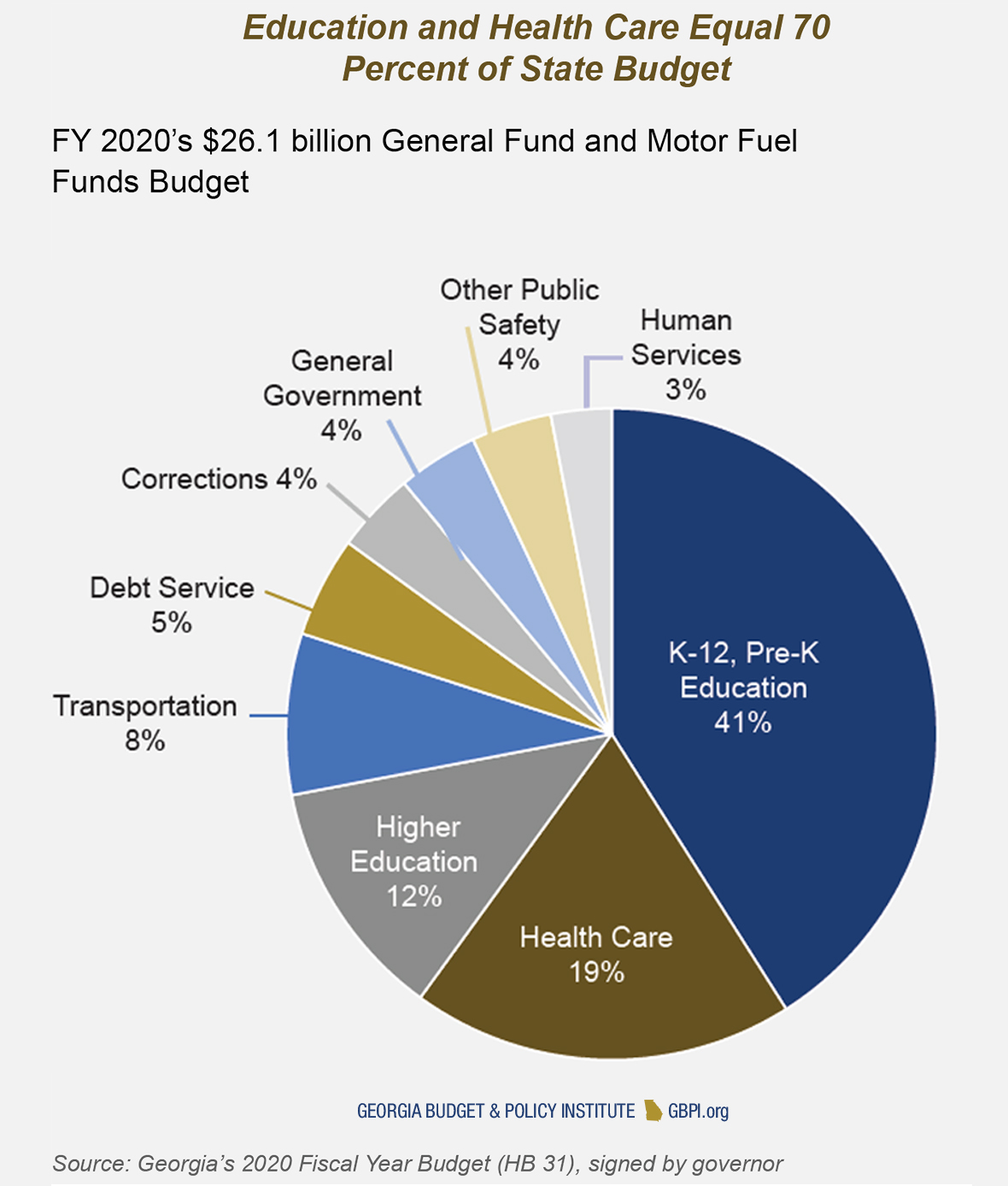

Georgia Sales Tax Rate Changes 2020

Local sales tax rate changes are set to take effect in a handful of states on june 1 2020.

Georgia sales tax rate changes 2020. The tax rate for the first. This page will be updated monthly as new sales tax rates are released. 89 is the highest possible tax rate atlanta georgia the average combined rate of every zip code in georgia is 7091.

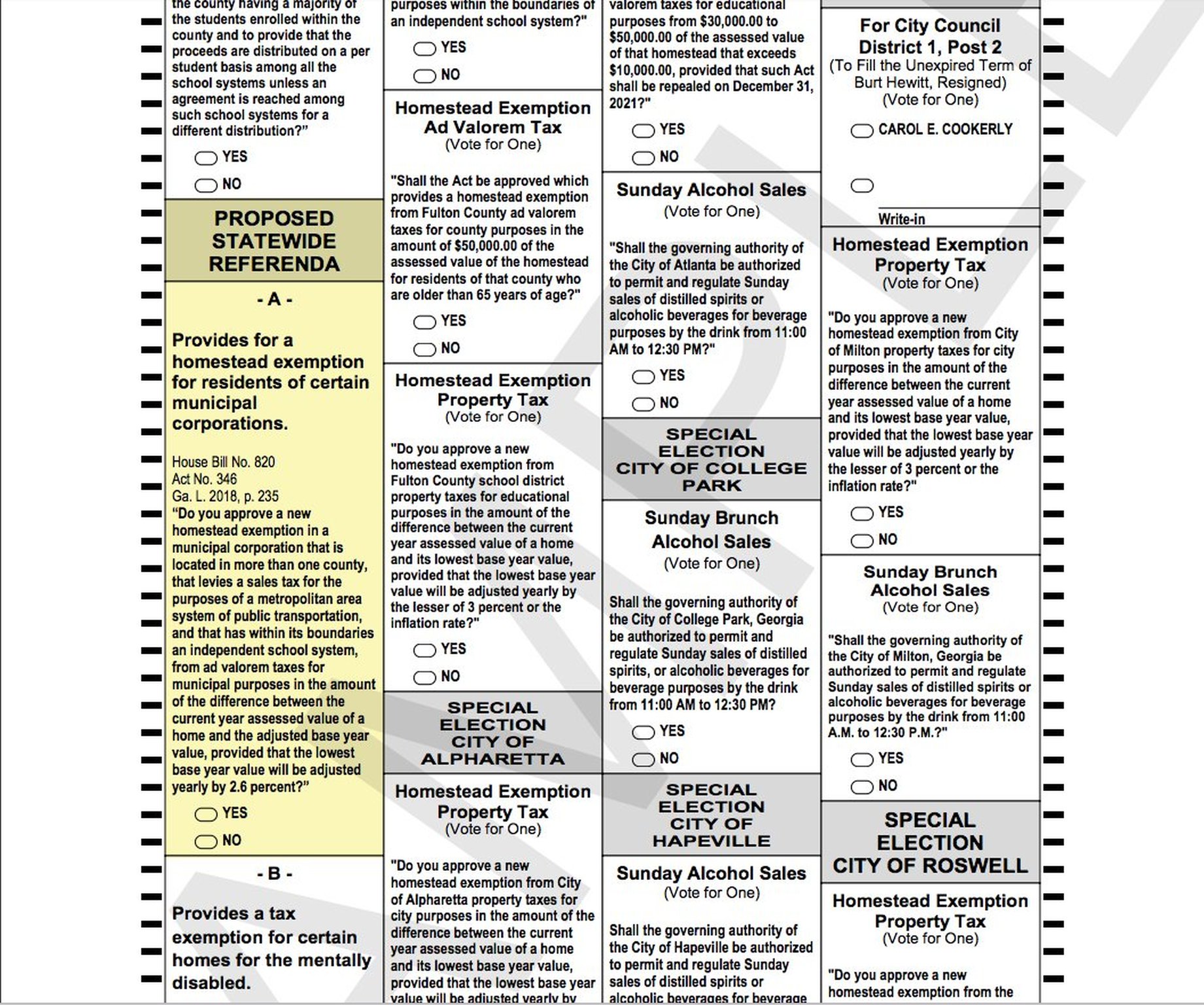

Effective october 1 2018 the generally applicable tax rate in ware county is 9 state sales tax at the statewide rate of 4 plus 5 local sales taxes at a rate of 1 each. Over the past year there have been seven local sales tax rate changes in georgia. Changes to the prepaid local tax on motor fuel.

Combined with the state sales tax the highest sales tax rate in georgia is 89 in the cities of. The latest sales tax rates for cities in georgia ga state. 4 is the smallest possible tax rate austell georgia 6 7 775 8 are all the other possible sales tax rates of georgia cities.

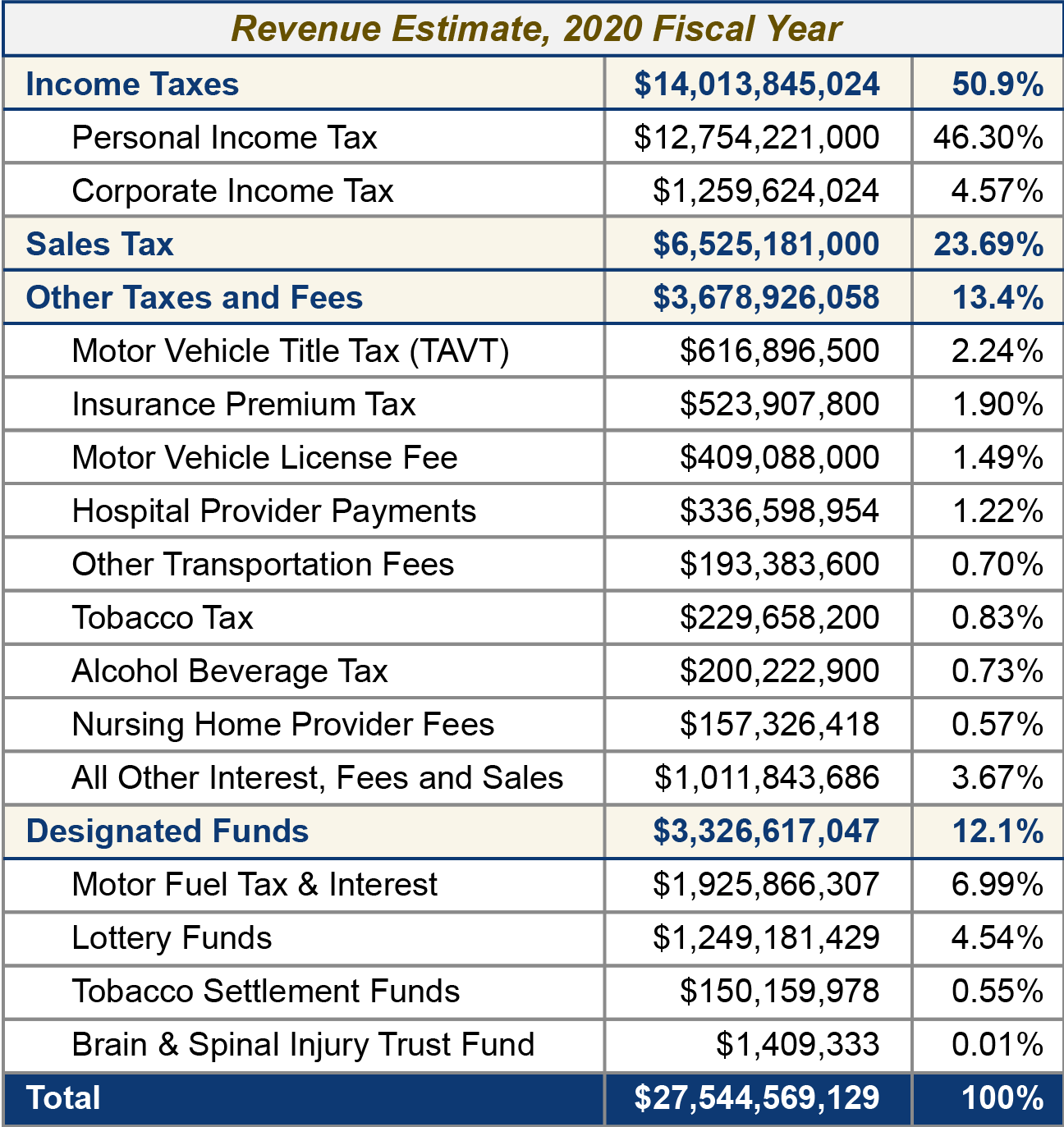

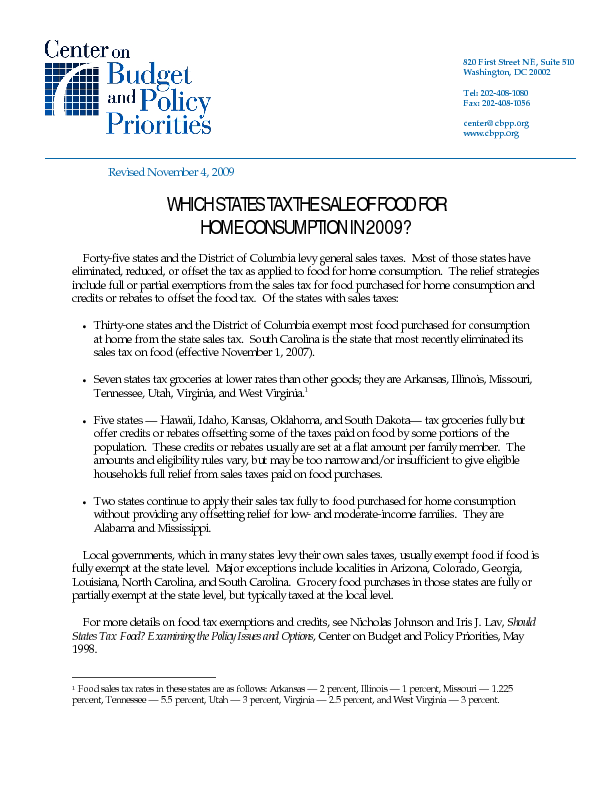

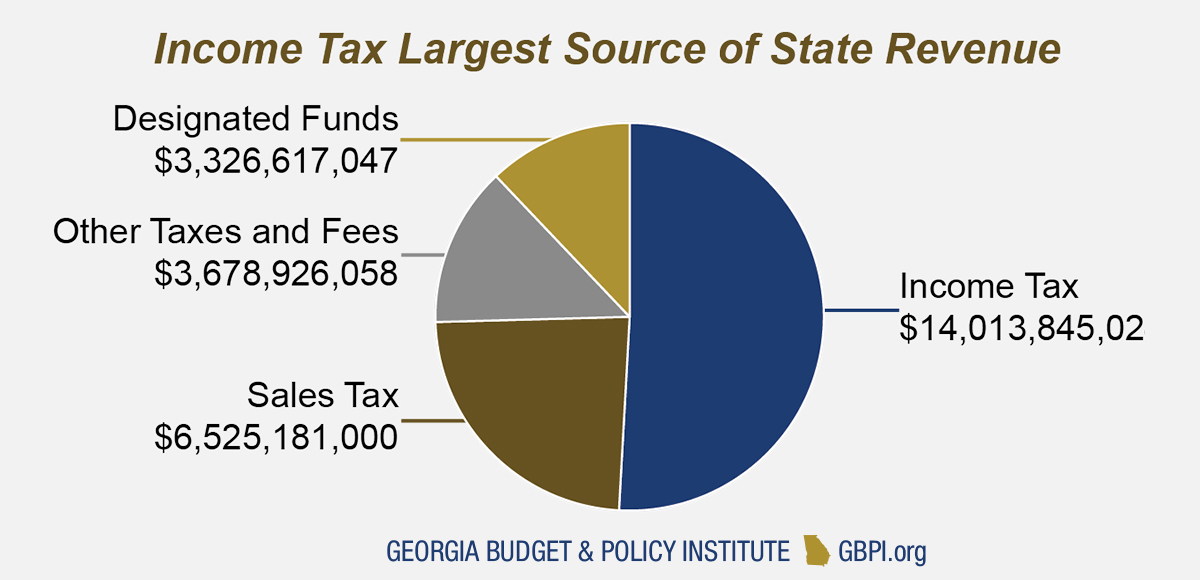

Georgia has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4there are a total of 311 local tax jurisdictions across the state collecting an average local tax of 3491. Sales use tax import return filing and remittance requirements this is a link to rule 560 12 1 22 on the georgia secretary of states website sales tax id verification tool. Georgia state rates for 2020.

This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply. 2019 rates included for use while preparing your income tax deduction. Sales tax rates general general rate chart effective beginning july 1 2020 6704 kb general rate chart effective april 1 2020 through june 30 2020 2202 kb.

The tax rate for the portion of a motor vehicle sale that exceeds 500000 is 6 because the 1 2nd lost and the 1 tsplost do not apply. Changes to the prepaid sales tax rates for diesel and gasoline. The georgia sales tax rate is 4 as of 2020 with some cities and counties adding a local sales tax on top of the ga state sales tax.

Rates include state county and city taxes. 2020 georgia sales tax changes. Exemptions to the georgia sales tax will vary by state.

/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3.png)

/best-and-worst-states-for-sales-taxes-3193296_final-5833bed0517f402abab0d55179d65e7d.png)

/2020-federal-state-minimum-wage-rates-2061043-final-d82d14b0792c49c8a7b85e3666d8b6b2.png)

.png)