Georgia Sales Tax Rate Changes

Sales tax rates miscellaneous rate codes.

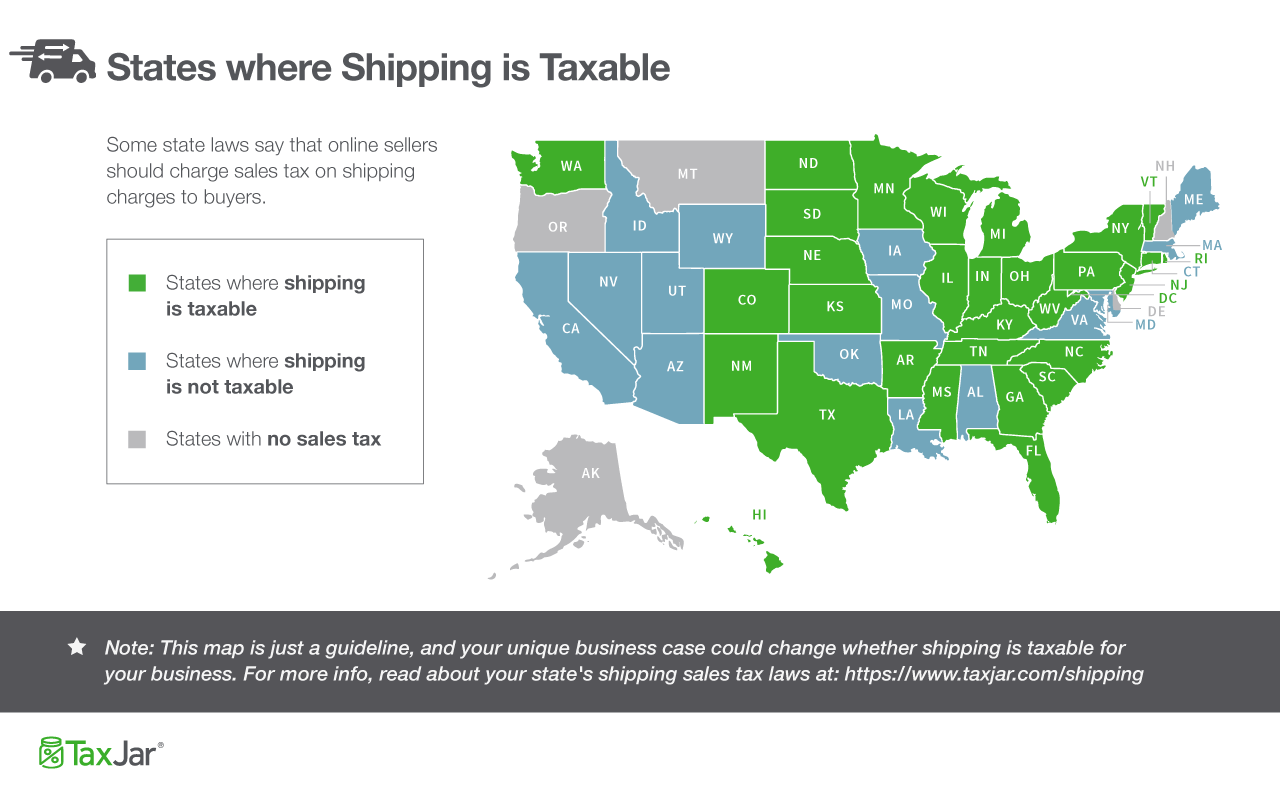

Georgia sales tax rate changes. Some of the georgia tax type are. Upcoming quarterly rate changes. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

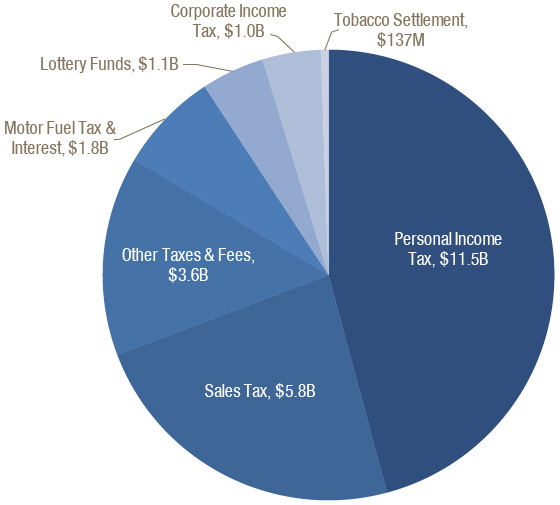

Prepaid sales tax on all motor fuel sold in the state of georgia must be remitted by all licensed motor fuel distributors suppliers and wholesalersthe tax is due at the same time as the state excise tax. This page does not contain all tax rates for a business location. 4 is the smallest possible tax rate austell georgia.

Sales tax upcoming quarterly rate changes. Rates include state county and city taxes. Sales tax rates prepaid local tax motor fuel for highway use sales tax upcoming quarterly rate changes.

Georgia tax center help individual income taxes register new business business taxes refunds information for tax professionals. The georgias tax rate may change depending of the type of purchase. The tax rate on all car sales is dropping from 7 to 66 which amounts to a savings of about 100 on a new car sold for 25000.

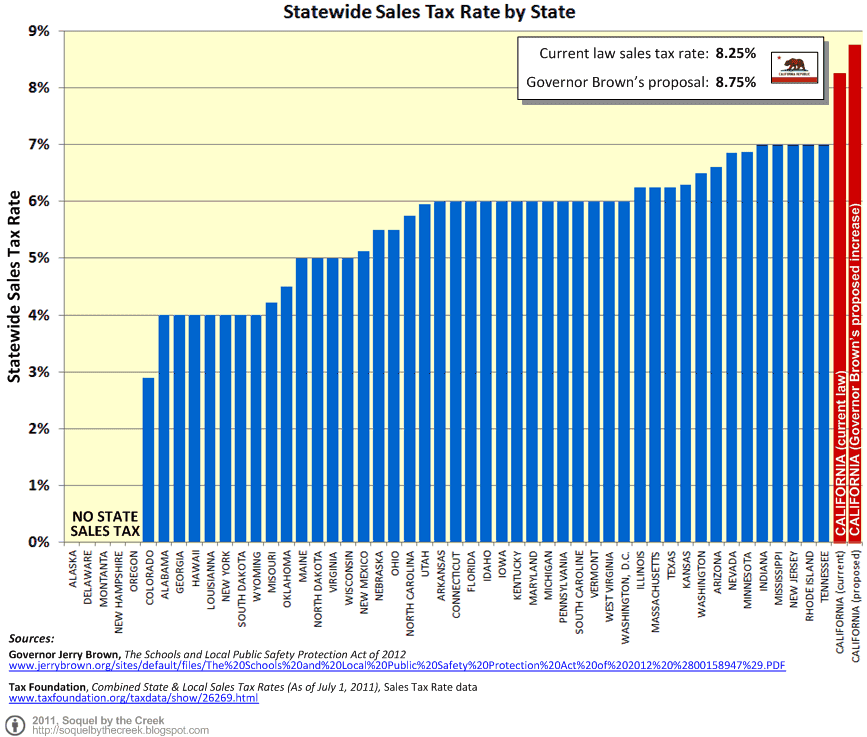

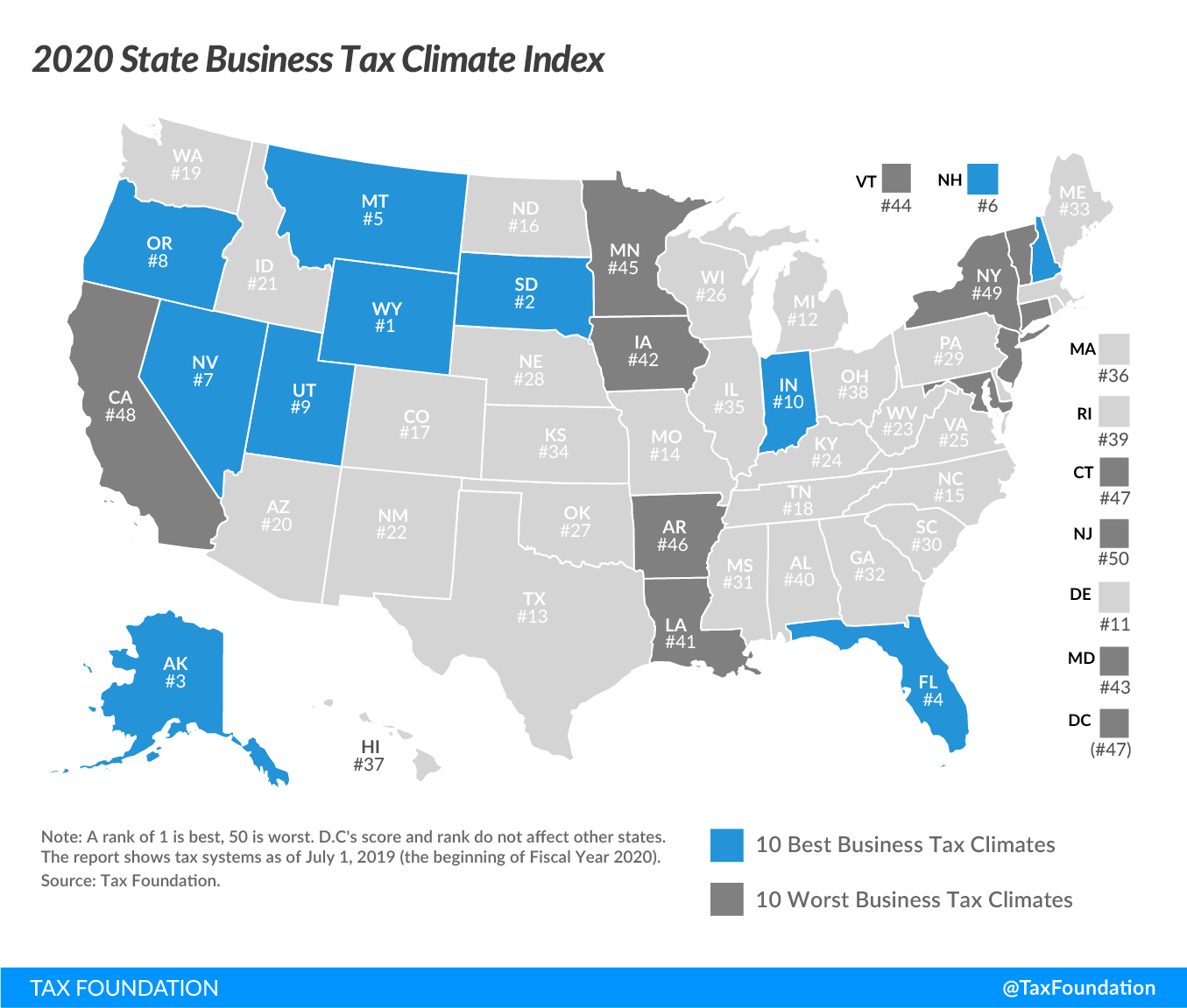

Georgia has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4there are a total of 311 local tax jurisdictions across the state collecting an average local tax of 3491. The latest sales tax rates for cities in georgia ga state. Rate changes effective july 1 2020 updated 12jun2020 5752 kb.

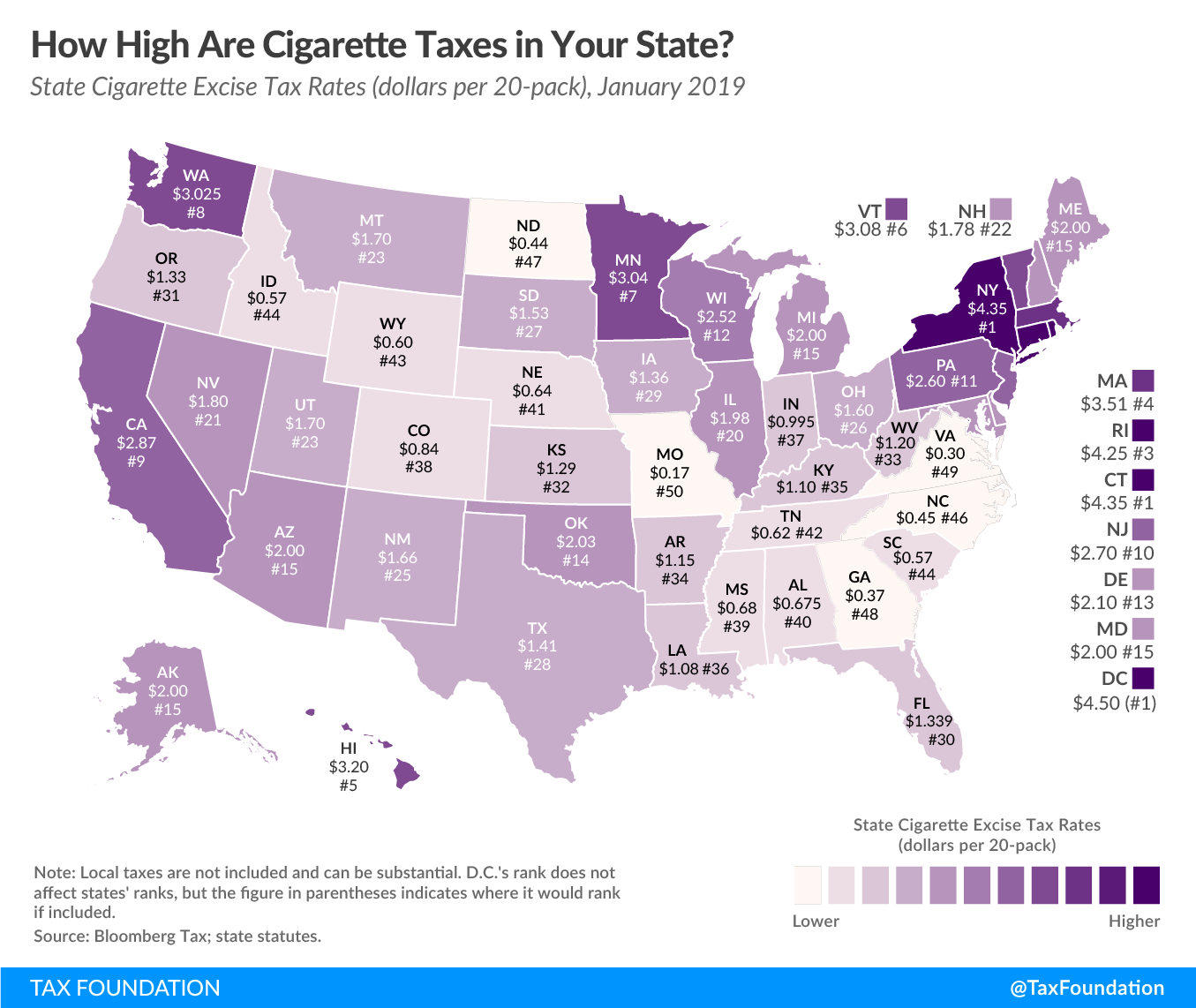

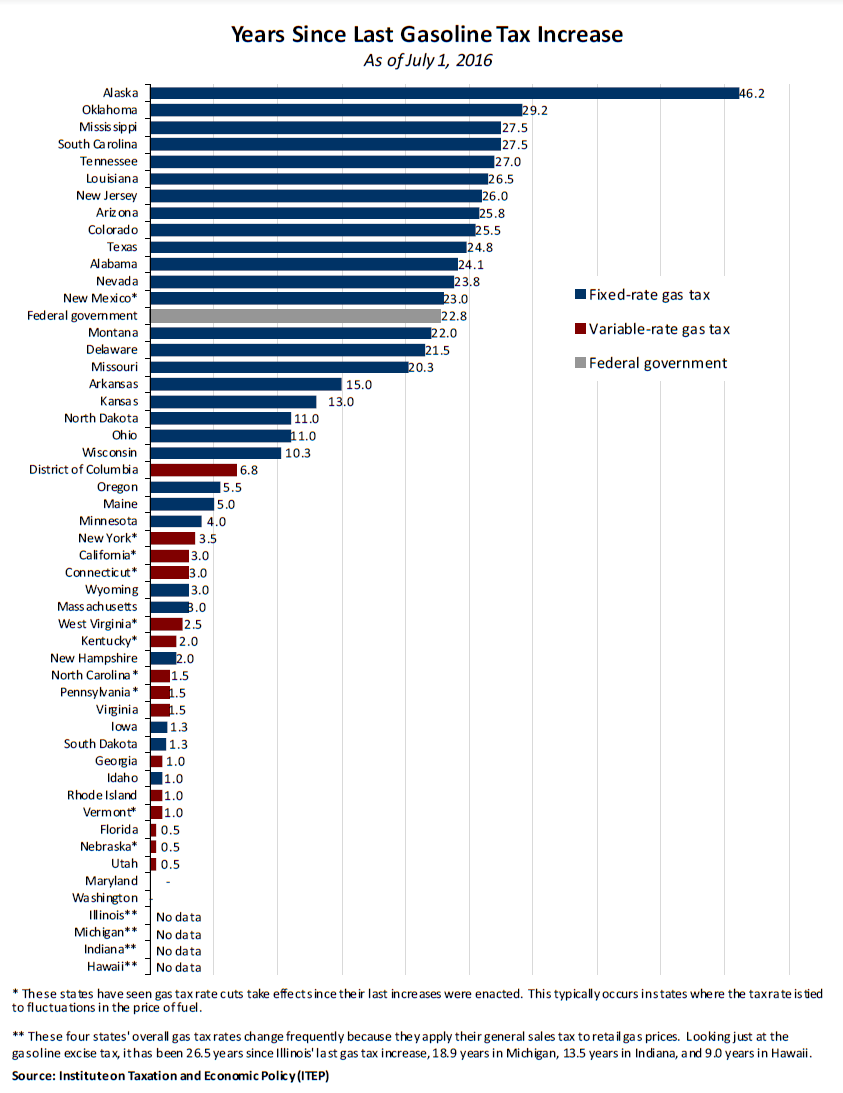

This web page contains changes to existing sales or use tax rates. Alabama georgia hawaii new york and wyoming. Sales tax rates general.

The rate in randolph county decreases from 8 to 7. Five states follow with 4 percent rates. Sales tax rates for energy sold to manufacturers.

No states have changed their statewide sales tax rates since july 2018 although the district of columbia raised its sales taxes from 575 percent to 6 percent in october. Several tax rate changes tax effect in georgia on july 1 2016. Sales tax rates jet fuel.

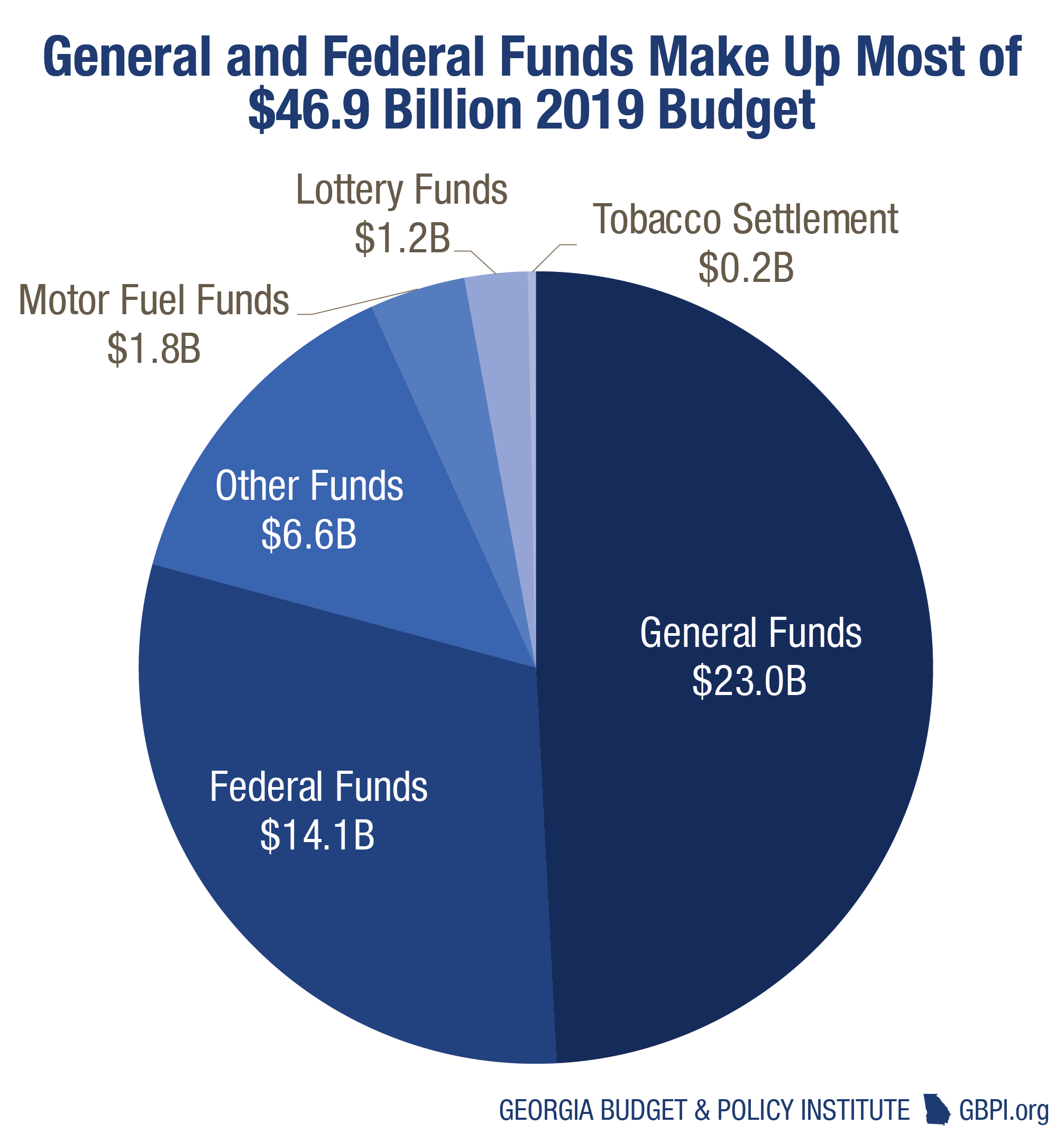

2019 rates included for use while preparing your income tax deduction. 2020 georgia sales tax changes over the past year there have been seven local sales tax rate changes in georgia. Consumers use rental tax sales tax sellers use lodgings tax and more.

To find all applicable sales or use tax rates for a specific business location or local government visit revenue online or download the dr 1002 on the sales use tax forms web page. Click here for a larger sales tax map or here for a sales tax table. For additional support with sales and use tax rates watch our video how to.

But some used car buyers will have to pay more in taxes overall.

.png)

/media/img/posts/2015/01/Georgia_Unemployment_Graph/original.png)

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3.png)

/best-and-worst-states-for-sales-taxes-3193296_final-5833bed0517f402abab0d55179d65e7d.png)