Georgia Income Tax Rate For Retirees

Ohios income tax.

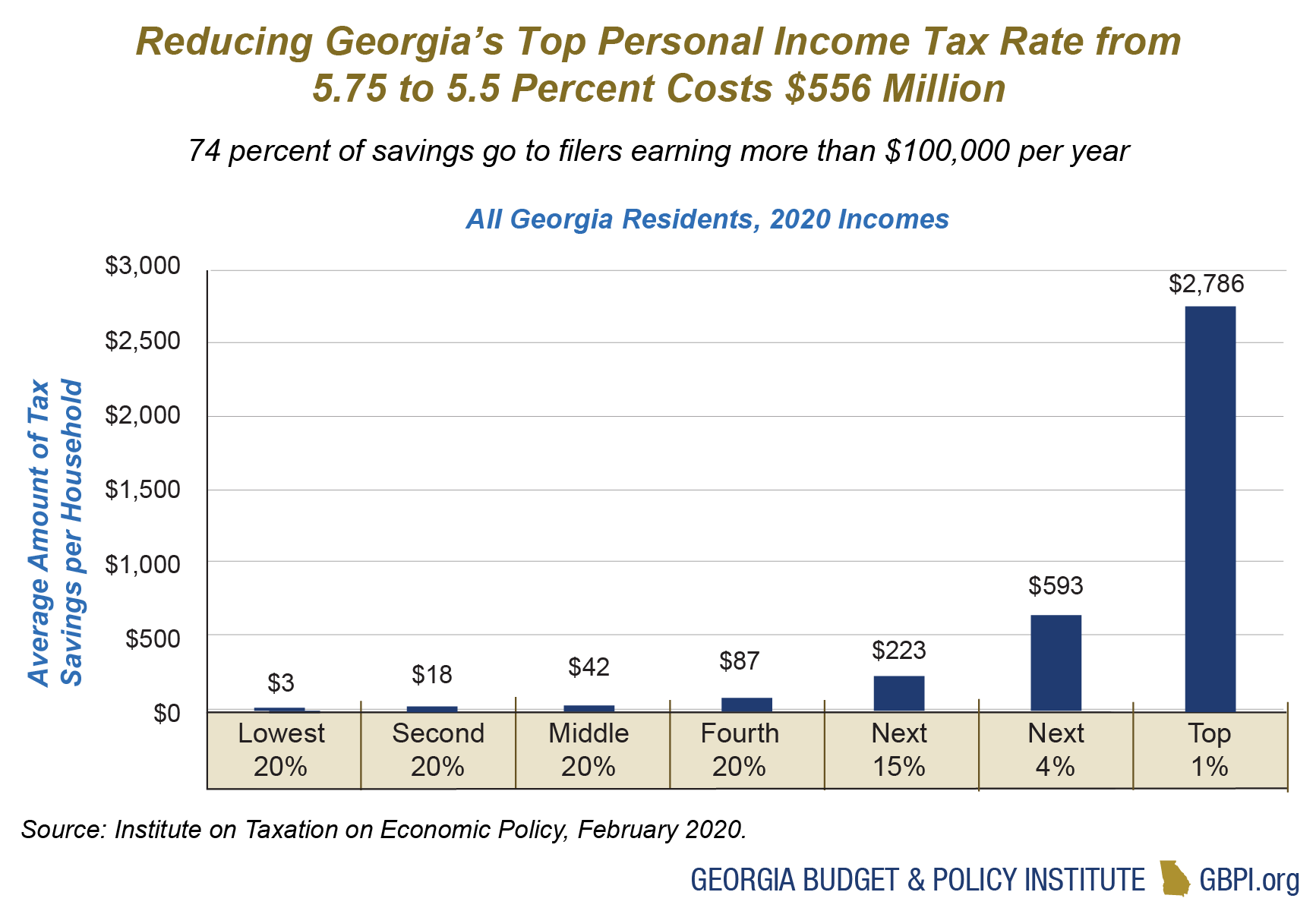

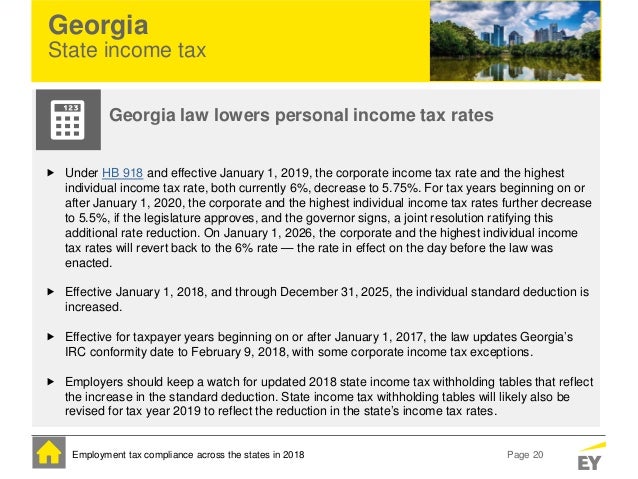

Georgia income tax rate for retirees. The georgia income tax has six tax brackets with a maximum marginal income tax of 575 as of 2020. Taxpayers who are 62 or older or permanently and totally disabled regardless of age may be eligible for a retirement income adjustment on their georgia tax return. Georgia has no inheritance or estate taxes.

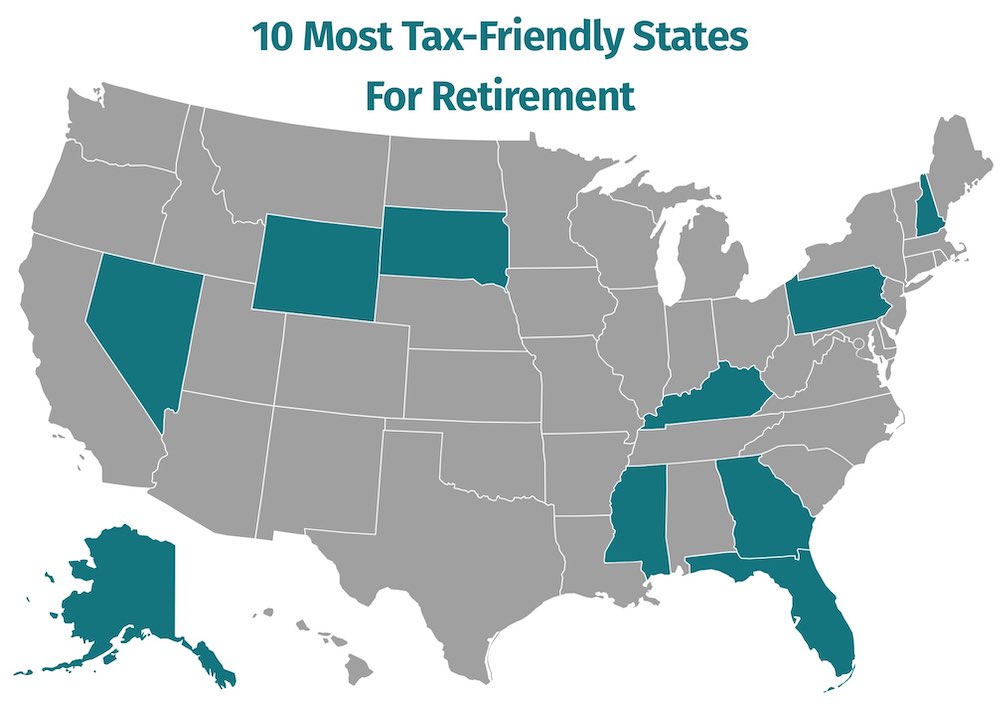

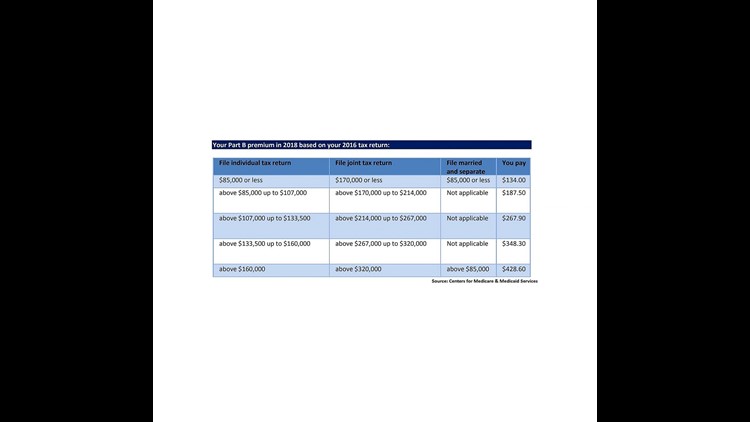

Interest dividends net rentals capital gains royalties pensions annuities and the first 400000 of earned income. However georgia remains among the top 10 tax friendly states for retirees as ranked by kiplinger in 2017. Military retirees ages 55 64 can exclude up to 20000 in any one tax year from their retirement pay those 65 and over can exclude up to.

Between the ages of 6264 retirees are able to avoid taxes on up to 35000 of their annual retirement income. Detailed georgia state income tax rates and brackets are available on this page. Higher earners pay higher rates although georgias brackets top out at 7000 for single filers which means the majority of full time workers will pay the top rate.

Earned income is income from a trade or business wages salaries tips or other compensation. When a retiree reaches age 65 the size of their exclusions expands to 65000. The first 3500 of military retirement pay is exempt.

Georgia does not tax social security retirement benefits and provides a maximum deduction of 65000 per person on all types of retirement income for anyone 65 or older. Social security income is exempt from state taxes as is up to 35000 of most types of. Retirement income includes items such as.

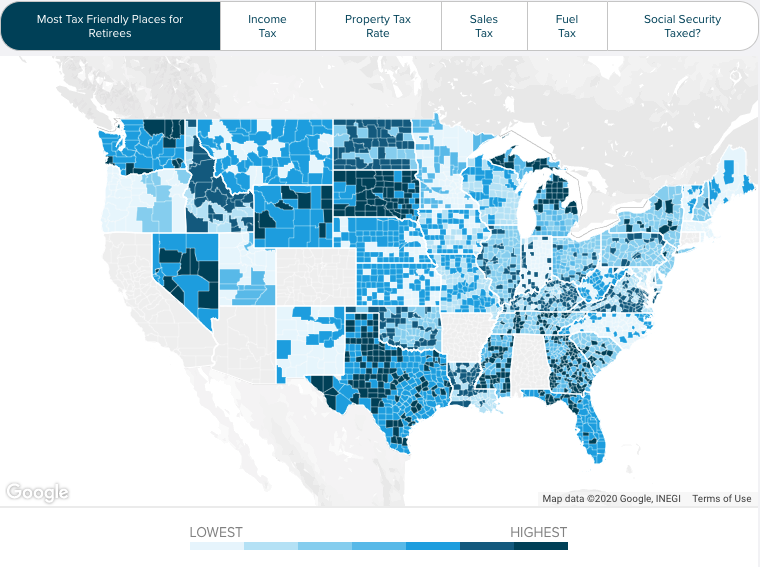

The buckeye state exempts social security benefits from state income taxes and also allows retirees to claim a tax credit of up to 200 on other types of retirement income. State by state guide to taxes on retirees click on any state in the map below for a detailed summary of taxes on retirement income property and purchases as well as special tax breaks for seniors.

/states-without-an-income-tax-36d1d404657e490db7bb3be36a9d0619.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/105880417-F-56a938613df78cf772a4e2eb.jpg)