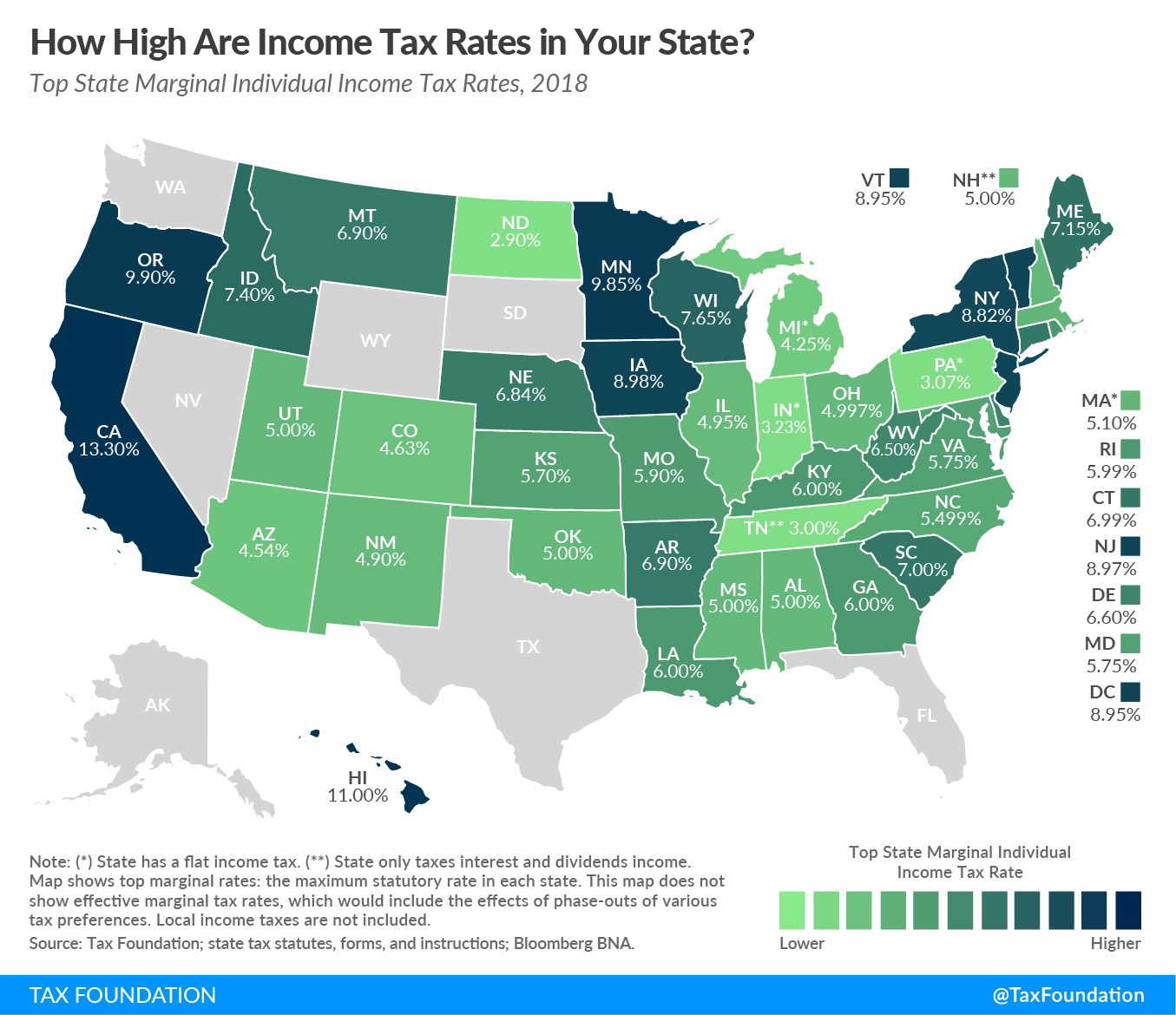

Georgia Income Tax Rate 2018

2018 georgia income tax tables 2018 georgia income tax tables.

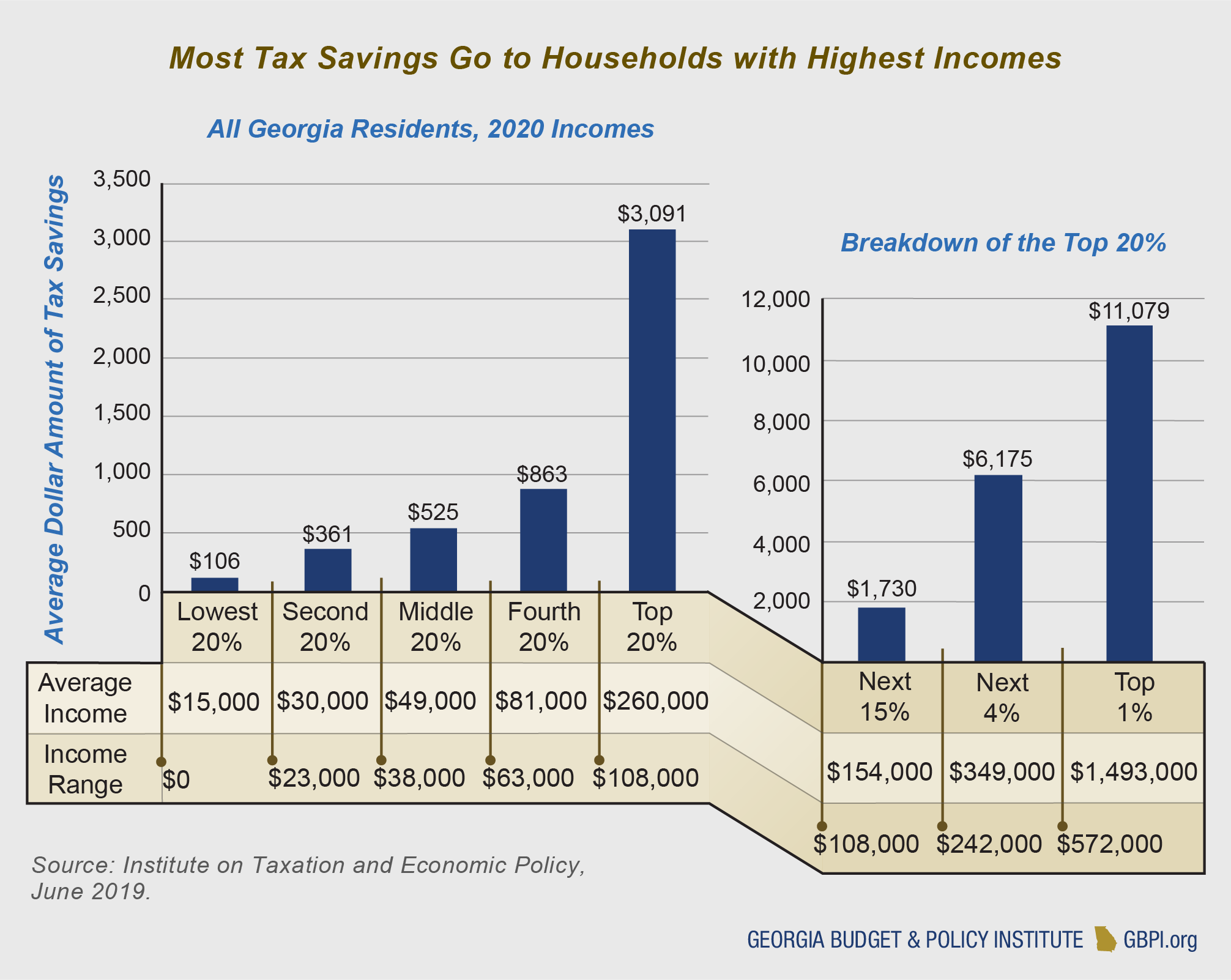

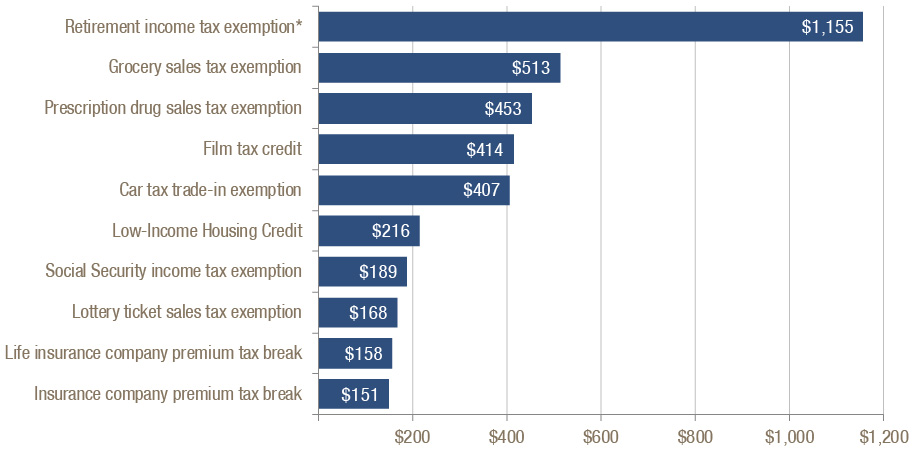

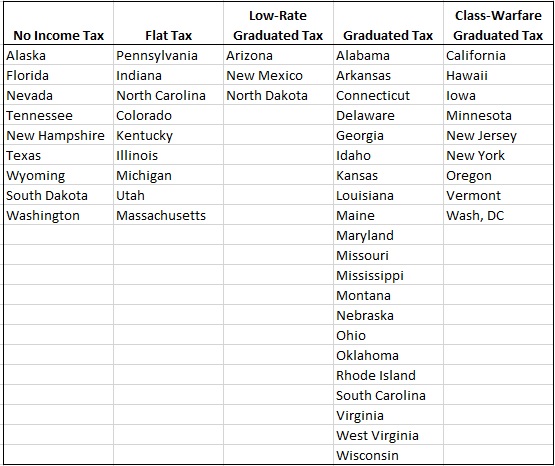

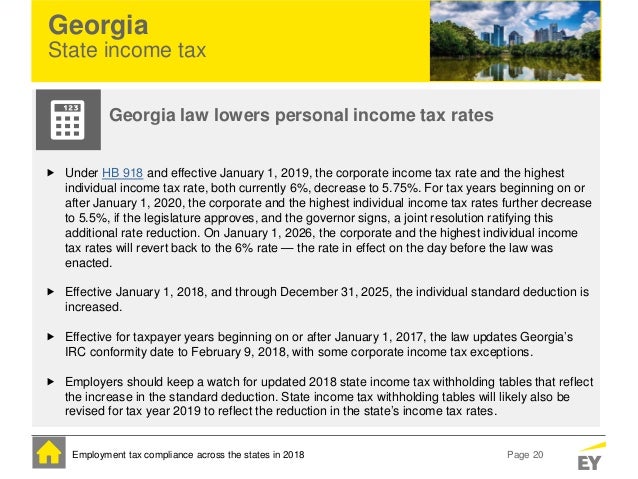

Georgia income tax rate 2018. Higher earners pay higher rates although georgias brackets top out at 7000 for single filers which means the majority of full time workers will pay the top rate. We can also see the progressive nature of georgia state income tax rates from the lowest ga tax rate bracket of 1 to the highest ga tax rate bracket of 575. Corporations may also have to pay a net worth tax.

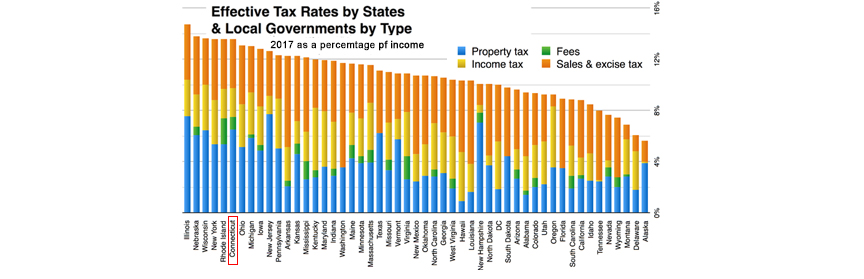

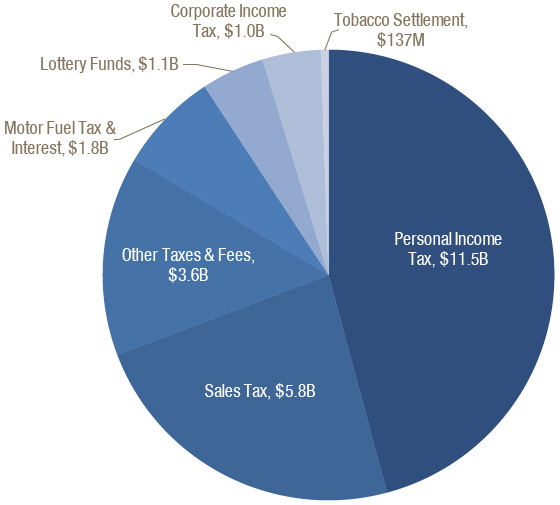

The states sales tax rates and property tax rates are both relatively moderate. Filing requirements for full and part year residents and military personnel. 4 on income between 3750 and 5250.

The rate of taxation is five and three quarters percent 575 of a corporations georgia taxable net income. 5 on income up to 7000. Georgia has no inheritance or estate taxes.

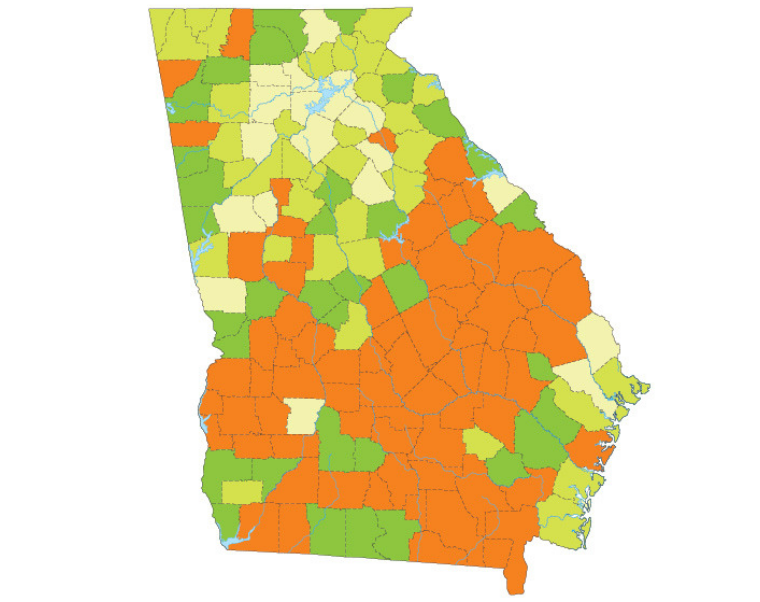

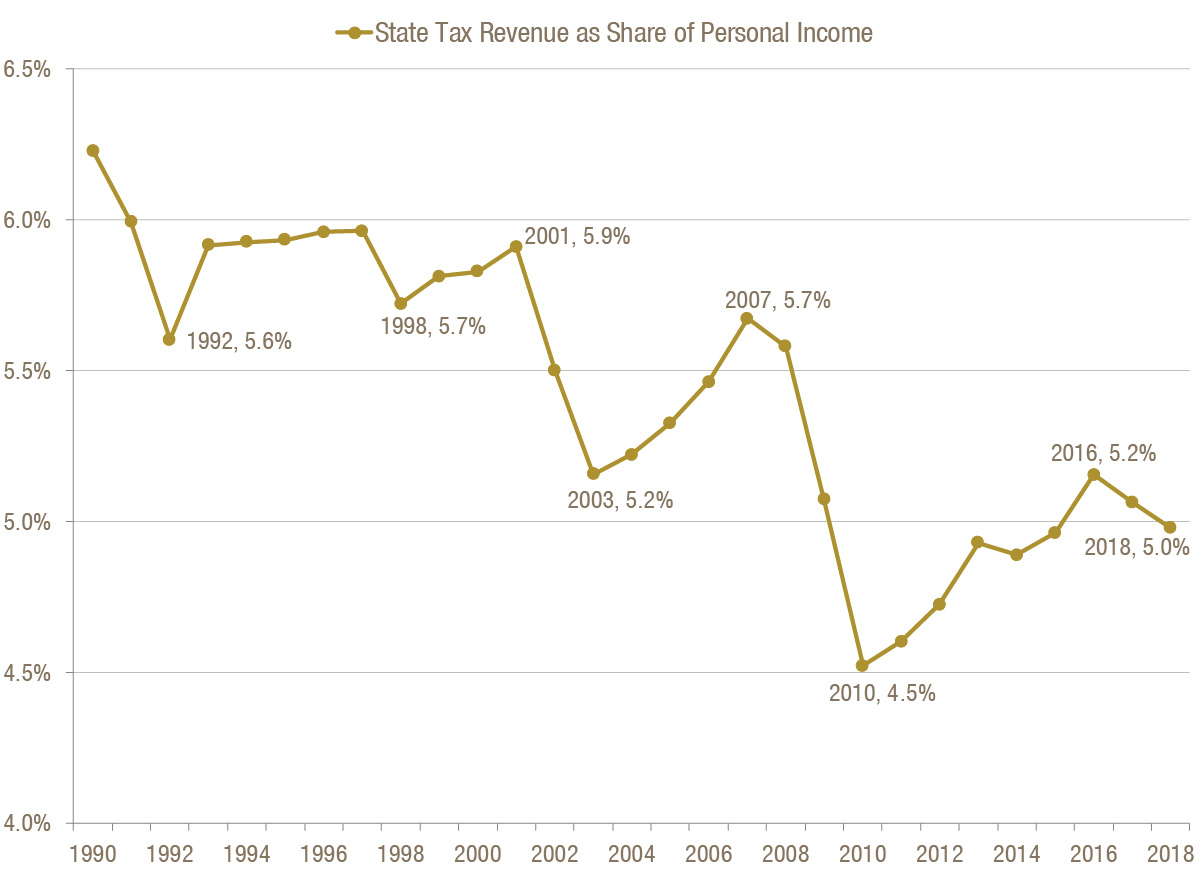

Effective october 1 2018 the generally applicable tax rate in ware county is 9 state sales tax at the statewide rate of 4 plus 5 local sales taxes at a rate of 1 each. Georgias income tax rates were last changed two years ago for tax year 2018 and the tax brackets were previously changed in 2009. Search for income tax statutes by keyword in the official code of georgia.

The georgia income tax has six tax brackets with a maximum marginal income tax of 575 as of 2020. Historical tax tables may be found within the individual income tax booklets. This years individual income tax forms.

The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 6 because the 1 2nd lost and the 1 tsplost do not apply. Filing state taxes the basics. In georgia different tax brackets are.

Overview of georgia retirement tax friendliness. Twitter page for georgia department of revenue. The tax rate for the first.

Georgia has six marginal tax brackets ranging from 1 the lowest georgia tax bracket to 575 the highest georgia tax bracket. For married couples who file jointly the tax rates are the same but the income brackets are higher at 1 on your first 1000 and at 575 if your combined. Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575.

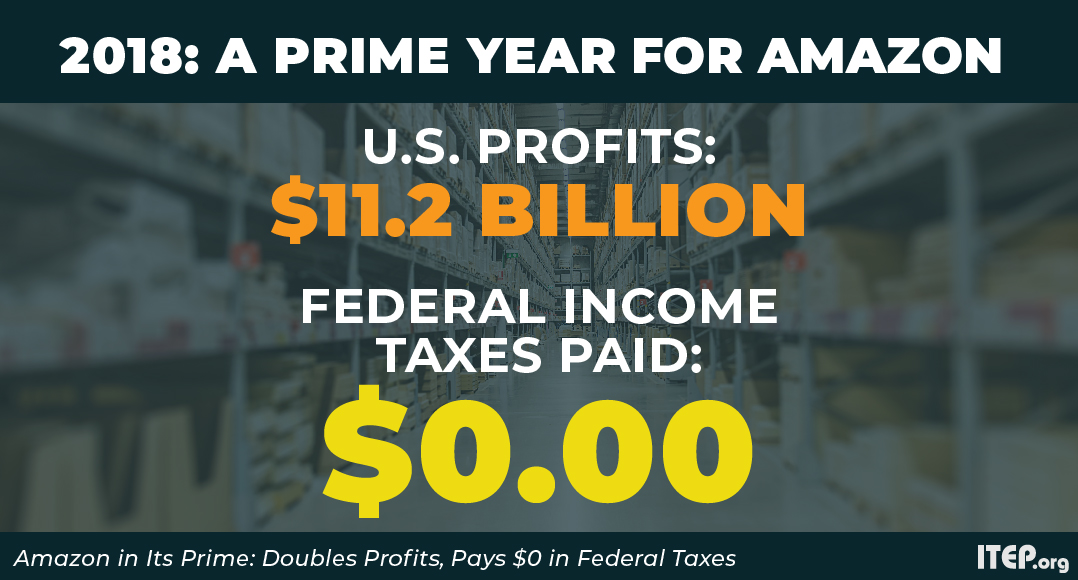

Corporations that own property do business in georgia or receive income from georgia sources are subject to corporate income tax. And finally 575 on all income above 7000. Popular online tax services.

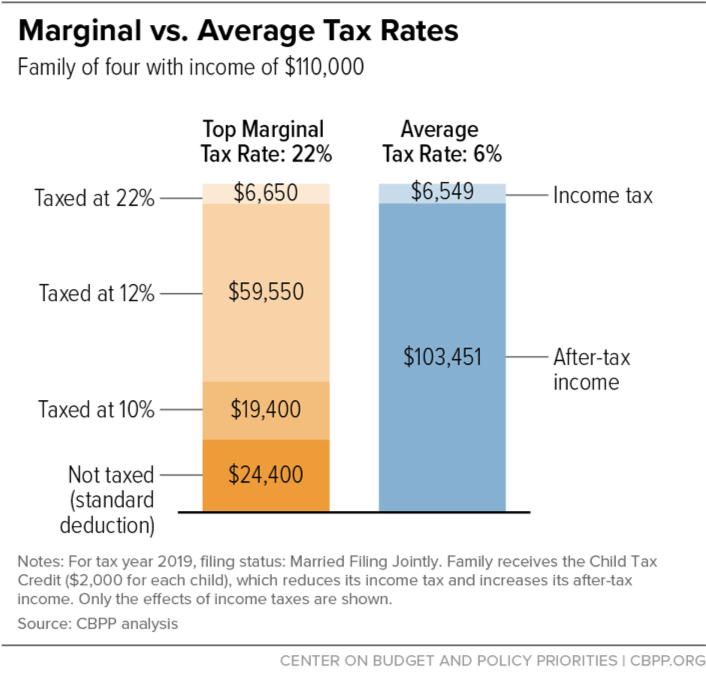

Each marginal rate only applies to earnings within the applicable marginal tax bracket. Facebook page for georgia department of revenue. Georgia does not tax social security retirement benefits and provides a maximum deduction of 65000 per person on all types of retirement income for anyone 65 or older.

Georgia tax brackets 2019 2020. Detailed georgia state income tax rates and brackets are available on this page.