Georgia Homestead Exemption Cobb County

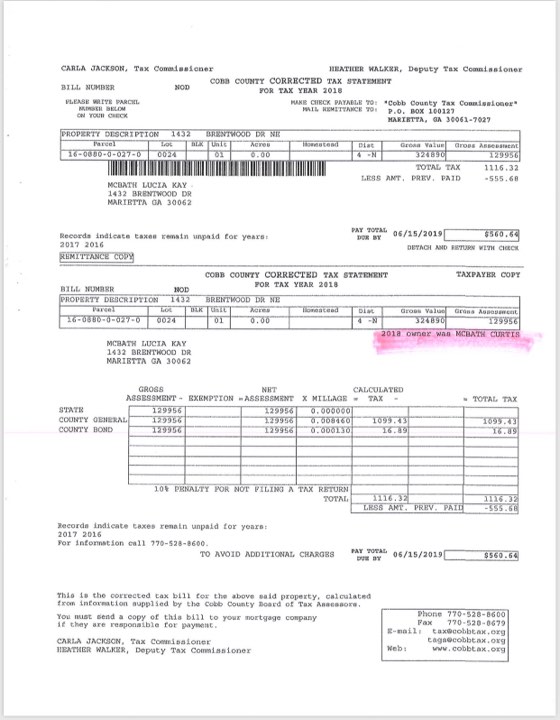

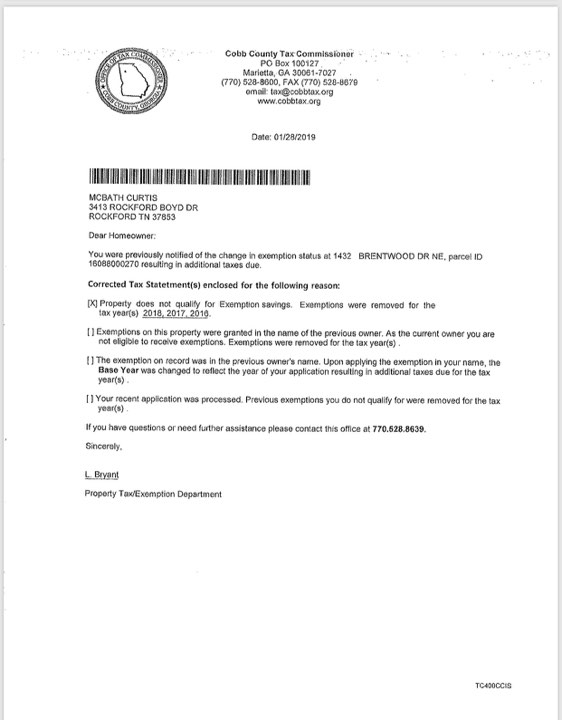

Rental properties do not qualify.

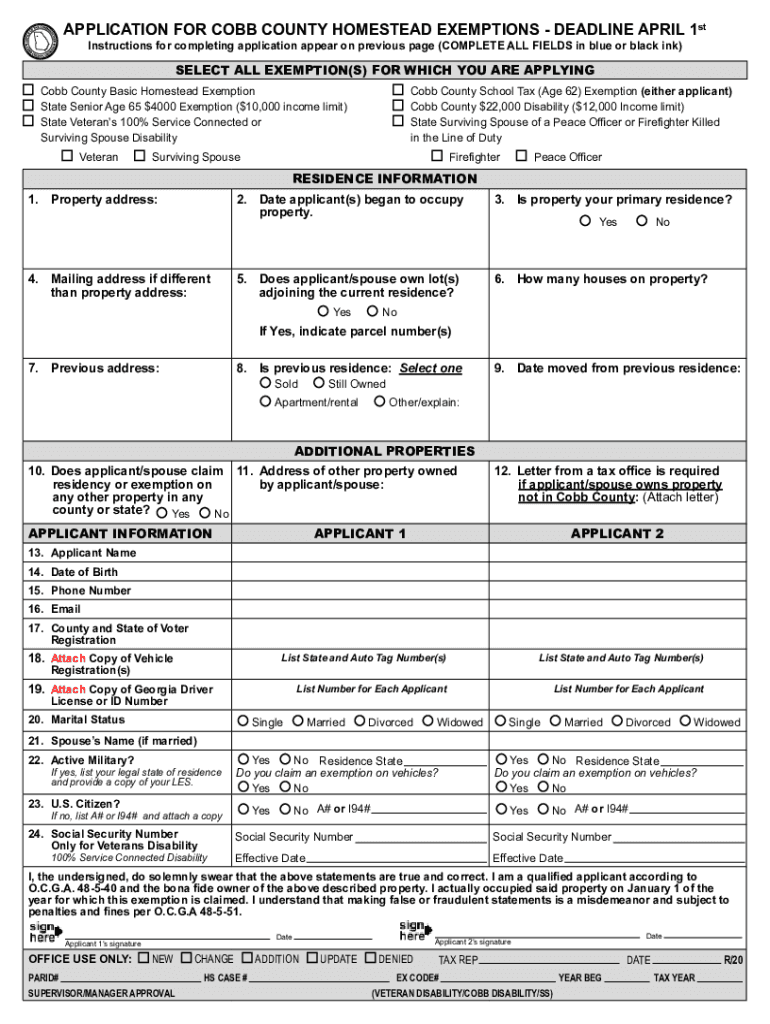

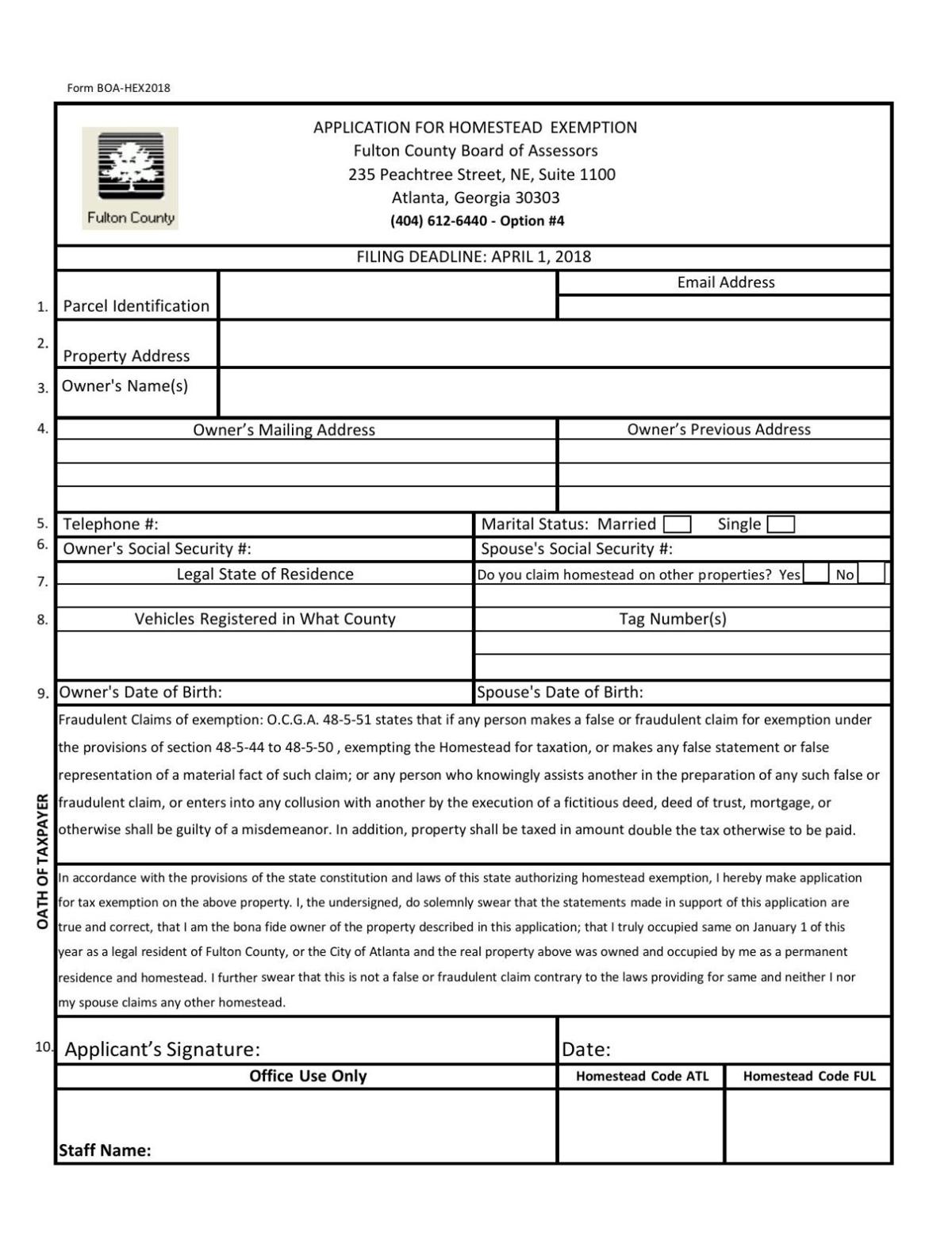

Georgia homestead exemption cobb county. You may apply for exemptions year round with the tax commissioners office however your application must be received or postmarked by april 1st to receive the exemption for that tax year. To apply fill out the form provided by the cobb county tax assessor office by march 1 for the exemption. If you have questions regarding city of smyrna homestead exemptions please call 678 631 5318.

Smyrna ga 30080 fax to. County property tax facts cobb by viewing the web pages at the local government services divisions website taxpayers should obtain a general understanding of the property tax laws of georgia that apply statewide. This page contains local information about a specific county.

The state of georgia offers homestead exemptions to all qualifying homeowners. Cobb county has additional exemptions for their. Homestead exemptions applications must be received or us.

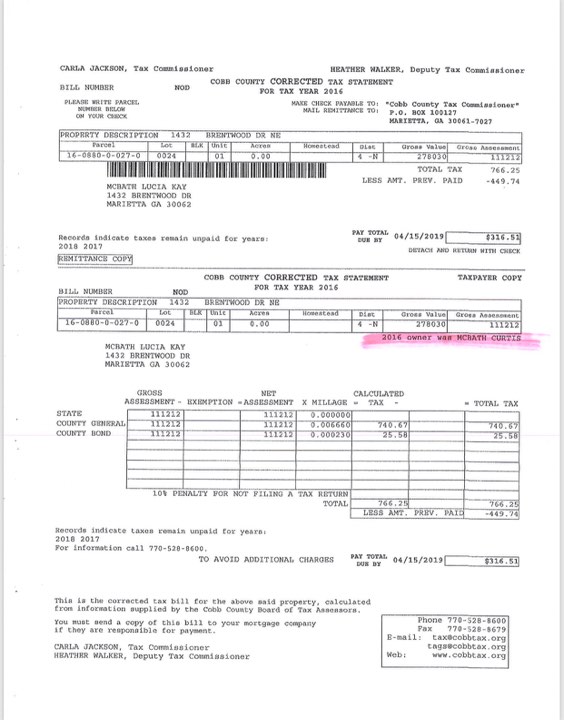

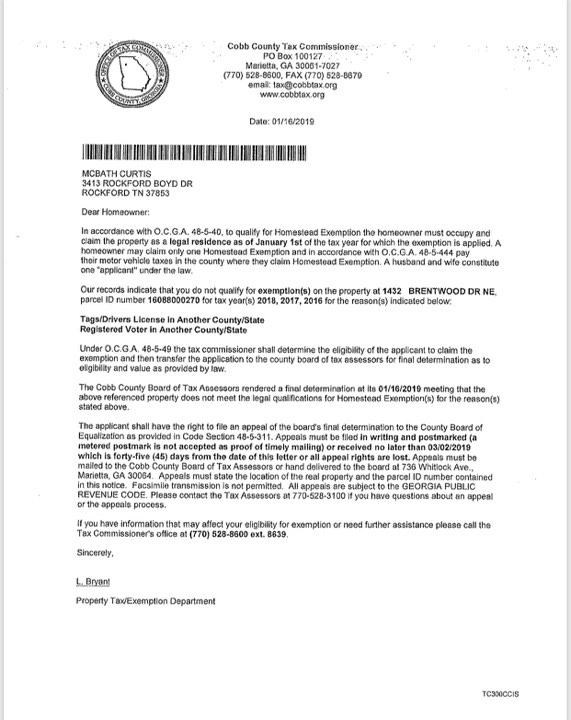

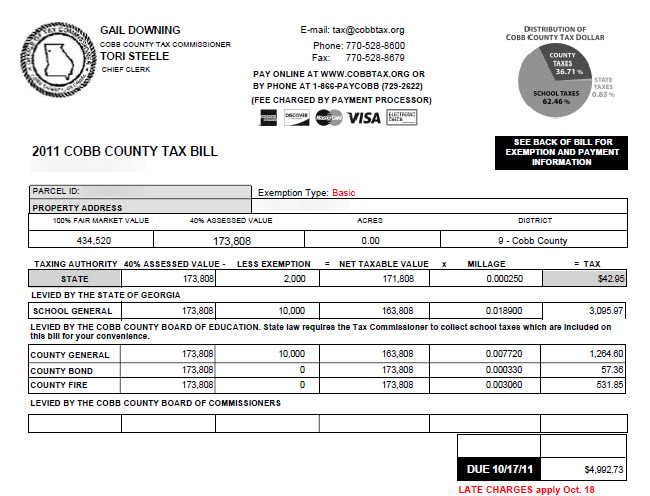

Gdvs personnel will assist veterans in obtaining the necessary documentation for filing. Georgia law ocga 48 5 444 states each motor vehicle owned by a resident of this state shall be returned in the county where the owner claims homestead exemption in other words you must provide the registration or tax receipts for all vehicles you own showing that you paid motor vehicle taxes in cobb county. The 2019 basic homestead exemption is worth 27360.

You must provide proof of georgia residency when you apply. The county seat of marietta was named. If you own occupy and claim your home as your legal residence on january 1st you are eligible for a homestead exemption.

To receive the homestead exemption for the current tax year the homeowner must have owned the property on january 1 and filed the homestead application by the same date property tax returns are due in the county. It was named for judge thomas willis cobb who served as a us. You need to apply only once not yearly.

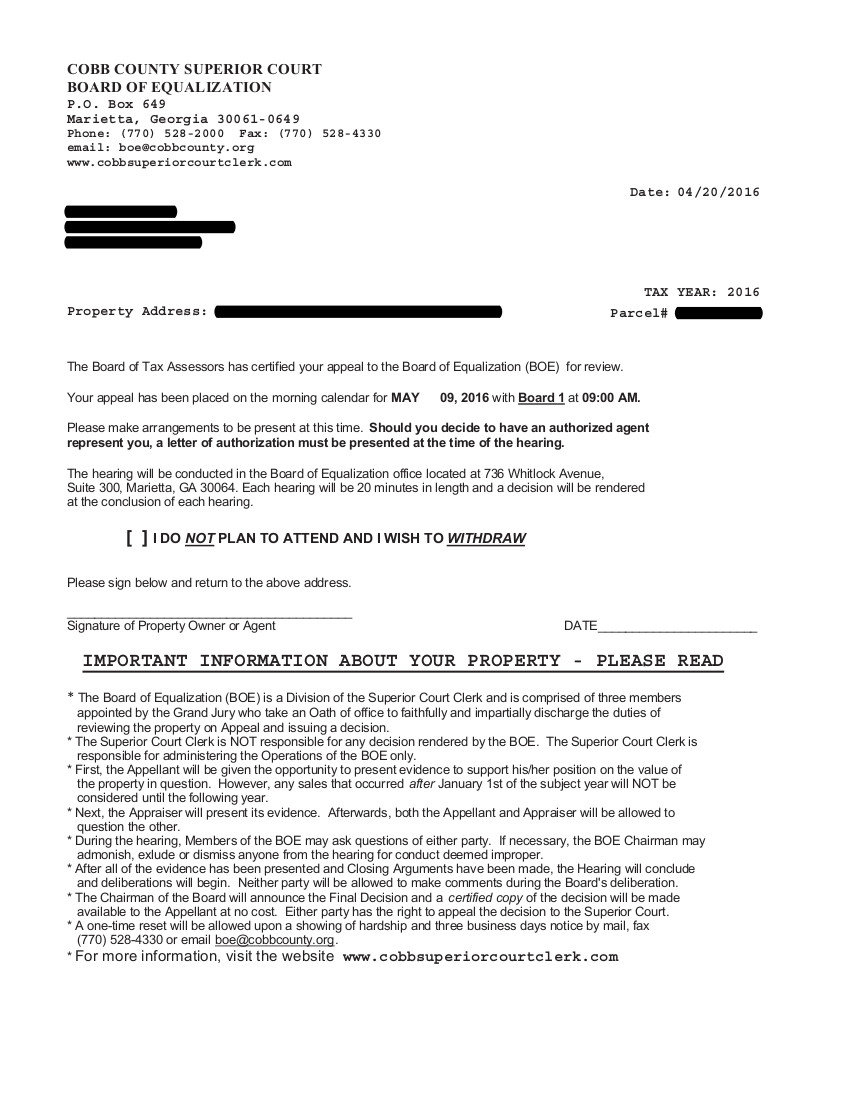

Any questions pertaining to tax exemptions at the local level should be asked to and answered by your county tax commissioners office. Exemptions offered by the state and counties. Cobb county created in 1832 was the 81st county in georgia.

What happens if you do not live in cobb county. Senator state representative and superior court judge. The administration of tax exemptions is as interpreted by the tax commissioners of georgias 159 counties.

Can i have an extension to file my homestead exemption. Post marked by wednesday april 1 to apply to the current 2020 tax year. Additional exemptions are available to those who meet legal criteria.

Census bureau ranks cobb county as the most educated in the state of georgia and 12th among all counties in the us. Cobb county school tax age 62 an exemption from all taxes in the school general and school bond tax categories. Cobb tax commissioners office shared some commonly asked questions and answers during limited operations due to covid 19.

In addition you are automatically eligible for a 2000 exemption in the state tax category.