Georgia Sales Tax Exemption Manufacturing

Georgia tax center help individual income taxes register new business.

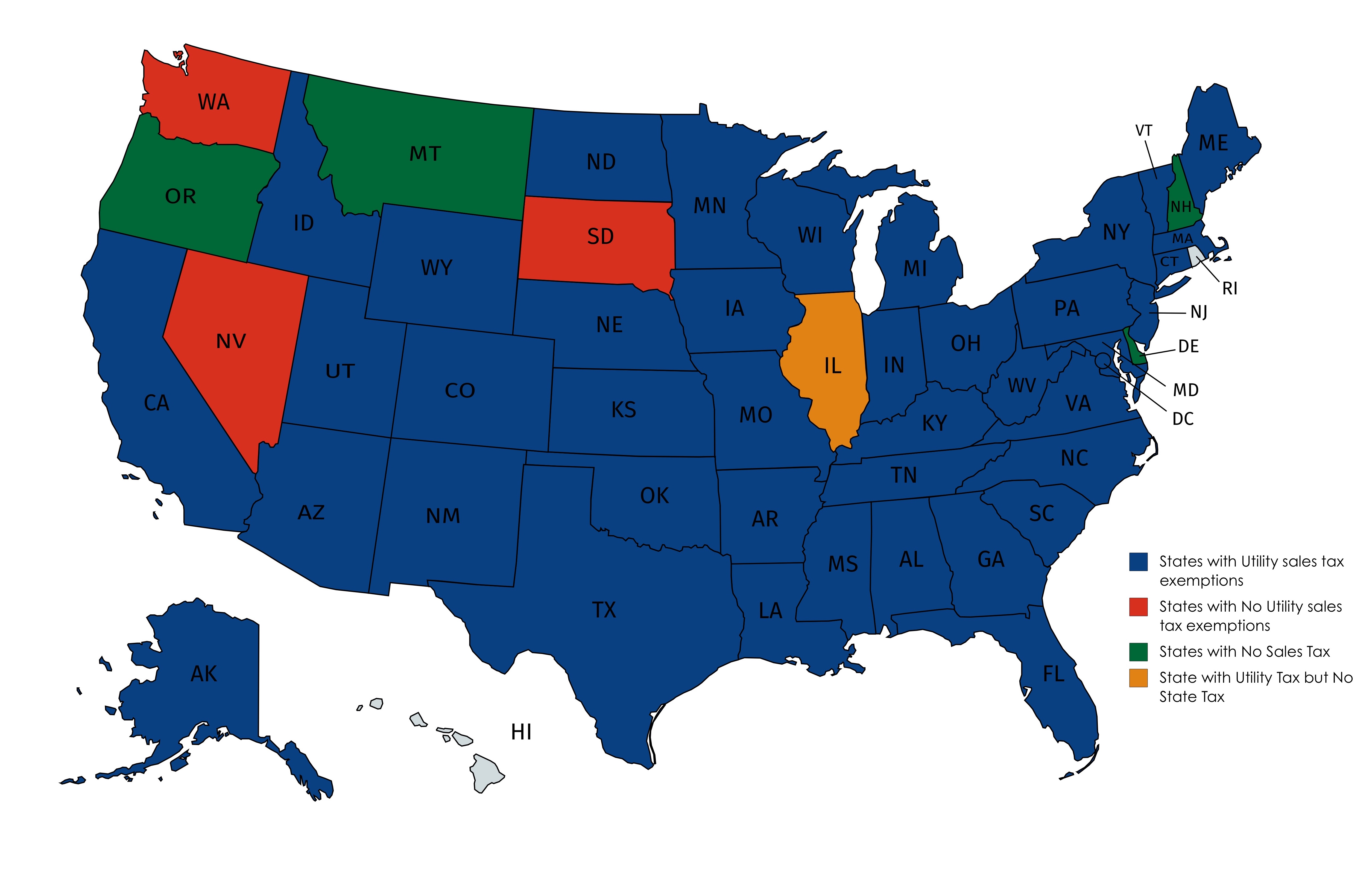

Georgia sales tax exemption manufacturing. Georgia code 48 8 32c1 states the sale use storage or consumption of energy which is necessary and integral to the manufacture of tangible personal property at a manufacturing plant in this state shall be exempt from all sales and use taxation except for the sales and use tax for educational purpose. 48 8 3 and several key exemptions are outlined in the table below. 25 exempt january 1 2013 to december 31 2013.

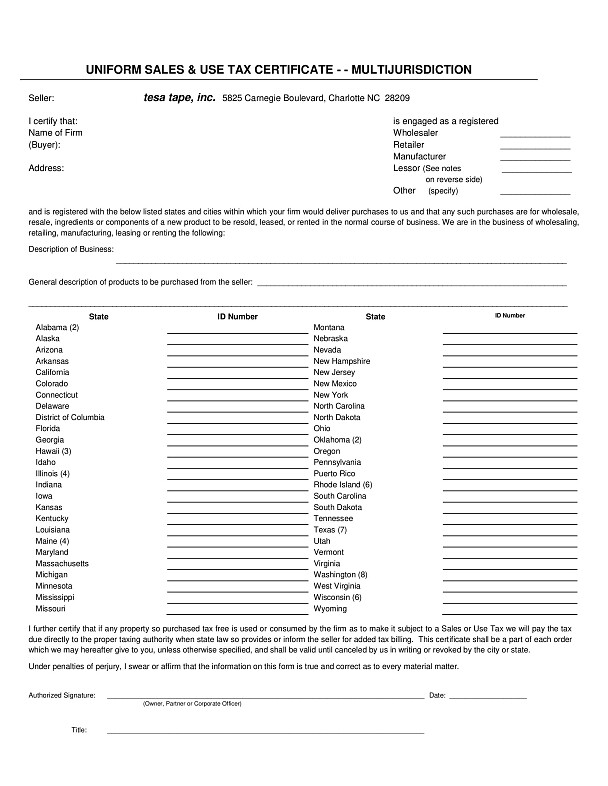

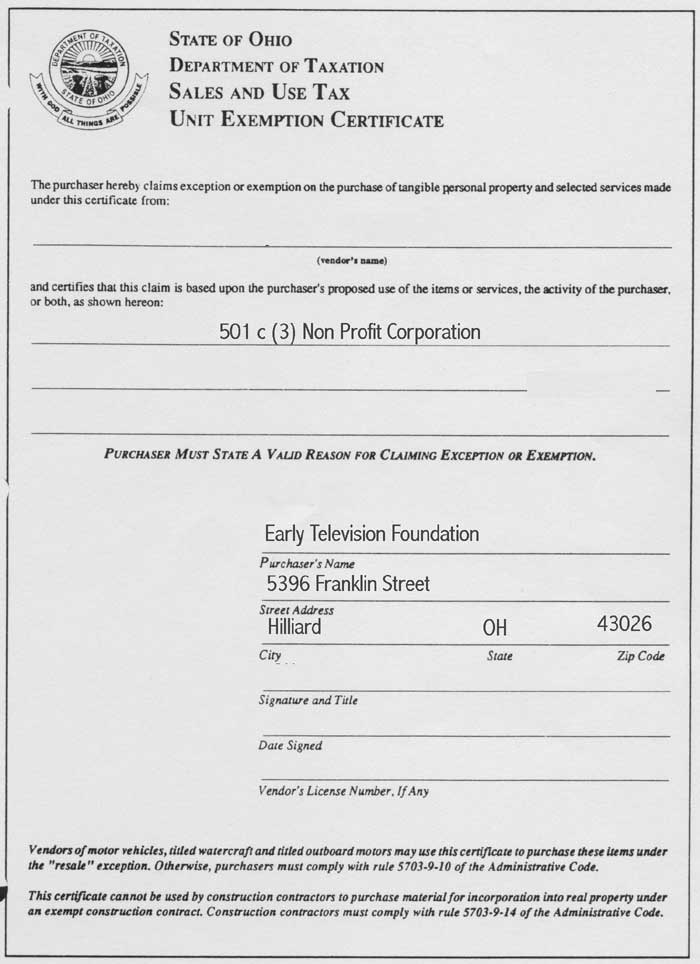

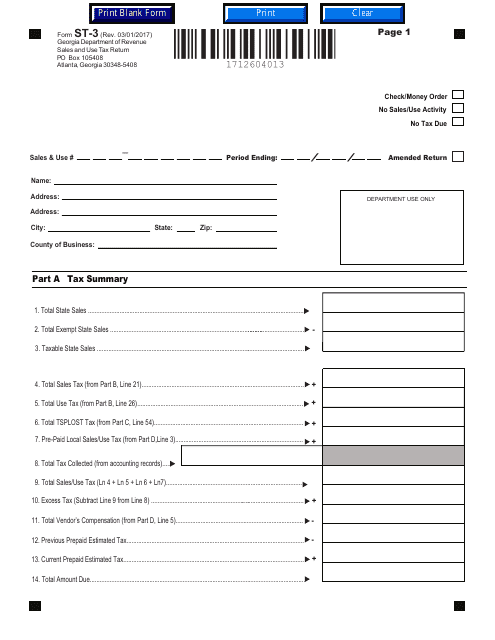

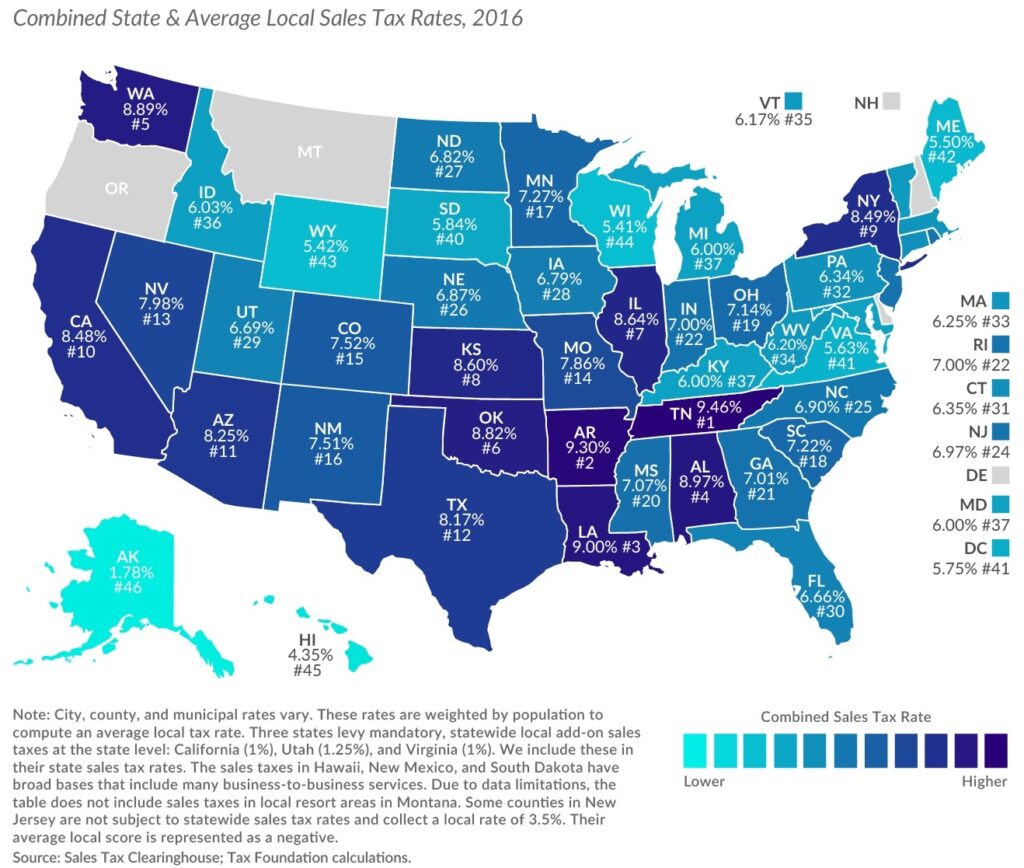

Filing and remittance requirements this is a link to rule 560 12 1 22 on the georgia secretary of states website sales tax id verification tool. A sales and use tax number is not required for this exemption. While georgias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

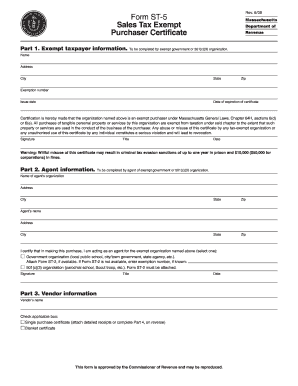

Sales of tangible personal property and services made to the university system of georgia and its educational units the american red cross a community service board located in this state georgia department of community affairs regional commissions or. Supplier date suppliers address city state zip code the undersigned does hereby certify that all tangible. 52014 state of georgia department of revenue sales and use tax certificate of exemption manufacturers to.

Sales tax instructional documents. These sales tax exemptions are defined in ocga. Energy that is necessary and integral to the manufacture of tangible personal property at a manufacturing plant in this state.

Manufacturing machinery and equipment industrial materials and packaging supplies 1 purpose. Sales use taxes fees excise taxes save citizenship verification local government central assessment digest compliance. This page describes the taxability of manufacturing and machinery in georgia including machinery raw materials and utilities fuel.

50 exempt january 1 2014 to december 31. This rule explains the sales and use tax exemptions in ocga 48 8 32 for machinery and equipment necessary and integral to the manufacture of tangible personal property in a manufacturing plant for. Tips for completing the sales and use tax return on gtc.

Sales use tax import return. There are several sales and use tax exemptions specific to the manufacturing industry for those entities that qualify as a manufacturer. This exemption applies to state and local sales and use tax and will be phased in as follows.

Georgia imposes a tax albeit subject to certain exemptions on the retail purchase retail sale storage use or consumption of tangible personal property certain enumerated services and utilities. To learn more see a full list of taxable and tax exempt items in georgia. Georgia helps companies lower their cost of doing business by offering the ability to purchase various types of goods and services tax free.

Calculating tax on motor fuel.

/media/img/posts/2015/01/Georgia_Unemployment_Graph/original.png)