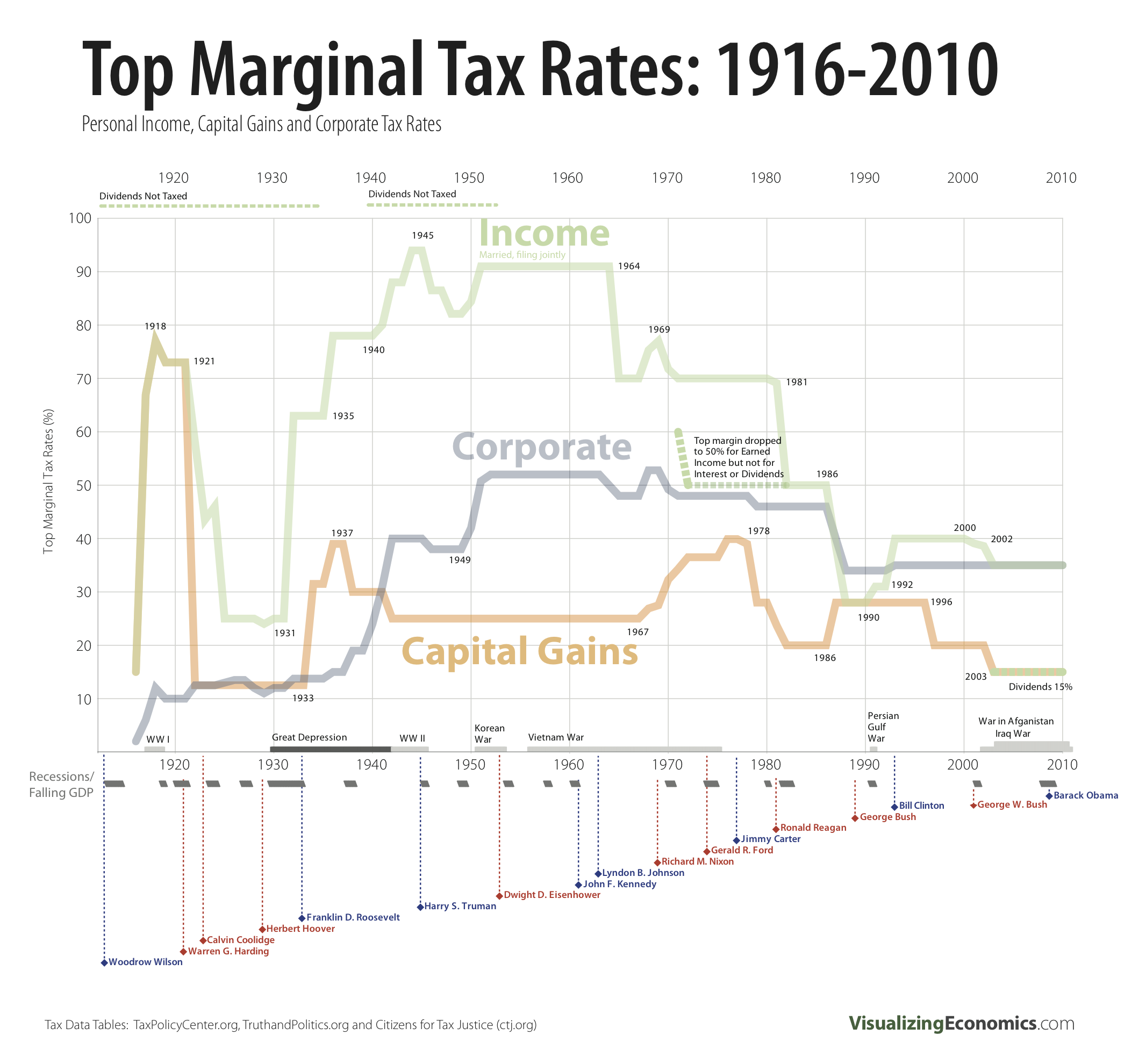

We can also see the progressive nature of georgia state income tax rates from the lowest ga tax rate bracket of 1 to the highest ga tax rate bracket of 575. Wallethub searched for answers by comparing state and local tax rates in the 50 states and the district of columbia against national medians. Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575.

Income tax local government motor fuel motor vehicle. Detailed georgia state income tax rates and brackets are available on this page.

.png)