Georgia Sales Tax Exemption Forms

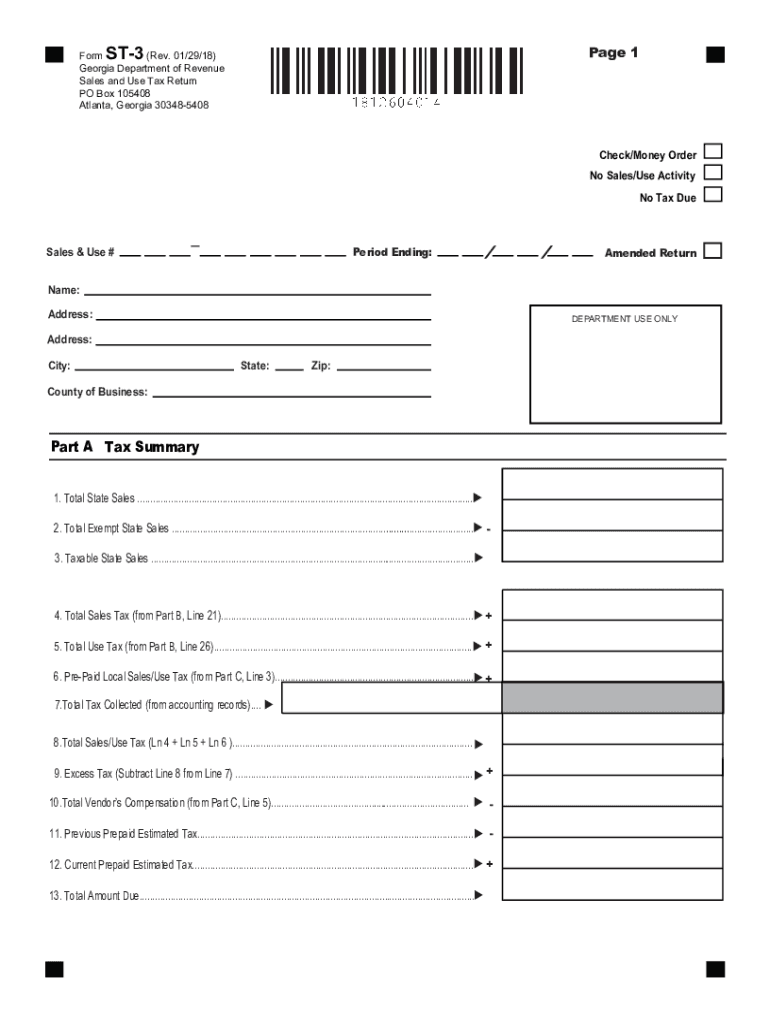

Sales use tax import return.

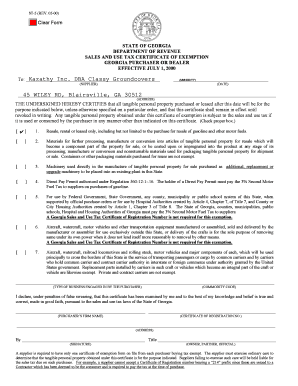

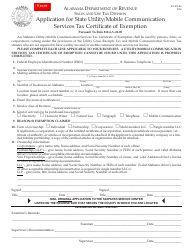

Georgia sales tax exemption forms. Gdvs personnel will assist veterans in obtaining the necessary documentation for filing. When nonprofit organizations engage in selling tangible personal property at retail they are required to comply with. Georgia trucking portal forms alcohol tobacco alcohol tobacco enforcement excise taxes online services.

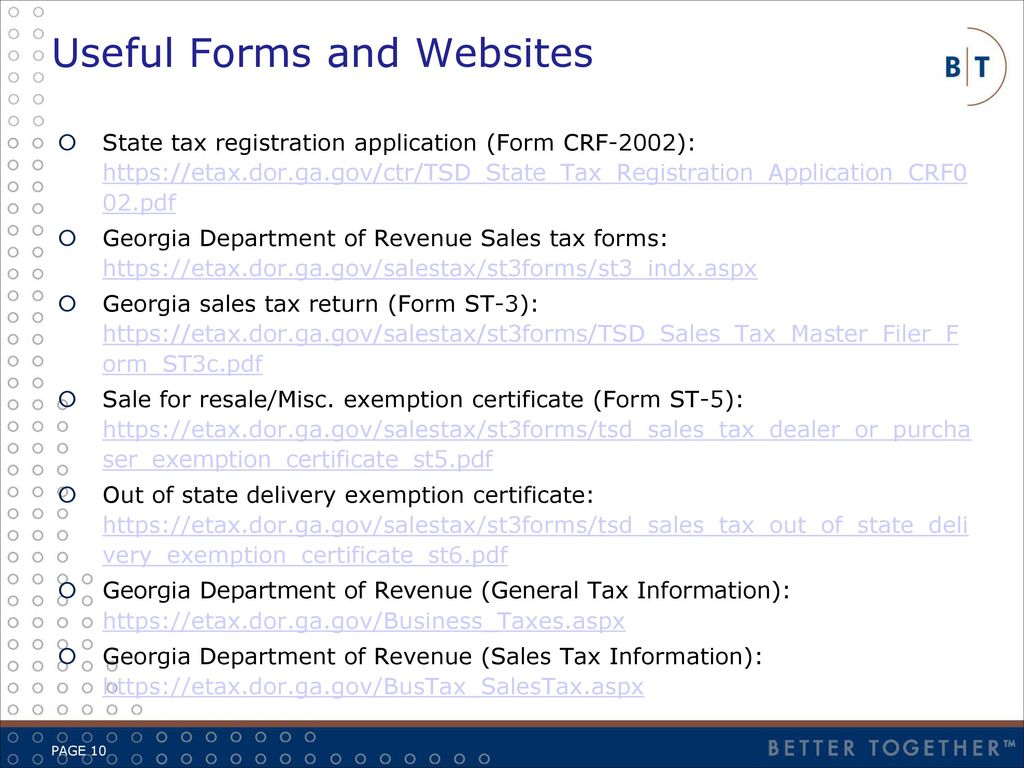

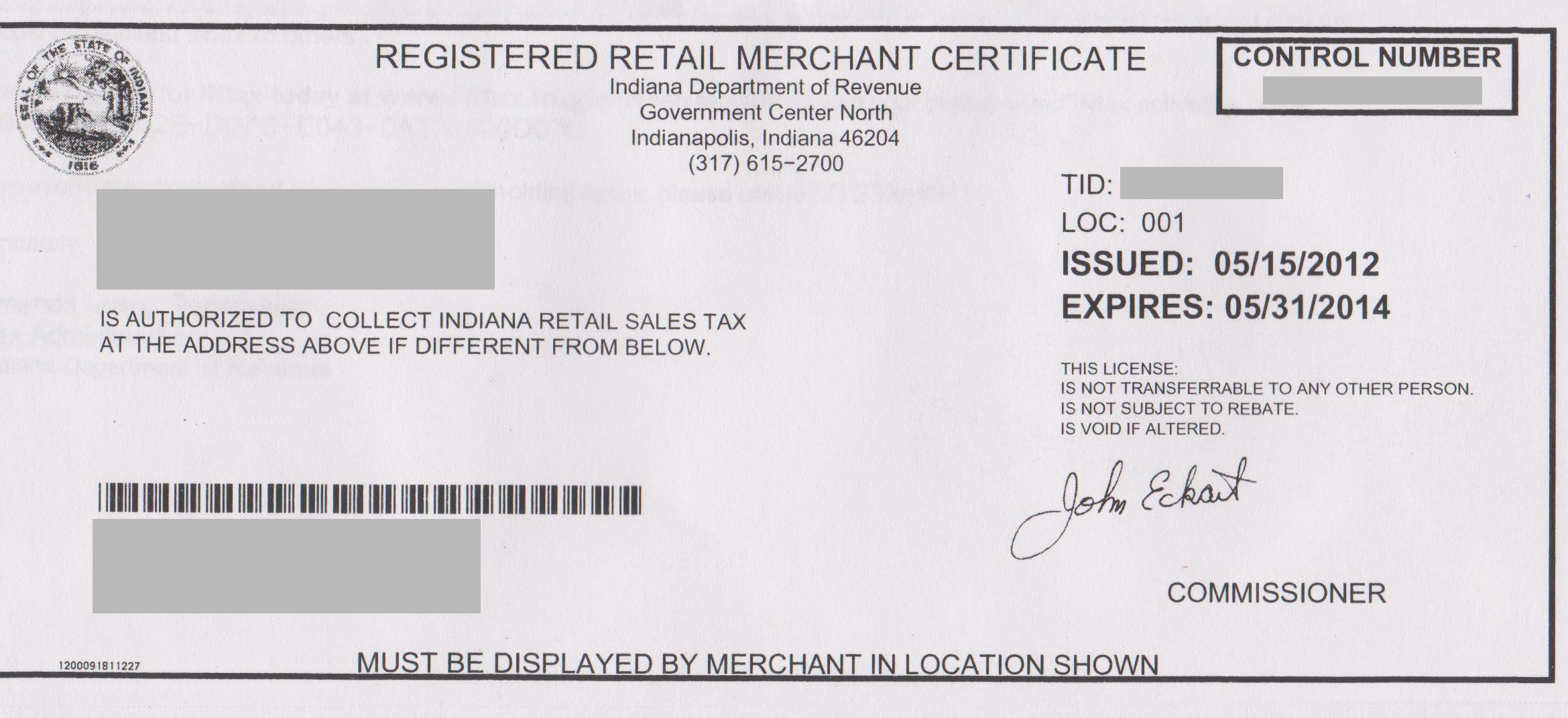

Facebook page for georgia department of revenue. St 3 sales and use tax return effective for sales april 2017 march 31 2018 41338 kb st 3 sales and use tax return effective for march 2017 sales only 41692 kb st 3 sales and use tax return for sales made before march 2017 47657 kb. The actual filing of documents is the veterans responsibility.

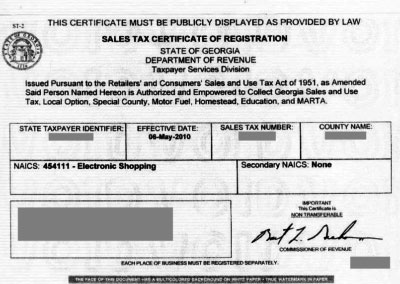

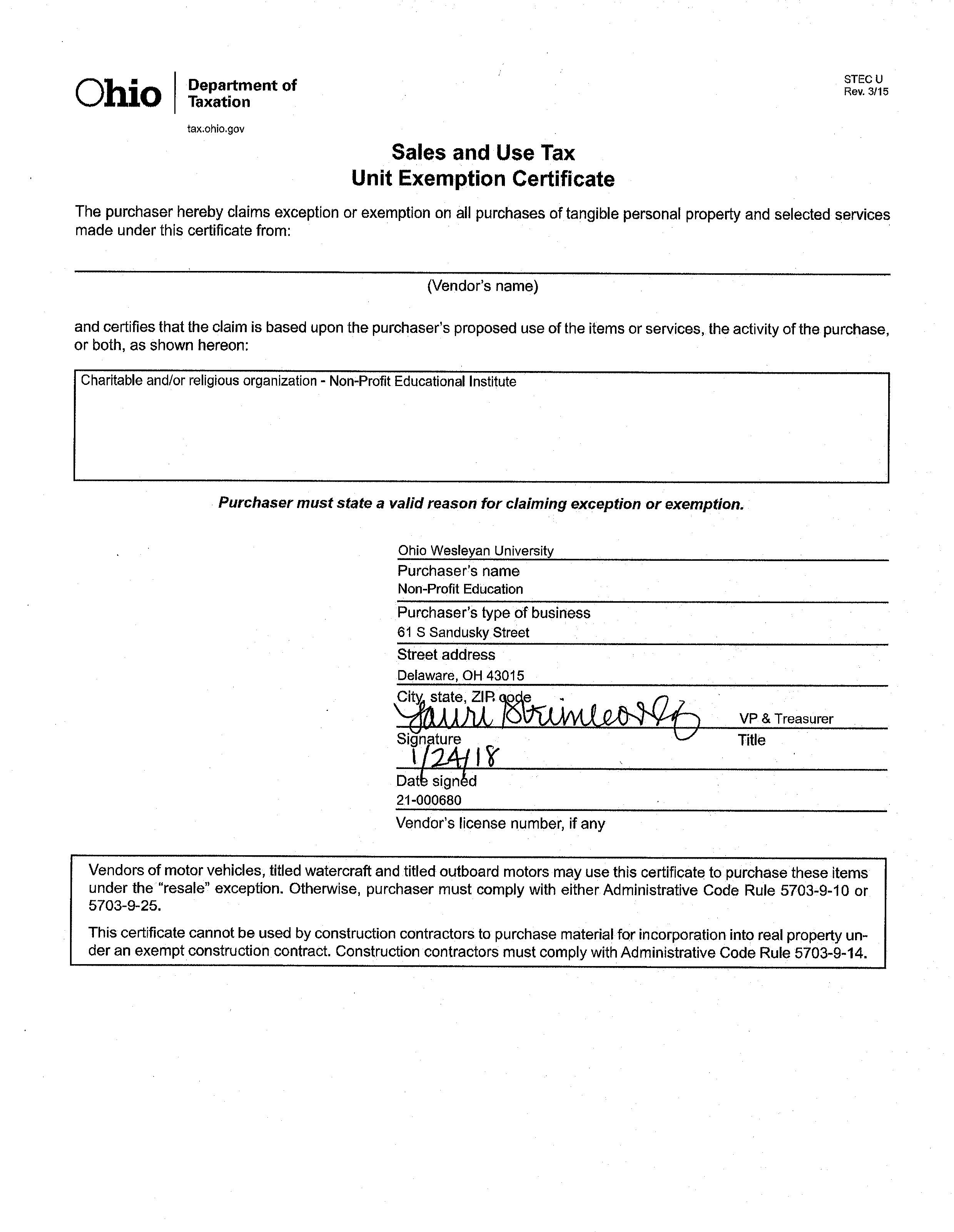

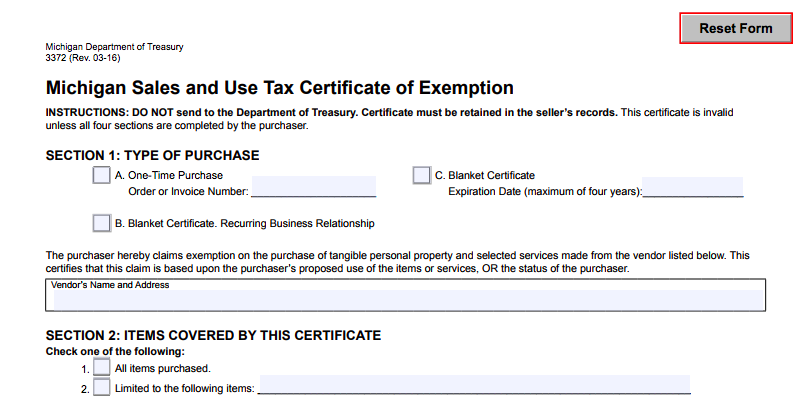

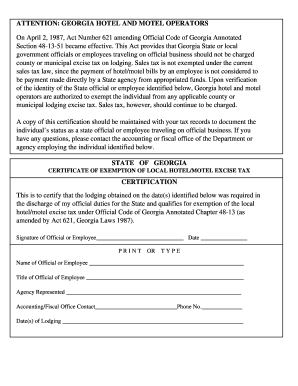

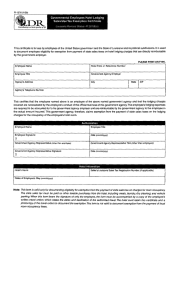

How to use sales tax exemption certificates in georgia. When you use a government purchase card such as the gsa smartpay travel card for business travel your lodging and rental car costs may be exempt from state sales tax. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales tax free purchases.

Calculating tax on motor fuel. These organizations are required to pay the tax on all purchases of tangible personal property. Sales use tax purchases and sales in general georgia statute grants no sales or use tax exemption to churches religious charitable civic and other nonprofit organizations.

Twitter page for georgia department of revenue. Sales tax instructional documents. A sales and use tax number is not required for this exemption.

These sales tax exemptions are defined in ocga. You will need to present this certificate to the vendor from whom you are making the exempt purchase it is up to the vendor to verify that you are indeed qualified to make a tax exempt purchase. United states tax exemption form.

48 8 3 and several key exemptions are outlined in the table below. Choose a link below to begin downloading. Sales of tangible personal property and services made to the university system of georgia and its educational units the american red cross a community service board located in this state georgia department of community affairs regional commissions or.

Tips for completing the sales and use tax return on gtc. Certain states require forms for cba purchase cards and cba travel cards. St 5 sales tax certificate of exemption 18086 kb department of revenue.

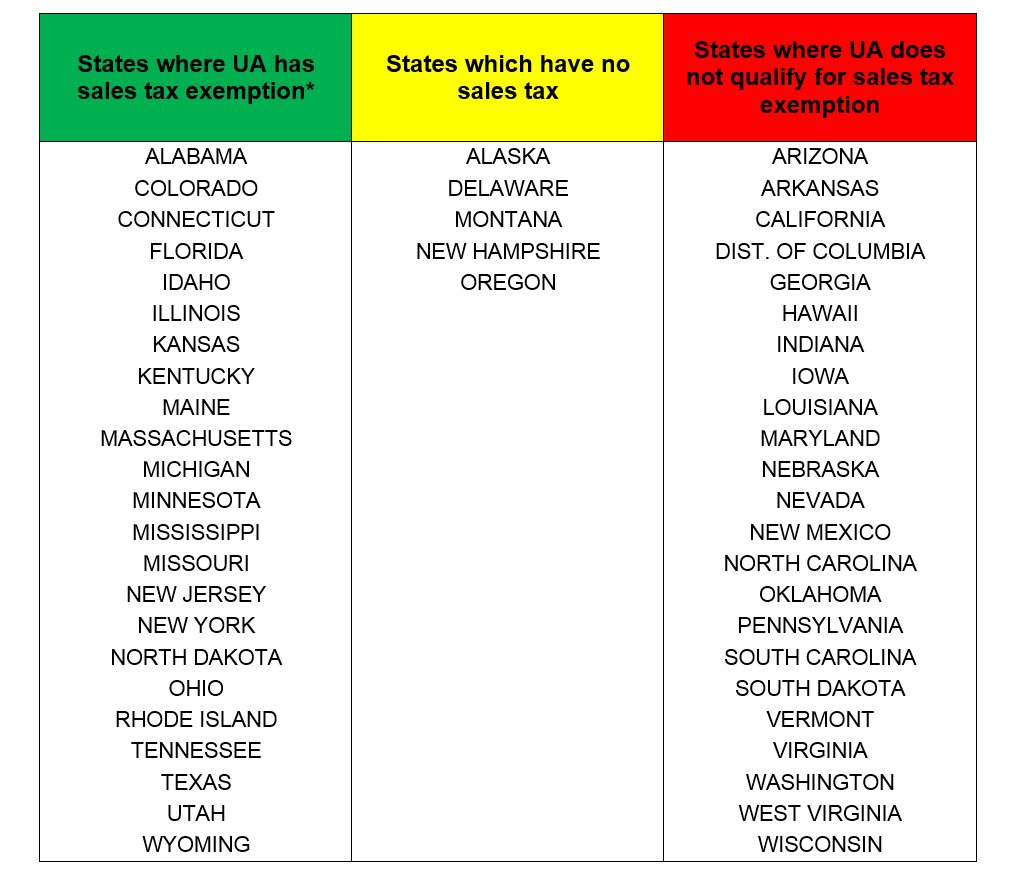

Centrally billed account cba cards are exempt from state taxes in every state. The administration of tax exemptions is as interpreted by the tax commissioners of georgias 159 counties. Gsa far 48 cfr 53229.

Form Mfd 3 Fillable Form Mfd 3 Motor Fuel Excise Tax Prepaid State Tax Exemption Certificate Rev 2 05

formupack.com

Georgia Tax Forms 2019 Printable State Ga Form 500 And Ga Form 500 Instructions

www.incometaxpro.net

Http Www Troup K12 Ga Us Userfiles 946 My 20files Hotel 20excise 20tax 20exempt 20form 20 2 Pdf Id 1106