Georgia State Income Tax

Search for income tax statutes by keyword in the official code of georgia.

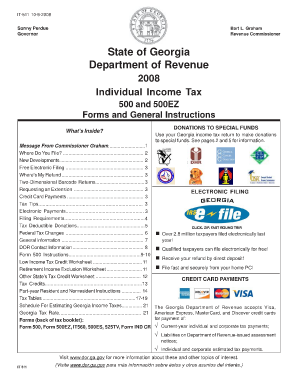

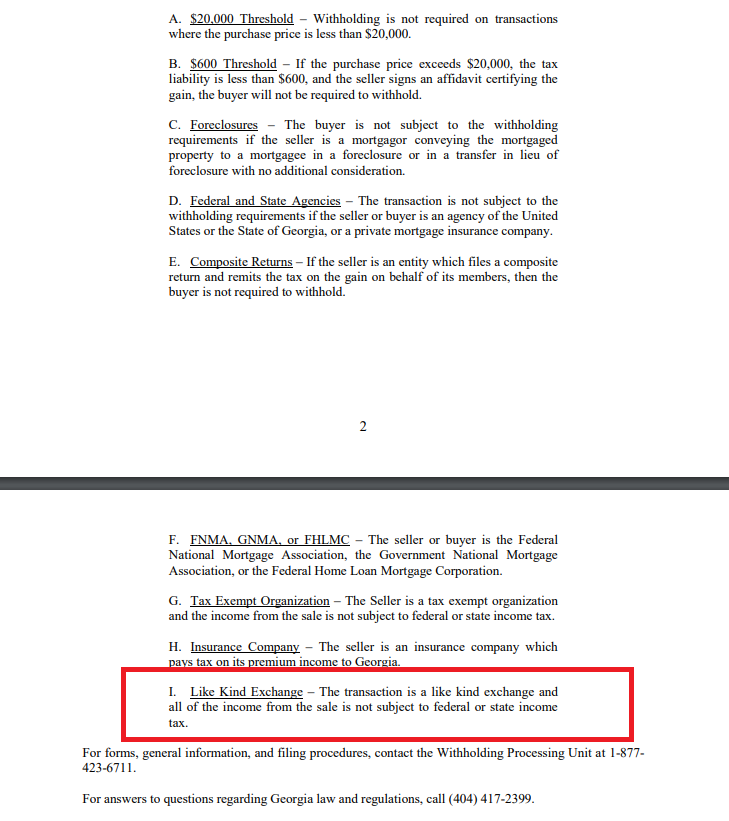

Georgia state income tax. State individual income tax rates 2000 2019 accessed march 24 2020. Local state and federal government websites often end in gov. Tax refund processing times vary and depend on the accuracy of the original return but youll get your refund more quickly if you file your return electronically.

Before sharing sensitive or personal information make sure youre on an official state website. It features the 23rd highest top rate and the 16th lowest bottom rate. Additionally taxpayers can still conduct all business with the department via online services telephone or designated secure lockbox locations.

Filing requirements for full and part year residents and military personnel. State of georgia government websites and email systems use georgiagov or gagov at the end of the address. You can check the status of your tax refund using the georgia tax center.

Filing state taxes the basics. Detailed georgia state income tax rates and brackets are available on this page. Georgia tax brackets 2019 2020.

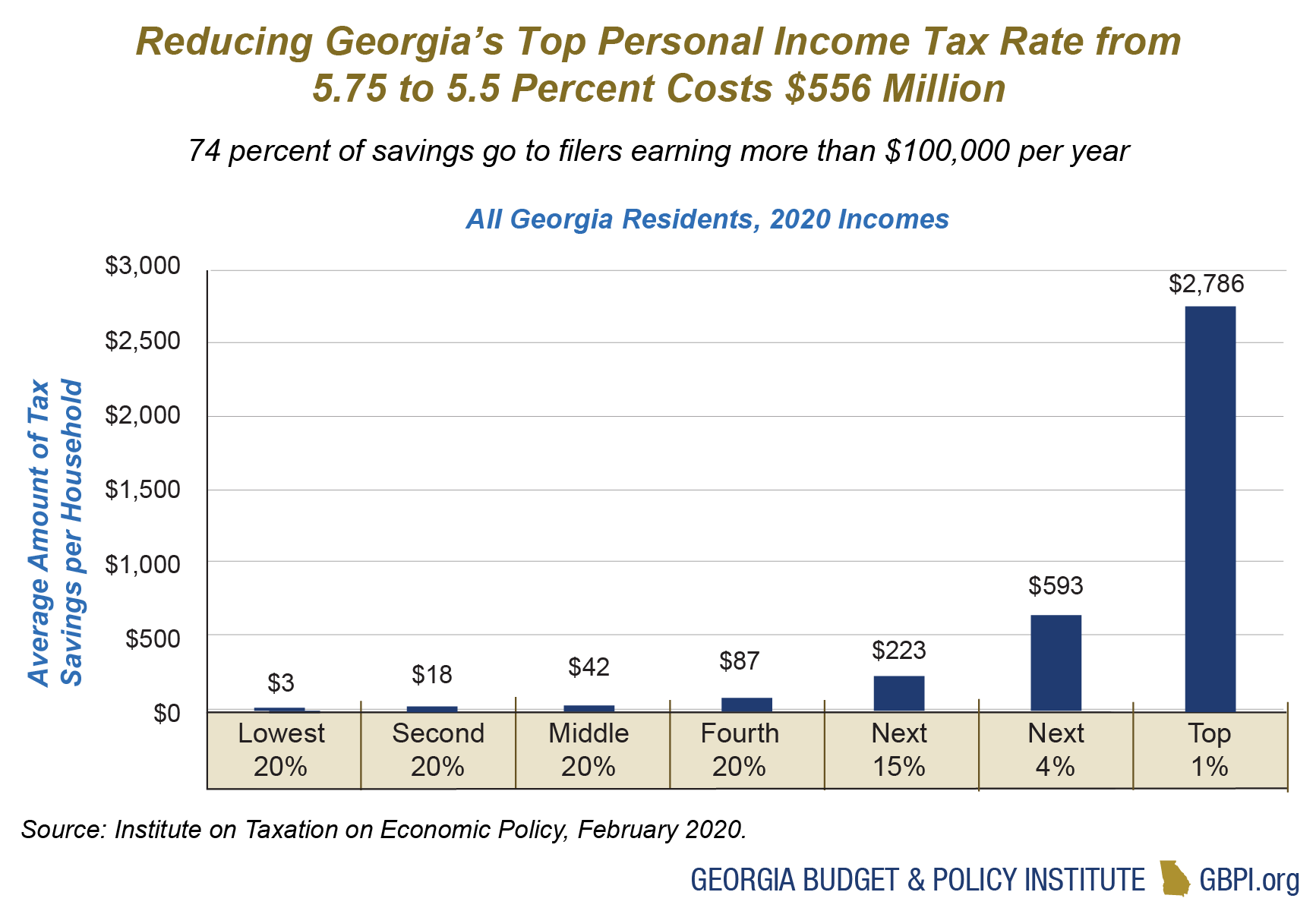

It may take up to 90 days from the date of receipt by dor to process a return and issue a refund. For individuals the 1099 g will no longer be mailed. We can also see the progressive nature of georgia state income tax rates from the lowest ga tax rate bracket of 1 to the highest ga tax rate bracket of 575.

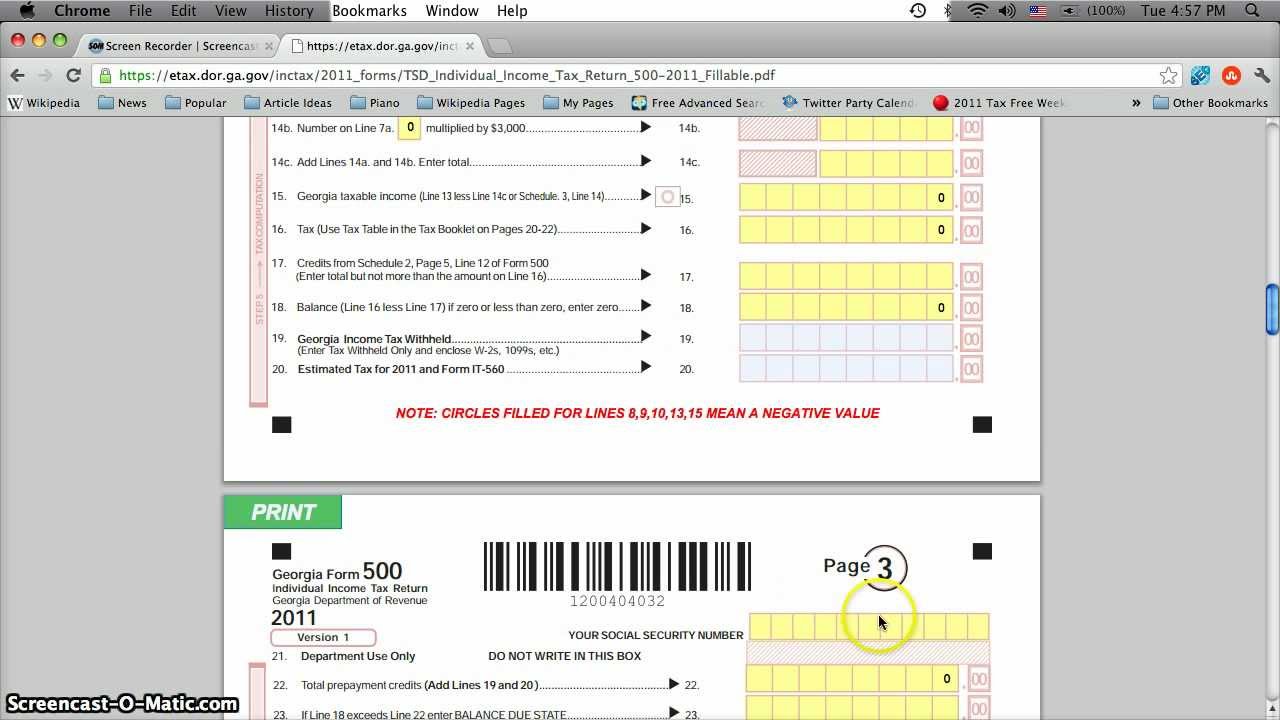

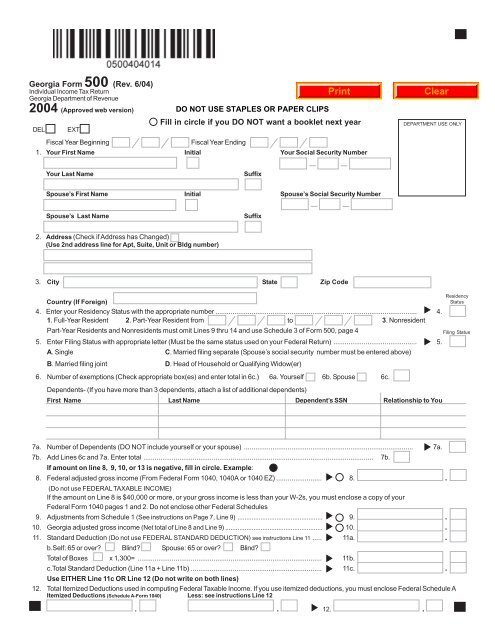

This years individual income tax forms. Accessed march 24 2020. Due to covid 19 customers will be required to schedule an appointment.

State individual income tax rates and brackets for. We will begin accepting returns january 27 2020. Taxpayers now can search for their 1099 g and 1099 int on the georgia tax center by selecting the view your form 1099 g or 1099 int link under individuals.

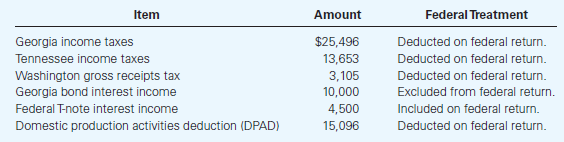

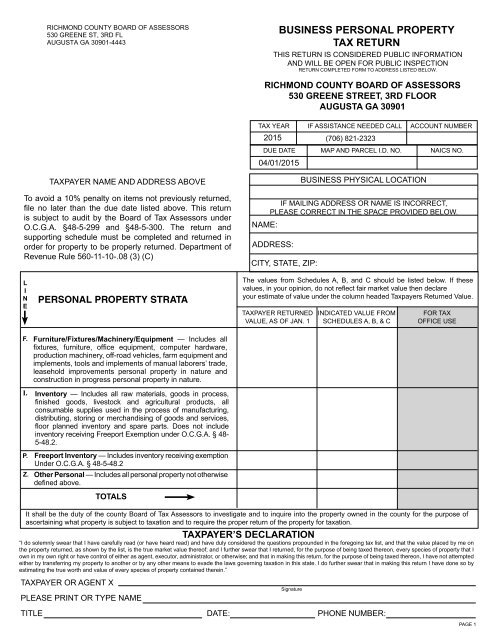

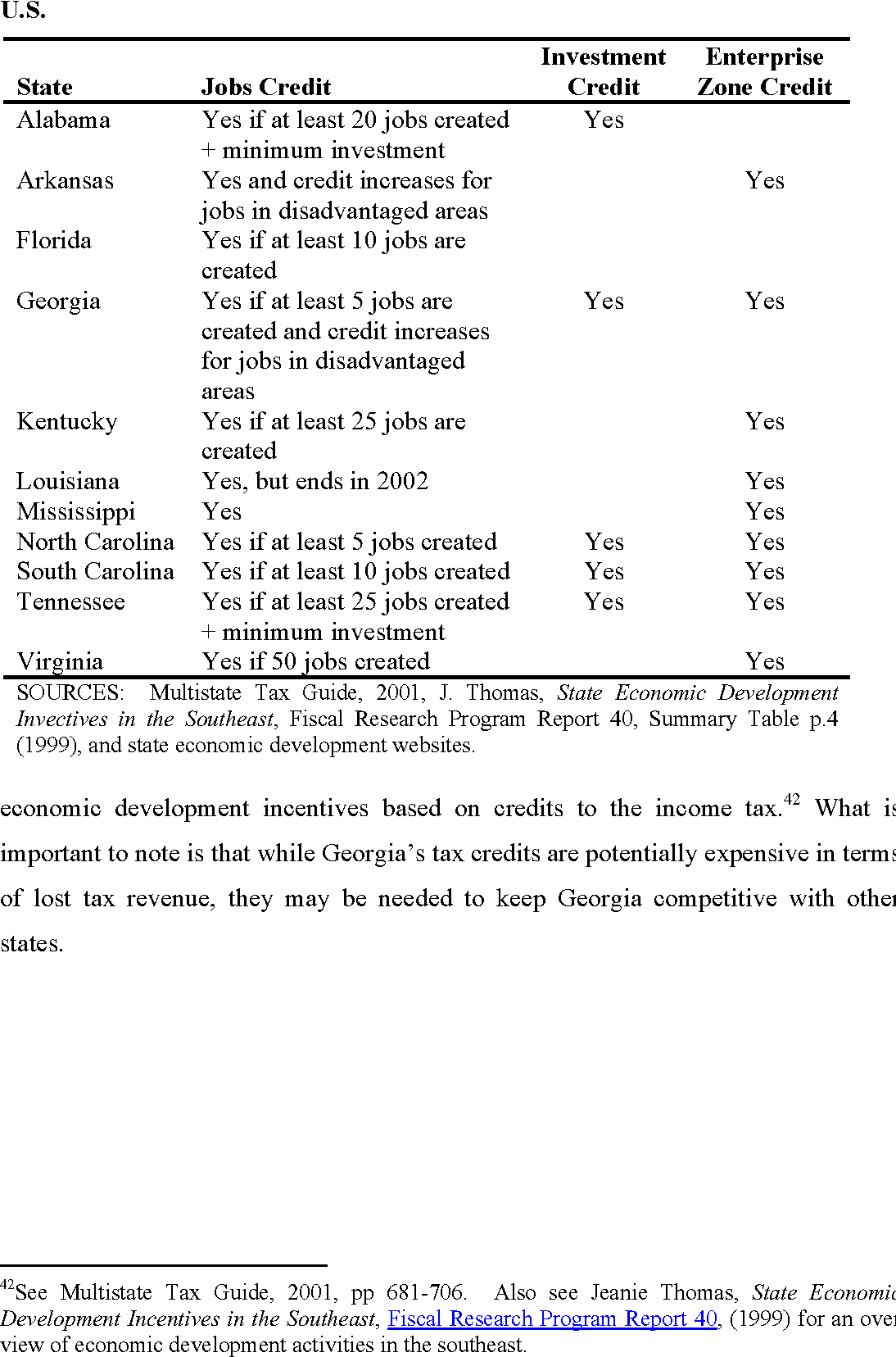

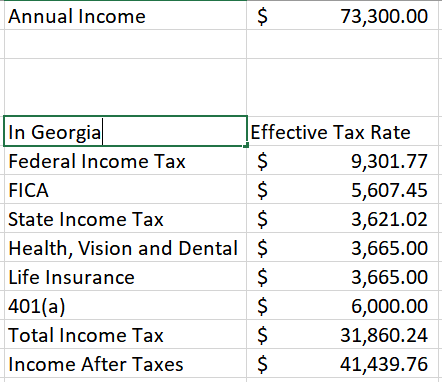

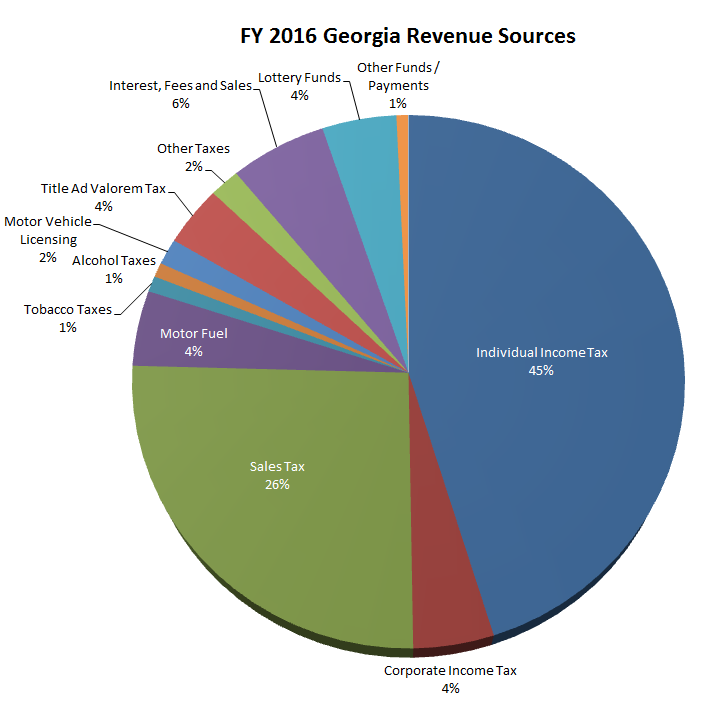

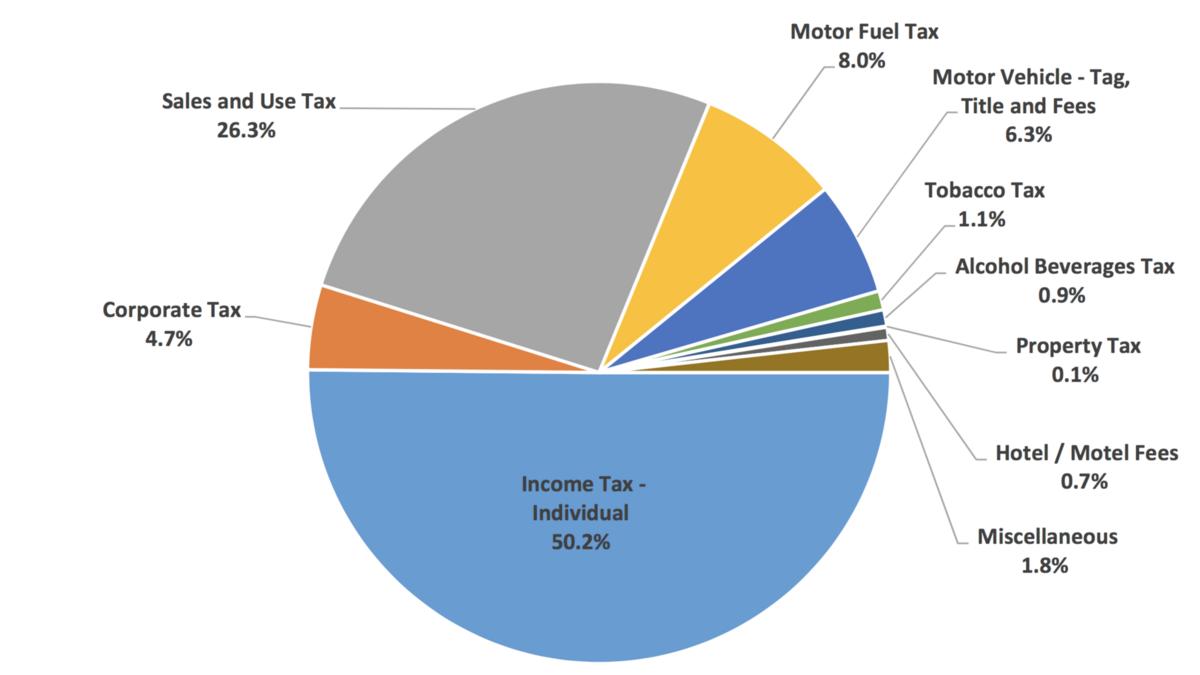

State individual income taxes accessed march 24 2020. Property and gas tax rates for the state are both near the national average. Overview of georgia taxes.

It is fairly average among states charging income tax. This 1099 g form is for taxpayers who itemized deductions and received a refund credit or offset. Looking at the tax rate and tax brackets shown in the tables above for georgia we can see that georgia collects individual income taxes differently for single versus married filing statuses for example.

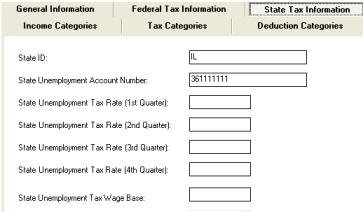

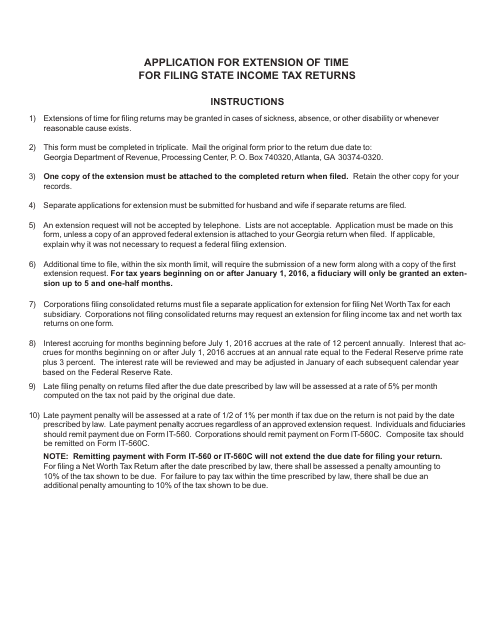

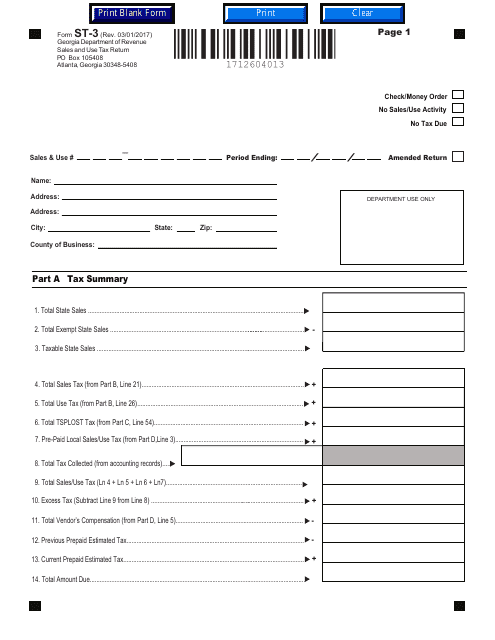

Income tax local government motor fuel motor vehicle. Federation of tax administrators. The department of revenue is protecting georgia taxpayers from tax fraud.

State individual income tax rates and brackets for 2019 page 5 10. An income tax return refund is the result of too much tax withholding estimated tax payments by a taxpayer throughout a tax year. The department of revenue has resumed in person customer service as of monday june 1 2020.