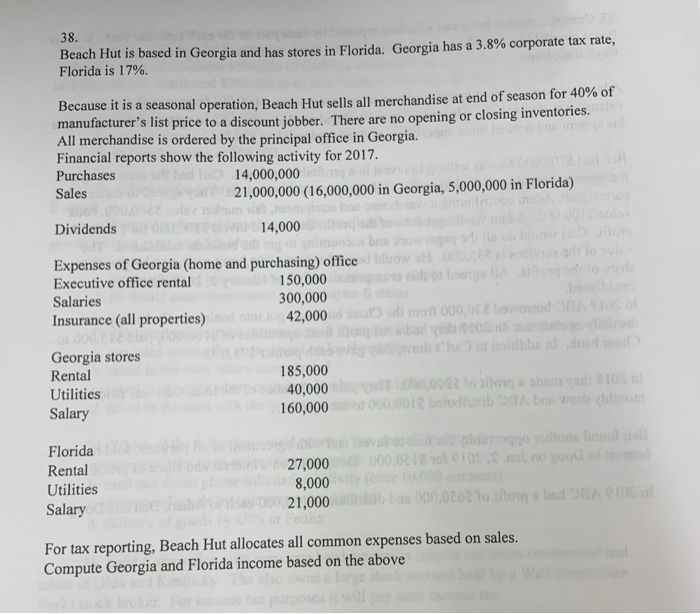

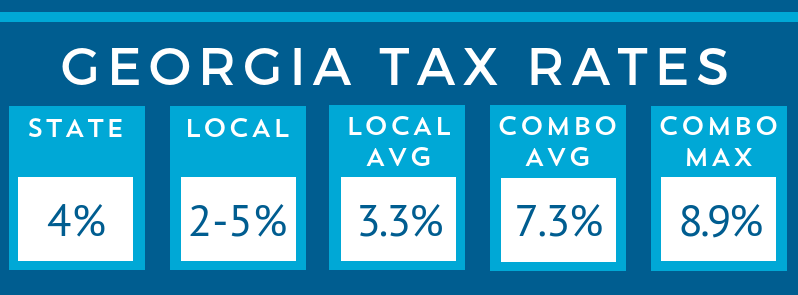

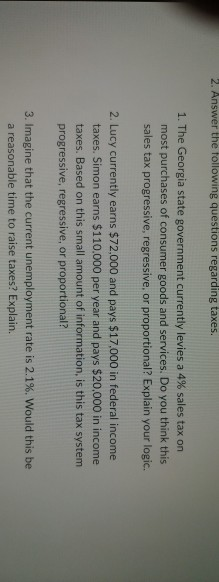

Georgia Sales Tax Rate

Georgia collects a 4 state sales tax rate on the purchase of all vehicles.

Georgia sales tax rate. Please refer to the georgia website for more sales taxes information. The georgia ga state sales tax rate is currently 4. In addition to taxes car purchases in georgia may be subject to other fees like registration title and plate fees.

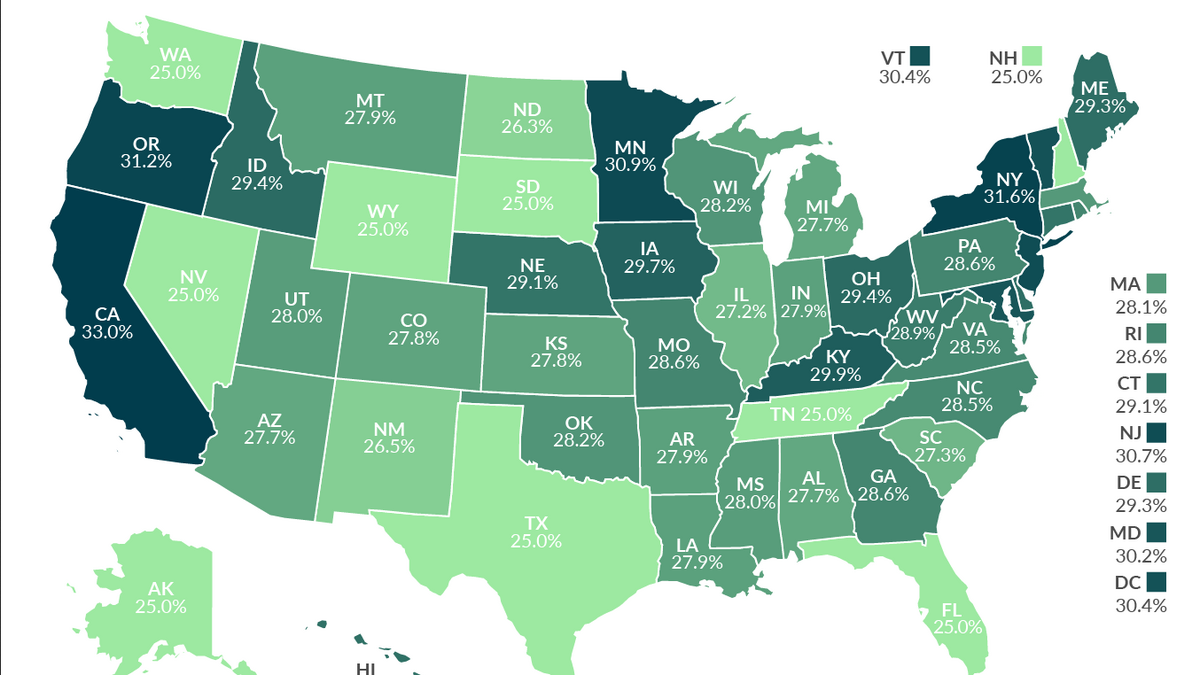

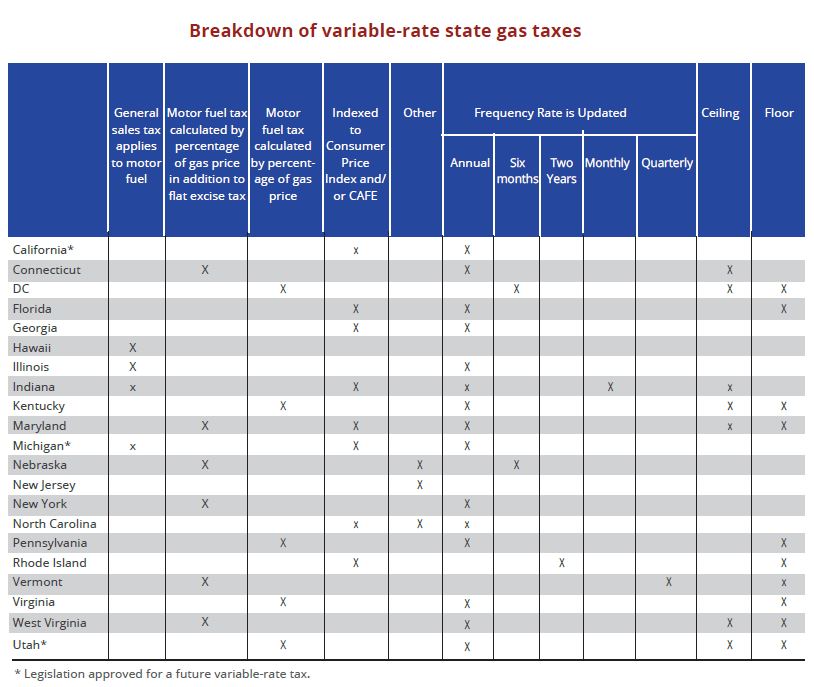

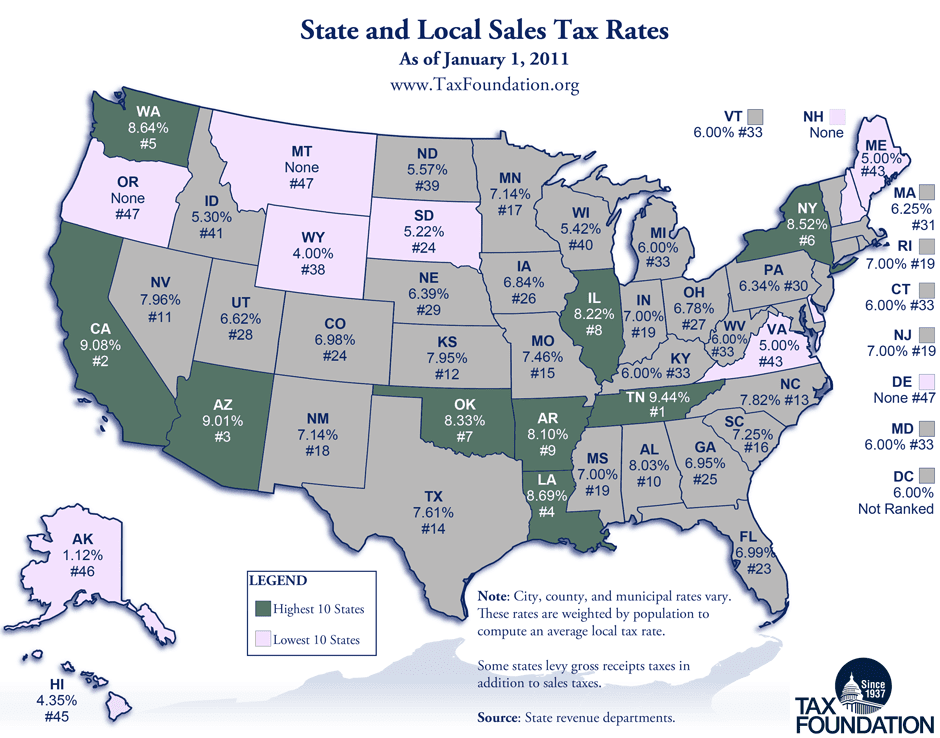

Dont hire a tax attorney call now. Before sharing sensitive or personal information make sure youre on an official state website. Georgia has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4there are a total of 311 local tax jurisdictions across the state collecting an average local tax of 3491.

Click here for a larger sales tax map or here for a sales tax table. Some of the georgia tax type are. State of georgia government websites and email systems use georgiagov or gagov at the end of the address.

The augusta sales tax rate is. The columbia county sales tax rate is. Current georgia sales tax rates listed for all counties in 2020.

Local state and federal government websites often end in gov. The georgia sales tax rate is currently. Combined with the state sales tax the highest sales tax rate in georgia is 89 in the cities of.

You can find these fees further down on the page. Georgia state rates for 2020. Sales tax rates general general rate chart effective beginning july 1 2020 6704 kb general rate chart effective april 1 2020 through june 30 2020 2202 kb.

Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575. Rates include state county and city taxes. The latest sales tax rates for cities in georgia ga state.

There is also a local tax of between 2 and 3. The georgias tax rate may change depending of the type of purchase. The 2018 united states supreme court decision in south dakota v.

This is the total of state county and city sales tax rates. Depending on local municipalities the total tax rate can be as high as 9. 4 is the smallest possible tax rate austell georgia.

Higher earners pay higher rates although georgias brackets top out at 7000 for single filers which means the majority of full time workers will pay the top rate. We help with sales tax audits defense litigation. The minimum combined 2020 sales tax rate for augusta georgia is.

Consumers use rental tax sales tax sellers use lodgings tax and more.

.png)

/best-and-worst-states-for-sales-taxes-3193296_final-5833bed0517f402abab0d55179d65e7d.png)

-311932-edited.png?width=800&name=Copy%20of%20Georgia%20Tax%20Rates%20(2)-311932-edited.png)

.png?width=800&name=Copy%20of%20Georgia%20Tax%20Rates%20(1).png)

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3.png)