Georgia Sales Tax Rate Calculator

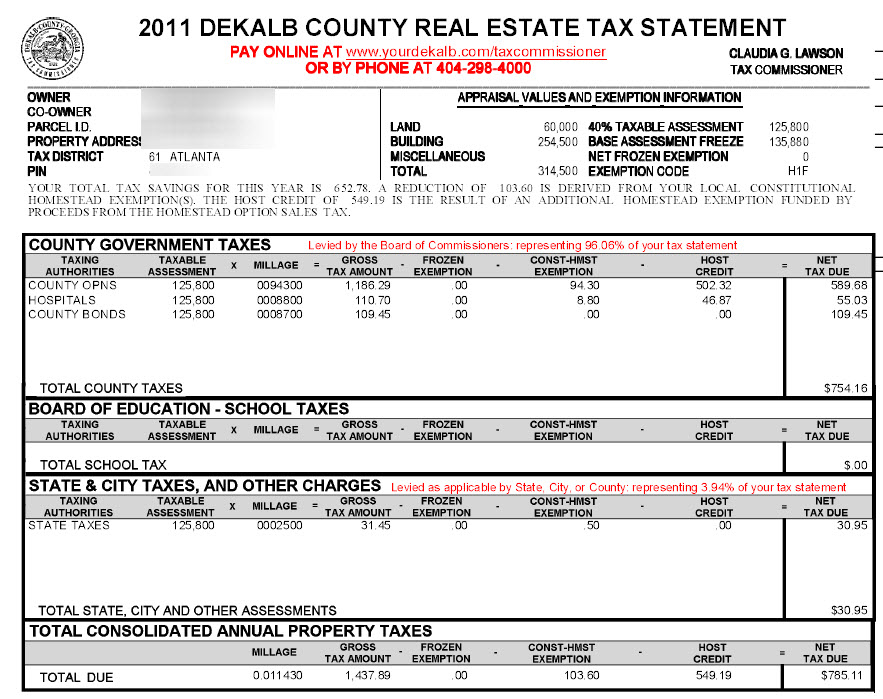

The tax must be paid at the time of sale by georgia residents or within six months of establishing residency by those moving to georgia.

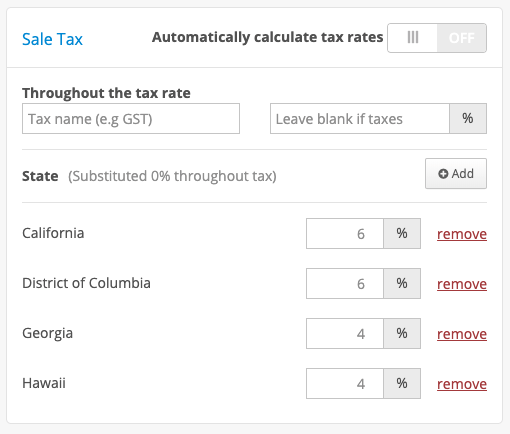

Georgia sales tax rate calculator. While most taxable products are subject to the combined tax rate some items are taxed differently at the state and local levels so be sure to apply the correct. Other 2020 sales tax fact for georgia as of 2020 there is 1 out of 632 cities in georgia that charge city sales tax for a ratio of 0158. Sales tax rates general general rate chart effective beginning july 1 2020 6704 kb general rate chart effective april 1 2020 through june 30 2020 2202 kb.

Higher earners pay higher rates although georgias brackets top out at 7000 for single filers which means the majority of full time workers will pay the top rate. Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575. This tax is based on the value of the vehicle.

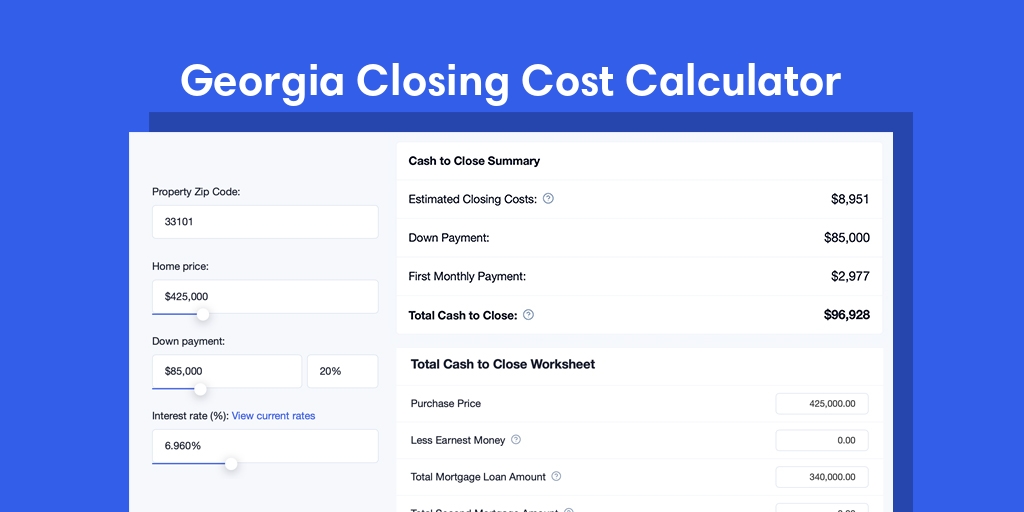

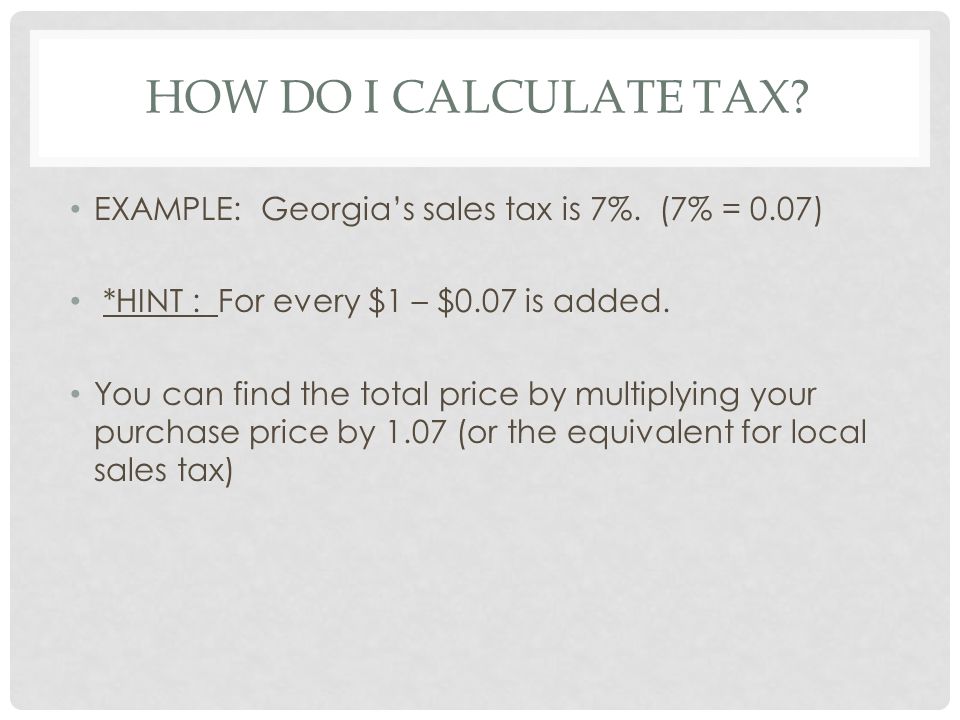

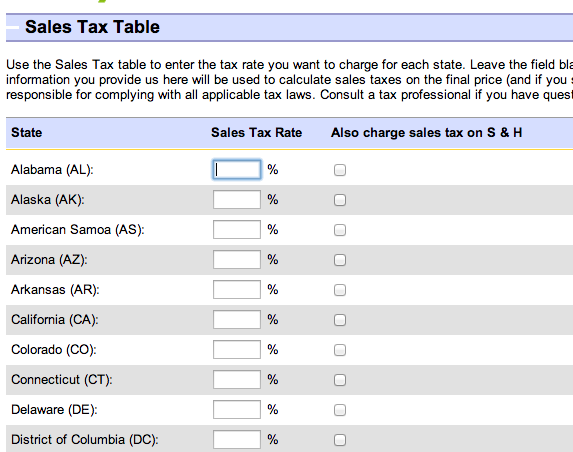

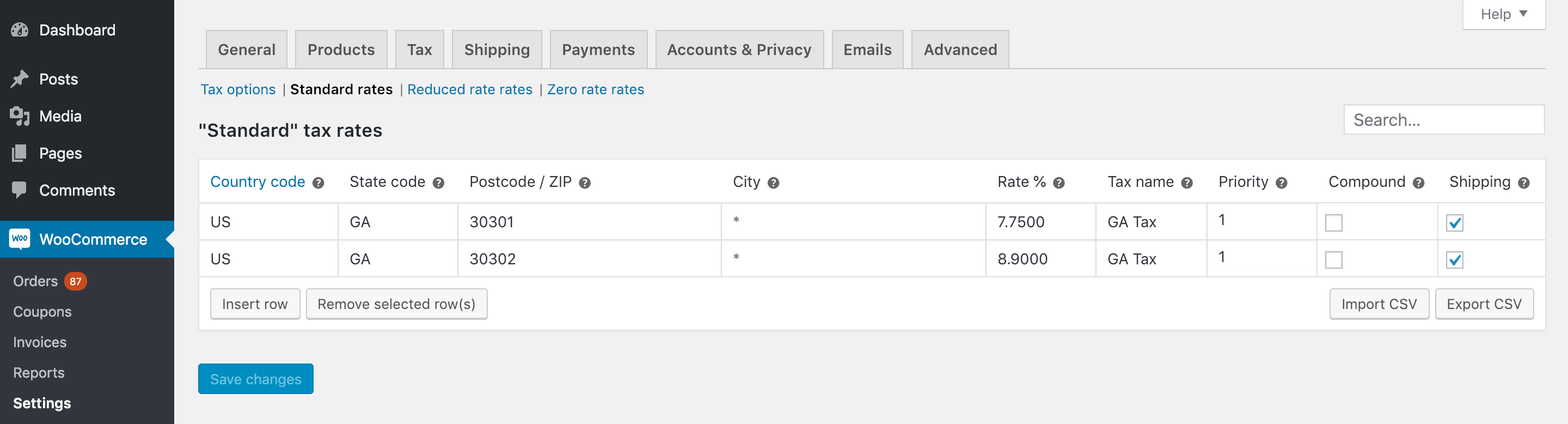

This means that depending on your location within georgia the total tax you pay can be significantly higher than the 4 state sales tax. Depending on local municipalities the total tax rate can be as high as 9. Just enter the five digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to georgia local counties cities and special taxation districts.

There is also 51 out of 1079 zip codes in georgia that are being charged city sales tax for a ratio of 4727. The georgia ga state sales tax rate is currently 4. The combined tax rate is the total sales tax of the jurisdiction for the address you submitted.

The last rates update has been made on july 2020. Title ad valorem tax tavt became effective on march 1 2013. It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership is transferred or a new resident registers the vehicle in georgia for the first time.

Georgia has a 4 statewide sales tax rate but also has 311 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3491 on top of the state tax. Any entity that conducts business within georgia may be required to register for one or more tax specific identification numbers permits andor licenses. Tavt is a one time tax that is paid at the time the vehicle is titled.

Sales use tax import return filing and remittance requirements this is a link to rule 560 12 1 22 on the georgia secretary of states website sales tax id verification tool.

.png)