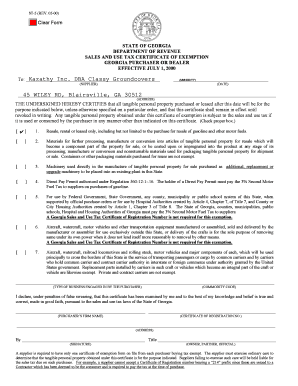

Sales Tax Exemption Certificate Georgia

These sales tax exemptions are defined in ocga.

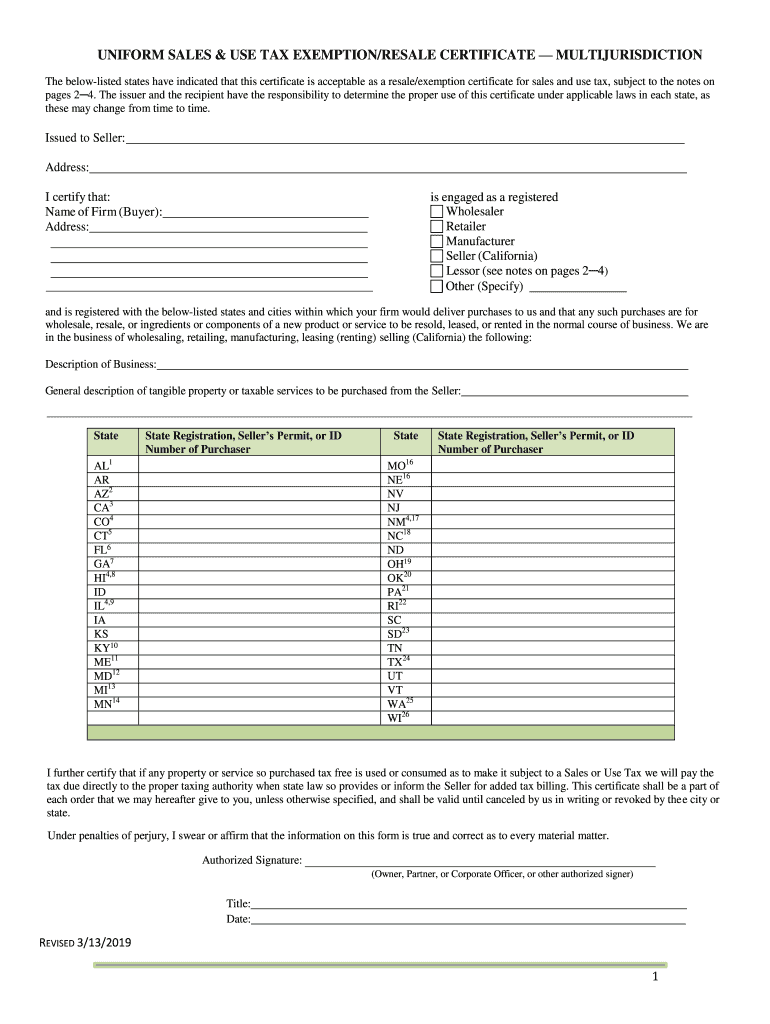

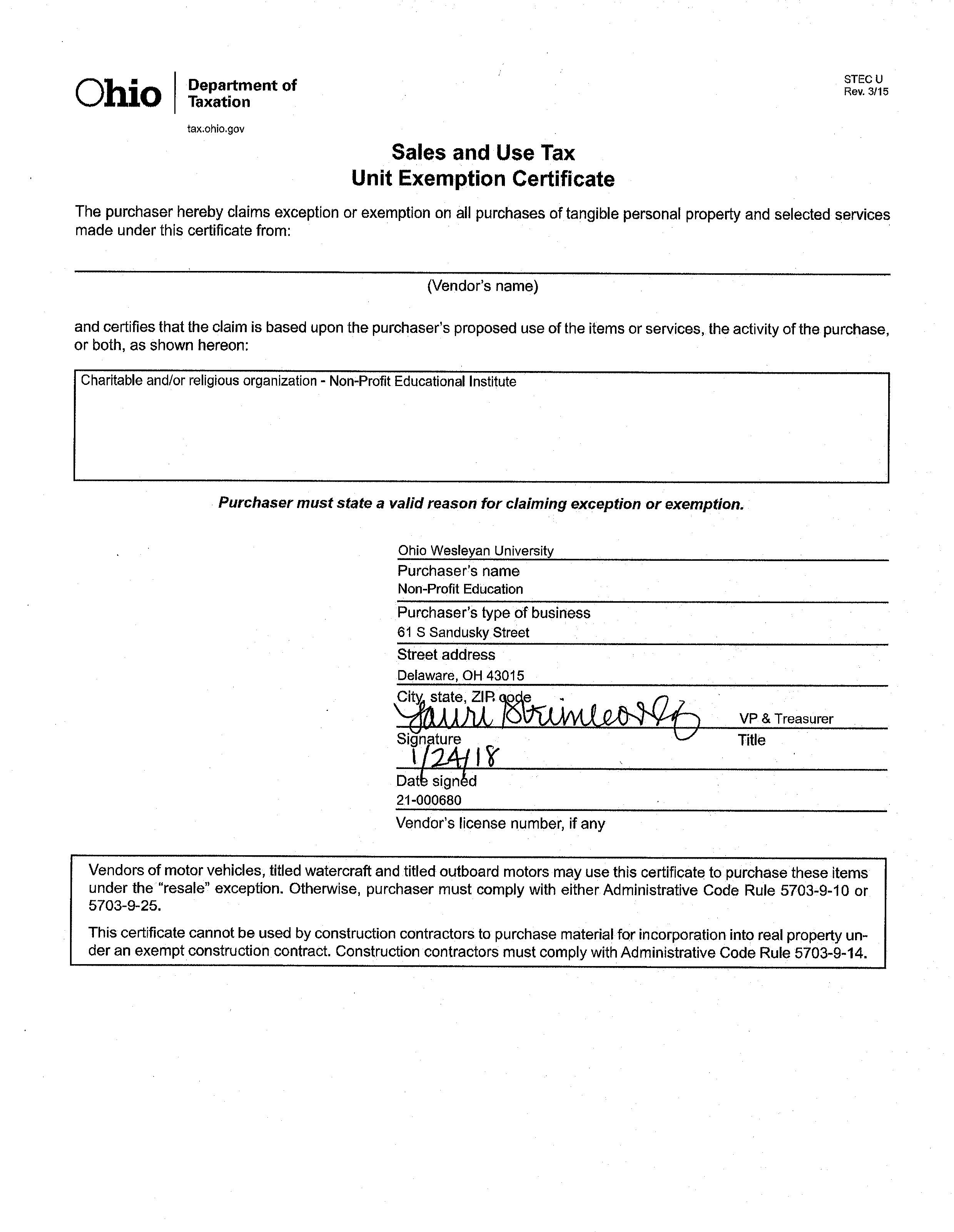

Sales tax exemption certificate georgia. A seller takes a certificate in good faith when he takes a certificate that is. In general a seller should only accept a certificate of exemption when the certificate is. The issuer and the recipient have the responsibility to determine the proper use of this certificate under applicable laws in each state as.

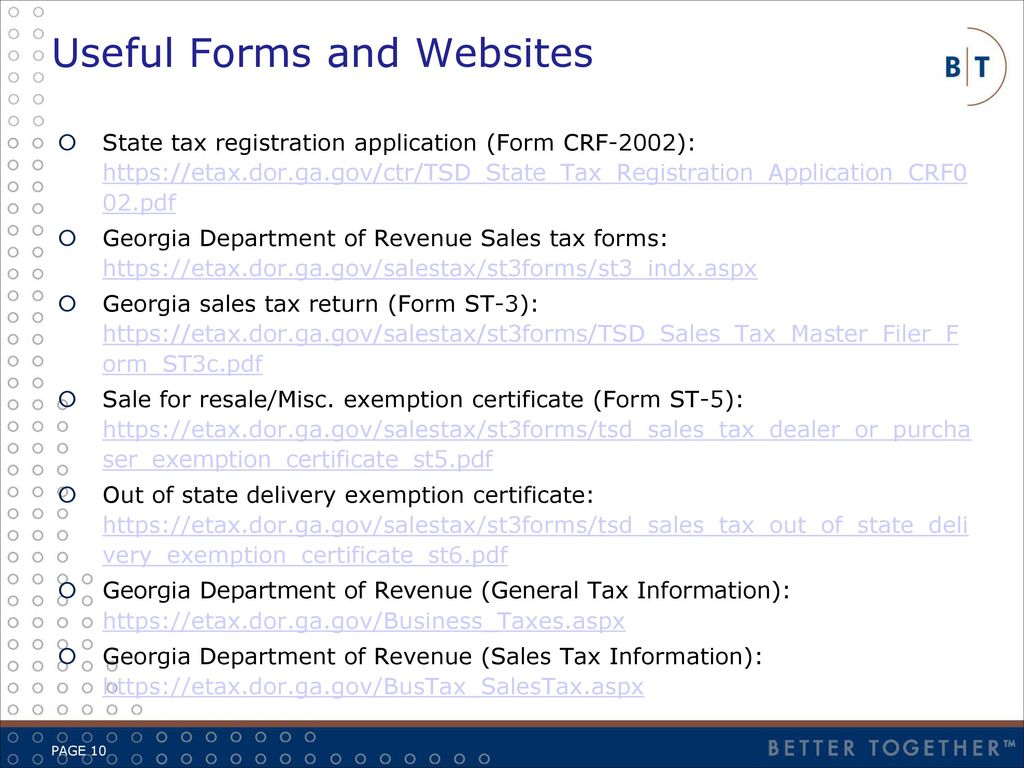

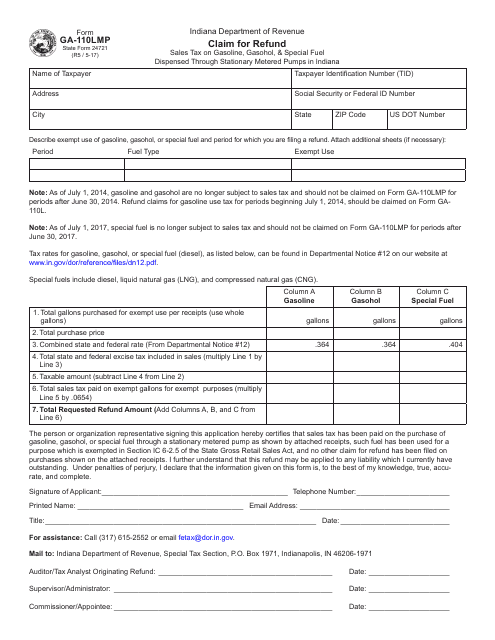

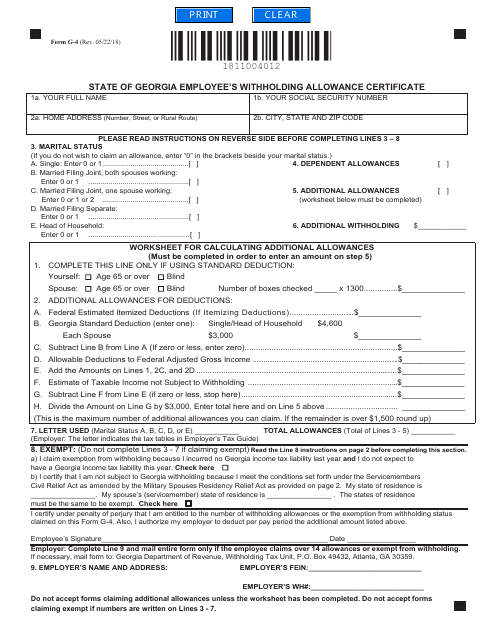

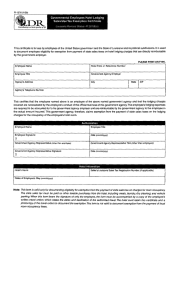

How to fill out the georgia sales tax certificate of exemption form st 5. Sales use taxes fees excise taxes save citizenship verification local government central assessment. Filling out the st 5 is pretty straightforward but is critical for the seller to gather all the information.

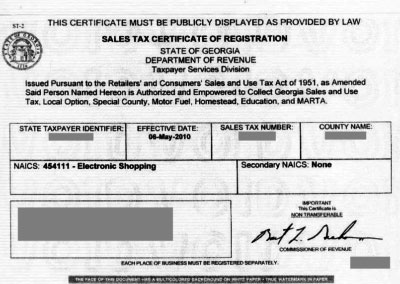

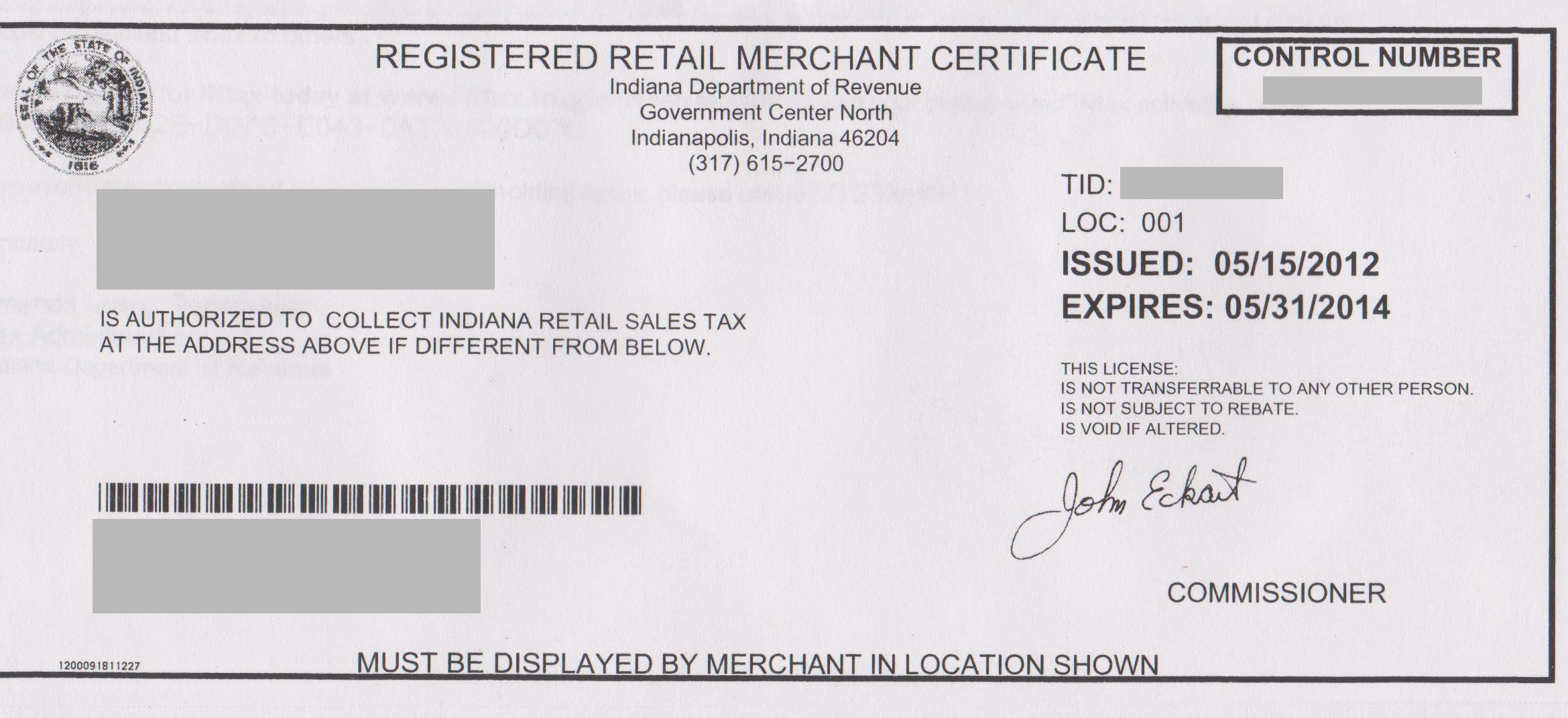

A sales and use tax number is not required for this exemption. Sales and use tax registration does not require renewal and remains in effect as long as the. 48 8 3 and several key exemptions are outlined in the table below.

Georgia is a member of the streamlined sales and use tax agreement an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states. Because georgia is a member of this agreement buyers can use the multistate tax commission mtc uniform sales tax certificate when making qualifying sales tax exempt purchases from vendors in georgia. 48 8 2 must register for a sales and use tax number and certificate of registration regardless of whether all sales will be online out of state wholesale or exempt from tax.

Any individual or entity meeting the definition of dealer in ocga. St 5 sales tax certificate of exemption 18086 kb department of revenue. All sales are subject to sales tax until the contrary is established.

St 5 certificate of exemption. The burden of proof that a sale is not subject to tax is upon the person who makes the sale unless the seller in good faith takes from the purchaser a valid certificate of exemption. Georgia tax center help individual income taxes register new business.

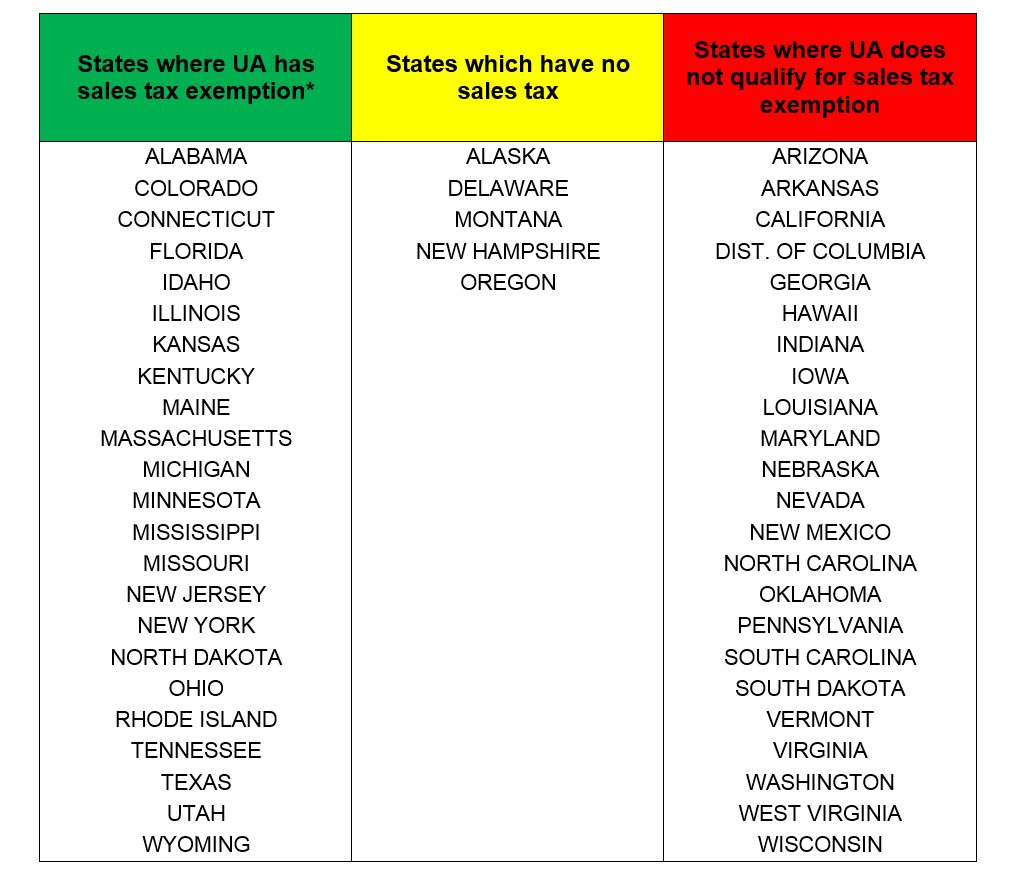

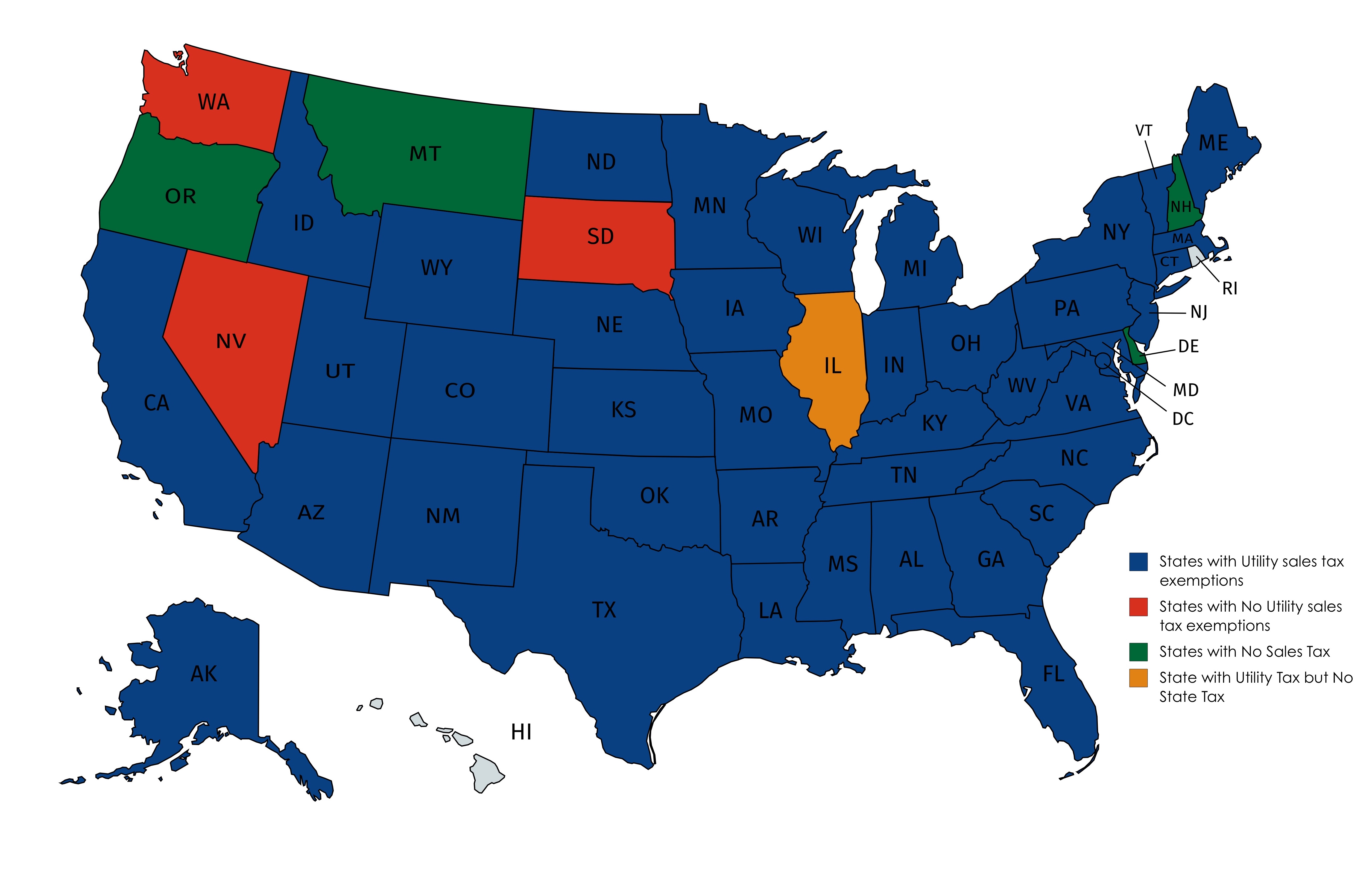

The below listed states have indicated that this certificate is acceptable as a resaleexemption certificate for sales and use tax subject to the notes on pages 24. The georgia department of revenue created a sales tax certificate of exemption to make things easier for documenting tax free transactions. Qualified farmers and agricultural producers can apply to receive a certificate showing that they are eligible for this exemption.

The georgia agriculture tax exemption gate is a program created through legislation which offers qualified agriculture producers a sales tax exemption on agricultural equipment and production inputs. Under penalties of perjury i declare that i have examined this certificate and to the best of my knowledge and belief this certificate is true. The burden of proof that a sale is not subject to the tax is on the person who makes the sale unless he in good faith takes from the purchaser a valid certificate of exemption.

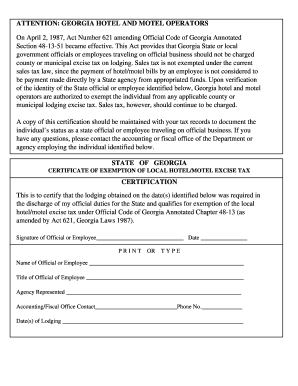

Http Www Troup K12 Ga Us Userfiles 946 My 20files Hotel 20excise 20tax 20exempt 20form 20 2 Pdf Id 1106