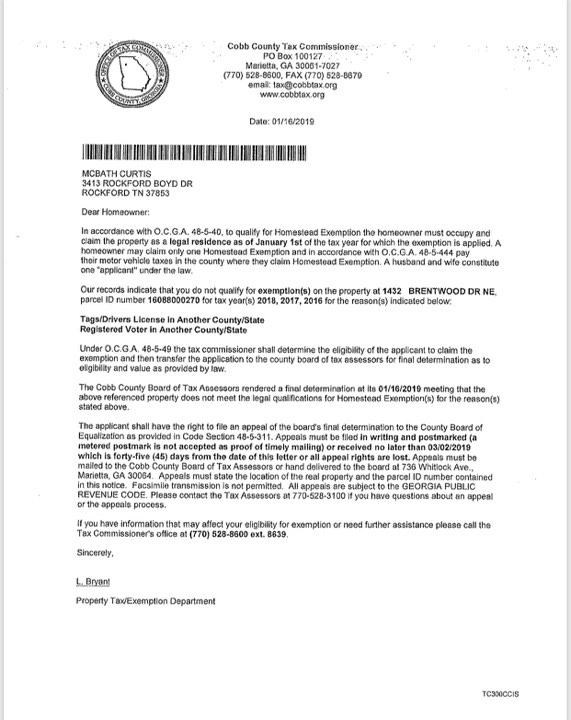

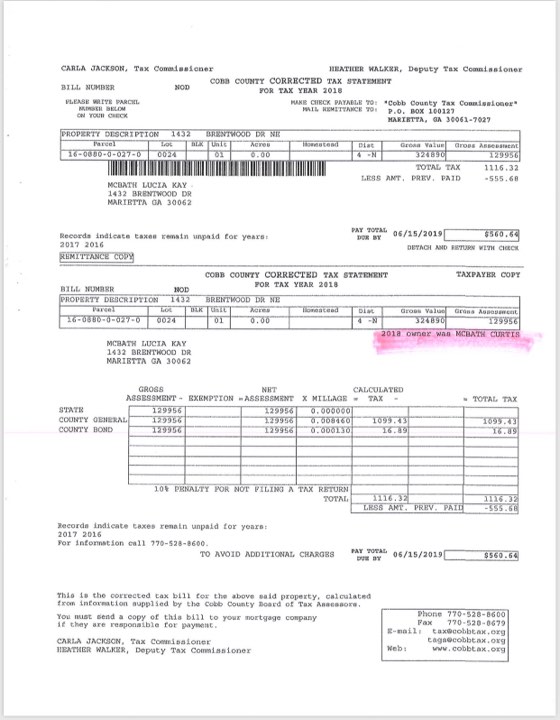

Georgia Homestead Exemption Law

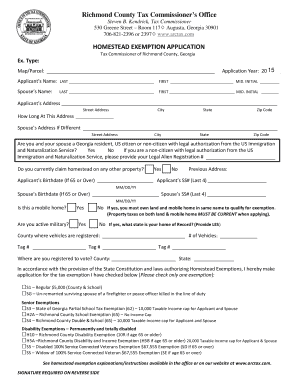

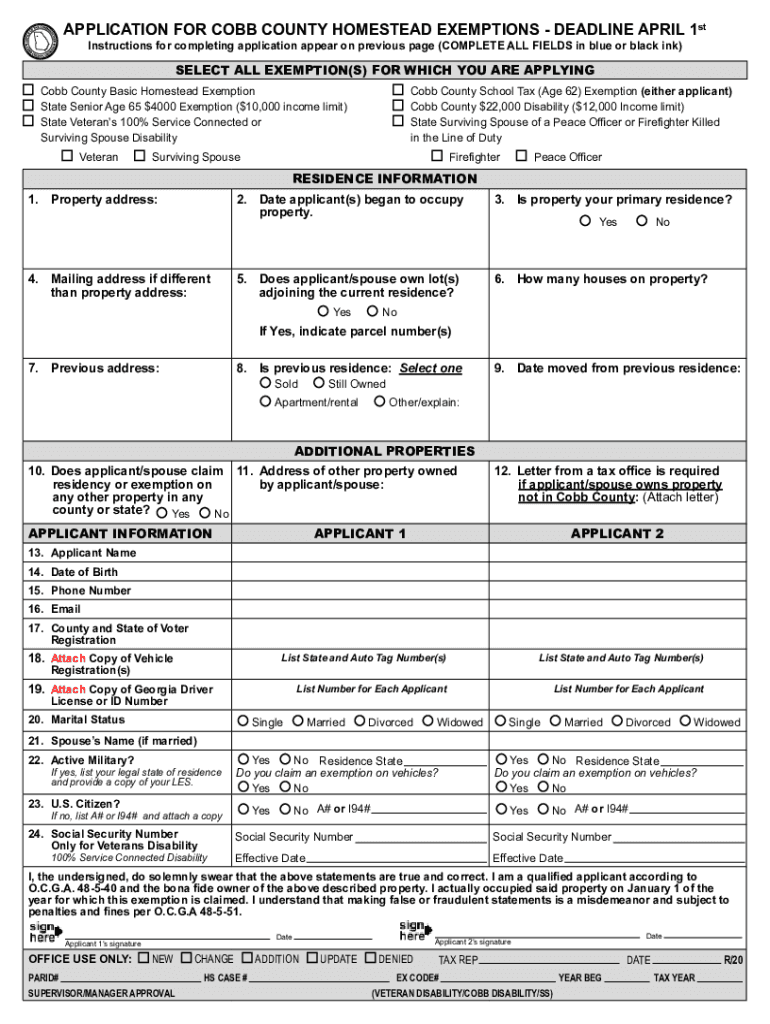

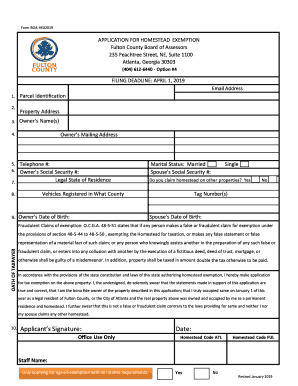

Go to sections c1 andor c2 on the back of this application to.

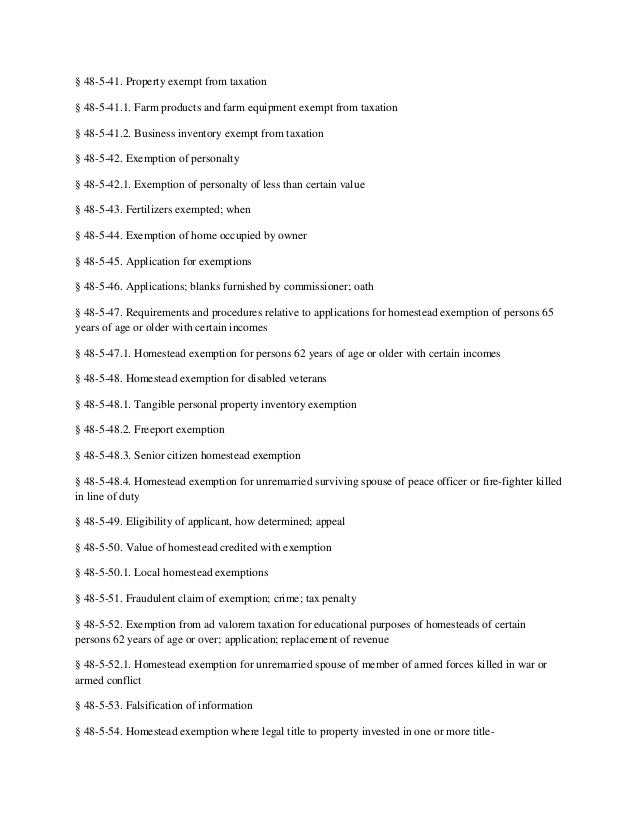

Georgia homestead exemption law. And for other purposes. Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary legal residence and up to 10 acres of land surrounding the residence. There are several homestead exemptions offered by the state of georgia that apply specifically to senior citizens.

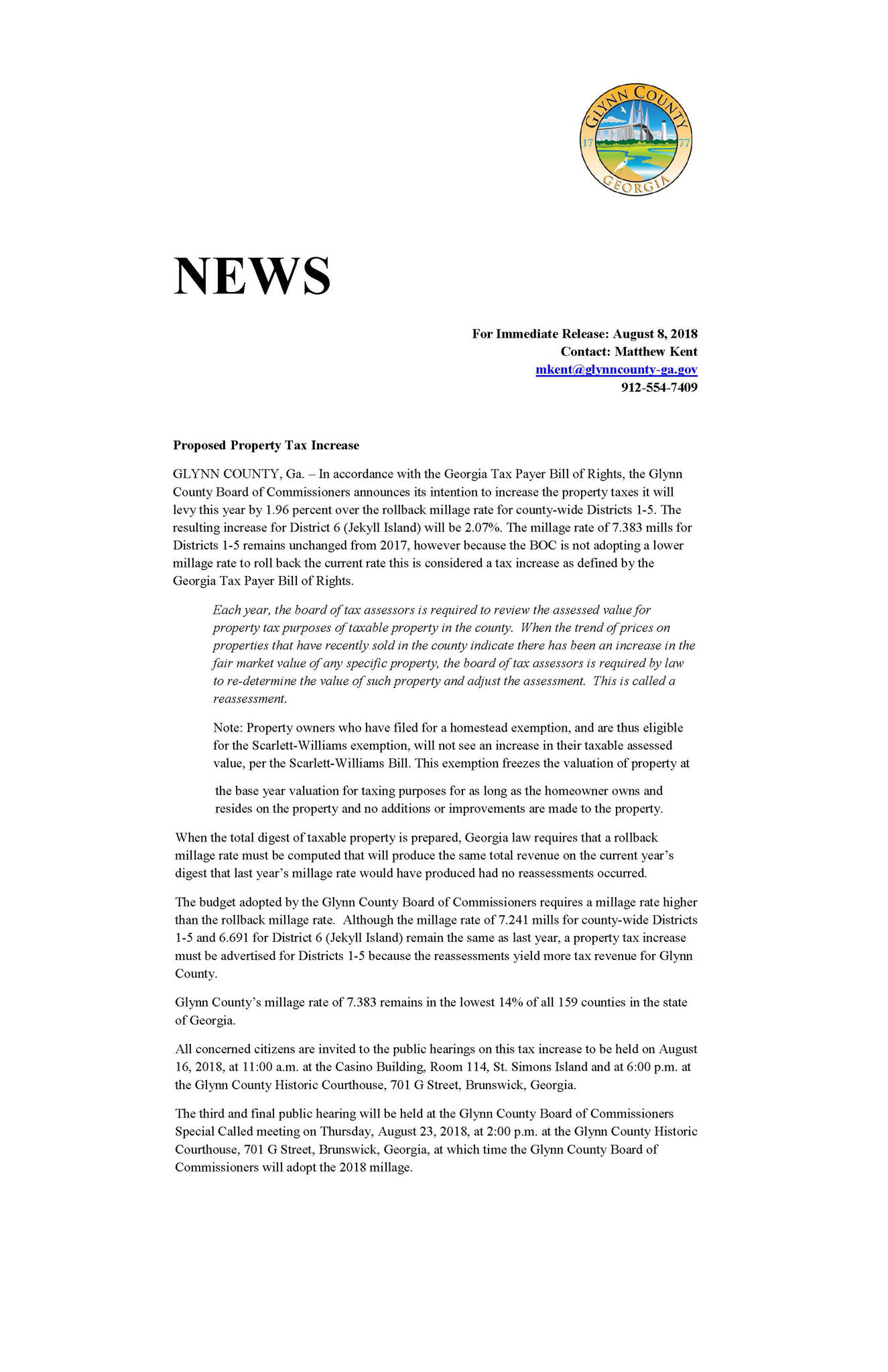

Its that time of year when were either dreading finding out what we owe in taxes or anxiously awaiting our tax refund. No matter which situation you fall under we can all agree that were always looking for ways to save on tax dollars. A separate exemption protects 21500 in home equity from sale in bankruptcy.

Georgia homestead laws allow creditors to exempt up to 10000 worth of their home under certain conditions. Georgias homestead exemption is found in the georgia state statutes at georgia code annotated 44 13 100a1 and 44 13 100a6. The homestead exemptions provided for in this application form are those authorized by georgia law.

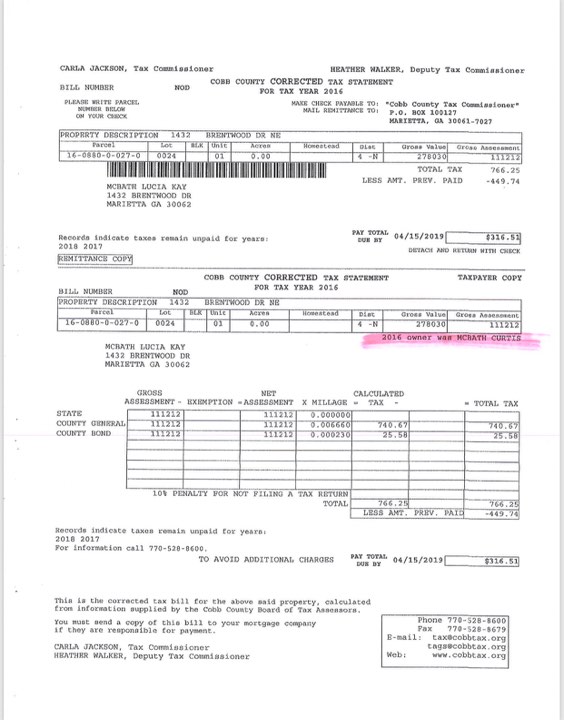

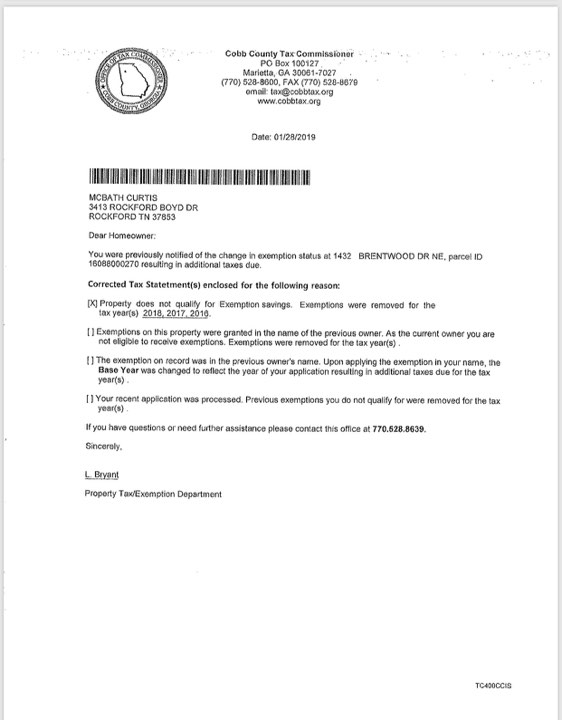

Any questions pertaining to tax exemptions at the local level should be asked to and answered by your county tax commissioners office. Yes 1. 9 be it enacted by the general assembly of georgia.

Contact your local county or city government for more information. 21500 of value in real estate or personal property including a co op that you or your dependent uses as a residence. To learn how to find state statutes check out nolos laws and legal research area.

Disabled veteran homestead tax exemption the administration of tax exemptions is as interpreted by the tax commissioners of georgias 159 counties. Up to 10000 of unused homestead exemption can be used to protect any other property. Were you or your spouse age 62 or older as of jan 1 of the year of this application.

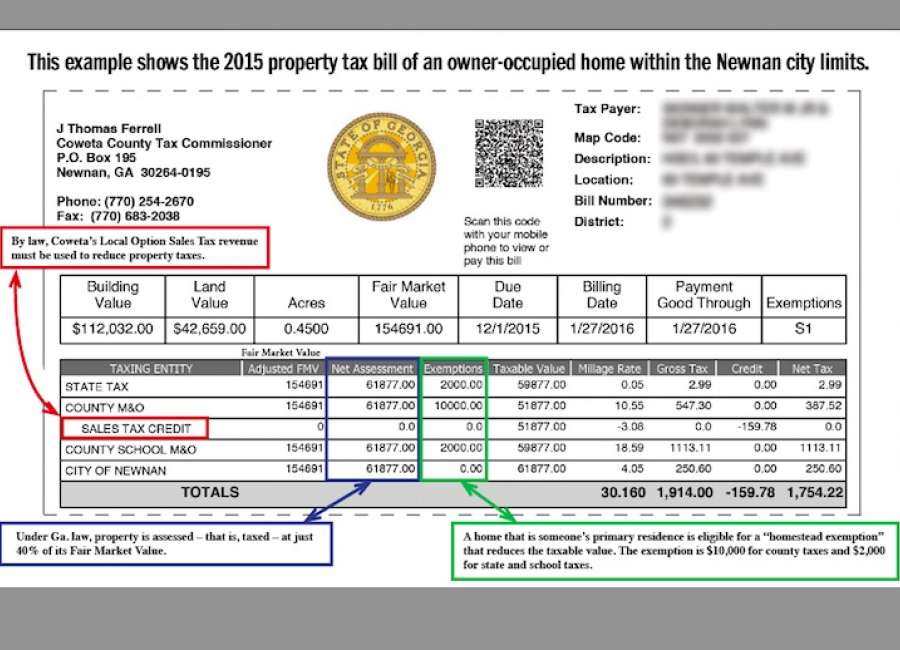

To repeal conflicting laws. 44 13 100a1 a6 44. The 2000 is deducted from.

Georgia has several homestead exemptions that lower homeowner property taxes. Standard homestead exemption the home of each resident of georgia that is actually occupied and used as the primary residence by the owner may be granted a 2000 exemption from county and school taxes except for school taxes levied by municipalities and except to pay interest on and to retire bonded indebtedness. Up to 43000 of value if married and the property is owned by only one spouse.

11 an act providing a homestead exemption from jackson county school district ad valorem 12 taxes for educational purposes in the amount of 1000000 of the assessed value of the. For example if your house is worth 100000 and you owe 90000 on your mortgage you have 10000 of equity in your home and that equity cannot be taken by creditors.