Georgia Sales Tax Rate On Used Cars

The ad valorem calculator can also estimates the tax due if you transfer your vehicle to georgia from another state.

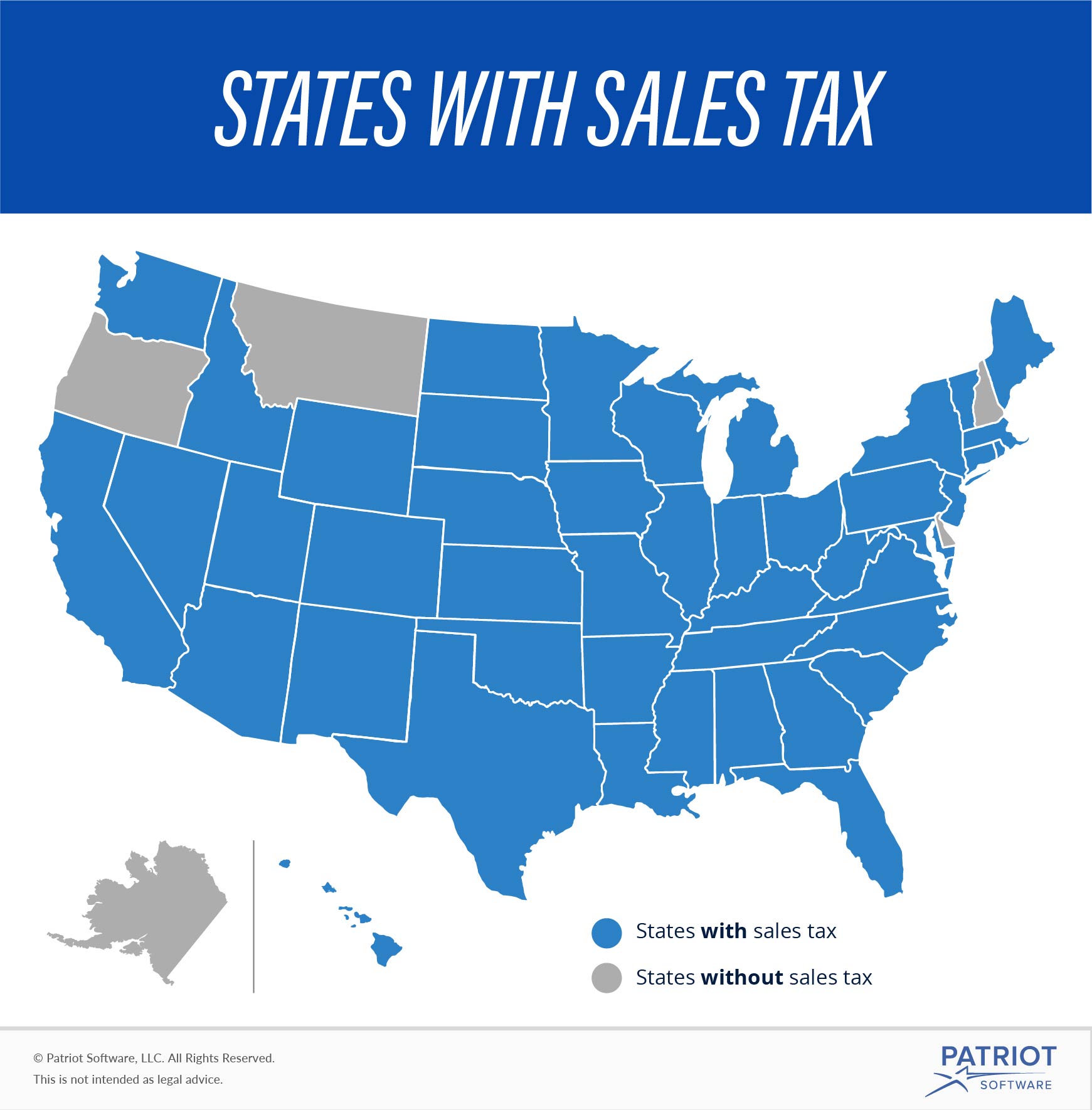

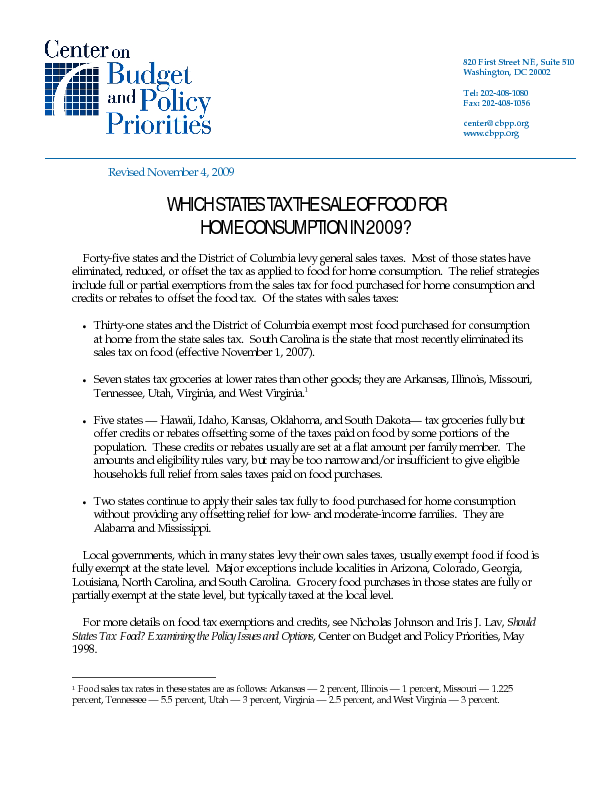

Georgia sales tax rate on used cars. See the sales tax rate in your county. Title ad valorem tax tavt became effective on march 1 2013. Sales use tax import return filing and remittance requirements this is a link to rule 560 12 1 22 on the georgia secretary of states website sales tax id verification tool.

A georgia title and license plate will not be issued until any georgia sales tax due is paid. Sales tax rates general general rate chart effective beginning july 1 2020 6704 kb general rate chart effective april 1 2020 through june 30 2020 2202 kb. But some used car buyers will have to pay more in taxes overall.

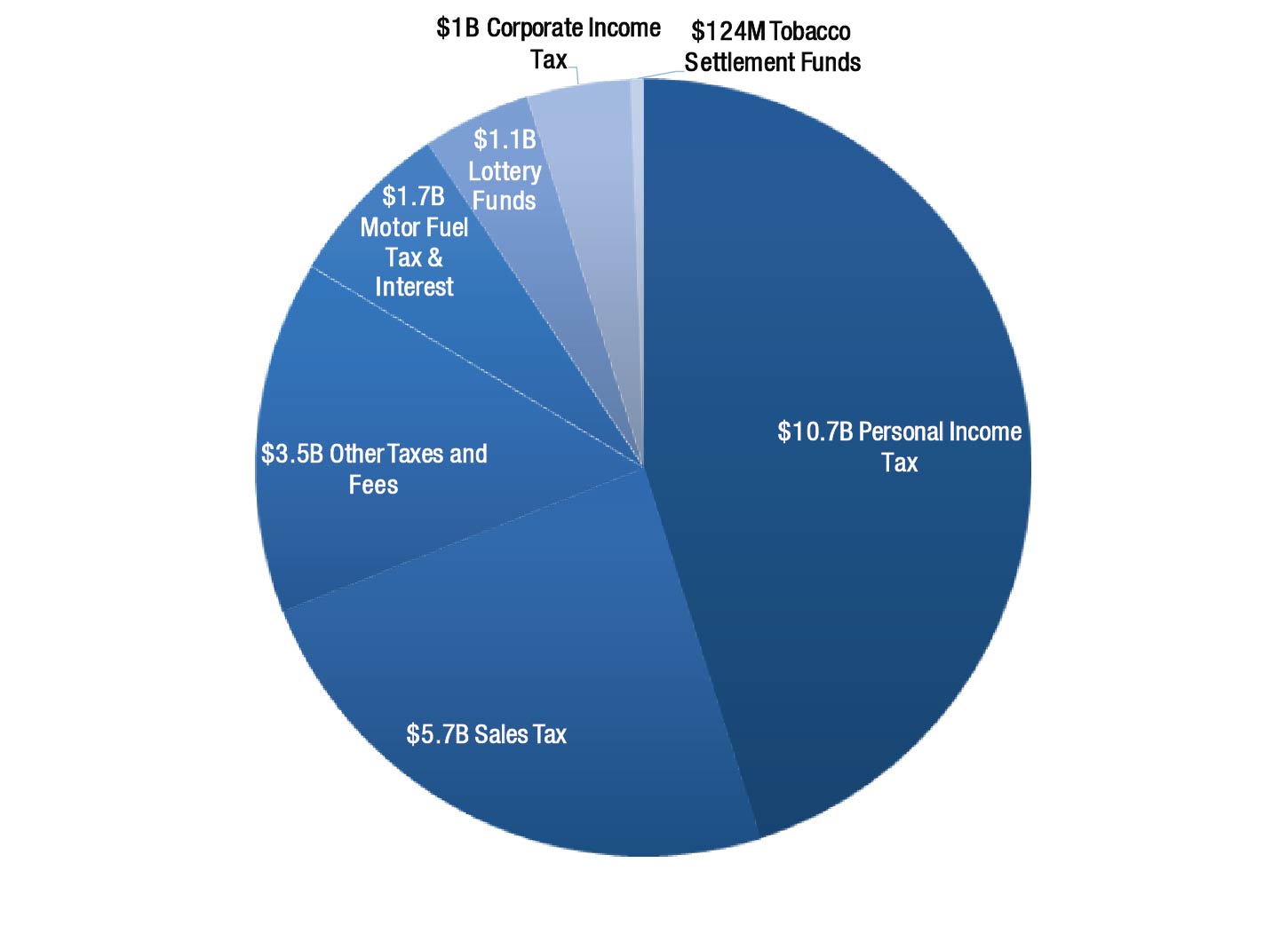

In addition to taxes car purchases in georgia may be subject to other fees like registration title and plate fees. This tax is based on the value of the vehicle. There is also a local tax of between 2 and 3.

The current tavt rate is 66 of the fair market value of the vehicle. Ad valorem title tax tavt people who purchase a new or used vehicle pay a one time ad valorem title tax. The tax must be paid at the time of sale by georgia residents or within six months of establishing residency by those moving to georgia.

The amount of sales tax due is based on the vehicles purchase price or the vehicles fair market value if a sales invoice is not submitted. Tavt is a one time tax that is paid at the time the vehicle is titled. Georgia collects a 4 state sales tax rate on the purchase of all vehicles.

The tax rate on all car sales is dropping from 7 to 66 which amounts to a savings of about 100 on a new car sold for 25000. The current tavt rate is 7 of the fair market value of the vehicle in most georgia counties. It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership is transferred or a new.

/buying-a-car-in-a-different-state-4148015-Final2-1a901895477c4c518d48407644568ce8.png)

/best-and-worst-states-for-sales-taxes-3193296_final-5833bed0517f402abab0d55179d65e7d.png)

.jpg)

/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3.png)