Georgia Homestead Exemption Active Duty Military

Surviving spouse of military member.

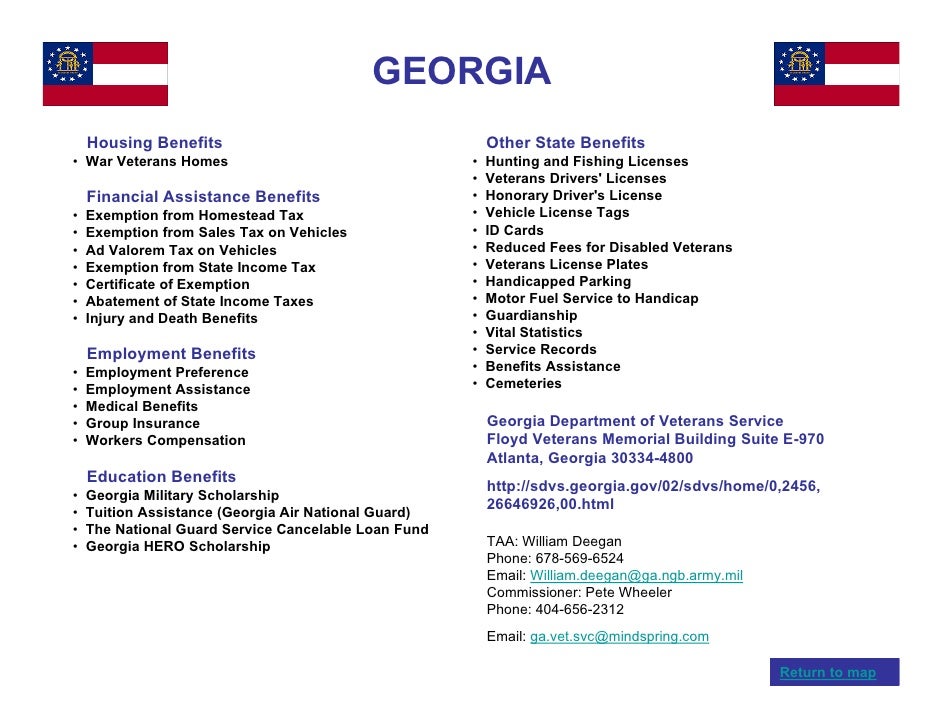

Georgia homestead exemption active duty military. If you are a nonresident of georgia stationed in georgia you are required to pay tax on any. The owner of a dwelling house of a farm that is granted a homestead exemption may also claim a homestead exemption in participation with the program of rural housing under contract with the local housing authority. Armed forces in combat activities during a period designated by the president is extended until 180 days after such deployment ends.

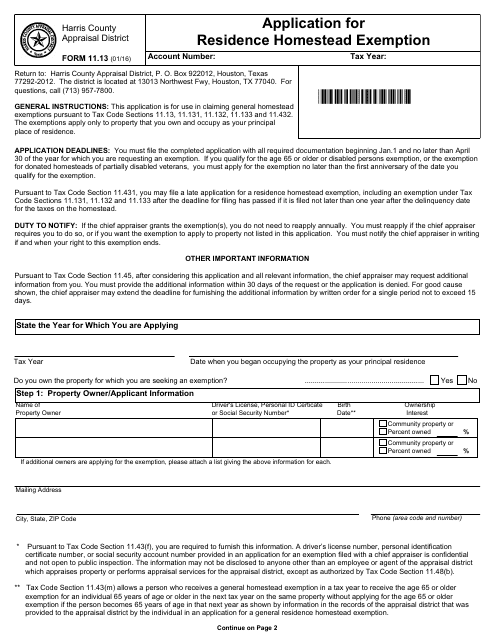

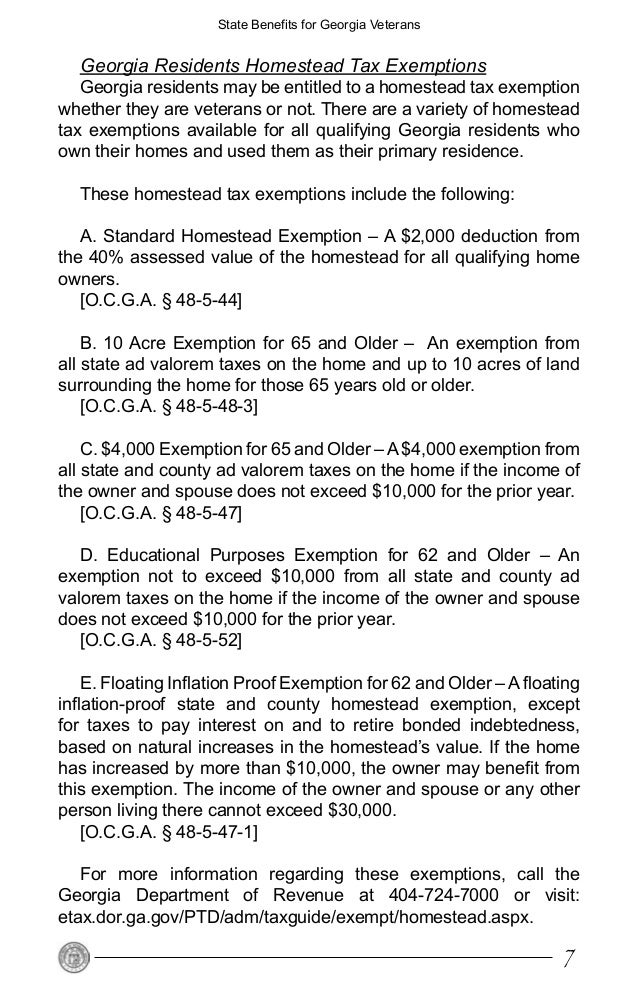

If you would like to apply for a new exemption applications must be filed in person at the evans office on 630 ronald reagan drive evans ga 30809 building c in the property tax office. Georgia homestead exemption for surviving spouse of us. The 2000 is deducted from the 40 assessed value of the homestead.

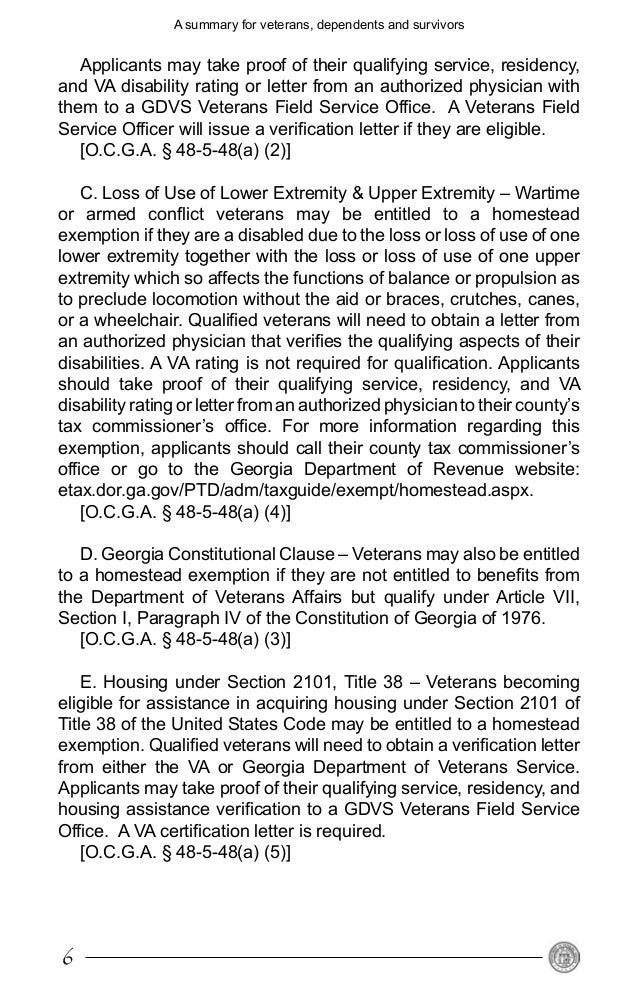

The tax filing deadline for combat deployed military personnel those who served on active duty as members of the us. Current orders reflecting georgia military base as permanent duty station. The un remarried surviving spouse of a member of the armed forces who was killed in or died as a result of any war or armed conflict will be granted a homestead exemption from all ad valorem taxes for county municipal and school purposes in the amount of 60000 plus an.

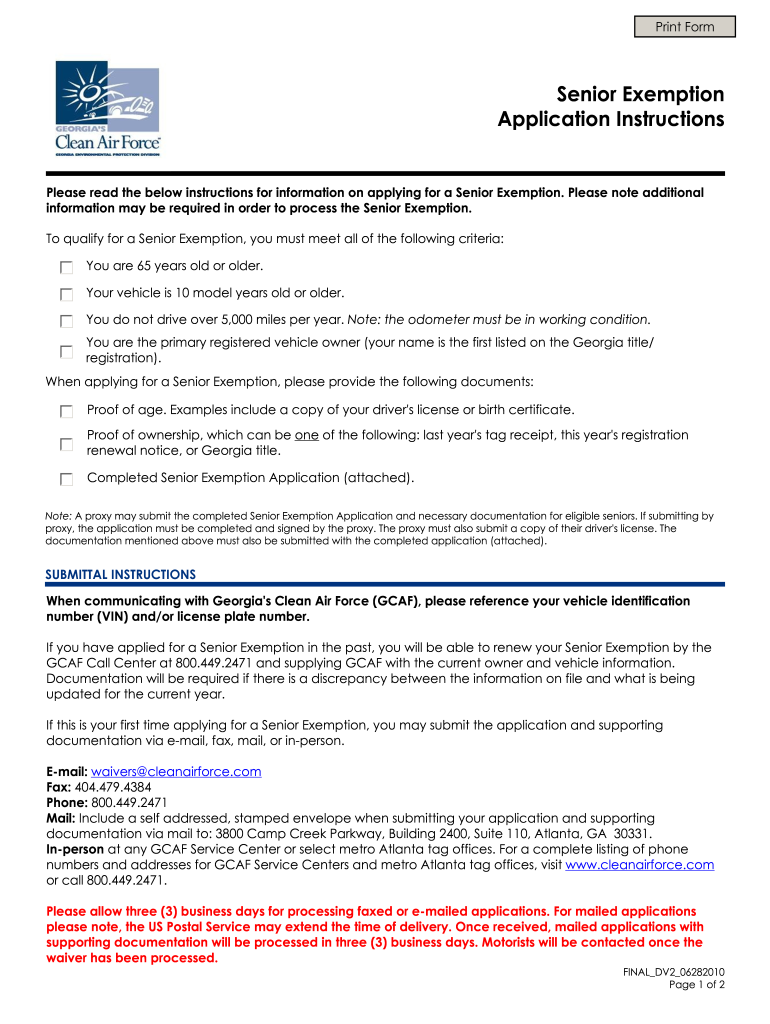

According to the georgia filing instructions active duty military members who are legal residents of georgia are subject to tax on all of their income regardless of where it was earned. To exempt title ad valorem tax tavt the nonresident service member must provide the following. Homestead exemption application period.

Taking a homestead exemption on your real property taxes for a house is a huge indicator. Not limited to veterans only the ad valorem tax break exempts qualified applicants from ad valorem taxation of a home and an adjacent 160 acres for those who are permanently and totally disabled or who is 65 years of age or older and has a net. Sales tax exemption for vehicle purchaseadaptation.

Property tax exemptions for disabled veterans by state alabama ad valorem tax exemption tax break for specially adapted housing for veterans. Military members killed in the line of duty while on active duty or active duty for training. Exemption from homestead tax 100 disabled veterans those getting va disability for loss of vision or limbs and their surviving unremarried spouses may be exempt from property tax on their homes.

The applicant is eligible for an exemption only if they do not register to vote in georgia and do not own or co own a home in georgia for which they claim a homestead exemption.