Georgia Sales Tax Exemption Rules

Sellers may verify a sales tax number by using the sales tax id verification tool.

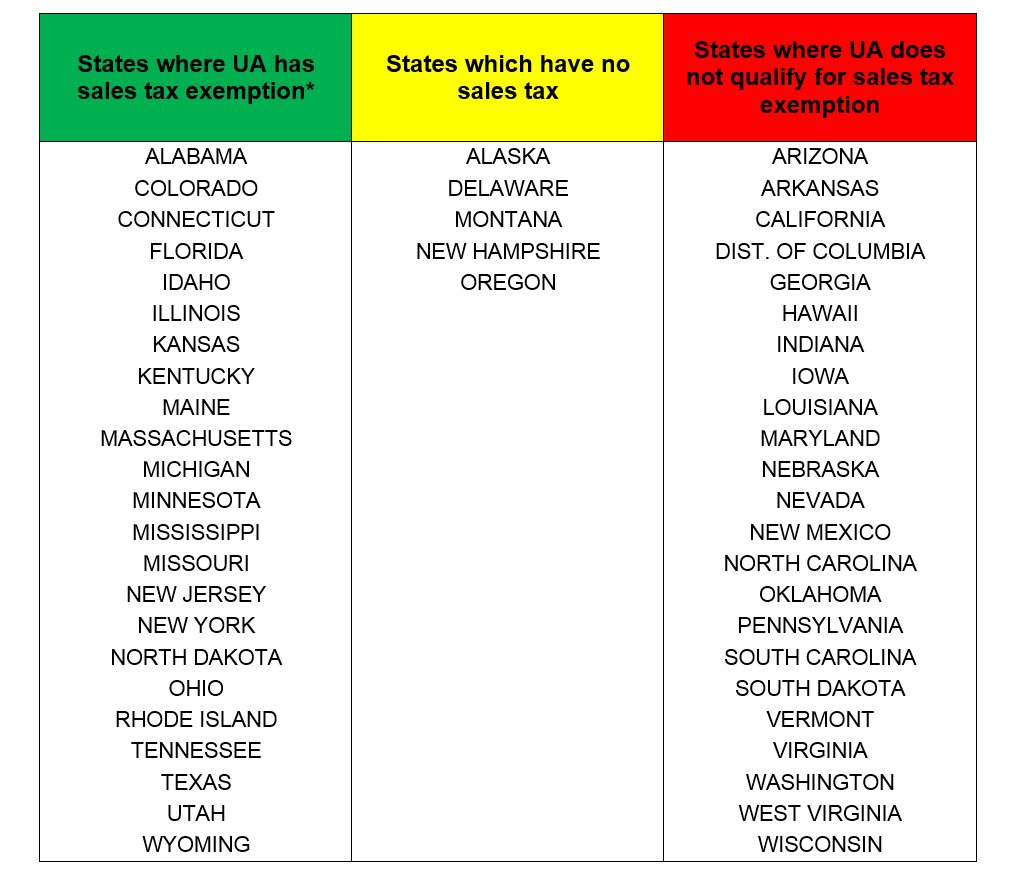

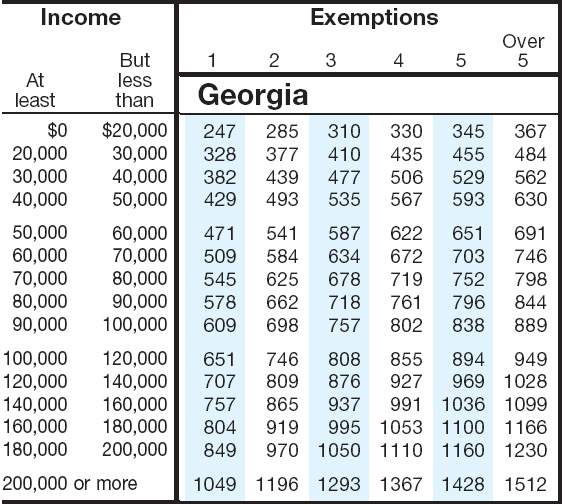

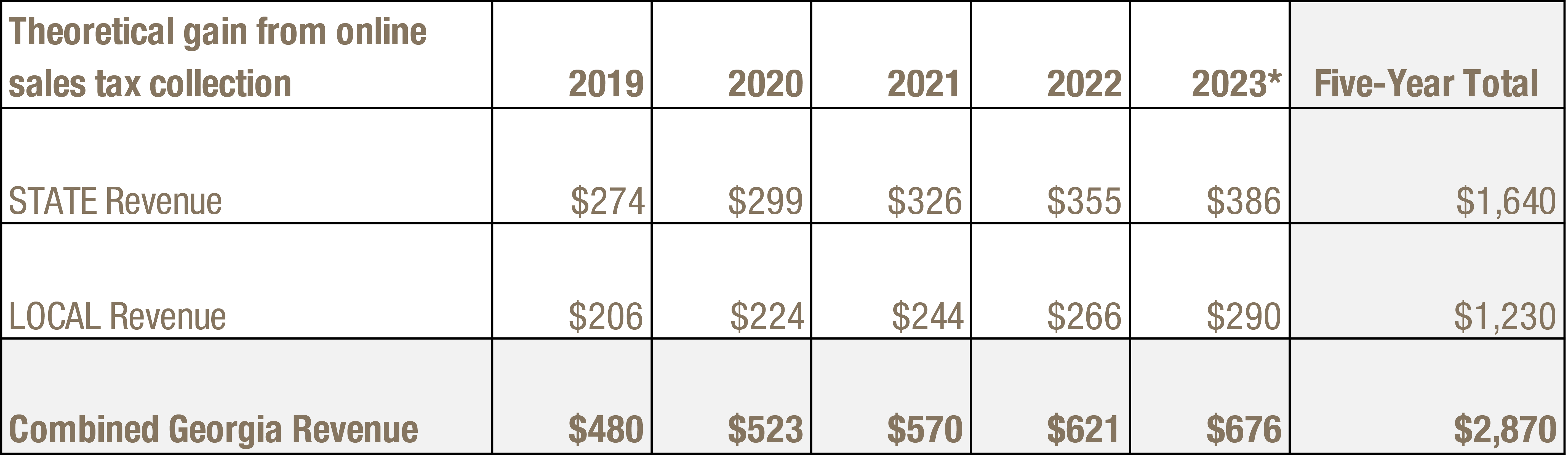

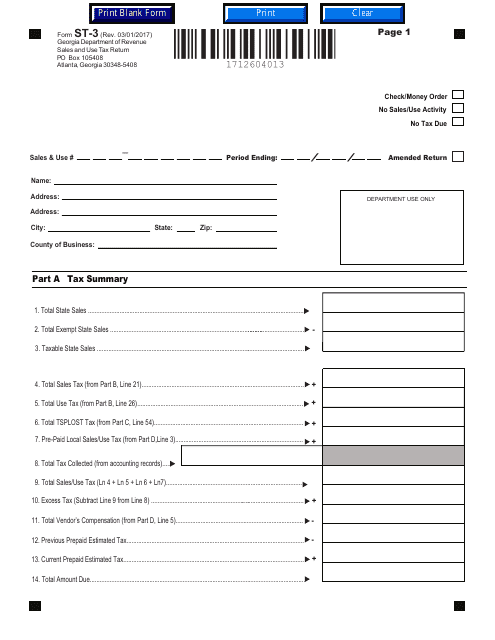

Georgia sales tax exemption rules. Tips for completing the sales and use tax return on gtc sales use tax import return filing and remittance requirements this is a link to rule 560 12 1 22 on the georgia secretary of states website. In georgia certain items may be exempt from the sales tax to all consumers not just tax exempt purchasers. The maximum local tax rate allowed by georgia law is 4.

While the georgia sales tax of 4 applies to most transactions there are certain items that may be exempt from taxation. St 5 sales tax certificate of exemption 18086 kb department of revenue. Georgia tax center help individual income taxes.

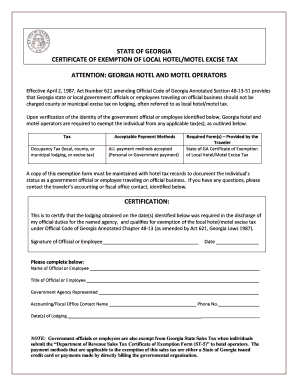

Official regulations sales and use tax regulations fees excise taxes other. These organizations are required to pay the tax on all purchases of tangible personal property. Several exemptions in the state are certain types of groceries some.

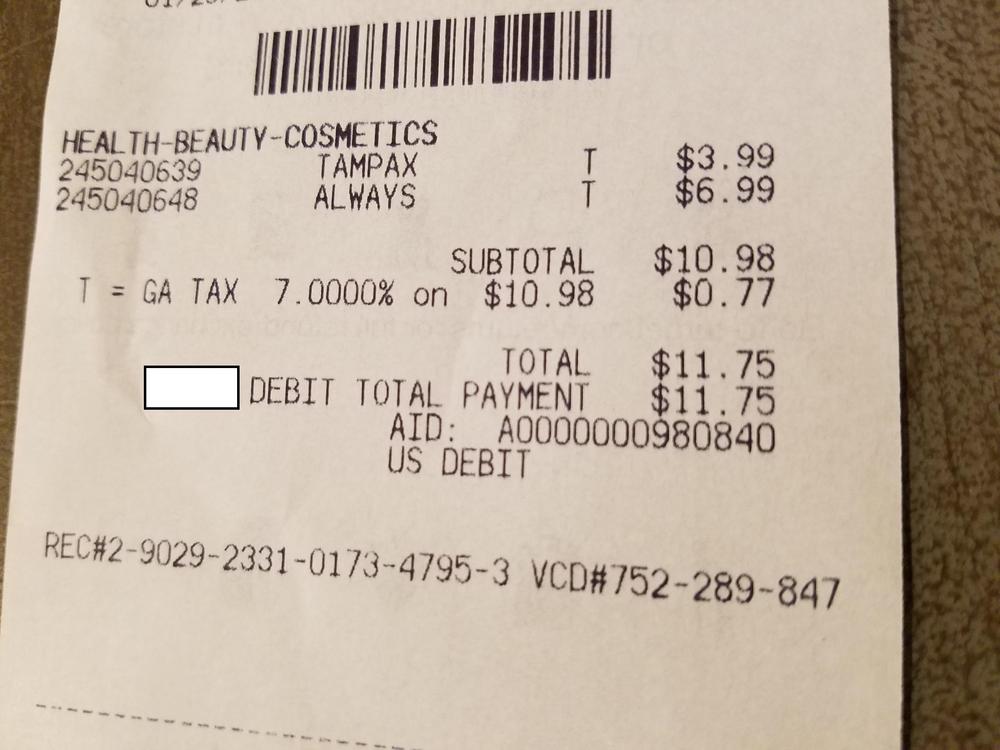

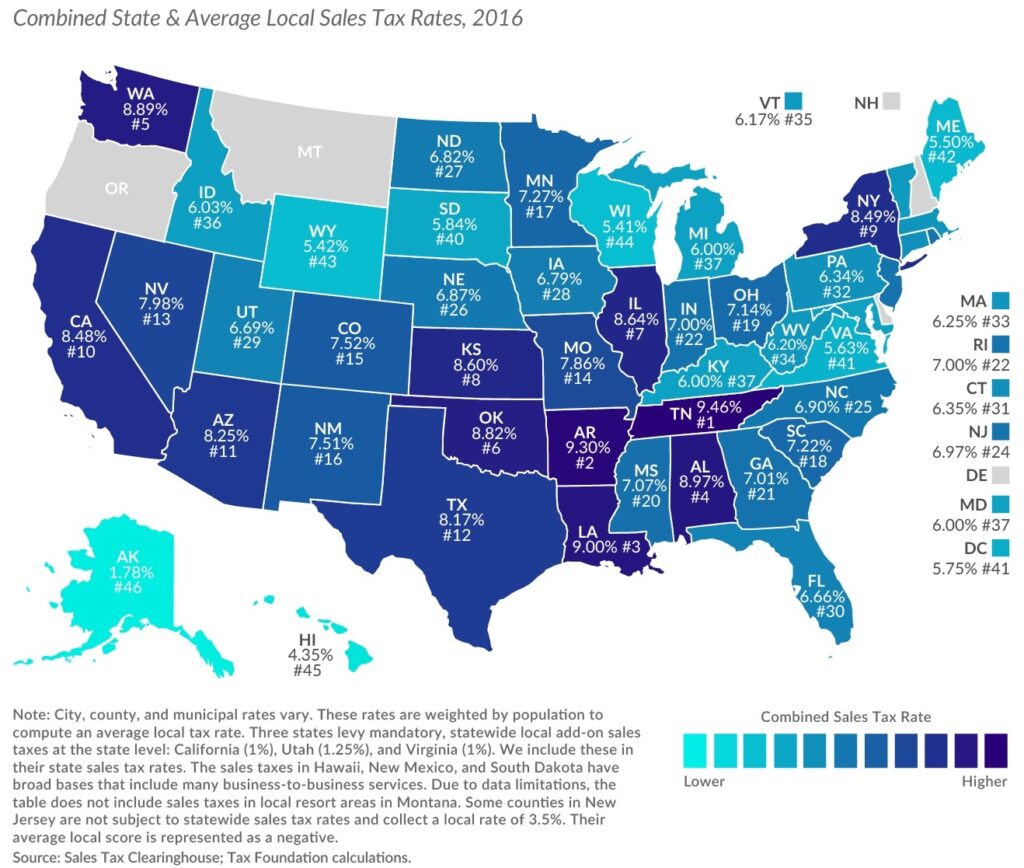

Municipal governments in georgia are also allowed to collect a local option sales tax that ranges from 2 to 49 across the state with an average local tax of 3491 for a total of 7491 when combined with the state sales tax. The sale use consumption or storage of materials containers labels sacks or bags used for packaging tangible personal property for shipment or sale. Rule 560 12 2 03 agriculture exemptions.

Georgia helps companies lower their cost of doing business by offering the ability to purchase various types of goods and services tax free. Sales tax exemptions in georgia. Sales use tax purchases and sales in general georgia statute grants no sales or use tax exemption to churches religious charitable civic and other nonprofit organizations.

Rules policies administration alcohol tobacco income tax local government motor fuel motor vehicle recording transfer taxes. Georgia has a statewide sales tax rate of 4 which has been in place since 1951. Georgia tax center help individual income taxes register new business.

These sales tax exemptions are defined in ocga. Most certificates of exemption and letters of authorization do not expire with the exception of the georgia agricultural tax exemption gate certificate which expires on an annual basis. In general georgia imposes tax on the retail sales price of tangible personal property and certain services.

48 8 3 and several key exemptions are outlined in the table below. 37 2 61d 48 8 38 50 8 44. This page discusses various sales tax exemptions in georgia.

Qualified authorities provided with a sales tax exemption under georgia law. Do certificates of exemption or letters of authorization expire.