Georgia Homestead Exemption

The state of georgia offers several types of homestead exemptions besides the standard exemption.

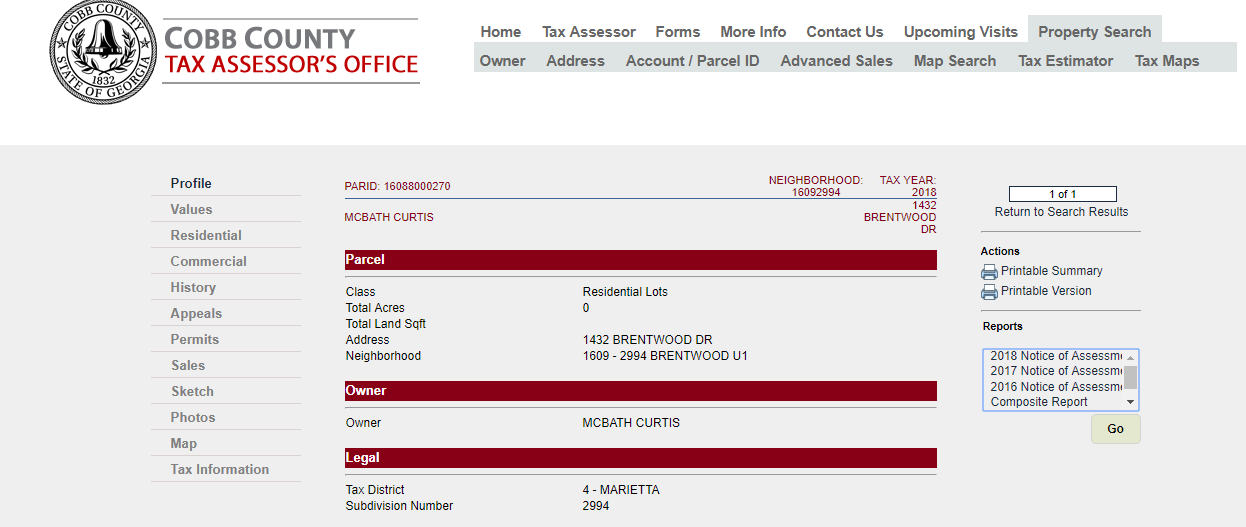

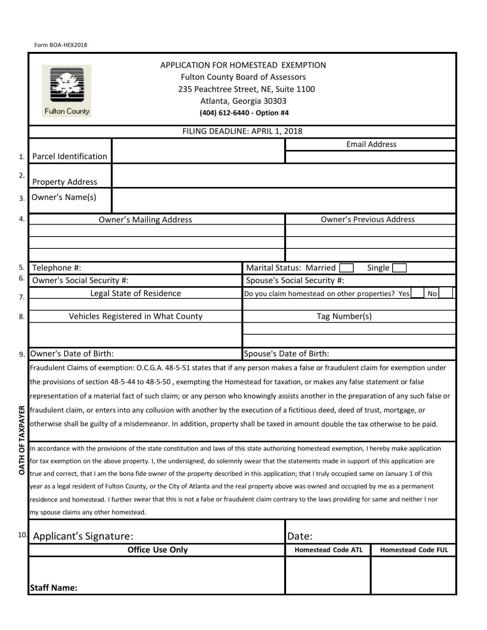

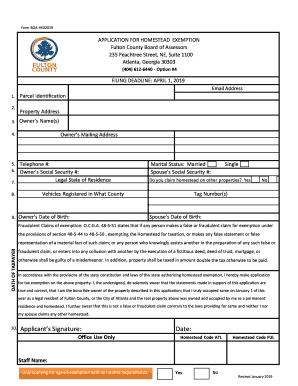

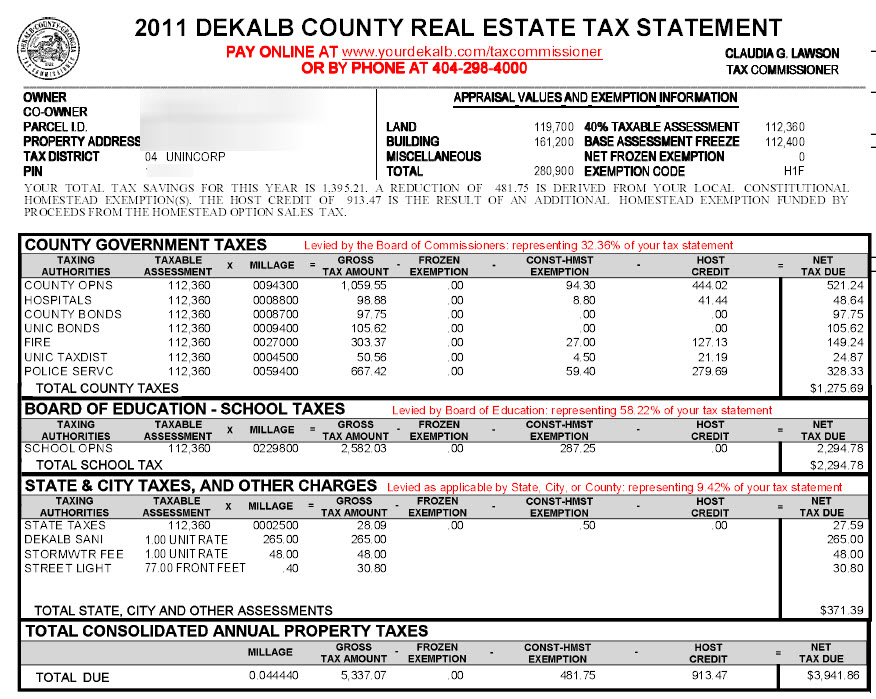

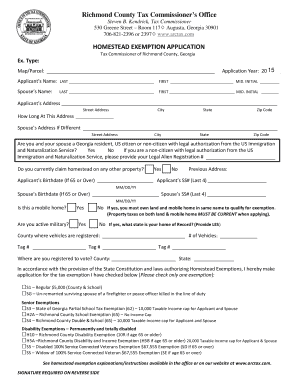

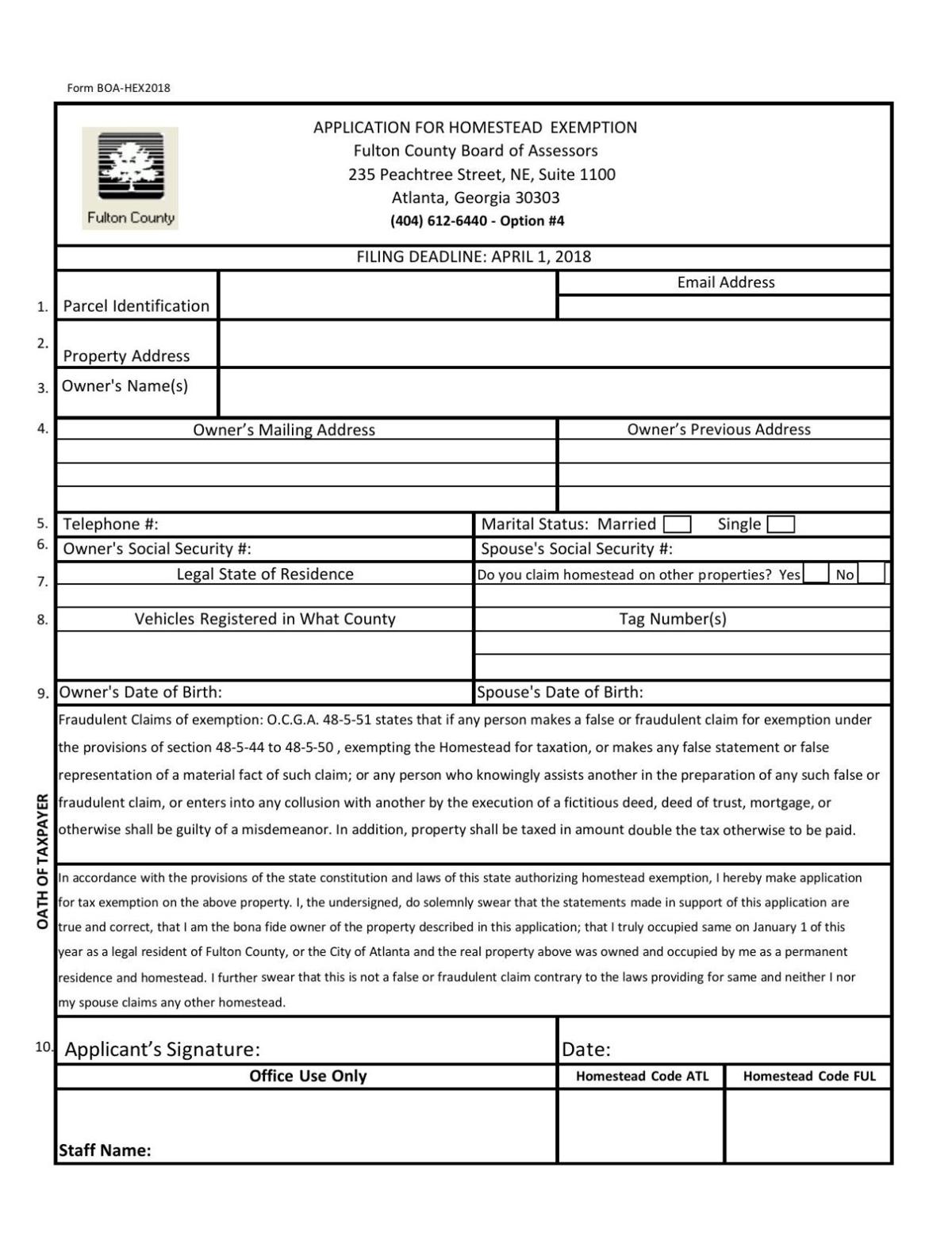

Georgia homestead exemption. Yes 1. Were you or your spouse age 62 or older as of jan 1 of the year of this application. Homeowners may qualify for different homestead exemptions from the various taxing jurisdictions including school system cities and fulton county.

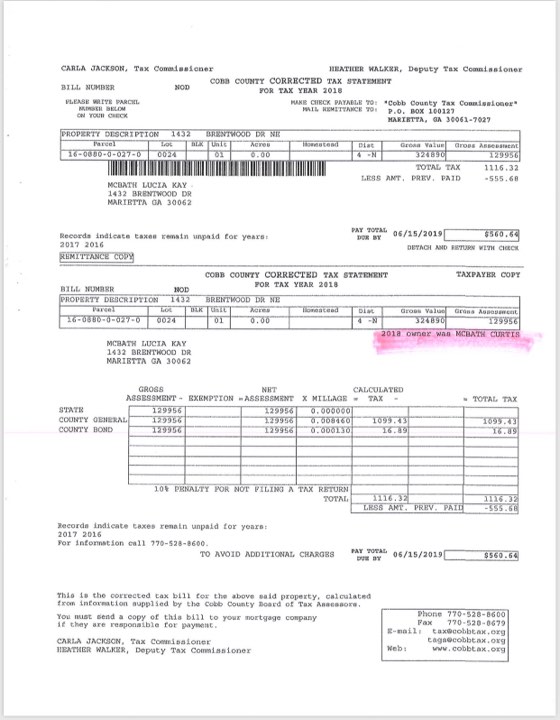

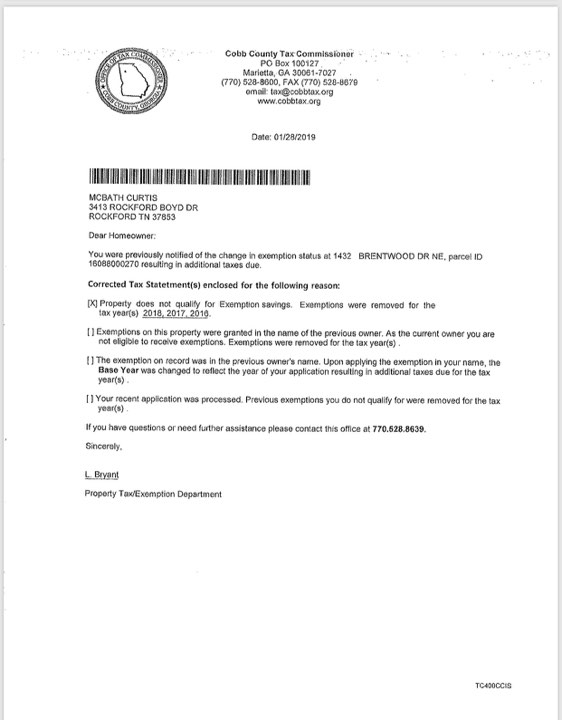

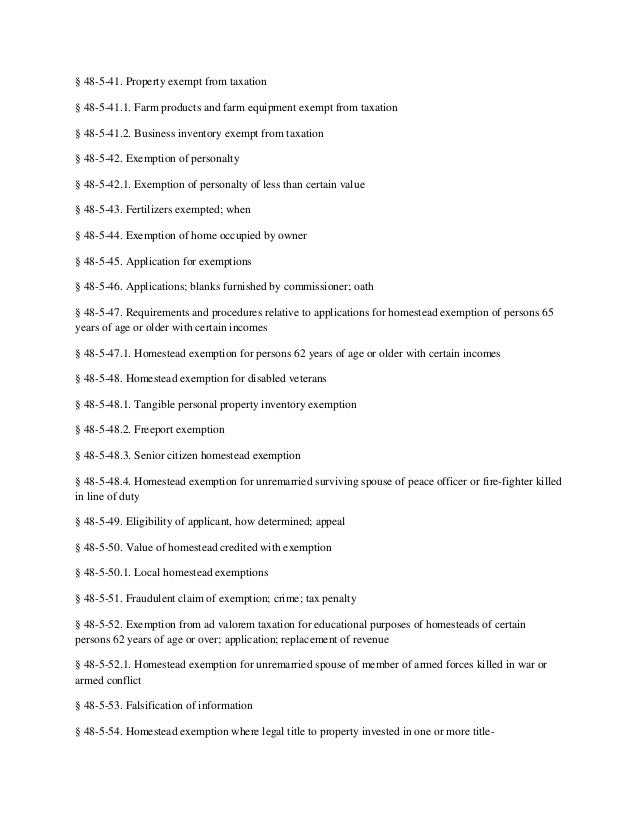

Disabled veteran homestead tax exemption the administration of tax exemptions is as interpreted by the tax commissioners of georgias 159 counties. Counties are authorized to provide for local homestead section a. You can read more about the additional exemptions listed below from georgias dor website.

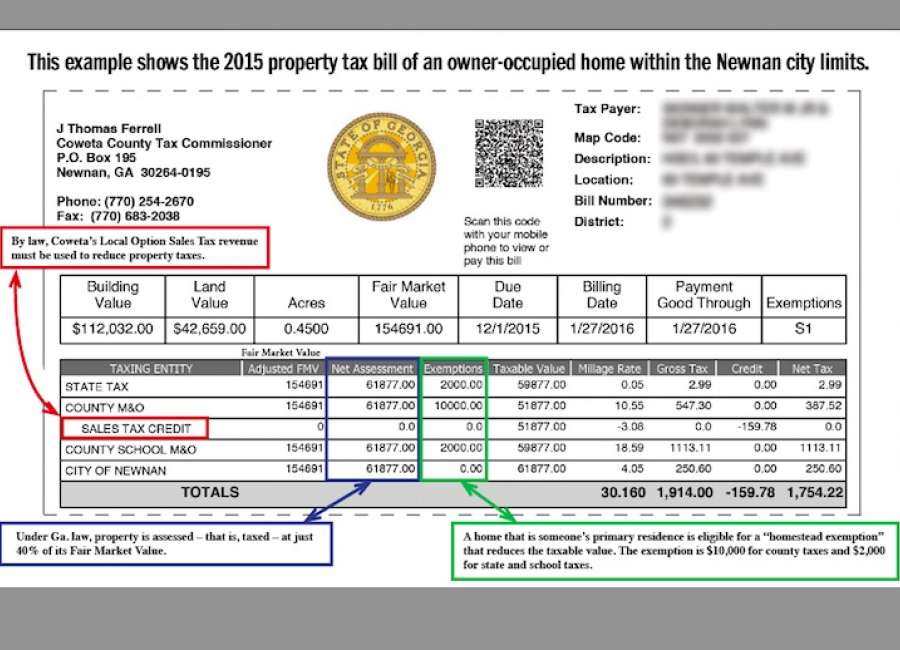

The homestead exemptions provided for in this application form are those authorized by georgia law. Georgias homestead exemption is found in the georgia state statutes at georgia code annotated 44 13 100a1 and 44 13 100a6. Individuals 65 and older can claim a 4000 exemption.

Go to sections c1 andor c2 on the back of this application to. Exemptions offered by the state and counties. Finding the georgia homestead exemption statute.

In georgia the homestead exemption is automatic you dont have to file a homestead declaration in order to claim the homestead exemption in bankruptcy. Georgia has several homestead exemptions that lower homeowner property taxes. Additional types of homestead exemptions in georgia.

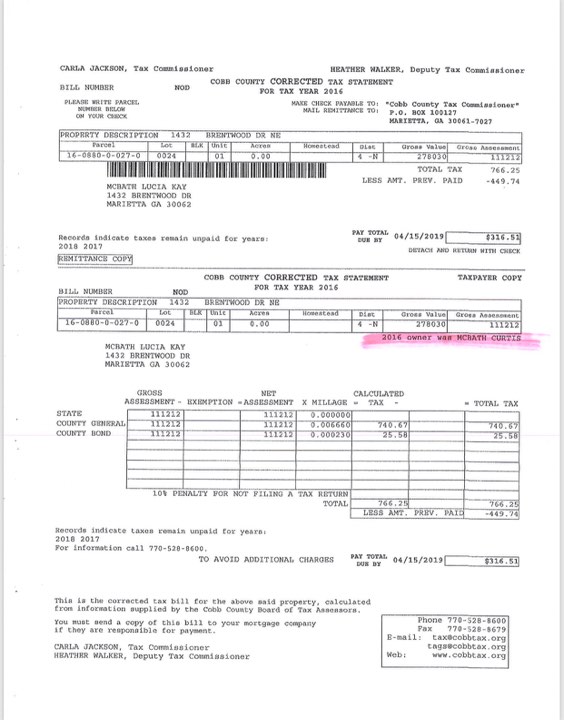

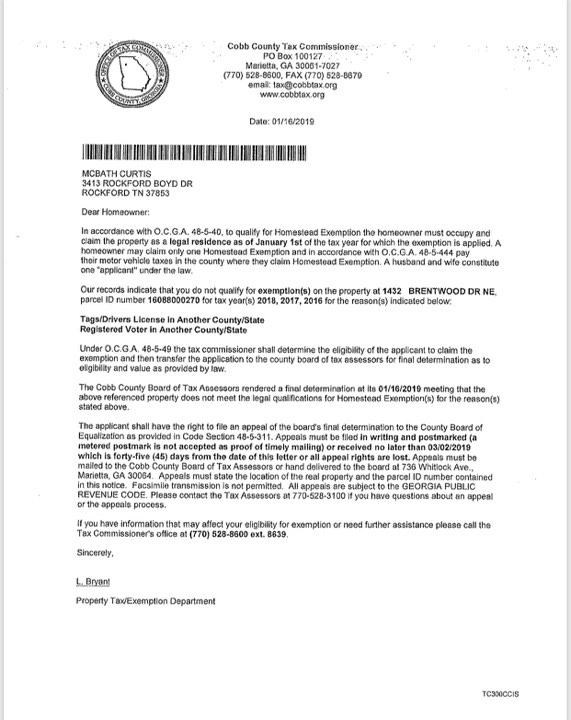

A separate exemption protects 21500 in home equity from sale in bankruptcy. The state of georgia offers homestead exemptions to all qualifying homeowners. To receive the homestead exemption for the current tax year the homeowner must have owned the property on january 1 and filed the homestead application by the same date property tax returns are due in the county.