Georgia Homestead Exemption Form

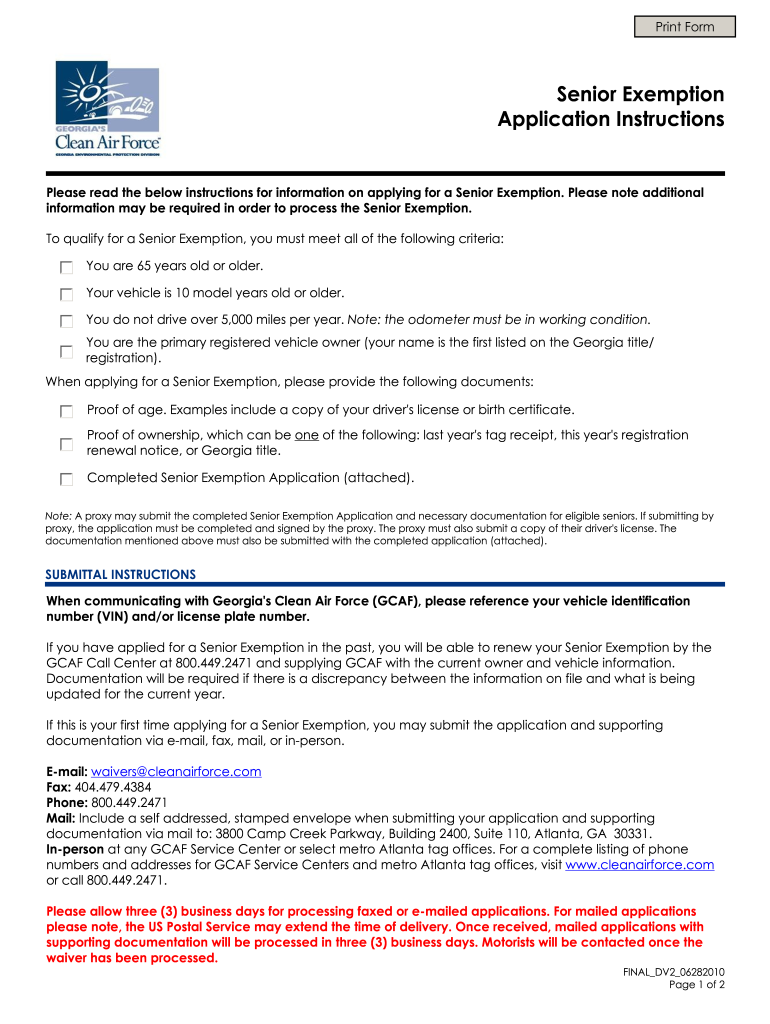

Must have letter certified by a medical doctor as being 100 disabled on or before january 1st of the effective tax year.

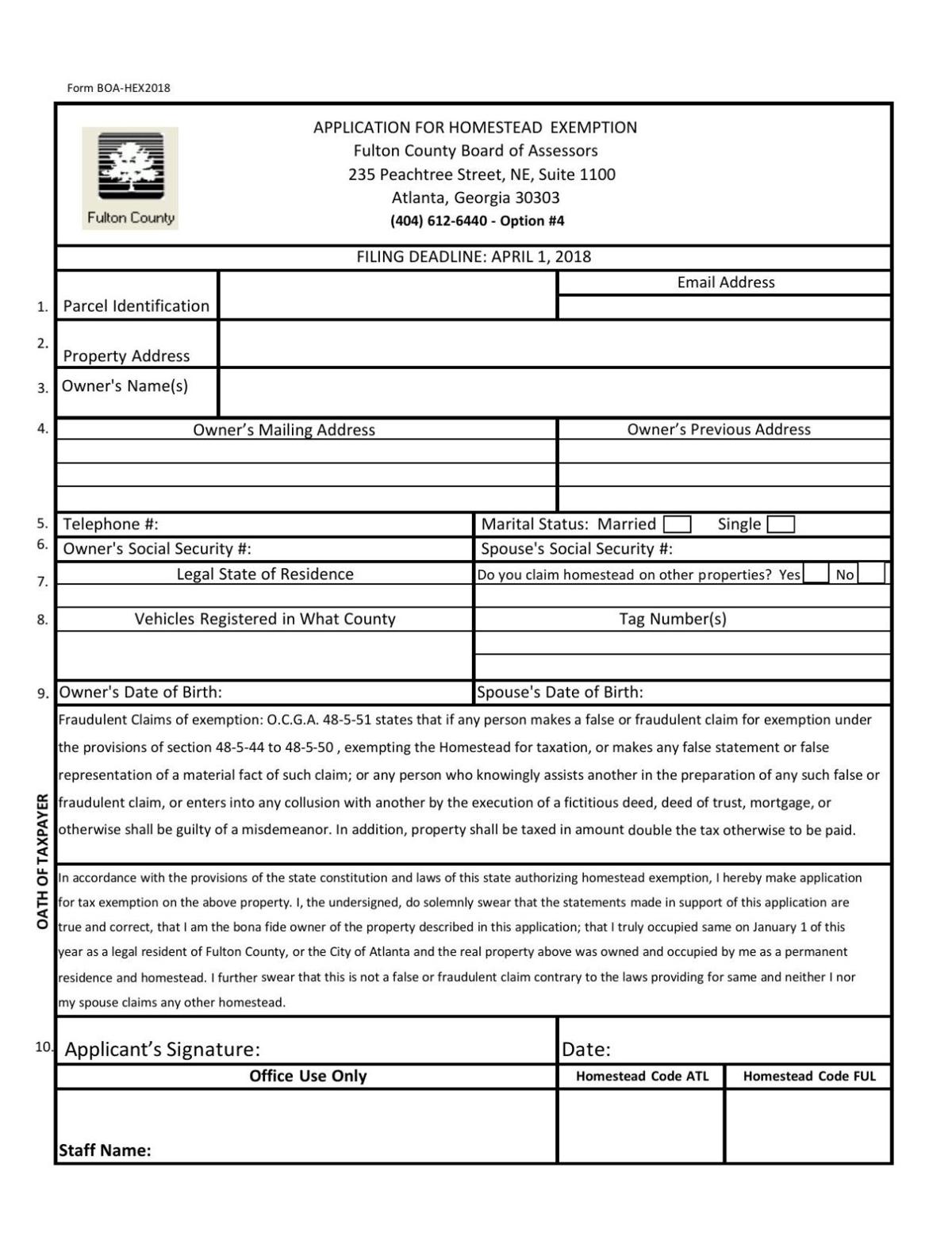

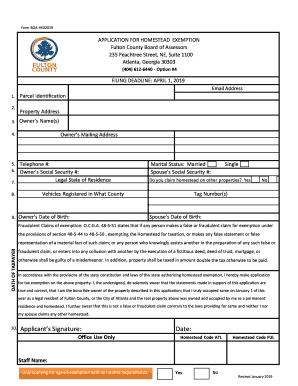

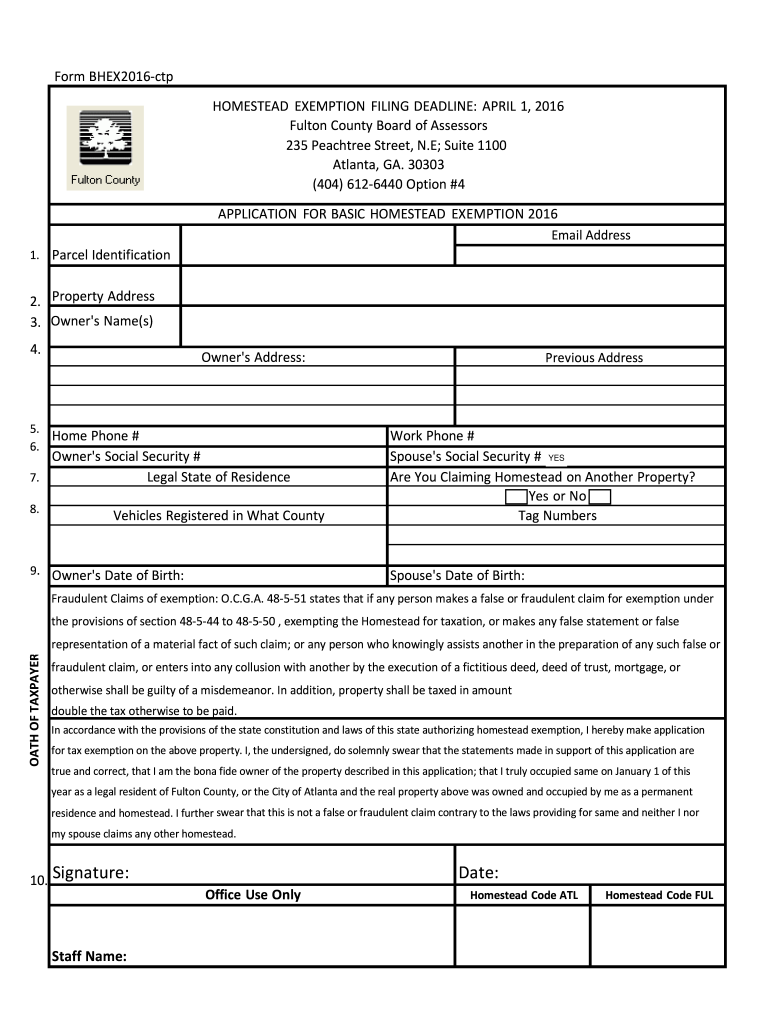

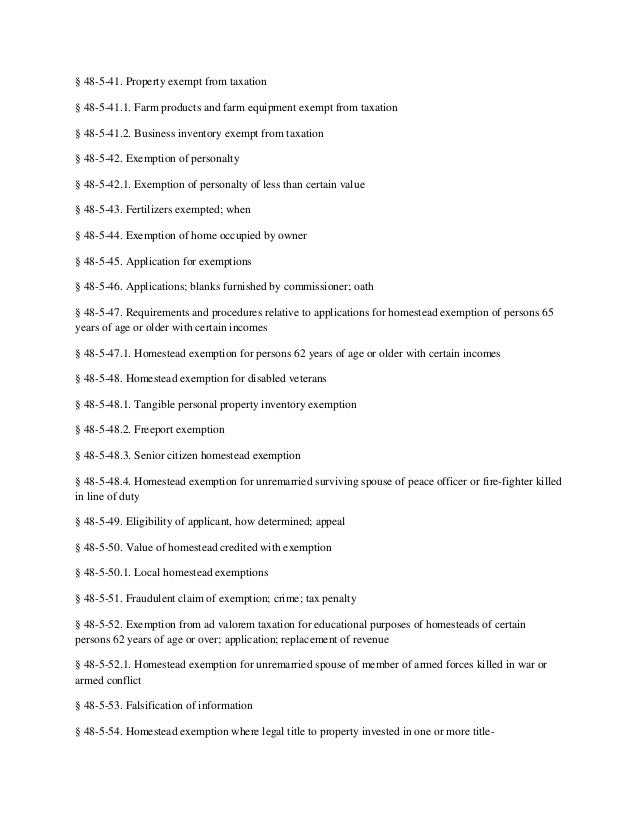

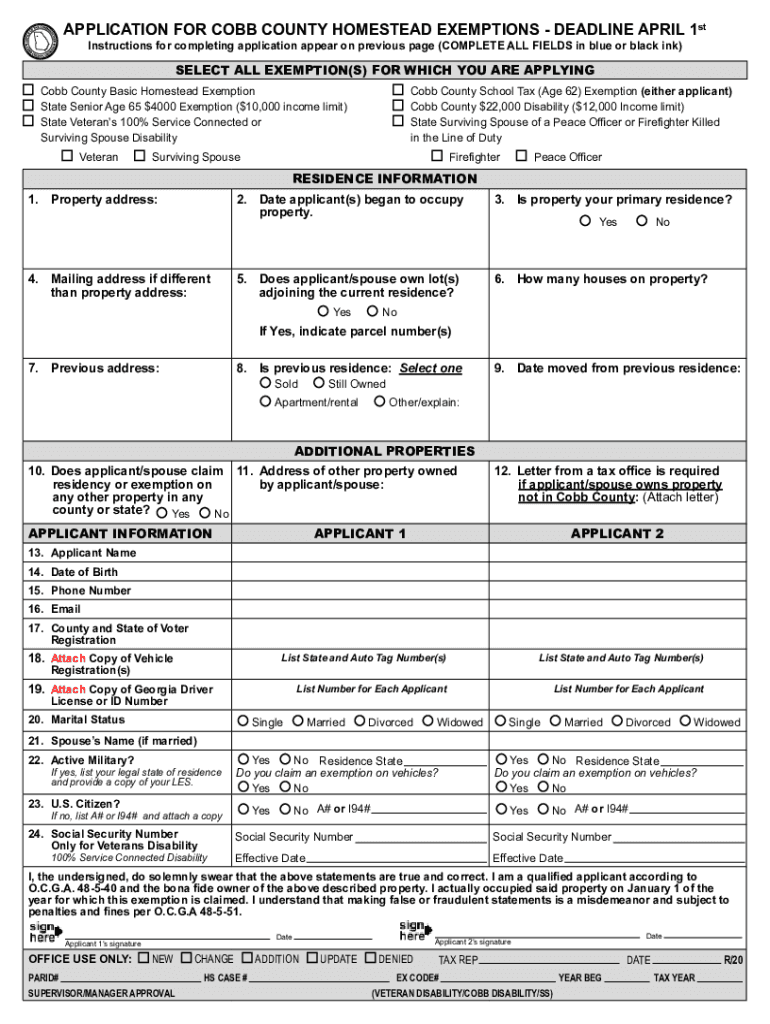

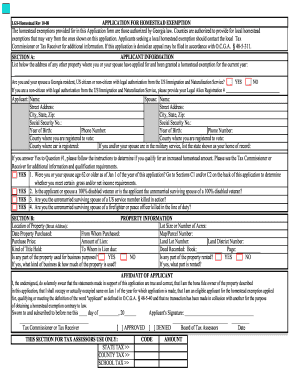

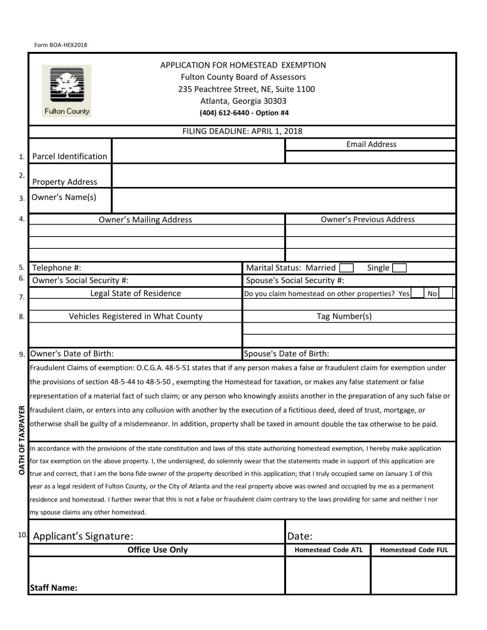

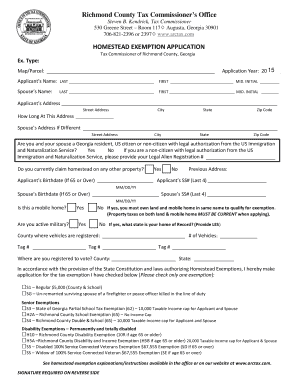

Georgia homestead exemption form. People owning and occupying property as a permanent residence as of january 1 may apply for a homestead exemption. Tax assessors office 240 constitution boulevard dallas ga 30132. You can file a homestead exemption application any time of the year with your county tax commissioner or county board of tax assessors but it must be filed by april 1 to be in effect for the current tax year.

Any questions pertaining to tax exemptions at the local level should be asked to and answered by your county tax commissioners office. Homeowners may qualify for different homestead exemptions from the various taxing jurisdictions including school system cities and fulton county. Counties are authorized to provide for local homestead section a.

View the 2020 homestead exemption guide once granted exemptions are automatically renewed each year as long as the homeowner continually occupies the property under the same ownership. Pt 311a 8597 kb appeal of assessment form the state of georgia provides a uniform appeal form for use by property owners. Must have homestead exemption.

If qualified you will be exempt from school taxes only up to 416400 fair market value or 166560 of assessed value disabled veterans. Disabled veteran homestead tax exemption the administration of tax exemptions is as interpreted by the tax commissioners of georgias 159 counties. Yes 1.

Disability school tax exemption el6 es1. Applications for exemptions must be filled in the. The 2000 is deducted from.

Standard homestead exemption the home of each resident of georgia that is actually occupied and used as the primary residence by the owner may be granted a 2000 exemption from county and school taxes except for school taxes levied by municipalities and except to pay interest on and to retire bonded indebtedness. Were you or your spouse age 62 or older as of jan 1 of the year of this application.