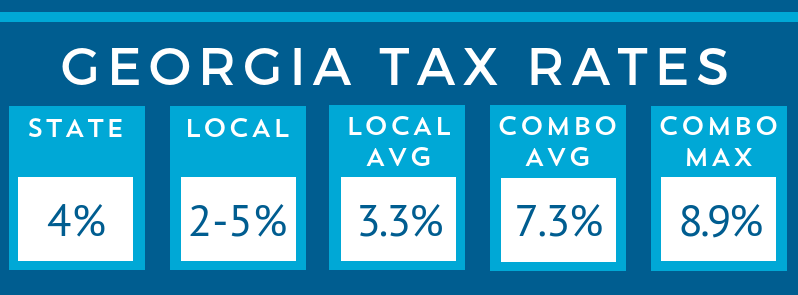

Georgia Sales Tax Exemption Verification

Georgia tax center help individual income taxes register new business.

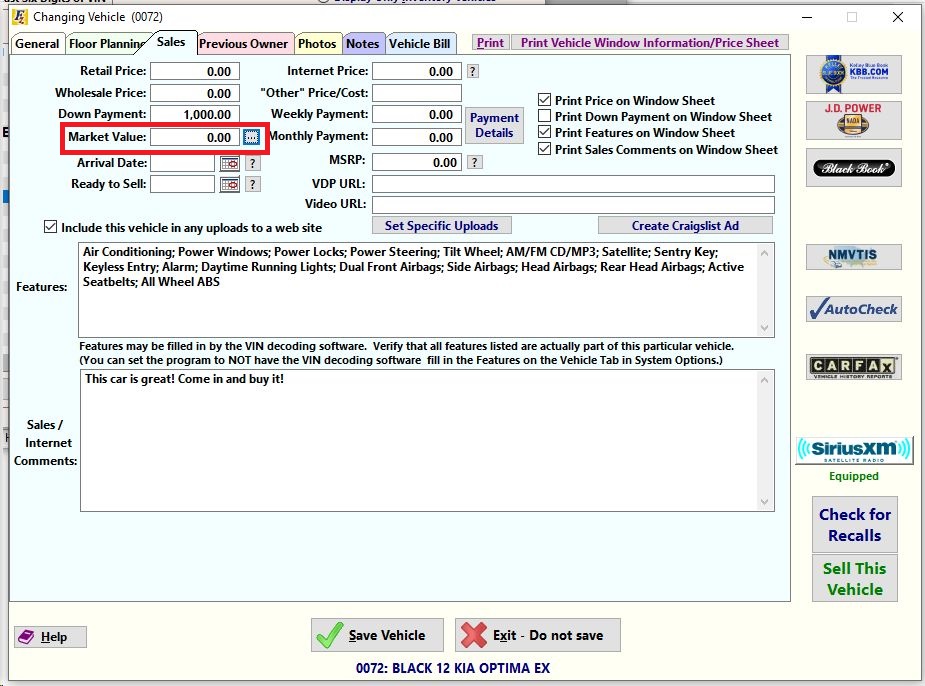

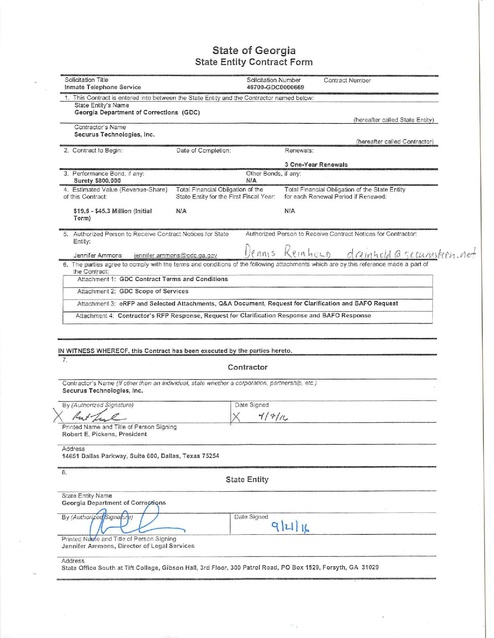

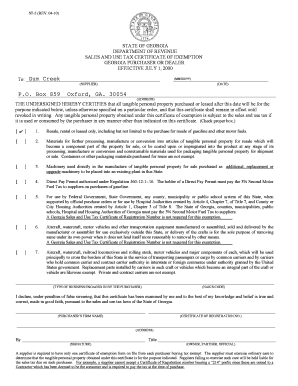

Georgia sales tax exemption verification. These sales tax exemptions are defined in ocga. Use either the resellers permit id number or streamlined sales tax number. Georgia helps companies lower their cost of doing business by offering the ability to purchase various types of goods and services tax free.

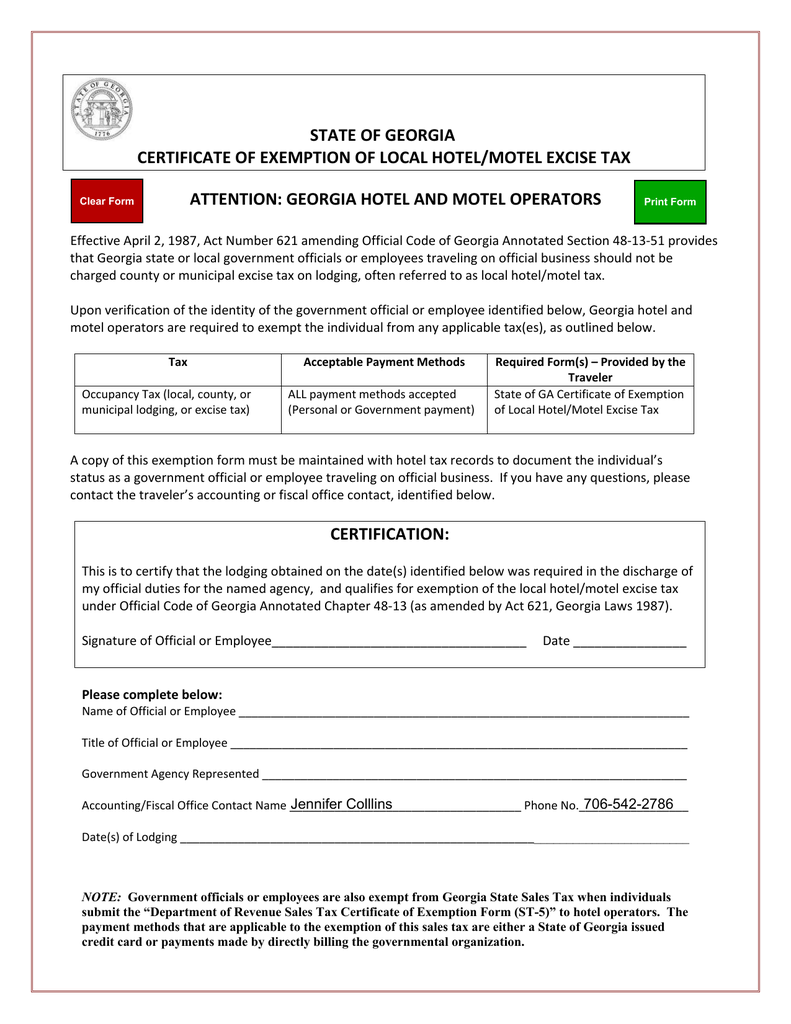

A sales and use tax number is not required for this exemption. In general a seller should only accept a certificate of exemption when the certificate is. 48 8 3 and several key exemptions are outlined in the table below.

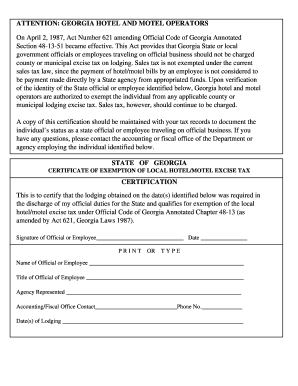

Sales use taxes fees excise taxes save citizenship verification local government central assessment digest compliance. Do certificates of exemption or letters of authorization expire. Tax exempt organization search.

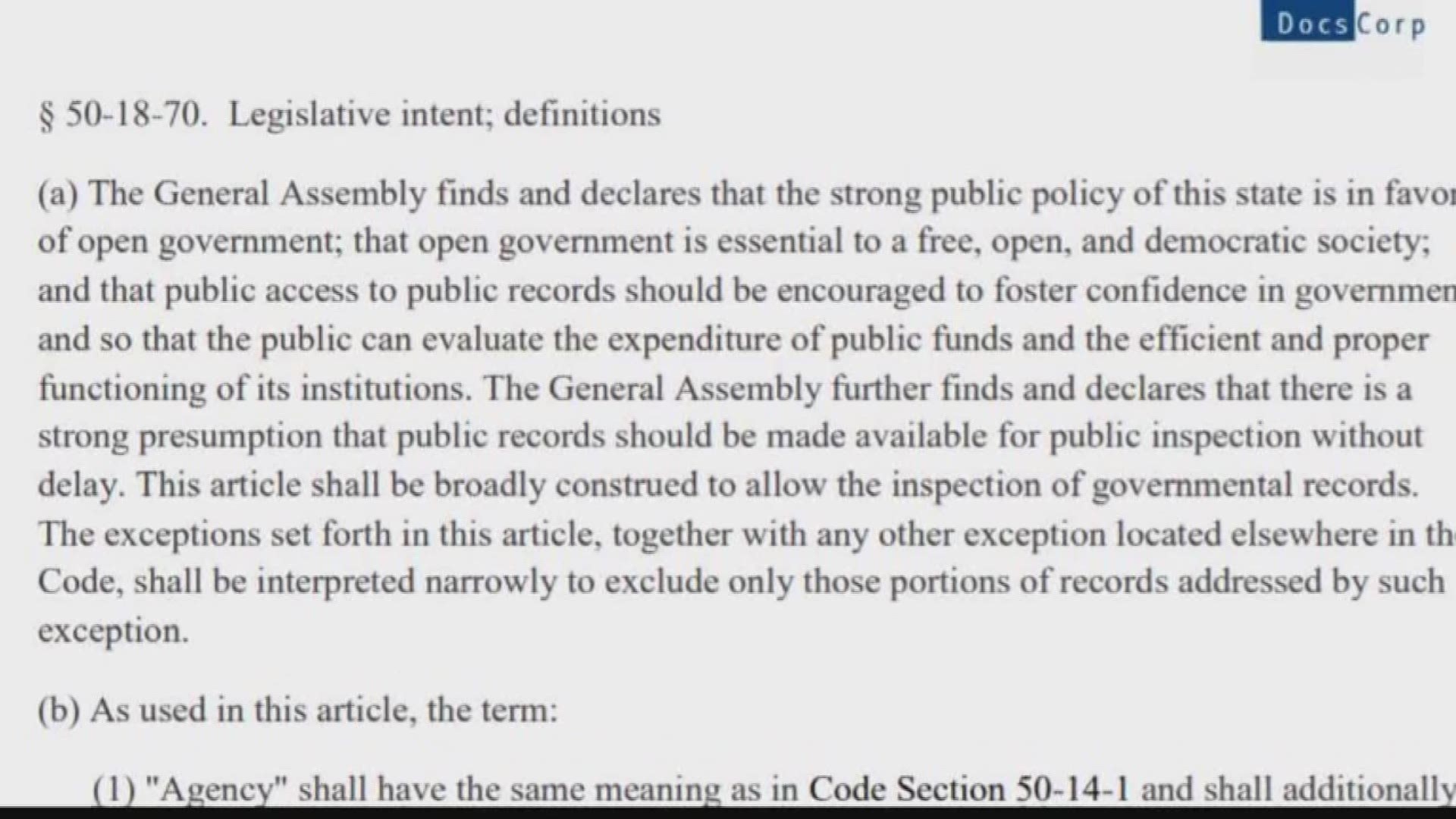

Sales and use tax faq. The gov means its official. Local state and federal government websites often end in gov.

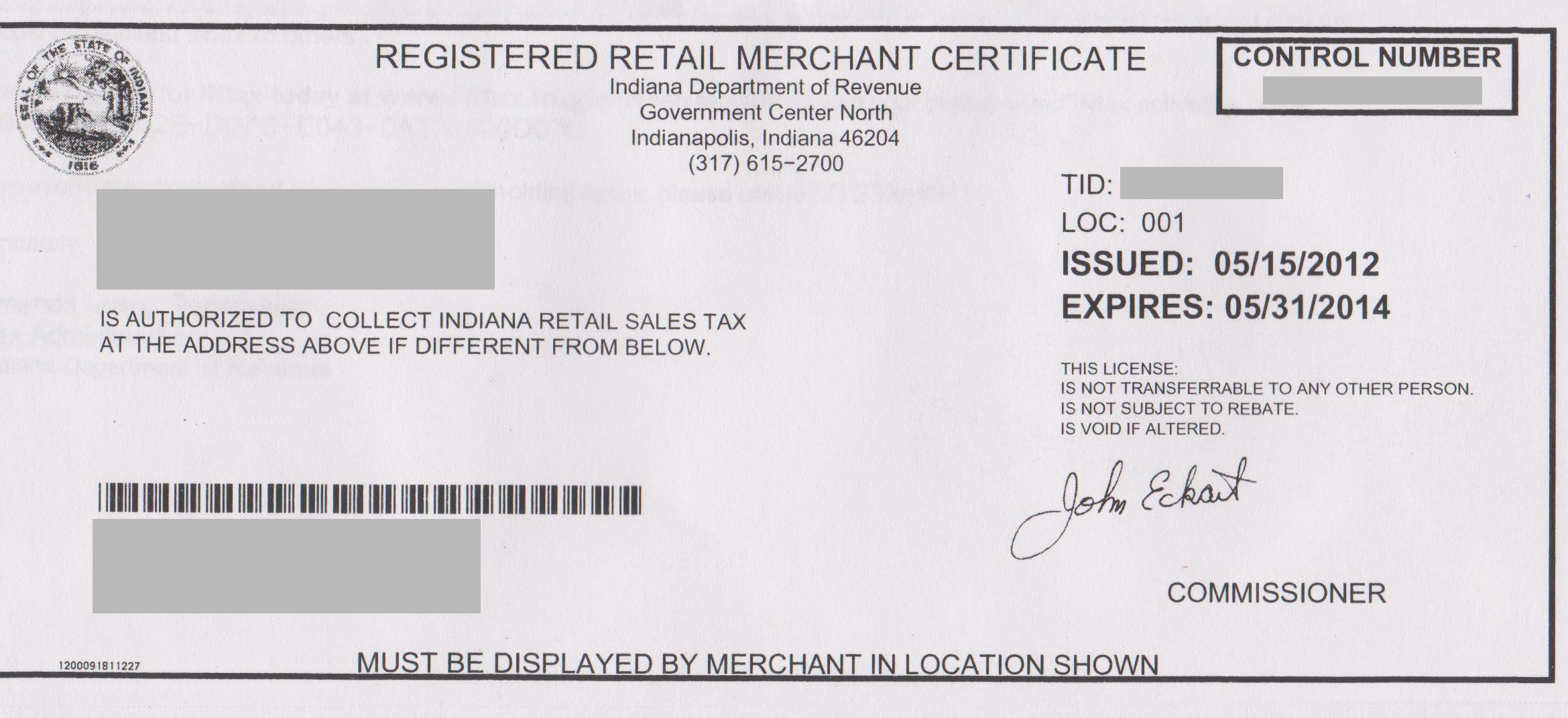

State of georgia government websites and email systems use georgiagov or gagov at the end of the address. Sales use tax import return filing and remittance requirements this is a link to rule 560 12 1 22 on the georgia secretary of states website sales tax id verification tool. Colorado click verify a license or certificate enter the 7 8 11 or 12 digit.

The burden of proof that a sale is not subject to tax is upon the person who makes the sale unless the seller in good faith takes from the purchaser a valid certificate of exemption. California click verify a permit license or account now read here for more on california resale certificates. Sellers may verify a sales tax number by using the sales tax id verification tool.

These organizations are required to pay the tax on all purchases of tangible personal property. Form 990 n e postcard is an annual electronic notice most small tax exempt organizations annual gross receipts normally 50000 or less are eligible to file instead of form 990 or form 990 ez. Sales use tax purchases and sales in general georgia statute grants no sales or use tax exemption to churches religious charitable civic and other nonprofit organizations.

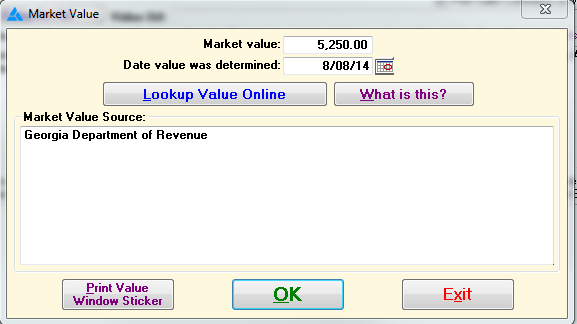

Most certificates of exemption and letters of authorization do not expire with the exception of the georgia agricultural tax exemption gate certificate which expires on an annual basis. Users may also download a complete list data posting date. Sales of tangible personal property and services made to the university system of georgia and its educational units the american red cross a community service board located in this state georgia department of community affairs regional commissions or.

Arkansas click inquiries validate sales tax permit. All sales are subject to sales tax until the contrary is established.

.png?width=800&name=Sales%20Tax%20Blog%20Images%20(1).png)

.png?width=800&name=Sales%20Tax%20Blog%20Images%20(3).png)