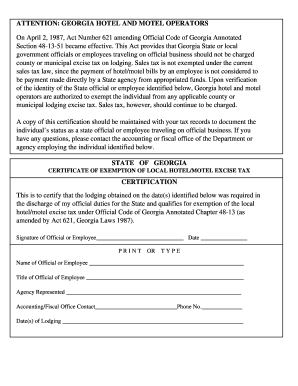

Georgia Sales Tax Exemption

Georgia tax center help individual income taxes register new business.

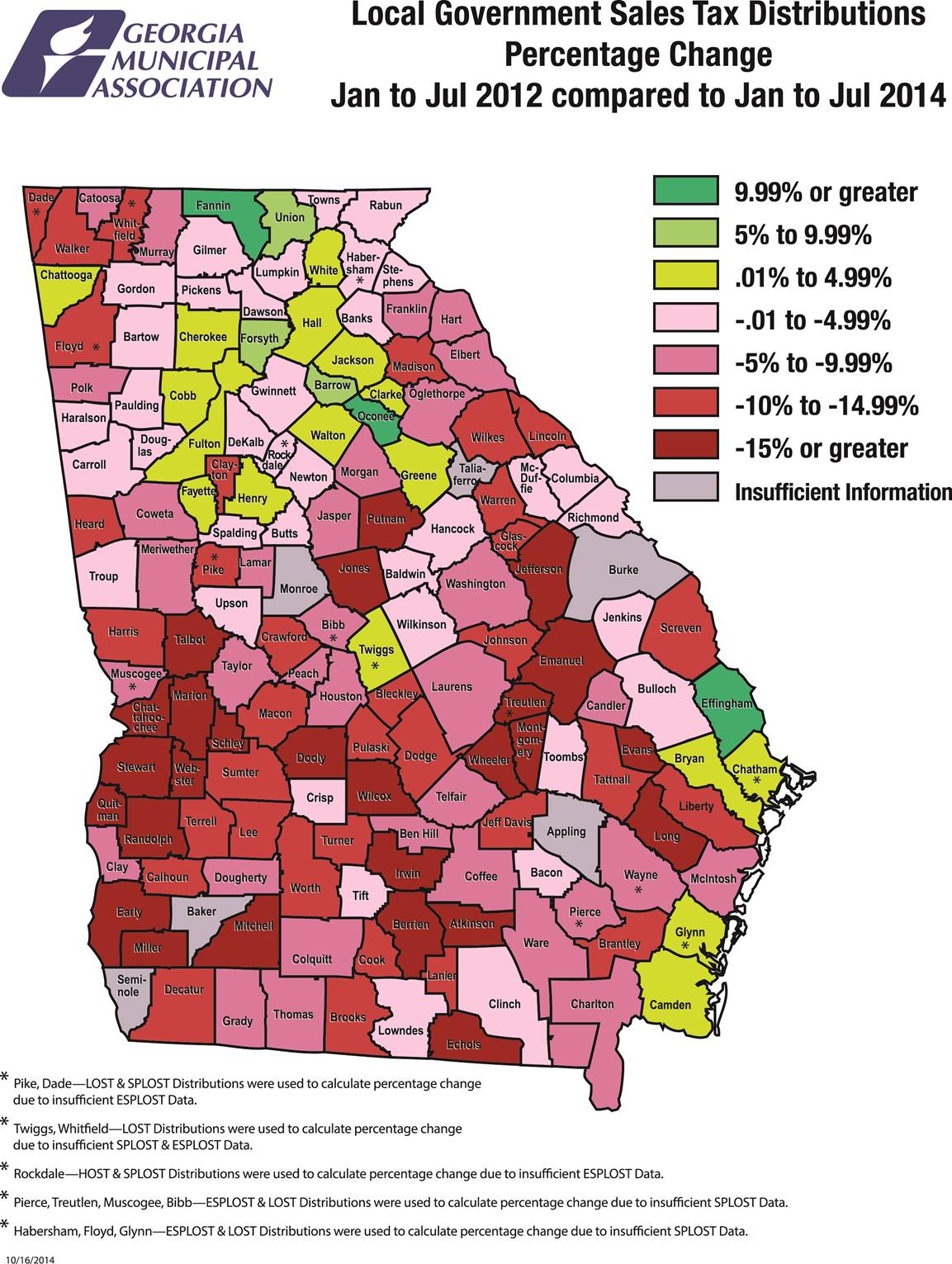

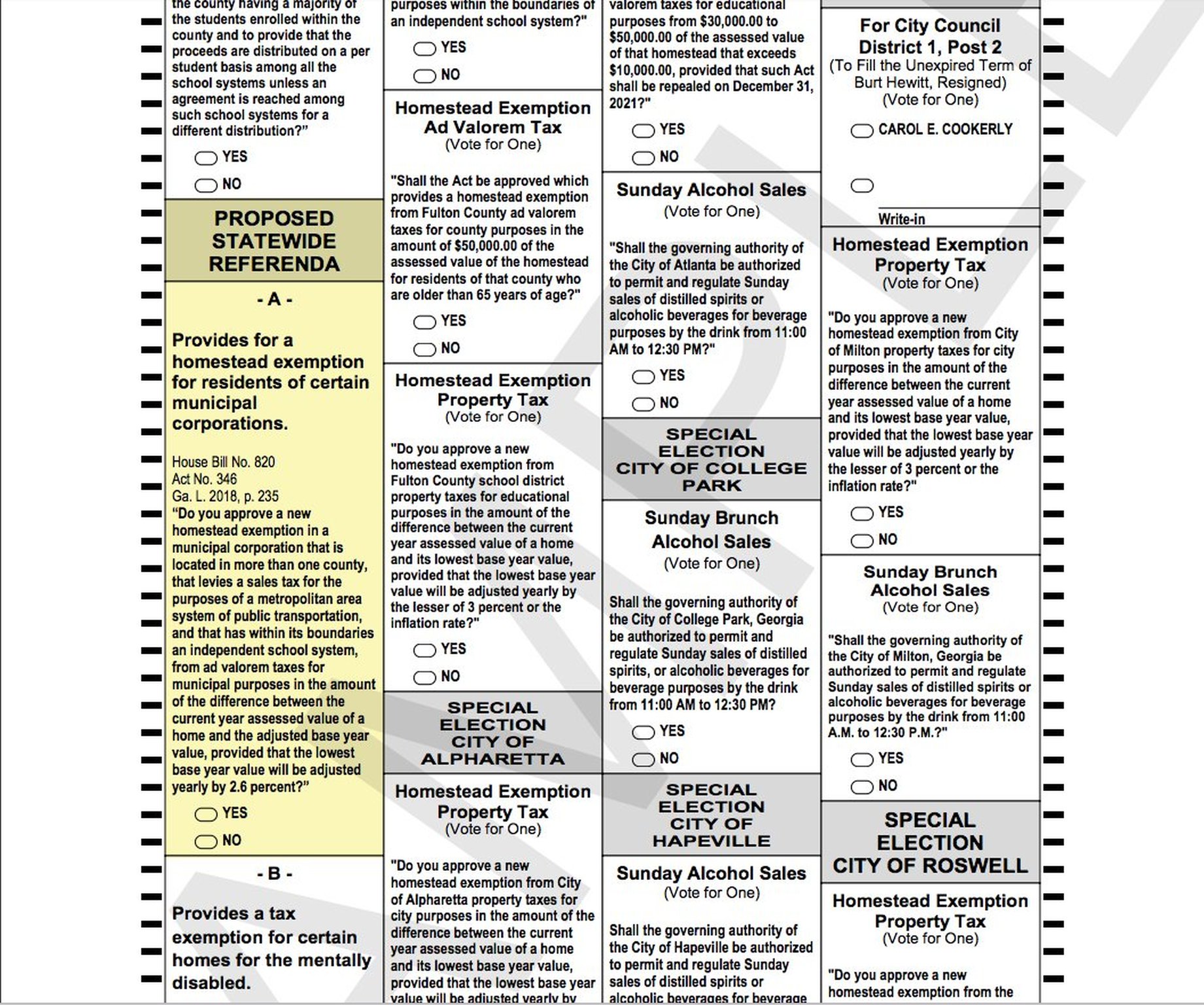

Georgia sales tax exemption. The department maintains a list of sales and use tax exemptionsthe exemptions are codified in chapter 8 of title 48 of the official code of georgia. Qualified authorities provided with a sales tax exemption under georgia law. 37 2 61d 48 8 38 50 8 44.

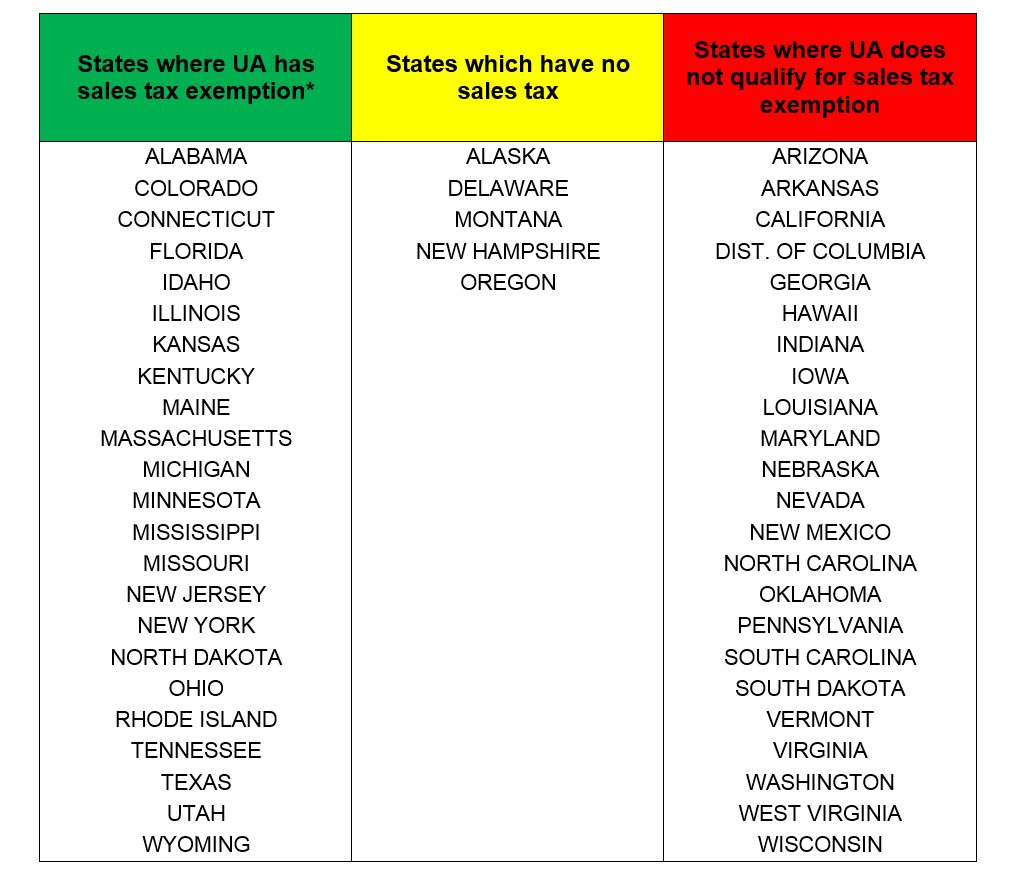

This page discusses various sales tax exemptions in georgia. A sales and use tax number is not required for this exemption. Because georgia is a member of this agreement buyers can use the multistate tax commission mtc uniform sales tax certificate when making qualifying sales tax exempt purchases from vendors in georgia.

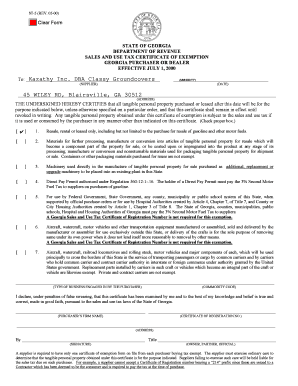

St 5 sales tax certificate of exemption 18086 kb department of revenue. What is a dealers responsibility when making an exempt sale. Georgia helps companies lower their cost of doing business by offering the ability to purchase various types of goods and services tax free.

The sale use consumption or storage of materials containers labels sacks or bags used for packaging tangible personal property for shipment or sale. These sales tax exemptions are defined in ocga. Georgia is a member of the streamlined sales and use tax agreement an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states.

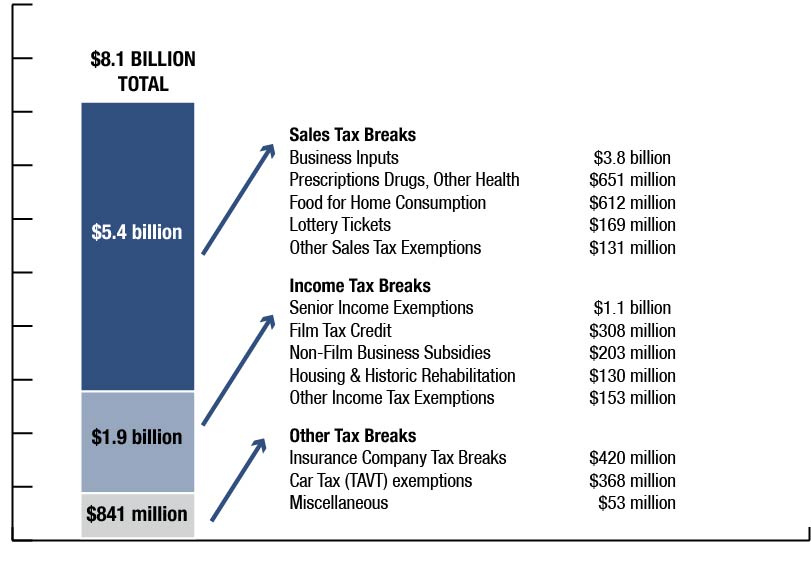

Several exemptions in the state are certain types of groceries some. Sales tax exemptions in georgia. Sales use taxes fees excise taxes save citizenship verification local government central assessment digest compliance.