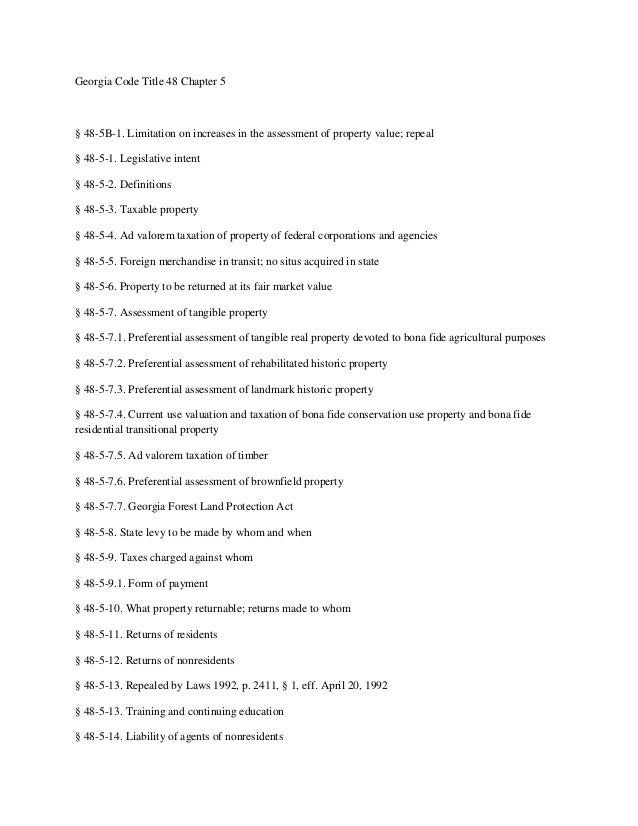

Georgia Homestead Exemption Codes

Hf01u4 2000 hf01 ue4 s1 regular homestead.

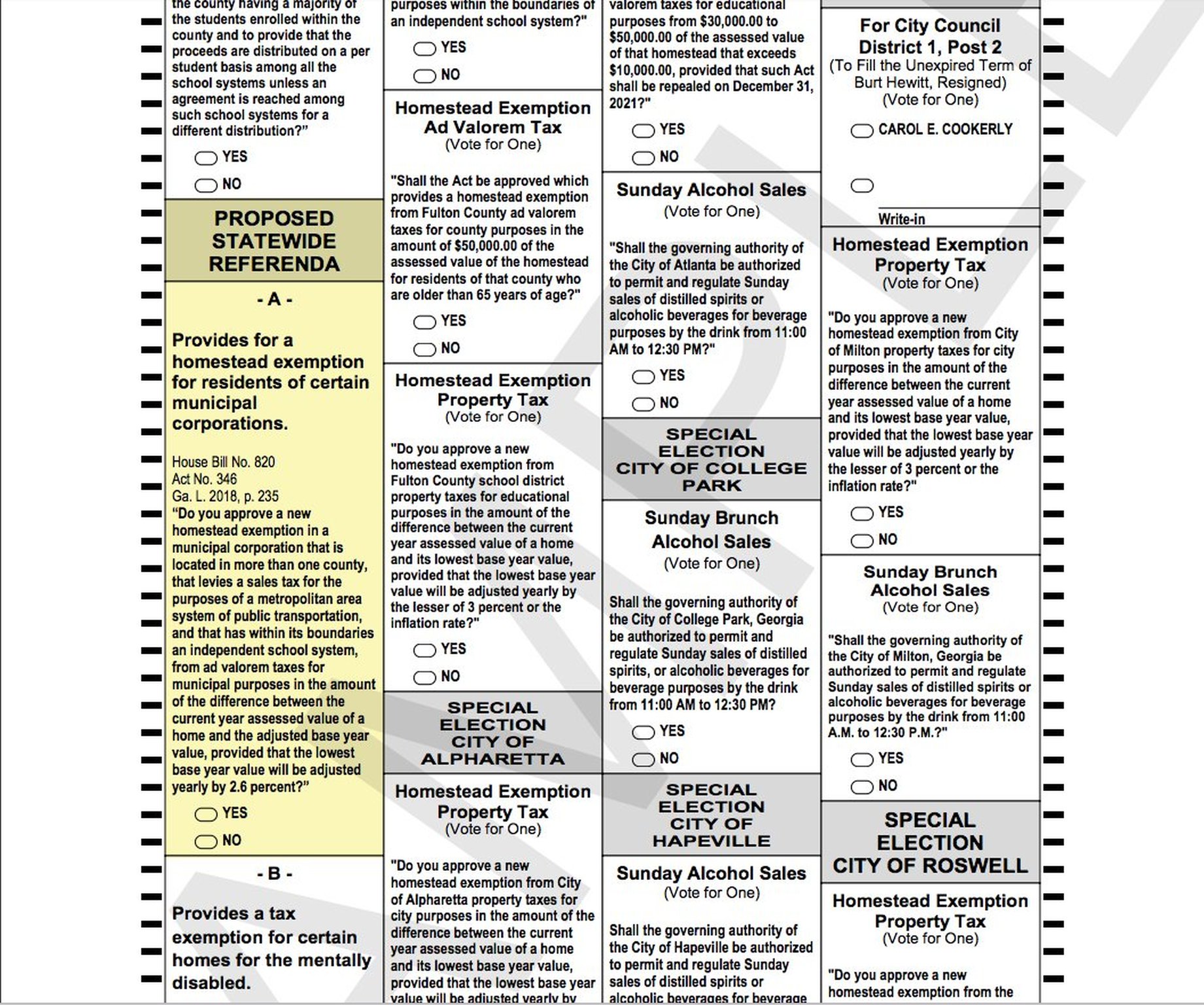

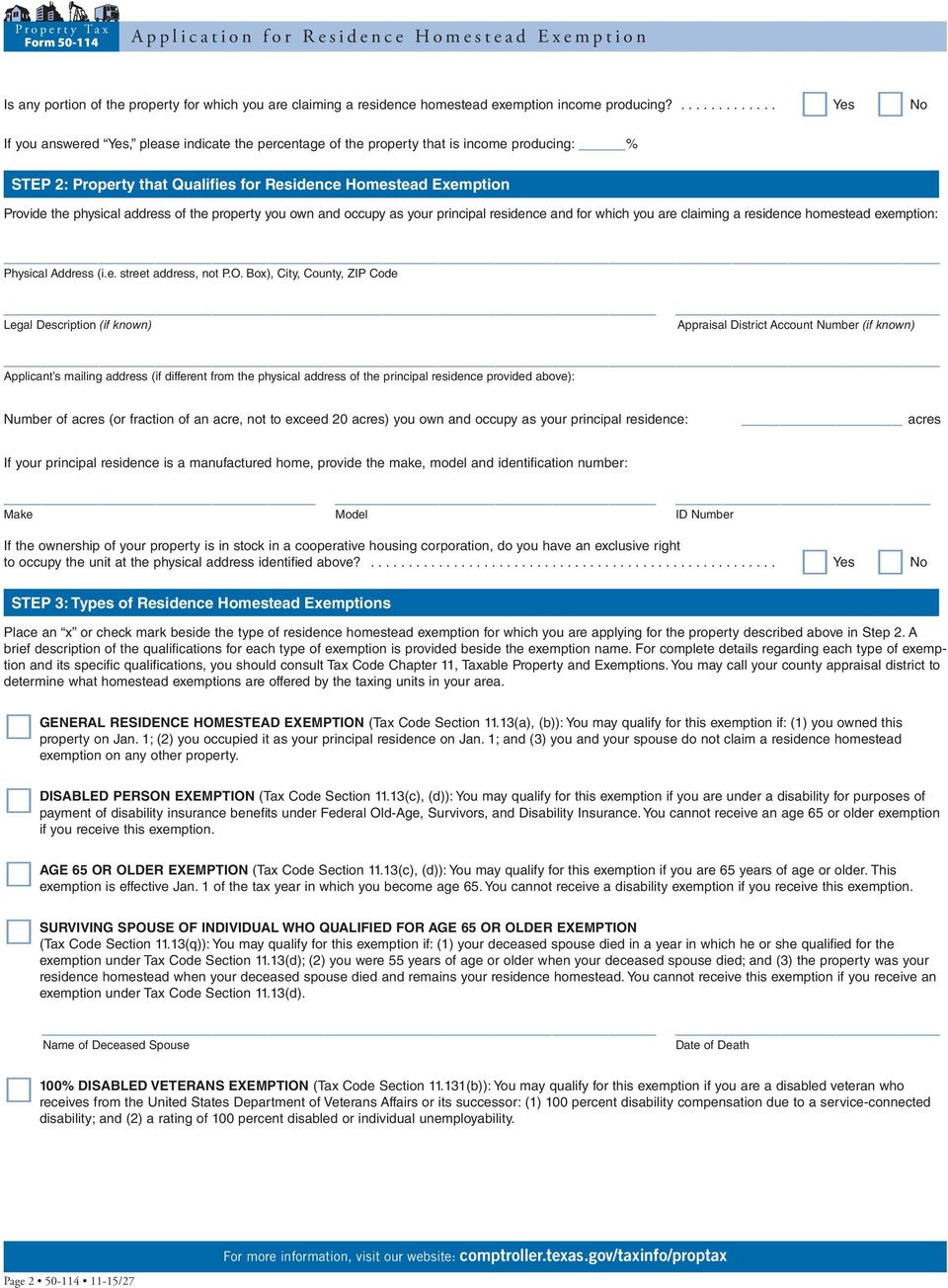

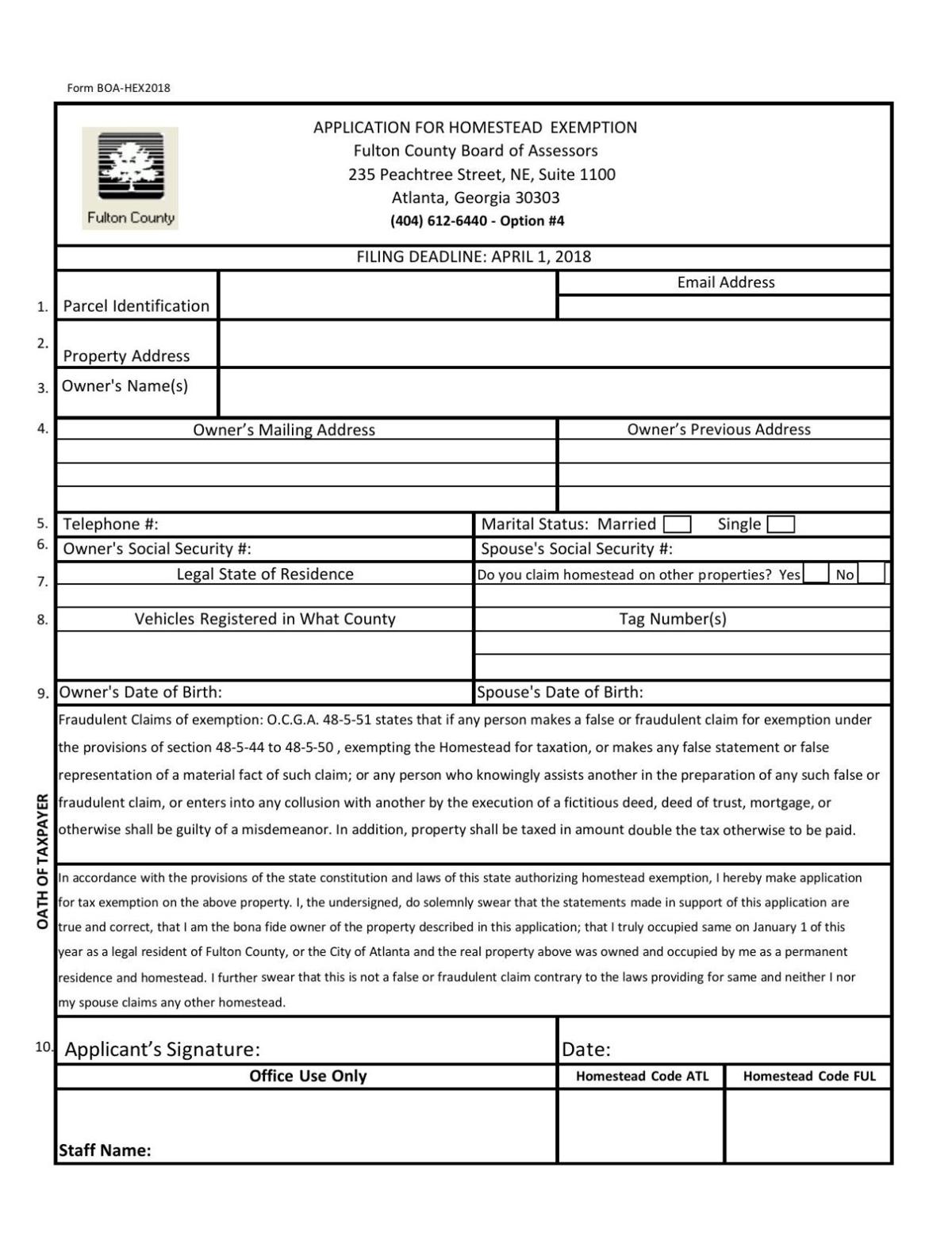

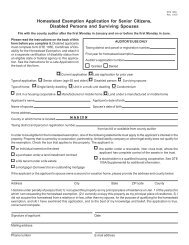

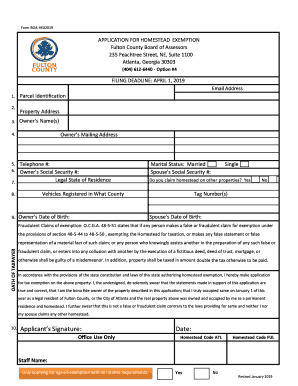

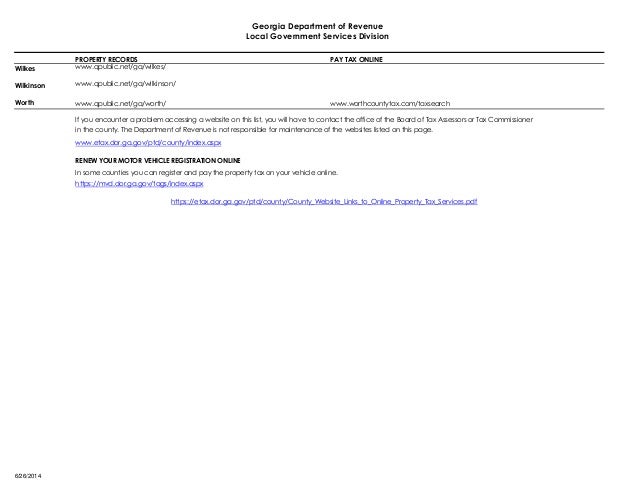

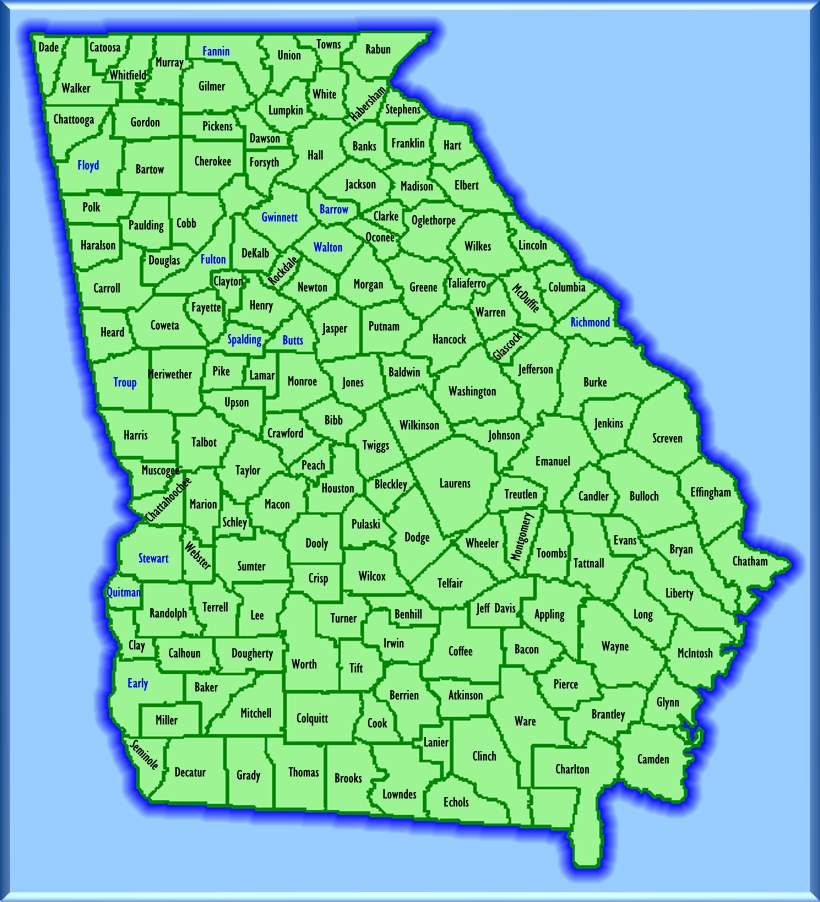

Georgia homestead exemption codes. City of clarkston seniors age 65 may apply for additional 20000 exemption from the assessed value of their property when they qualify for homestead exemption. Were you or your spouse age 62 or older as of jan 1 of the year of this application. City of decatur exemptions are applied for with the city of decatur.

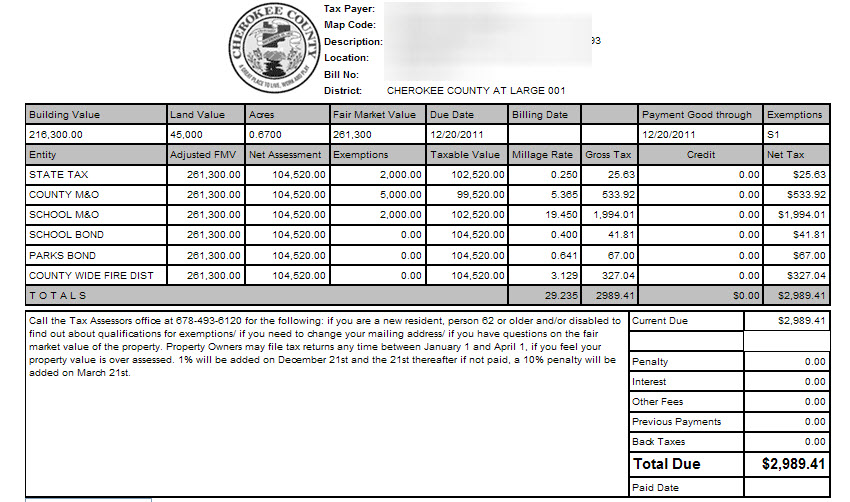

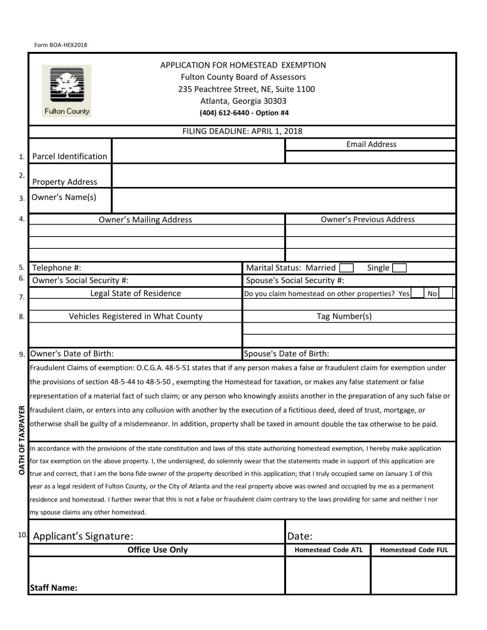

Georgia has several homestead exemptions that lower homeowner property taxes. The 2000 is deducted from. Basic homestead exemption of 25000.

Counties are authorized to provide for local homestead section a. The 2000 is deducted from the 40 assessed value of the homestead. For example if your house is worth 100000 and you owe 90000 on your mortgage you have 10000 of equity in your home and that equity cannot be taken by creditors.

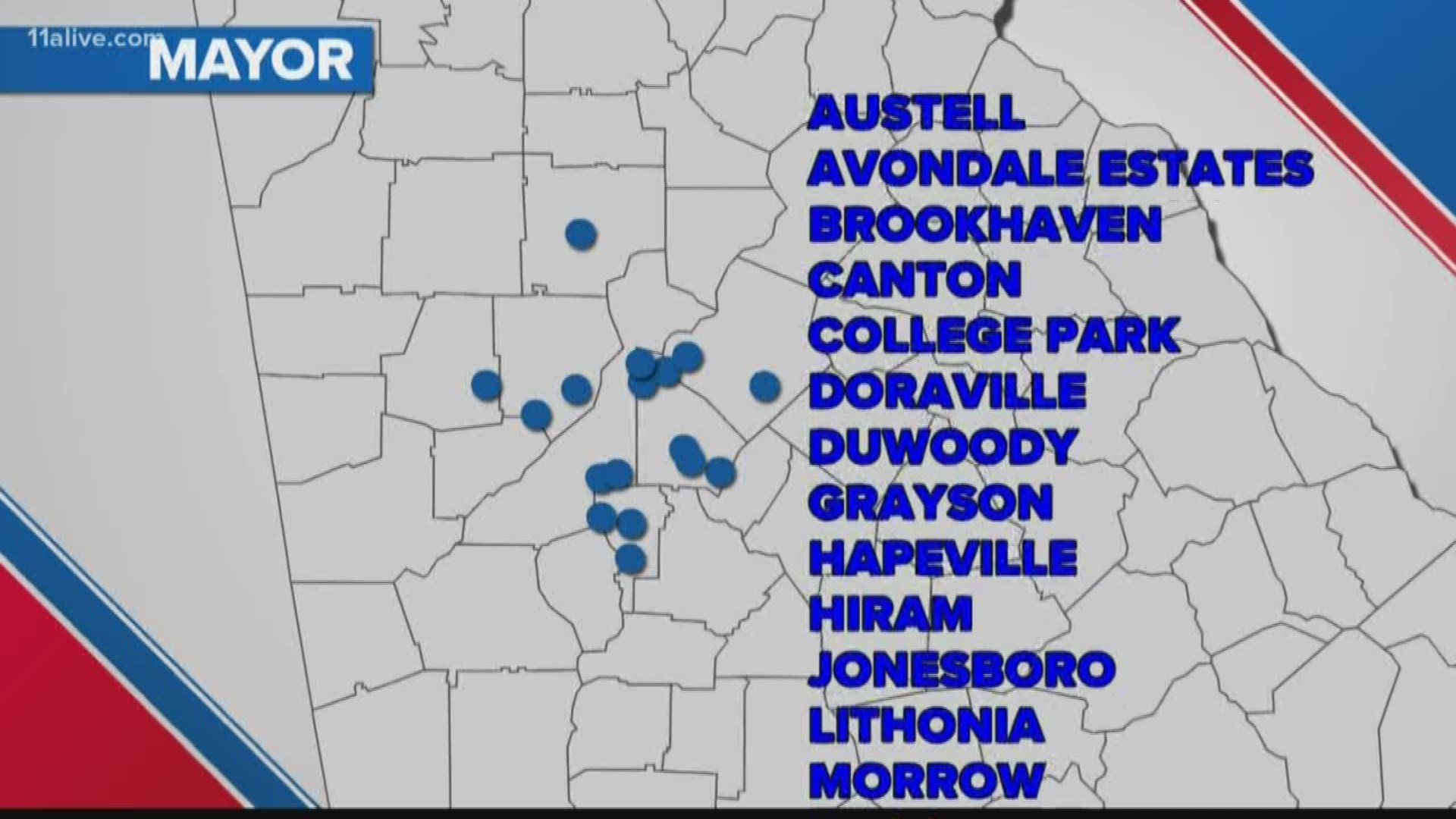

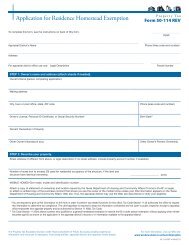

In georgia the homestead exemption is automatic you dont have to file a homestead declaration in order to claim the homestead exemption in bankruptcy. City of doraville exemptions are awarded along with the county exemptions. Go to sections c1 andor c2 on the back of this application to.

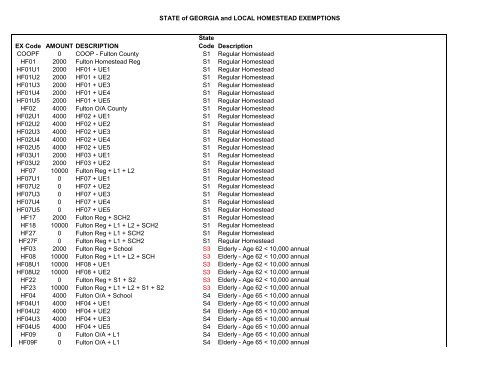

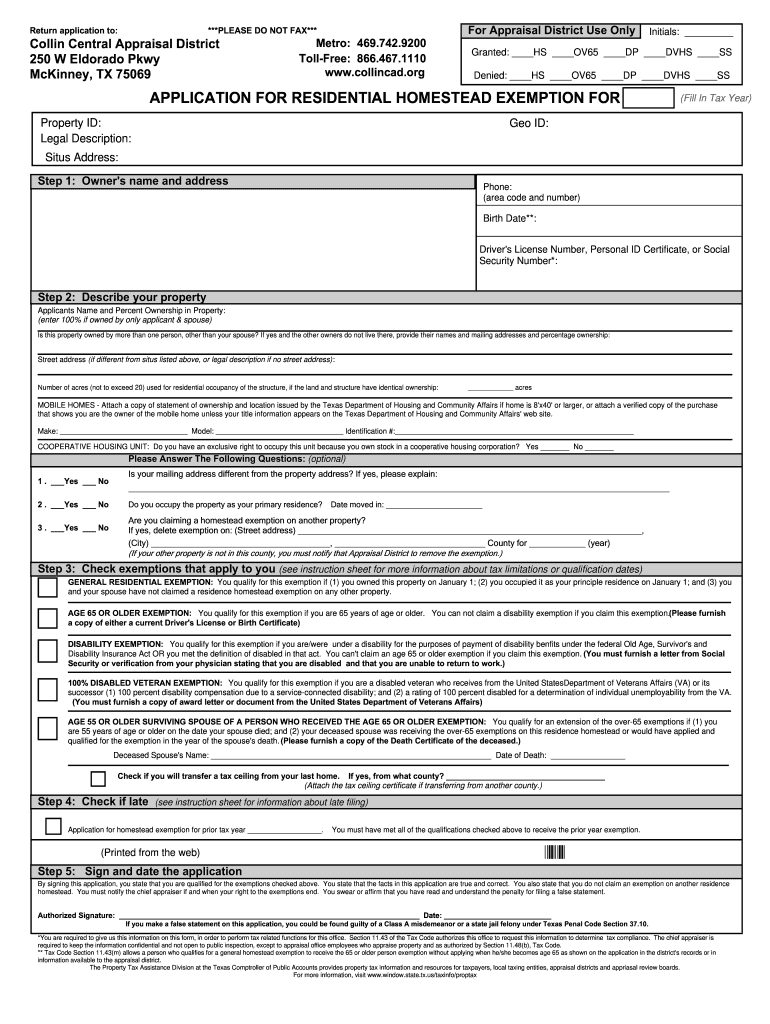

Finding the georgia homestead exemption statute. Ex code amount description. Hf01 2000 fulton homestead reg s1 regular homestead.

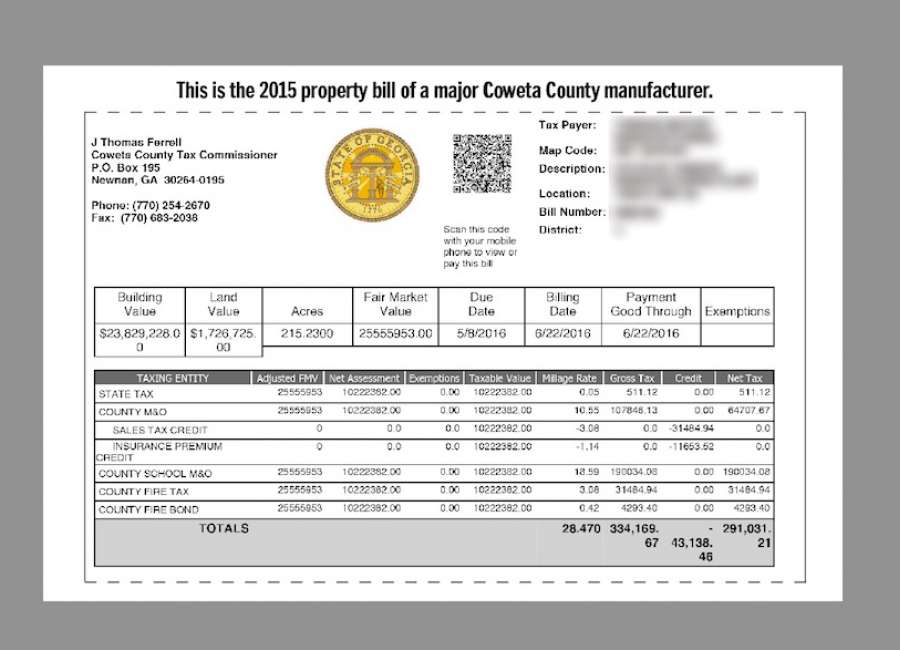

Yes 1. More about property tax. State of georgia and local homestead exemptions.

Sales ratio study dept. Hf01u1 2000 hf01 ue1 s1 regular homestead. The owner of a dwelling house of a farm that is granted homestead exemption may also claim a homestead exemption in participation with the program of rural housing under contract with the local housing authority.

Hf01u2 2000 hf01 ue2 s1 regular homestead. Standard homestead exemption the home of each resident of georgia that is actually occupied and used as the primary residence by the owner may be granted a 2000 exemption from county and school taxes except for school taxes levied by municipalities and except to pay interest on and to retire bonded indebtedness. A separate exemption protects 21500 in home equity from sale in bankruptcy.

Georgias homestead exemption is found in the georgia state statutes at georgia code annotated 44 13 100a1 and 44 13 100a6. Property tax homestead exemptions freeport exemption property tax appeals property tax valuation property tax millage rates property tax online property tax forms laws. Hf01u3 2000 hf01 ue3 s1 regular homestead.

State of georgia and local homestead exemptions ex code amount description state code description coopf 0 coop fulton county s1 regular homestead hf01 2000 fulton homestead reg s1 regular homestead hf01u1 2000 hf01 ue1 s1 regular homestead hf01u2 2000 hf01 ue2 s1 regular homestead hf01u3 2000 hf01 ue3 s1 regular homestead. Property tax proposed and adopted rules. Nearly every home in georgia is taxed on 40 percent of fair market value and the standard homestead exemption subtracts 2000 from that.

.jpg?width=550&name=bigstock-Name-Tax-Cuts-45610096_(2).jpg)