Georgia Homestead Exemption Creditors

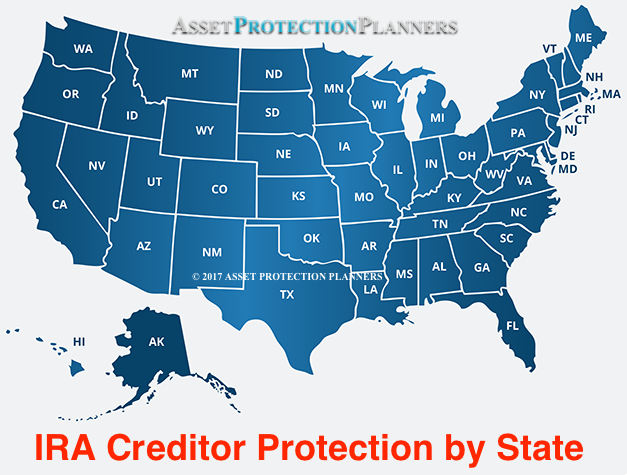

The basic georgia specific exemptions most bankruptcy filers care about are the homestead exemption motor vehicle exemption personal property exemption support exemption public benefits exemption wage exemption tools of the trade exemption pension and retirement exemption insurance exemption and wildcard exemption.

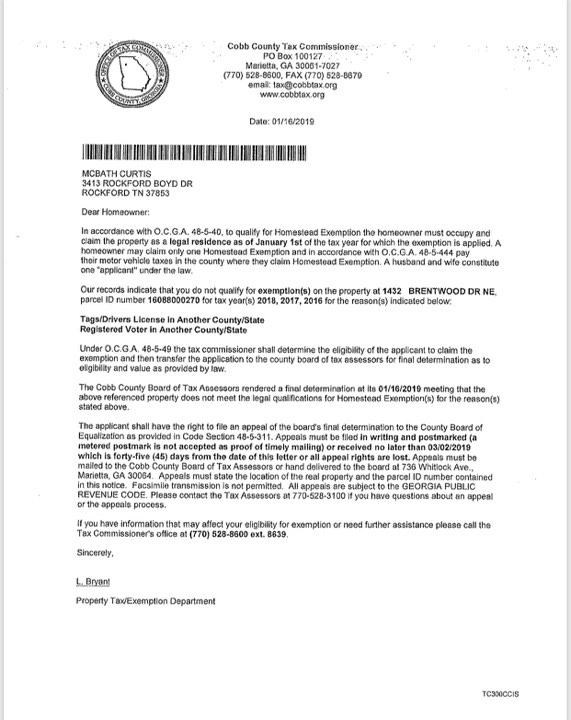

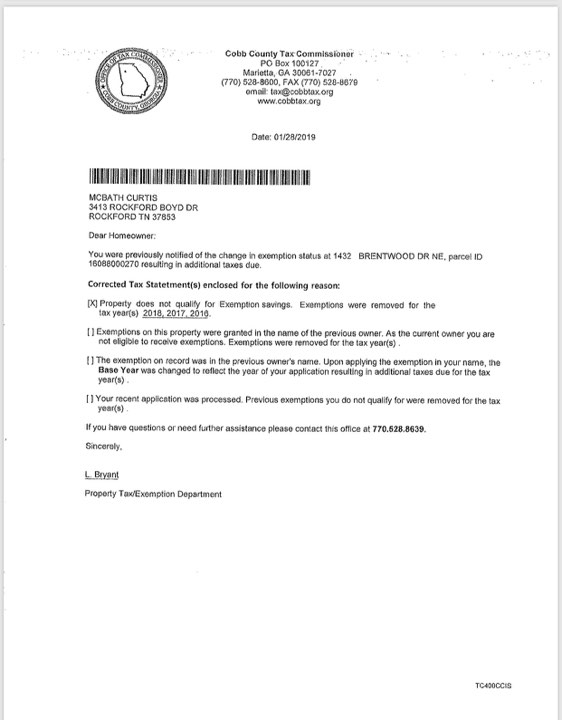

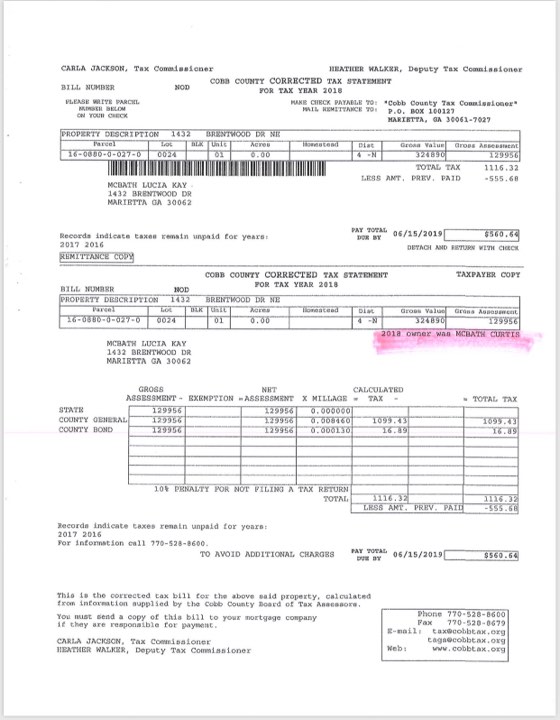

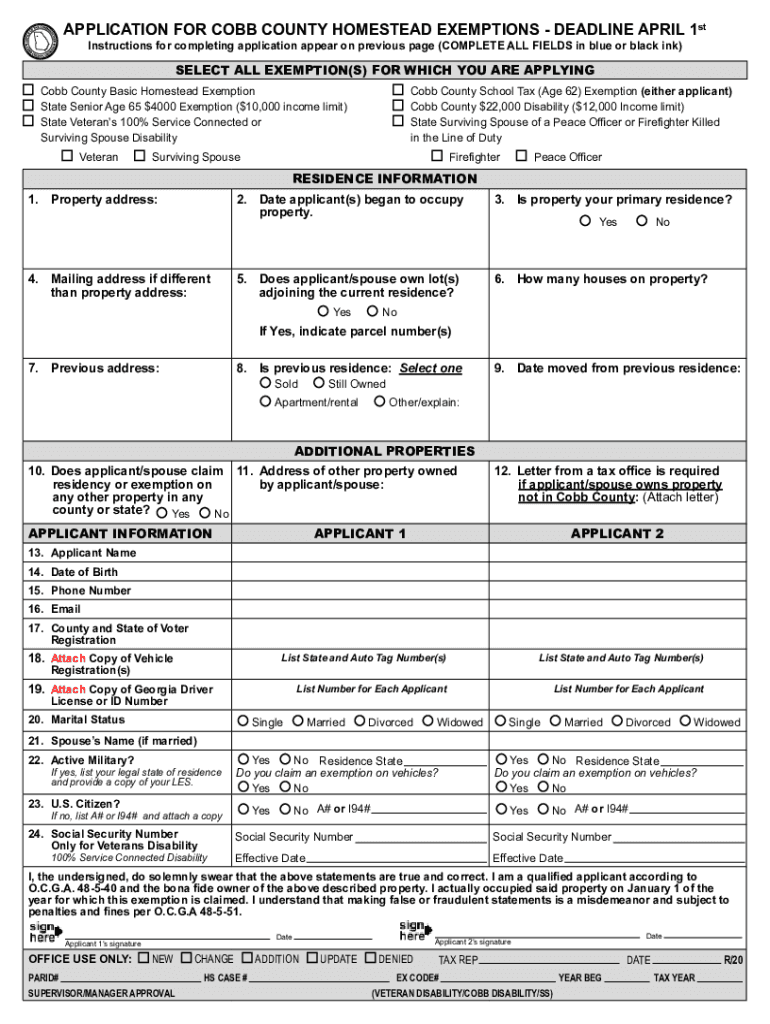

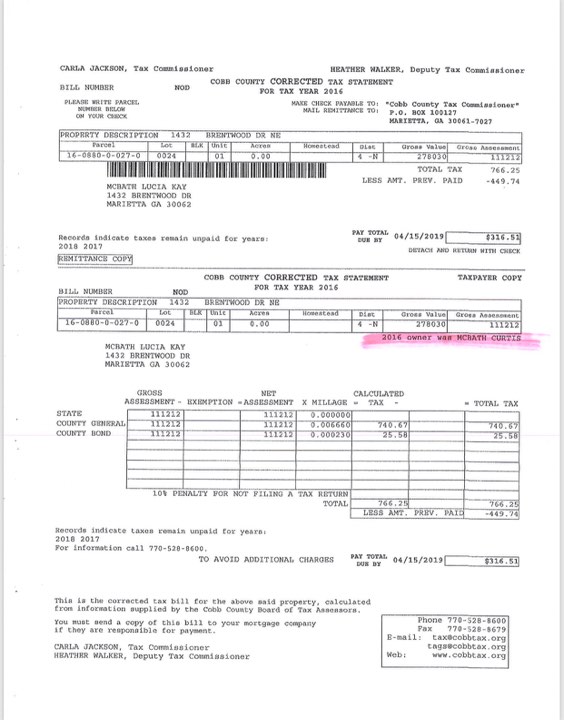

Georgia homestead exemption creditors. If a creditor has obtained a judgment against you and seeks to enforce it by taking your cash or by seizing and selling other property you most likely can keep at least some of that property by using exemptions. Georgia asset protection summary. Nearly every home in georgia is taxed on 40 percent of fair market value and the standard homestead exemption subtracts 2000 from that.

So a homestead exemption is a legal provision designed to protect the value in a principal dwelling place. In georgia the homestead exemption is automatic you dont have to file a homestead declaration in order to claim the homestead exemption in bankruptcy. Thus homestead exemptions can provide asset protection from creditors for at least some of the value in the homestead.

Exempting stimulus payments. Homestead exemptions by state and territory. A separate exemption protects 21500 in home equity from sale in bankruptcy.

For example if your house is worth 100000 and you owe 90000 on your mortgage you have 10000 of equity in your home and that equity cannot be taken by creditors. A creditor sale doesnt destroy the exemption. Georgia has several homestead exemptions that lower homeowner property taxes.

However were the home to be sold you would be entitled to a check for 50000 the amount of state xs homestead exemption. 33 25 11 33 25 11 and 33 28 7. Unless otherwise clarified or advised by legal.

Georgia homestead laws allow creditors to exempt up to 10000 worth of their home under certain conditions. A homestead generally refers to the primary residence owned and occupied by a person or family. In georgia the cash value of a life insurance policy and annuity contract is exempt from creditors.

Finding the georgia homestead exemption statute. Life insurance and annuities. Georgias homestead exemption is found in the georgia state statutes at georgia code annotated 44 13 100a1 and 44 13 100a6.

The cares act doesnt provide stimulus payments with exemption protection. The code of georgia offers a homestead exemption of up to 5000 in value. In this example creditors could force the sale of the home to go after the 50000.