Georgia Homestead Exemption S1

Contact your local county or city government for more information.

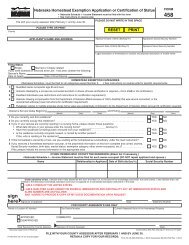

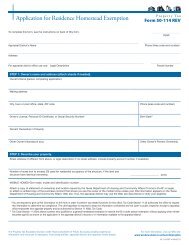

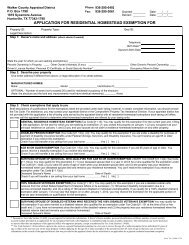

Georgia homestead exemption s1. The deadline for filing for a homestead exemption in glynn county is april 1. Must have letter certified by a medical doctor as being 100 disabled on or before january 1st of the effective tax year. You must provide legal evidence of residency and united states citizenship such as a georgia drivers license or georgia id card.

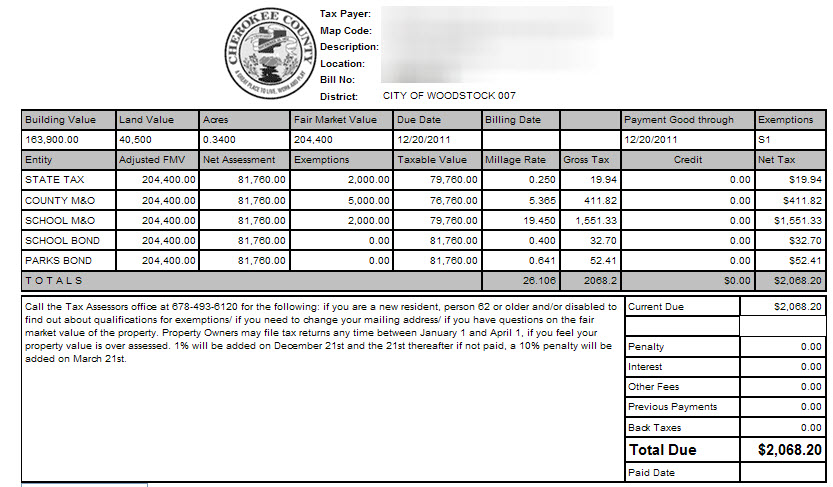

The 2000 is deducted from. In georgia the homestead exemption is automatic you dont have to file a homestead declaration in order to claim the homestead exemption in bankruptcy. The state of georgia offers homestead exemptions to all qualifying homeowners those exemptions are shown below on this page.

Homeowners over the age of 65 may qualify for school tax exemption. Standard homestead exemption s1 superseded by local legislation to a 10000 exemption on county mothe home of each resident of georgia that is actually occupied and used as the primary residence by the owner may be granted a 2000 exemption from state county and school taxes except for school taxes levied by municipalities and except to. Georgias homestead exemption is found in the georgia state statutes at georgia code annotated 44 13 100a1 and 44 13 100a6.

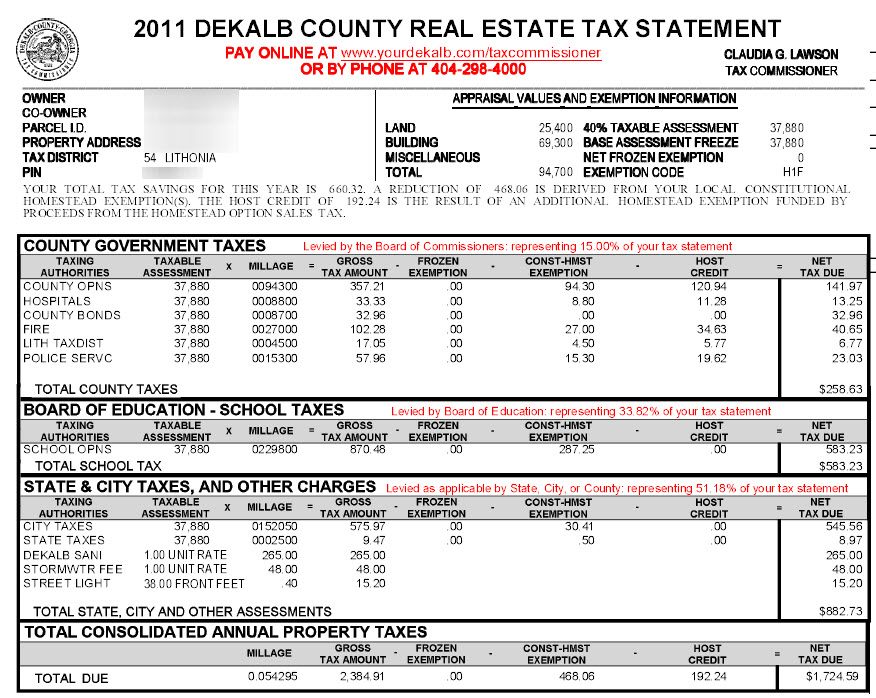

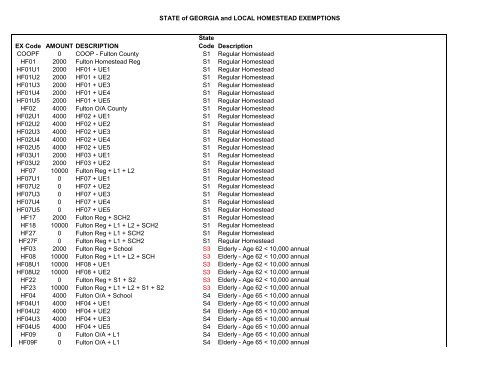

Hf27 0 fulton reg l1 sch2 s1 regular homestead hf27f 0 fulton reg l1 sch2 s1 regular homestead hf03 2000 fulton reg school s3 elderly age 62 10000 annual. Standard homestead exemption the home of each resident of georgia that is actually occupied and used as the primary residence by the owner may be granted a 2000 exemption from county and school taxes except for school taxes levied by municipalities and except to pay interest on and to retire bonded indebtedness. Its that time of year when were either dreading finding out what we owe in taxes or anxiously awaiting our tax refund.

Regular homestead exemption s1 regular homestead exemption. If qualified you will be exempt from school taxes only up to 416400 fair market value or 166560 of assessed value disabled veterans. Senior school tax and specialized homestead exemptions.

For all property owners who occupy the property as of january 1 of the application year. State of georgia and local homestead exemptions hf7u5s 0 hf07 ue5 state sc age 65 hf35f 0 fulton veterans spouse sd age 65 100 disabled veteran un remarried spouse. Title ad valorem tax motor vehicles purchased on or after march 1 2013 and titled in this state are exempt from sales and use tax and annual ad valorem taxthe taxes are replaced by a one time tax that is imposed on the fair market value of the vehicle called the title ad valorem tax feetavt.

Disability school tax exemption el6 es1. Homestead exemption applications are due by april 1 to receive credit for this tax year. No income or age limit.

Must have homestead exemption. Exemptions are not automatic and each exemption must be applied for individually. Includes 5000 off the assessed value on county 5000 off school and 2000 off state.

Finding the georgia homestead exemption statute.