Georgia State Income Tax Rate Calculator

Georgia state tax calculator tax calculator the georgia tax calculator is updated for the 202021 tax year.

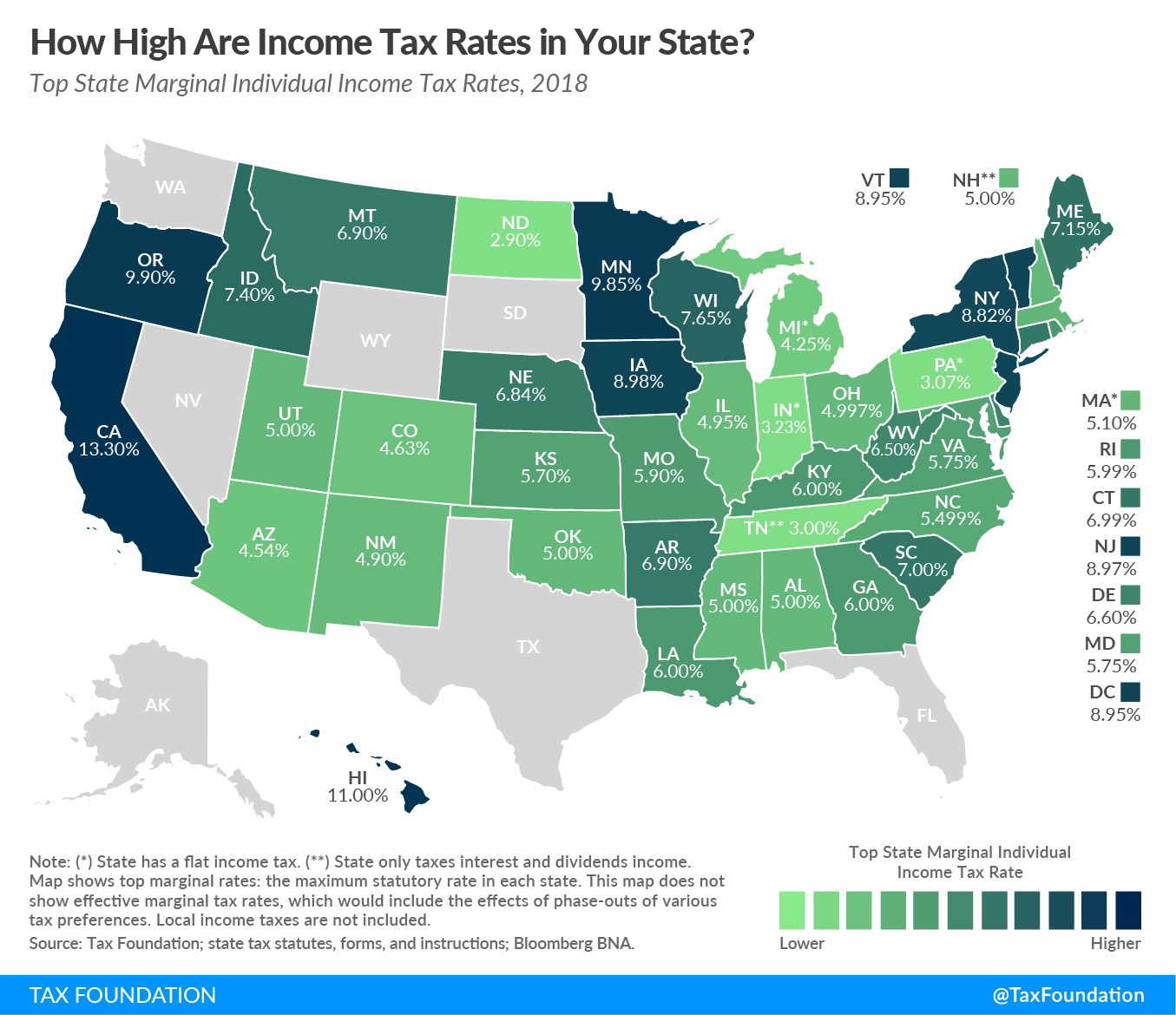

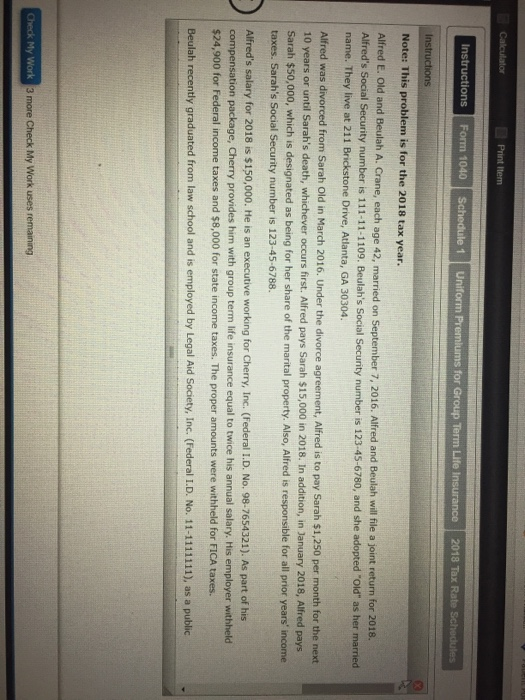

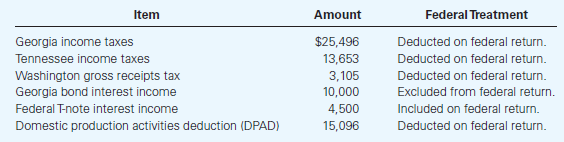

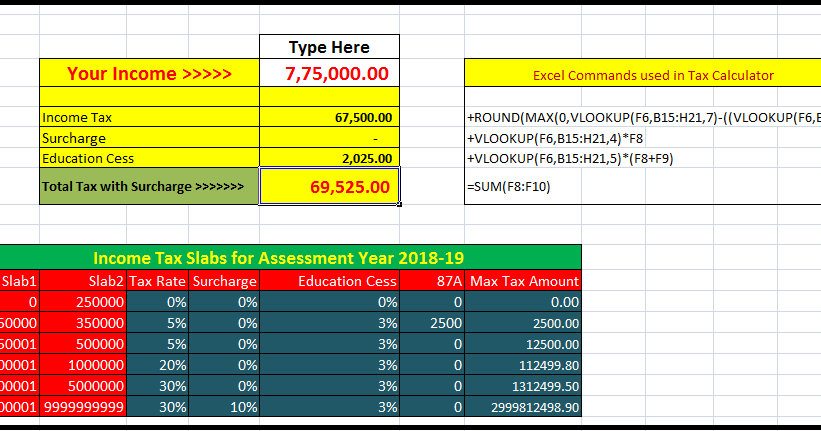

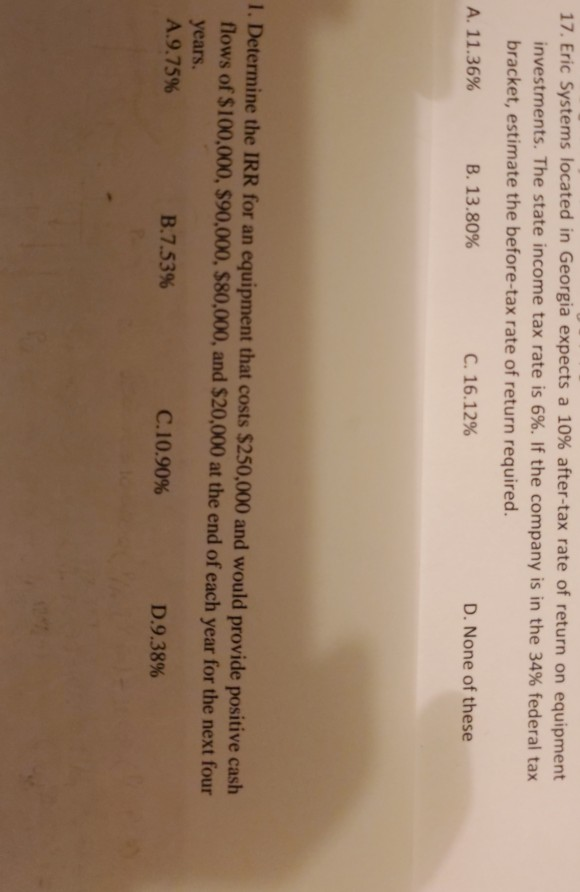

Georgia state income tax rate calculator. Our calculator has recently been updated in order to include both the latest federal tax rates along with the latest state tax rates. Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. Peach state residents who make more money can expect to pay more in state and federal taxes.

Overview of georgia taxes. The provided information does not constitute financial tax or legal advice. Filing state taxes the basics.

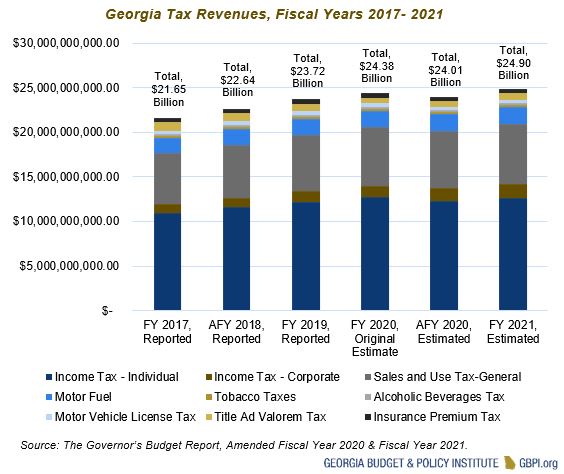

The georgia income tax has six tax brackets with a maximum marginal income tax of 575 as of 2020. Popular online tax services. The georgia state tax tables for 2019 displayed on this page are provided in support of the 2019 us tax calculator and the dedicated 2019 georgia state tax calculatorwe also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for each state.

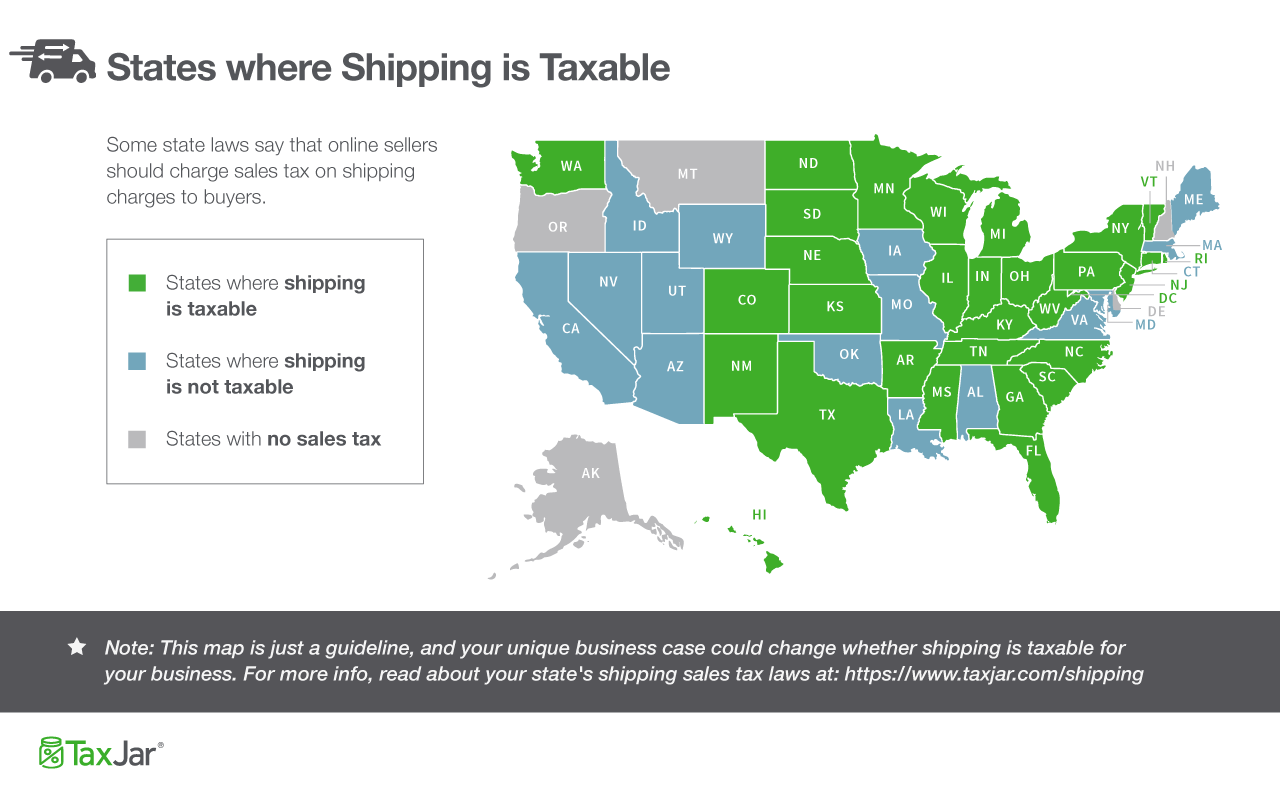

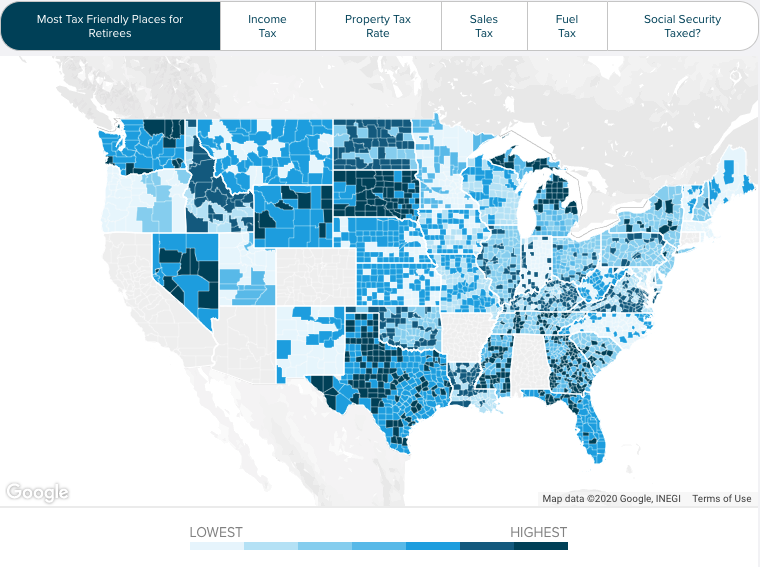

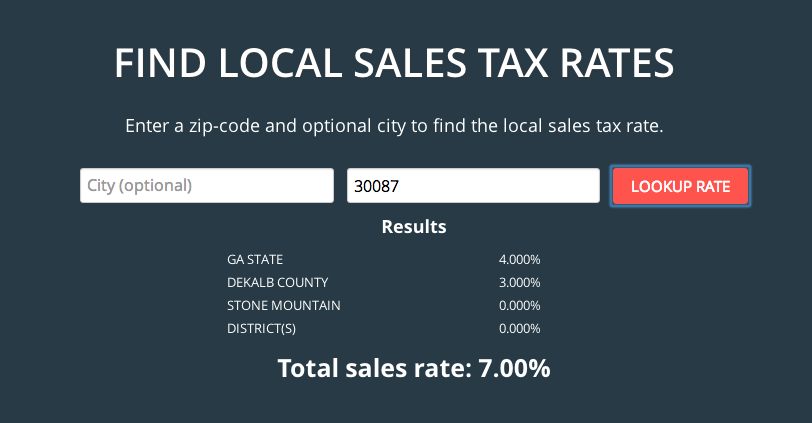

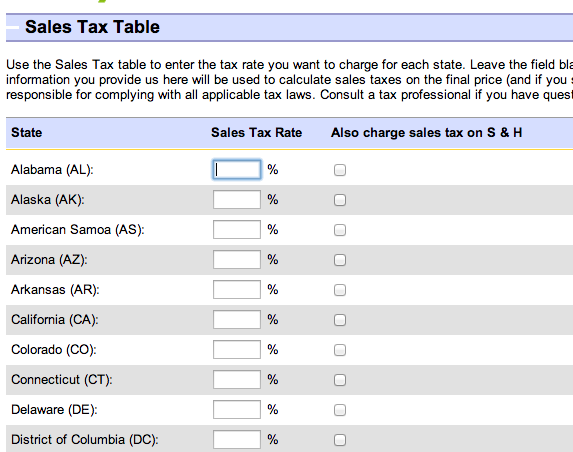

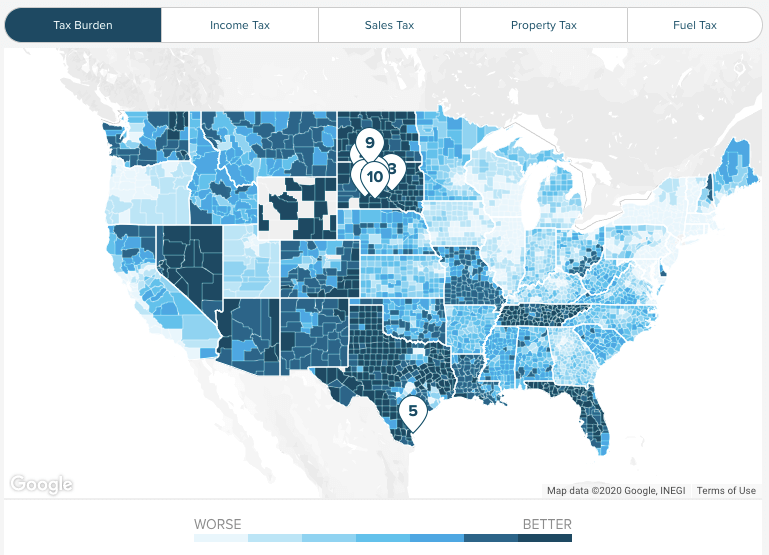

Higher earners pay higher rates although georgias brackets top out at 7000 for single filers which means the majority of full time workers will pay the top rate. Search for income tax statutes by keyword in the official code of georgia. The states sales tax rates and property tax rates are both relatively moderate.

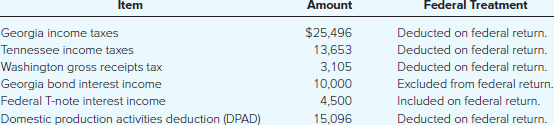

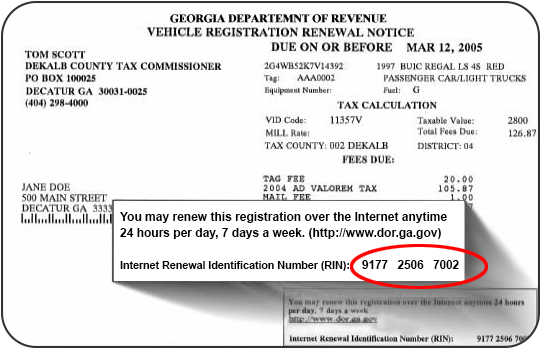

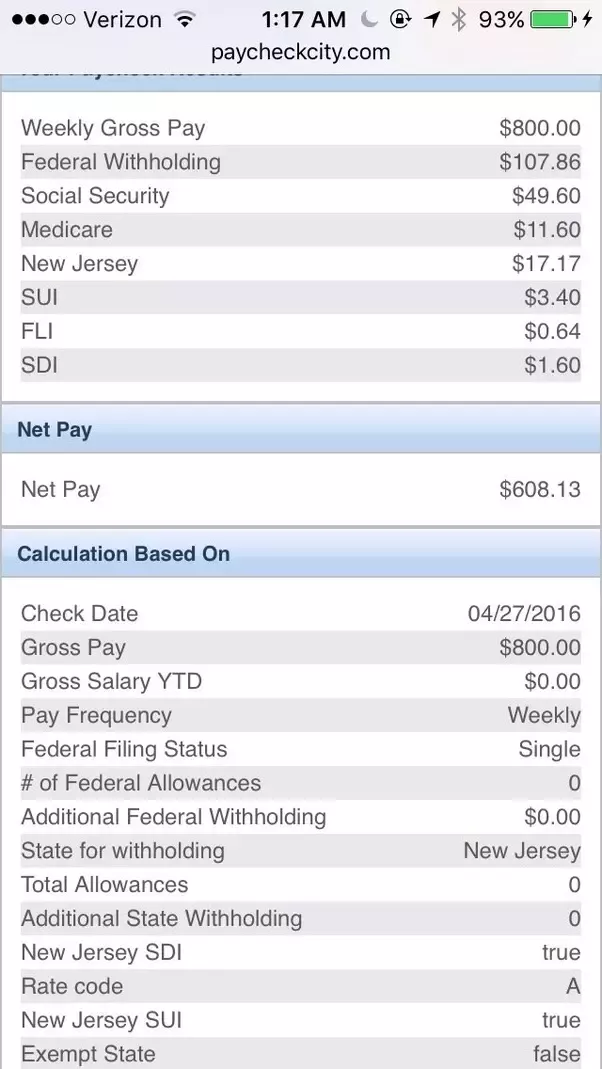

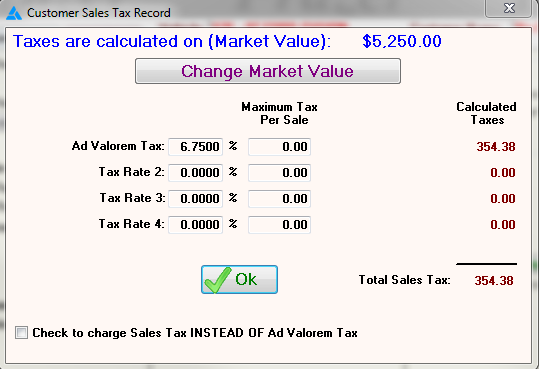

Your household income location filing status and number of personal exemptions. Also we separately calculate the federal income taxes you will owe in the 2019 2020 filing season based on the trump tax plan. The georgia department of revenue is responsible for publishing the latest georgia state tax.

We strive to make the calculator perfectly accurate. Detailed georgia state income tax rates and brackets are available on this page. Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575.

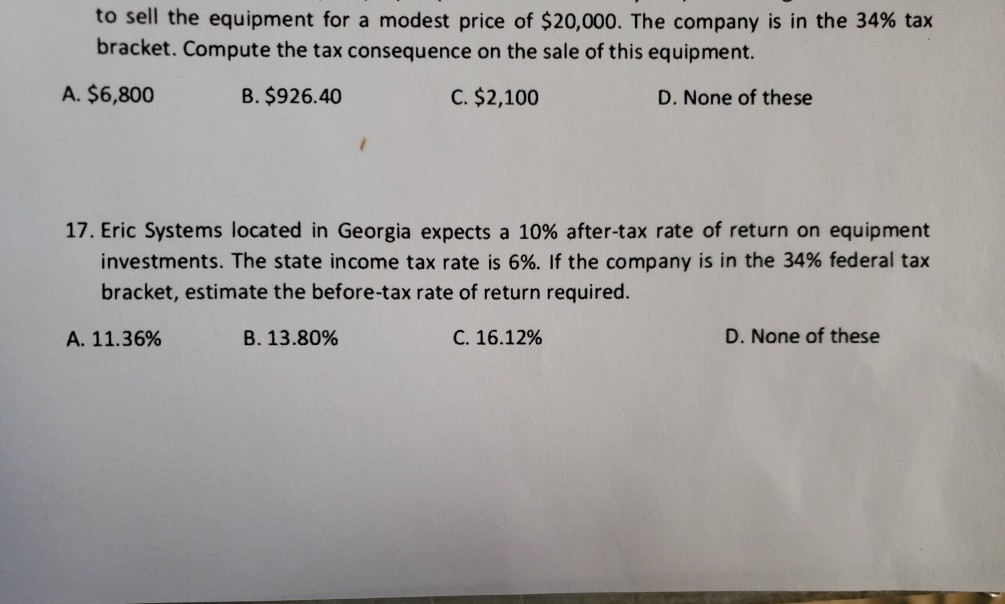

Filing requirements for full and part year residents and military personnel. Georgia does not tax social security retirement benefits and provides a maximum deduction of 65000 per person on all types of retirement income for anyone 65 or older. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self employment tax capital gains tax and the net investment tax.

Georgia has no inheritance or estate taxes. The ga tax calculator calculates federal taxes where applicable medicare pensions plans fica etc allow for single joint and head of household filing in gas.

2.png)