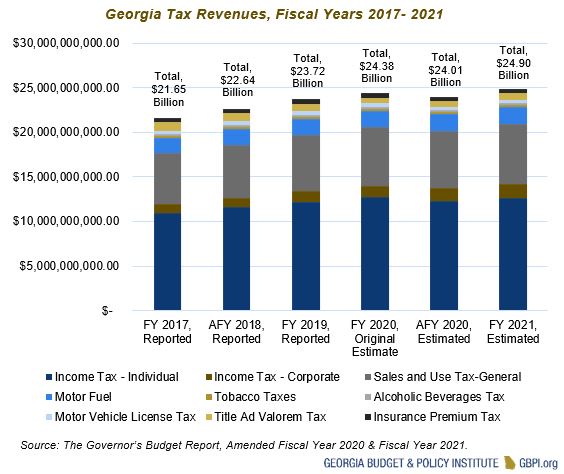

Georgia State Income Tax Rate Brackets

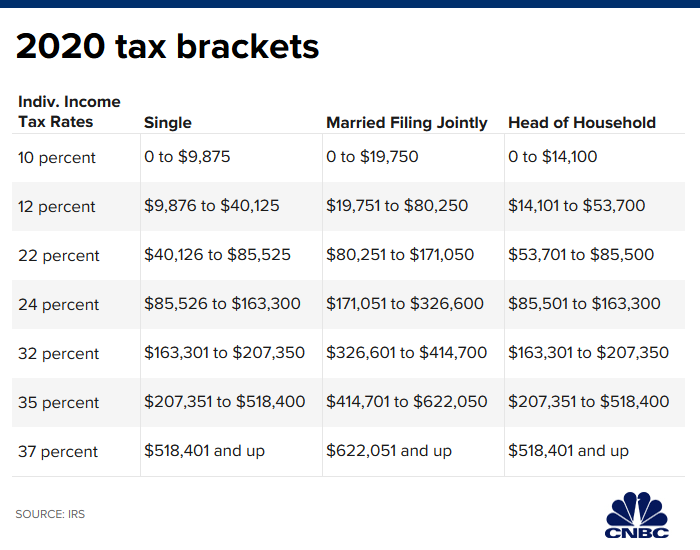

Looking at the tax rate and tax brackets shown in the tables above for georgia we can see that georgia collects individual income taxes differently for single versus married filing statuses for example.

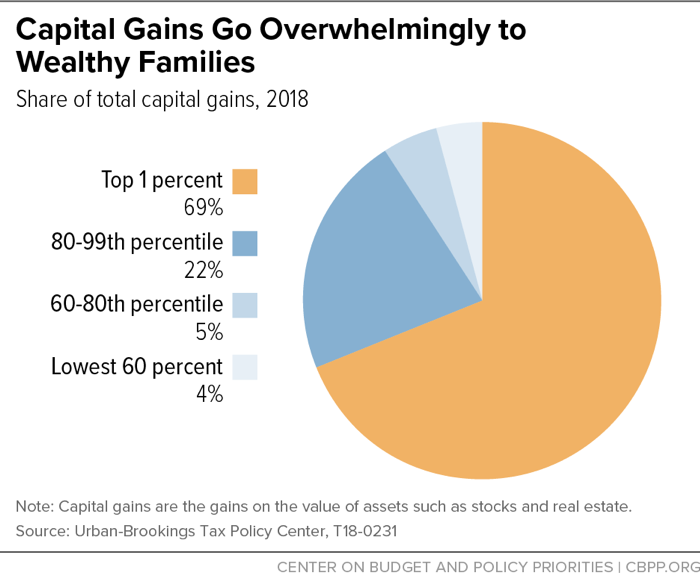

Georgia state income tax rate brackets. The tax rate for the first 500000 of a motor vehicle sale is 7 because the 1 2nd lost does not apply. The states sales tax rates and property tax rates are both relatively moderate. The capital gains tax calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property.

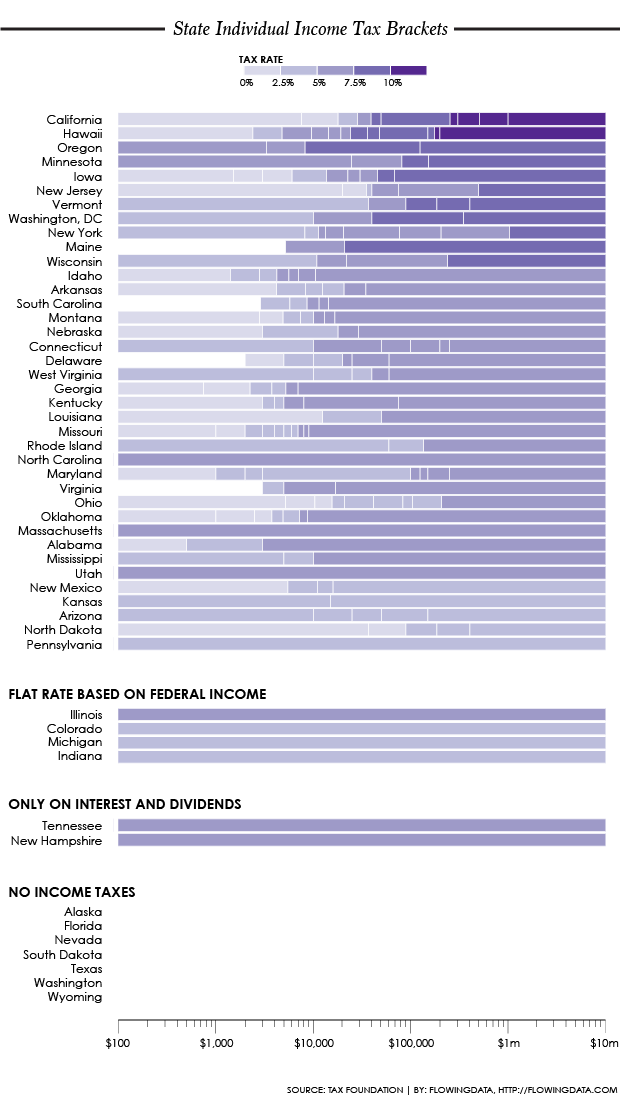

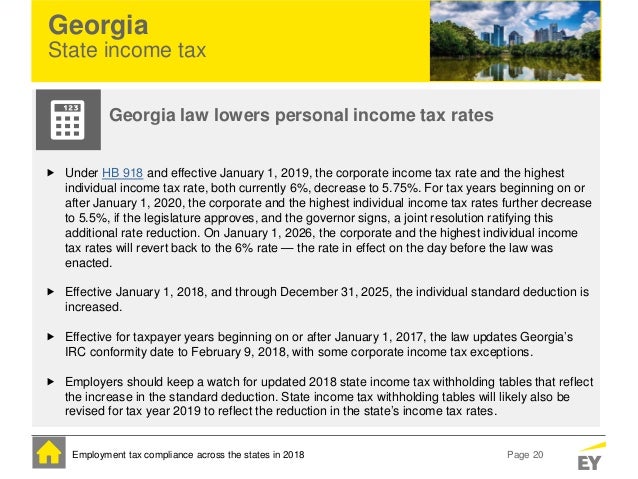

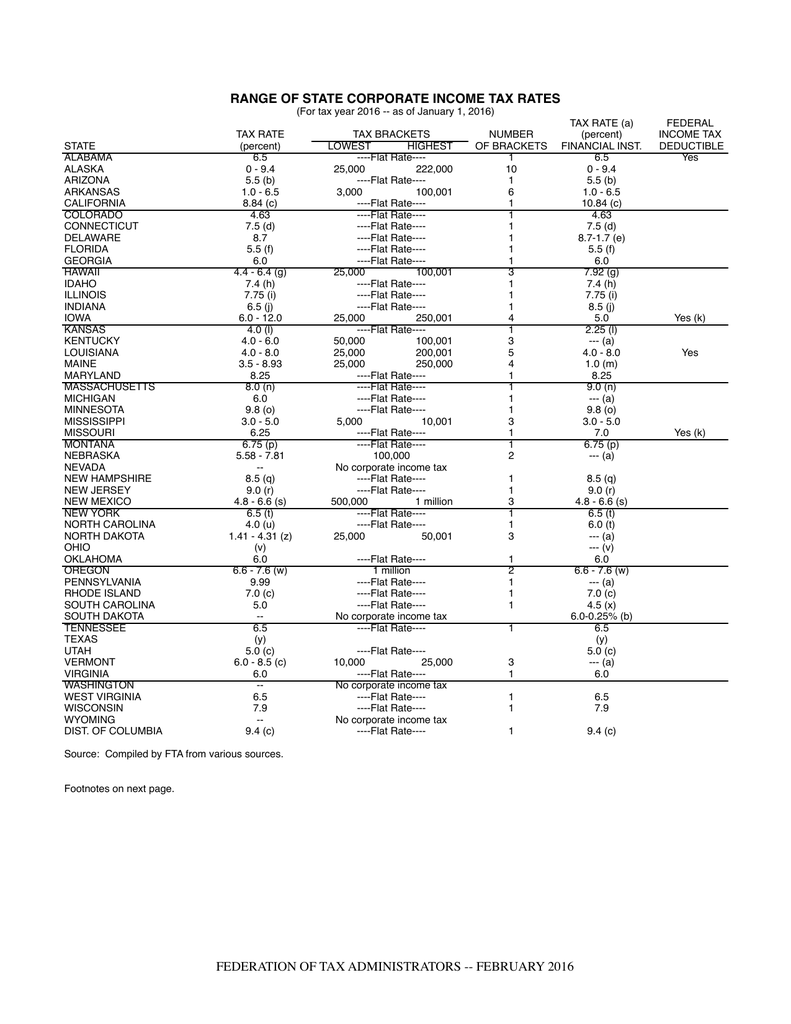

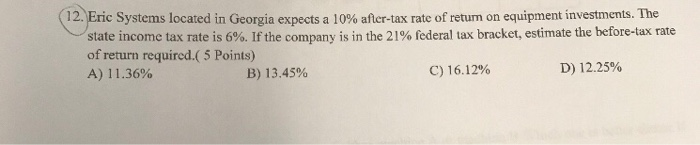

Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575. In the district of columbia the top rate kicks in at 1 million as it does in california when the states millionaires tax surcharge is included. Georgia has no inheritance or estate taxes.

The generally applicable tax rate in muscogee county is 8 state sales tax at the statewide rate of 4 plus 4 local sales taxes at a rate of 1 each. Georgias income tax rates were last changed two years ago for tax year 2018 and the tax brackets were previously changed in 2009. Georgia tax brackets 2019 2020.

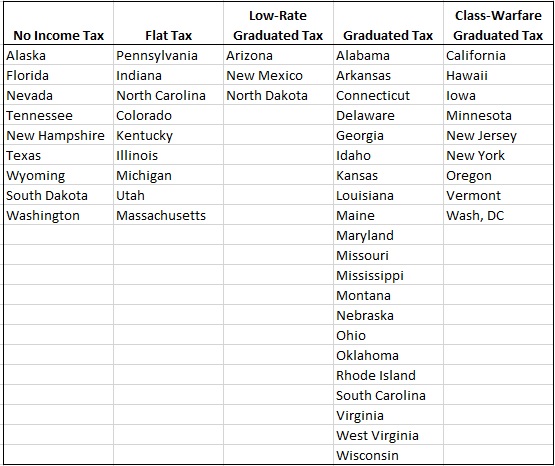

If you want to compare all of the state tax rates on one page visit. A flat rate of 463 of federal taxable income with modifications. In some states a large number of brackets are clustered within a narrow income band.

In georgia different tax brackets are. Georgias taxpayers reach the states sixth and highest bracket at 7000 in annual income. 259 to 454 the highest rate applies to incomes over 165674.

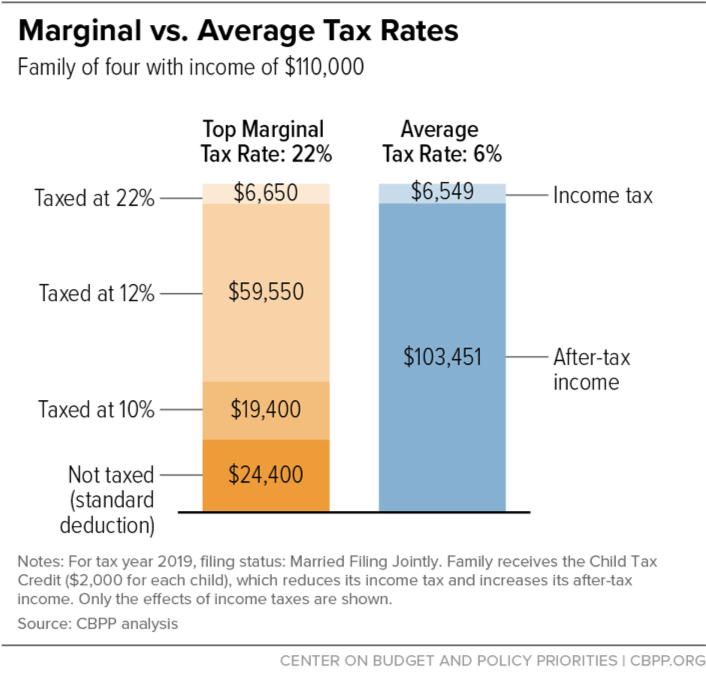

Detailed georgia state income tax rates and brackets are available on this page. Each marginal rate only applies to earnings within the applicable marginal tax bracket. We can also see the progressive nature of georgia state income tax rates from the lowest ga tax rate bracket of 1 to the highest ga tax rate bracket of 575.

Includes short and long term 2019 federal and state capital gains tax rates. The georgia income tax has six tax brackets with a maximum marginal income tax of 575 as of 2020. Choose any state from the list above for detailed state income tax information including 2020 income tax tables state tax deductions and state specific income tax calculators.

Georgia has six marginal tax brackets ranging from 1 the lowest georgia tax bracket to 575 the highest georgia tax bracket. Georgia does not tax social security retirement benefits and provides a maximum deduction of 65000 per person on all types of retirement income for anyone 65 or older. 09 to 69 the highest rate applies to incomes over 37200.

2 to 5 the highest rate applies to incomes over 3000. 1 to 133 the highest rate applies to incomes over 1000000.