Georgia State Income Tax Exemptions

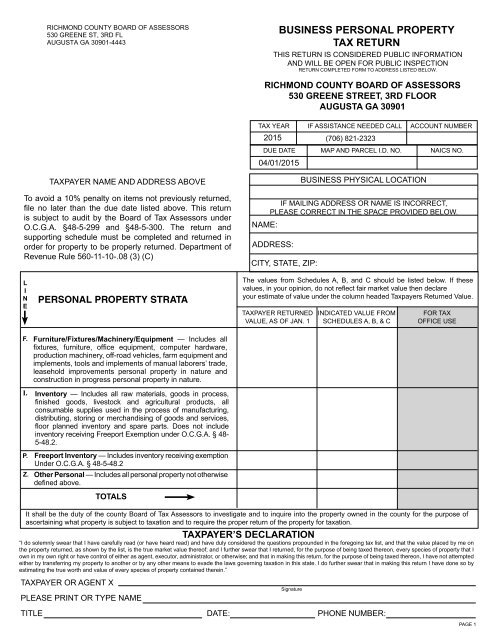

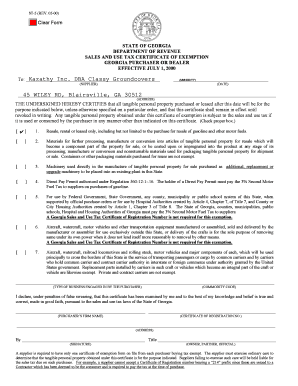

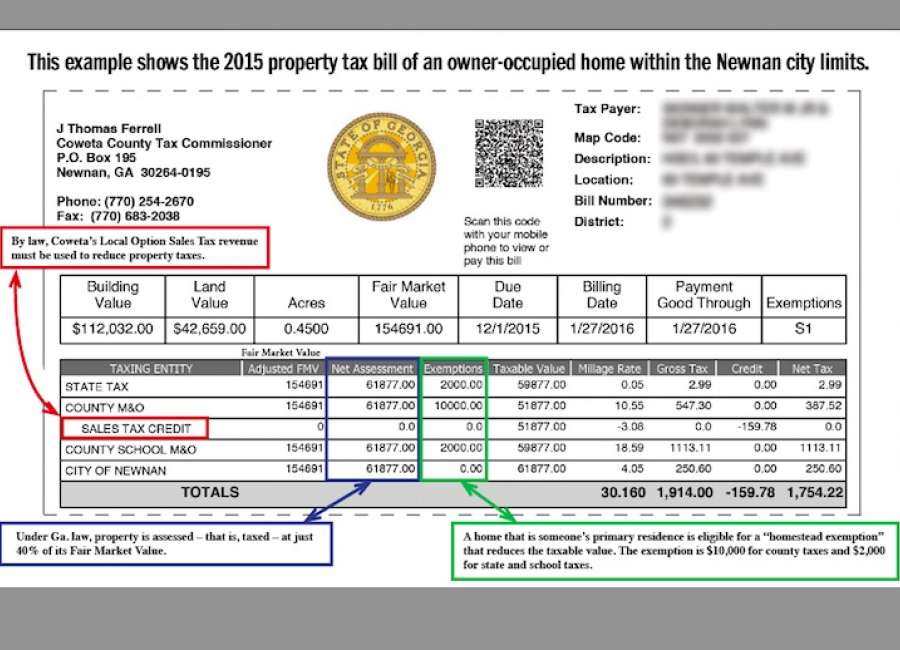

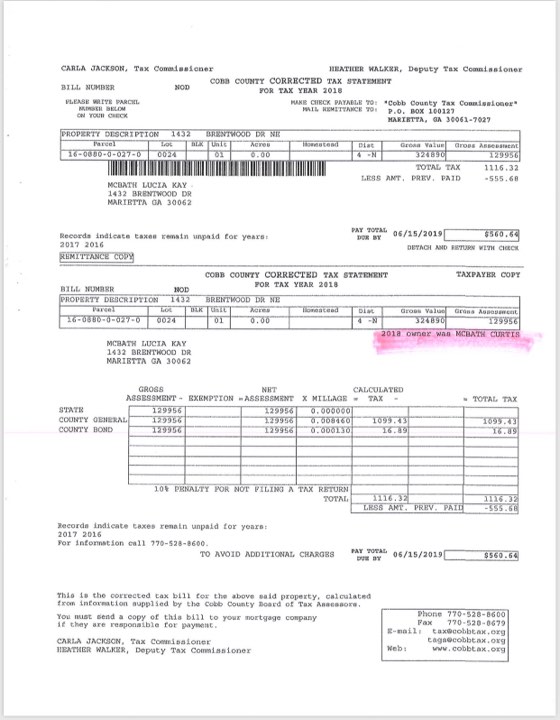

The state of georgia offers homestead exemptions to all qualifying homeowners.

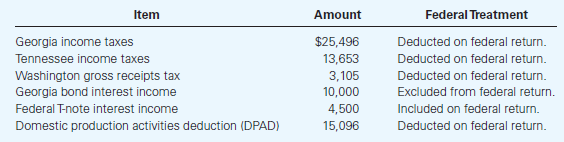

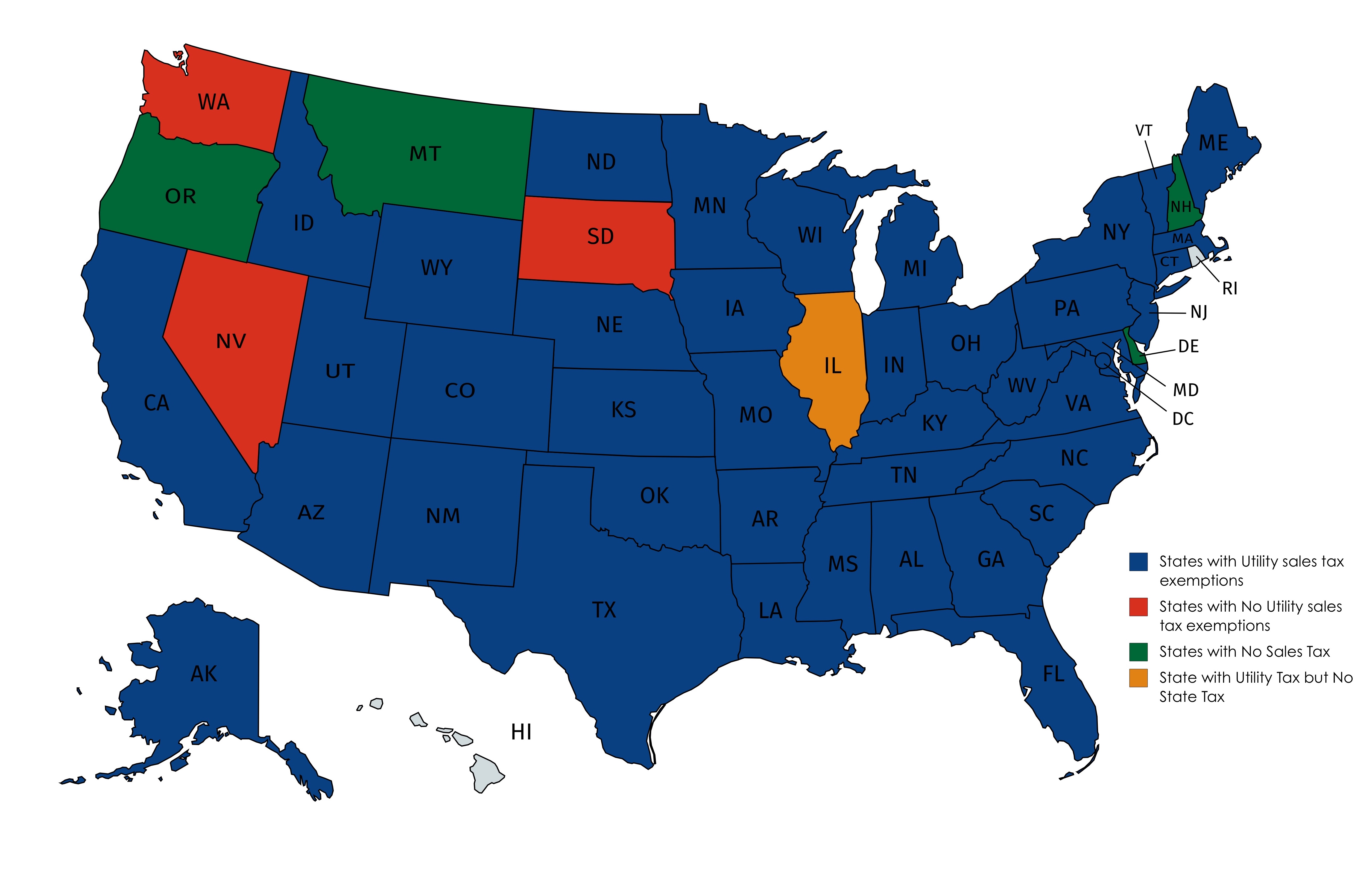

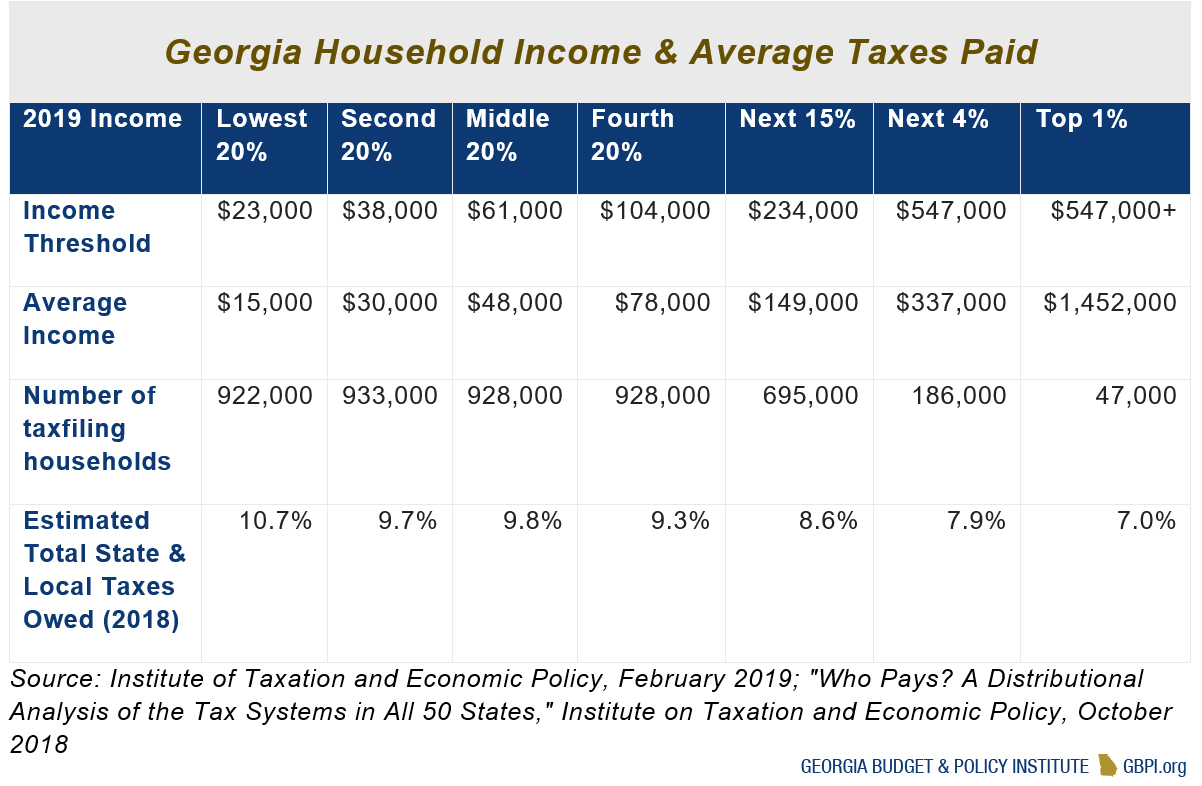

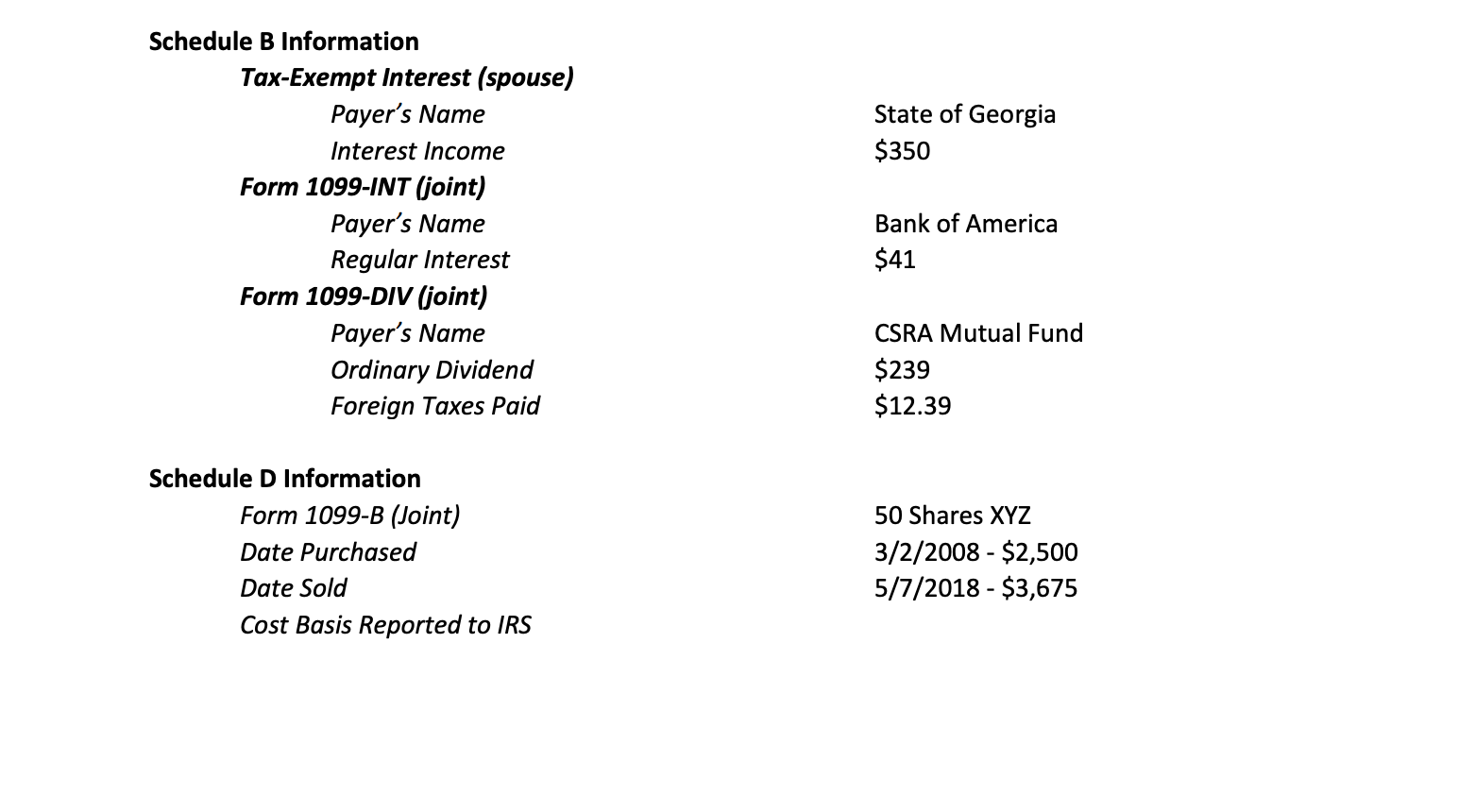

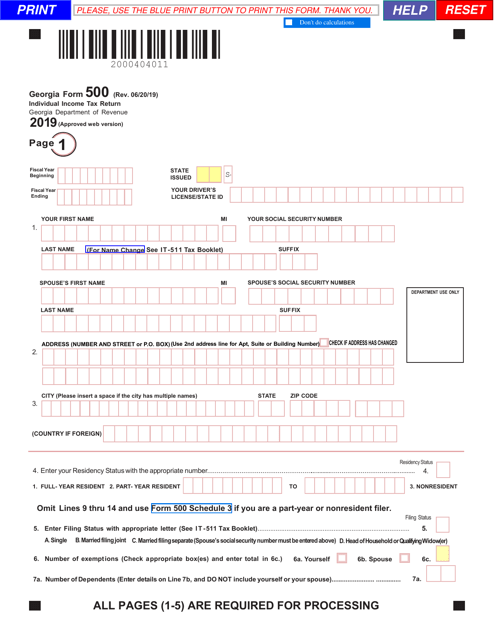

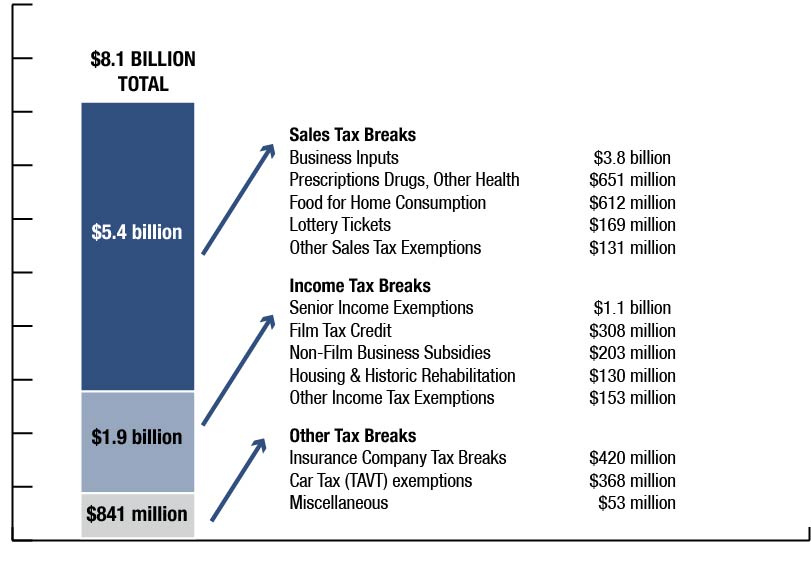

Georgia state income tax exemptions. Income tax local government motor fuel motor vehicle. The states sales tax rates and property tax rates are both relatively moderate. Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575.

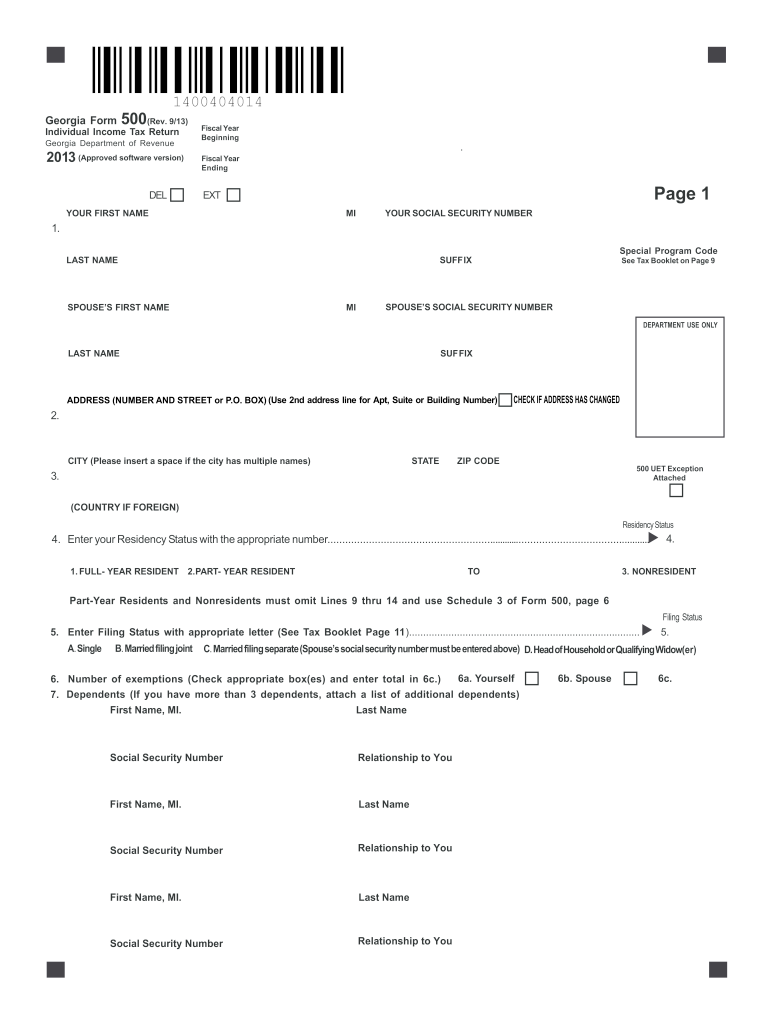

This years individual income tax forms. Filing state taxes the basics. Filing requirements for full and part year residents and military personnel.

Popular online tax services. Exemptions offered by the state and counties. Higher earners pay higher rates although georgias brackets top out at 7000 for single filers which means the majority of full time workers will pay the top rate.

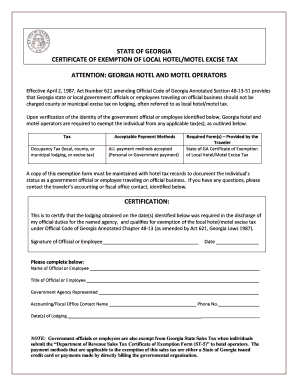

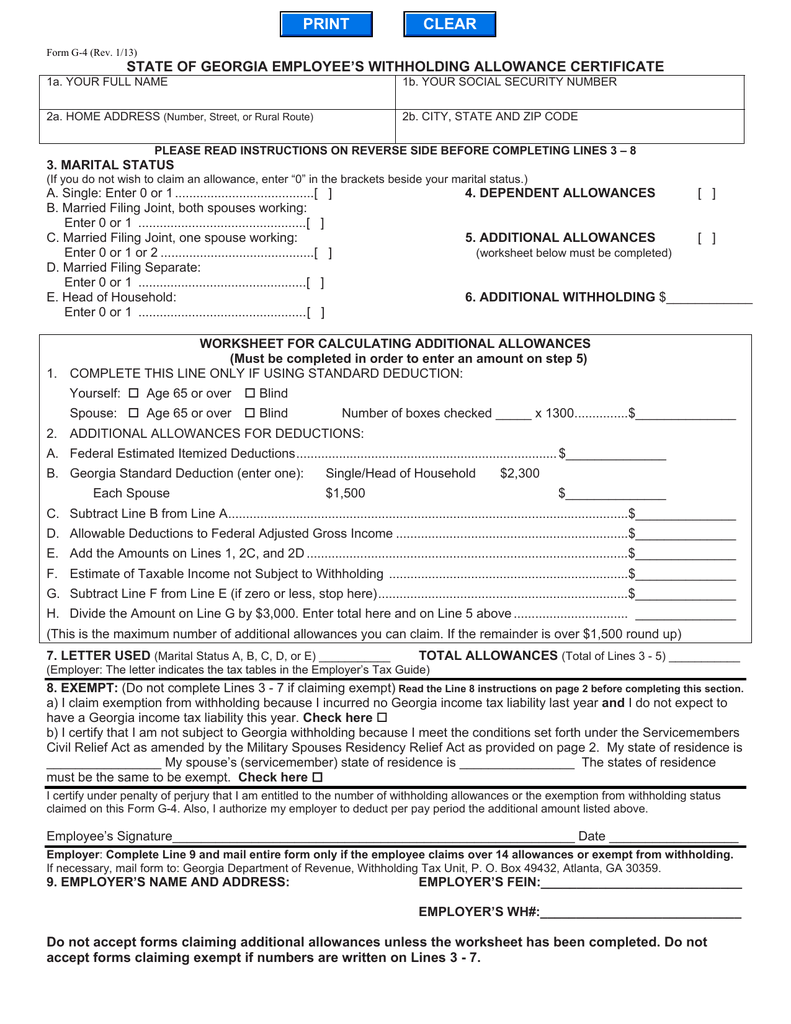

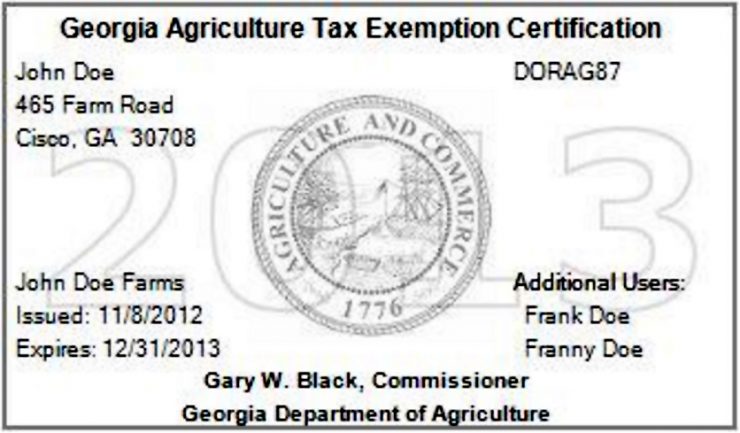

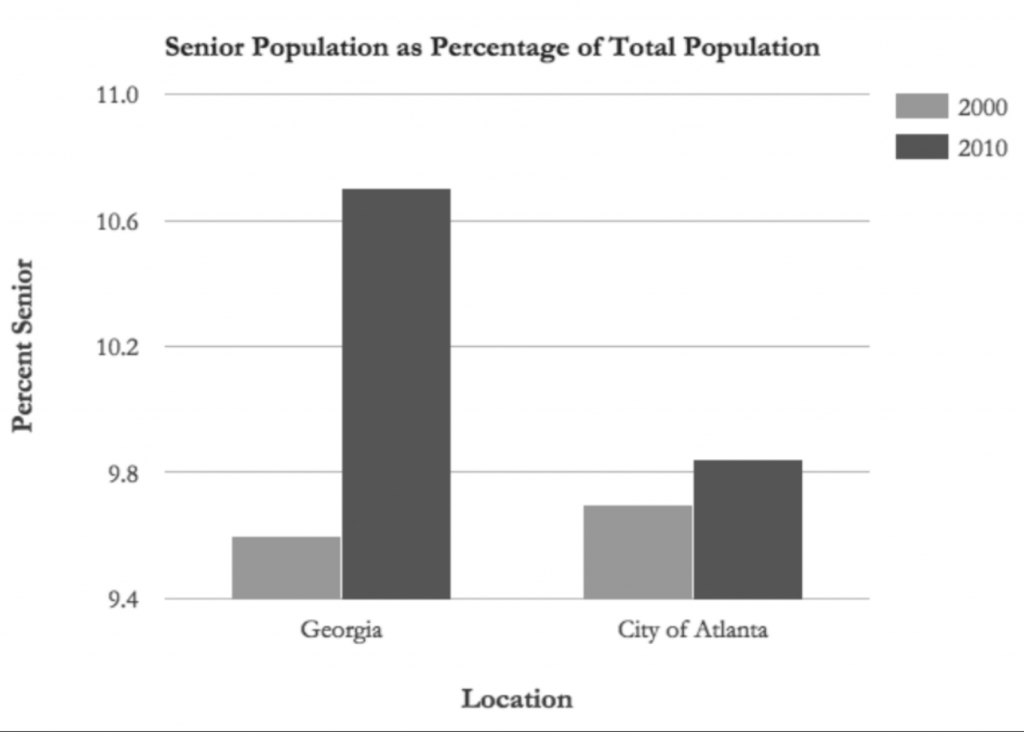

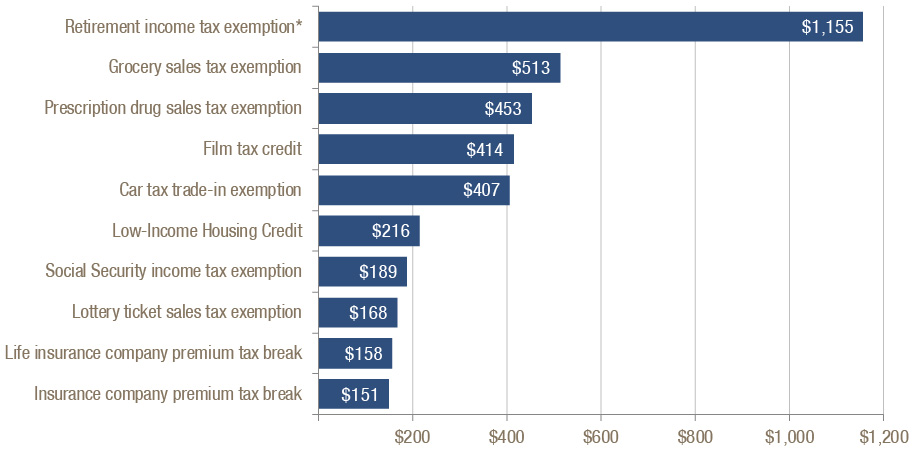

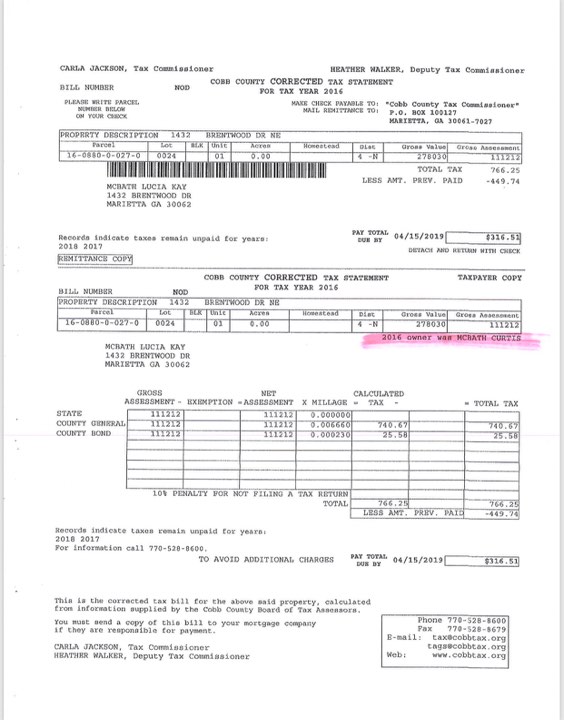

The administration of tax exemptions is as interpreted by the tax commissioners of georgias 159 counties. You must apply for a state income tax determination letter with the georgia department of revenue by submitting form 3605 application for state income tax. Taxpayers who are 62 or older or permanently and totally disabled regardless of age may be eligible for a retirement income adjustment on their georgia tax return.

Department of revenue department of revenue. Call 1 800 georgia to verify that a website is an official website of the state of georgia. The highest georgia state tax rate paid by the majority of residents will drop from 6 percent to 575 percent further decreasing to 550 percent in 2020.

You dont have to be retired just have retirement income which is defined as follows. Gdvs personnel will assist veterans in obtaining the necessary documentation for filing. To receive the homestead exemption for the current tax year the homeowner must have owned the property on january 1 and filed the homestead application by the same date property tax returns are due in the county.

See form it 511 for the retirement income exclusion worksheet to calculate the maximum allowable adjustment for this year. Search for income tax statutes by keyword in the official code of georgia. State of georgia income tax retirement income exclusion for 2018 currently in georgia at age 62 citizens may exempt all retirement income from state income tax.

After you have received your determination letter from the irs and your certificate of incorporation from the secretary of states office for tax years beginning before 112008. Georgia does not tax social security retirement benefits and provides a maximum deduction of 65000 per person on all types of retirement income for anyone 65 or older.