Georgia Sales Tax Rate Lookup

Rates include state county and city taxes.

/best-and-worst-states-for-sales-taxes-3193296_final-5833bed0517f402abab0d55179d65e7d.png)

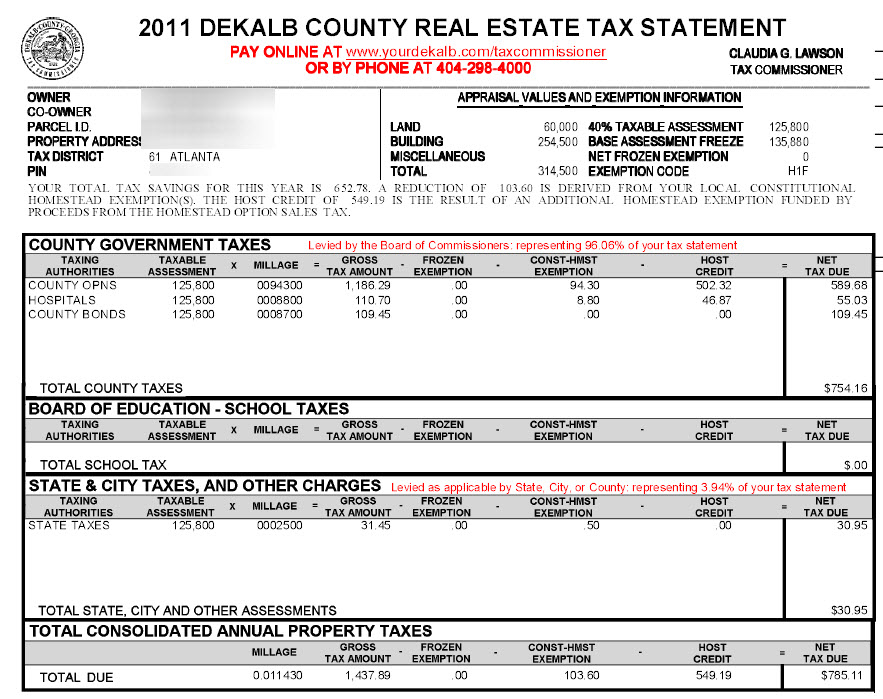

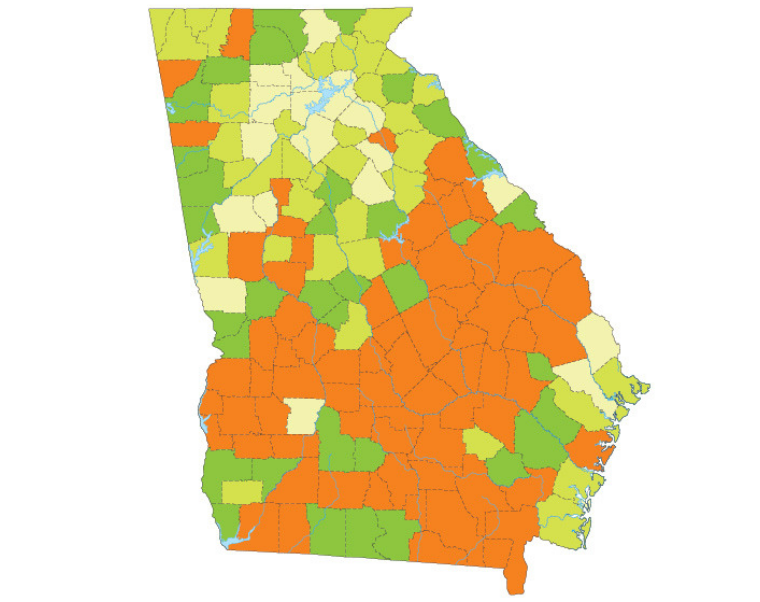

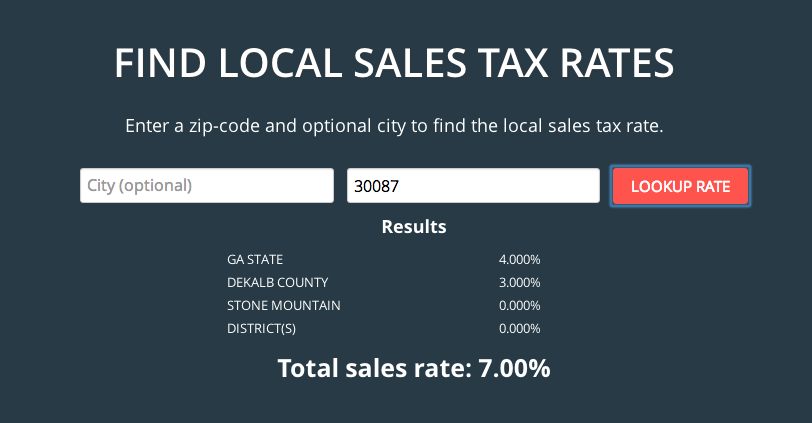

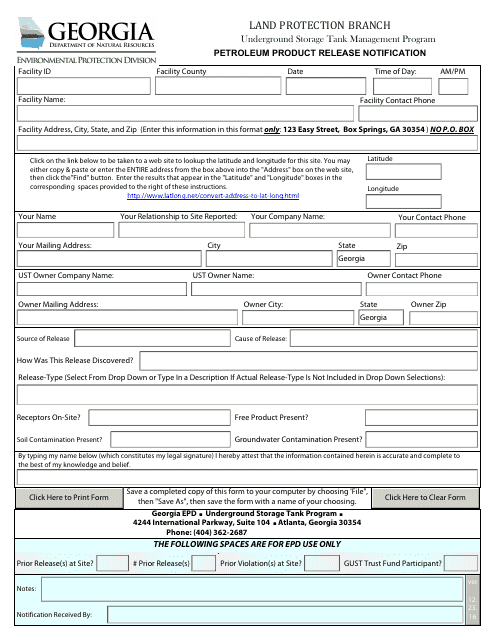

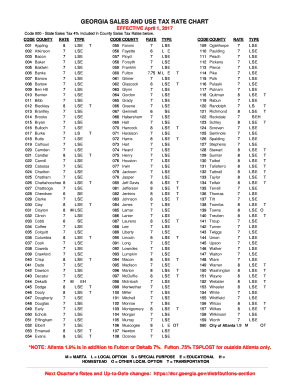

Georgia sales tax rate lookup. Georgia has a 4 statewide sales tax rate but also has 311 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3491 on top of the state tax. Sales tax rates jet fuel. This means that depending on your location within georgia the total tax you pay can be significantly higher than the 4 state sales tax.

8 will be the total rate of sales and use tax in the city. The jurisdiction breakdown shows the different tax rates that make up the combined rate. Print a copy of the search results for your records.

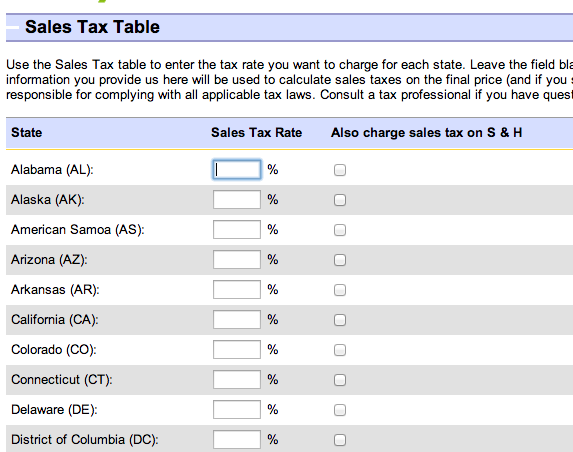

Sales tax rates for energy sold to manufacturers. Use this search tool to look up sales tax rates for any location in washington. The latest sales tax rates for cities in georgia ga state.

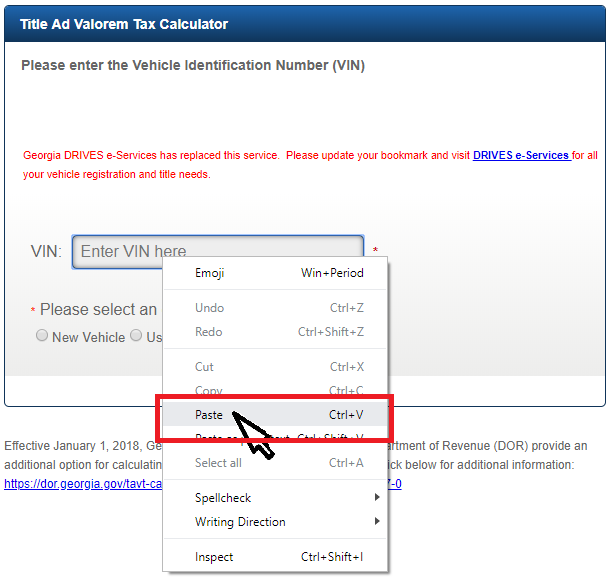

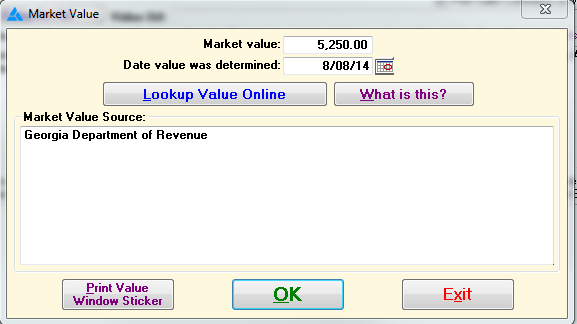

Enter the sales tax numbers for verification. The tax rate for the first 500000 of a motor vehicle sale is 7 because the 1 2nd lost does not apply. This tax will be collected on the sale of food.

Sales use tax import return filing and remittance requirements this is a link to rule 560 12 1 22 on the georgia secretary of states website sales tax id verification tool. Sales tax rates miscellaneous rate codes. Sales tax rates general general rate chart effective beginning july 1 2020 6704 kb general rate chart effective april 1 2020 through june 30 2020 2202 kb.

Zip zip code is required but the 4 is optional. This tool only verifies georgia sales tax numbers. The city of atlanta is not in one county but is in parts of fulton and dekalb counties.

2019 rates included for use while preparing your income tax deduction. The 1 city of atlanta municipal sales and use tax generally applies to all sales that are subject to the 4 state tax except motor vehicle sales. To calculate sales and use tax only.

While most taxable products are subject to the combined tax rate some items are taxed differently at the state and local levels so be sure to apply the correct. Sales tax rates general. The combined tax rate is the total sales tax of the jurisdiction for the address you submitted.

The generally applicable tax rate in muscogee county is 8 state sales tax at the statewide rate of 4 plus 4 local sales taxes at a rate of 1 each.

-311932-edited.png?width=800&name=Copy%20of%20Georgia%20Tax%20Rates%20(2)-311932-edited.png)