Georgia State Income Tax Calculator

Popular online tax services.

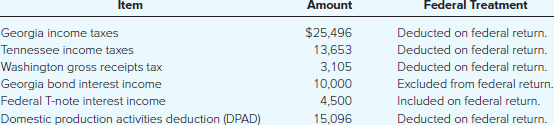

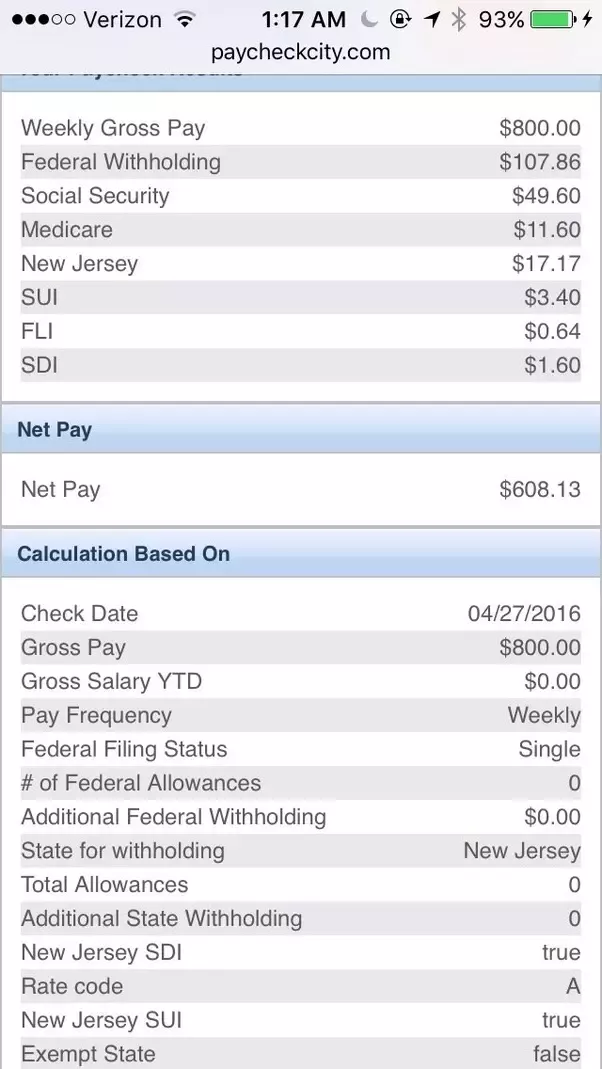

Georgia state income tax calculator. This years individual income tax forms. Filing state taxes the basics. The latest federal tax rates for 2015 16 tax year as published by the irs the latest state tax rates for 20202021 tax year and will be update to the 20212022 state tax tables once fully published as published by the various states.

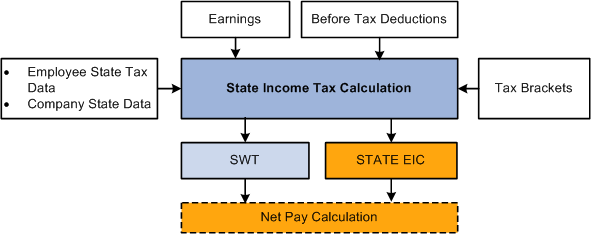

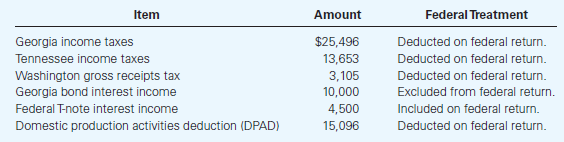

The georgia tax calculator is designed to provide a simple illlustration of the state income tax due in georgia to view a comprehensive tax illustration which includes federal tax medicare state tax standarditemised deductions and more please use the main 202021 tax reform calculator. Using our georgia salary tax calculator. Exempt from state tax.

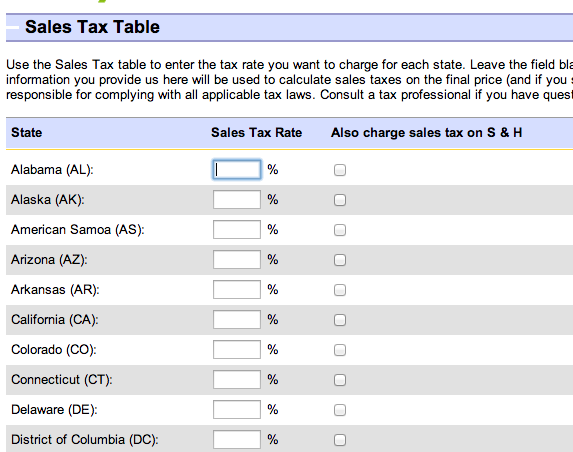

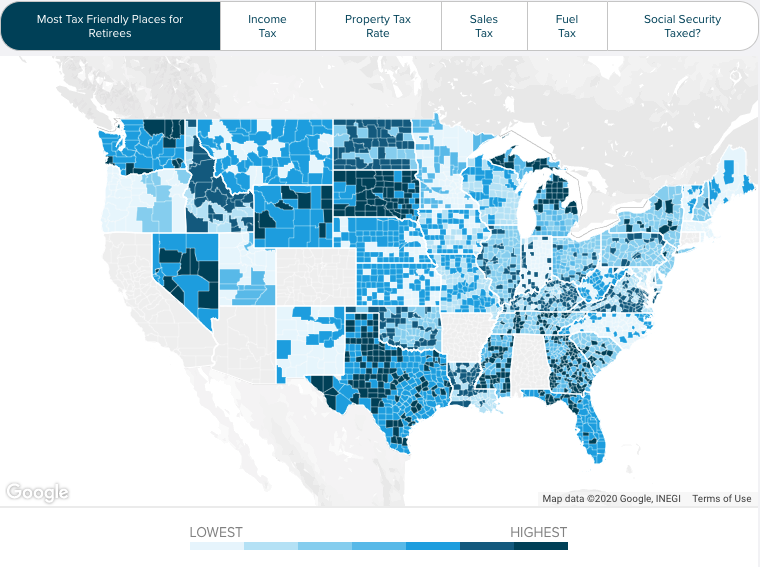

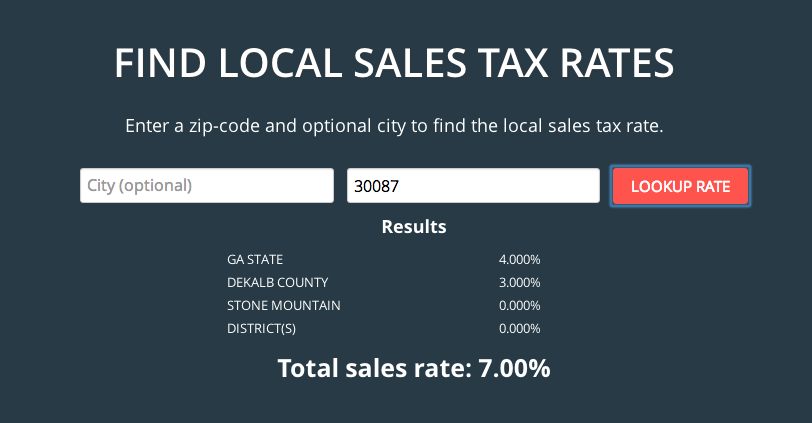

Your household income location filing status and number of personal exemptions. There are no local income taxes in georgia. After a few seconds you will be provided with a full breakdown of the tax you are paying.

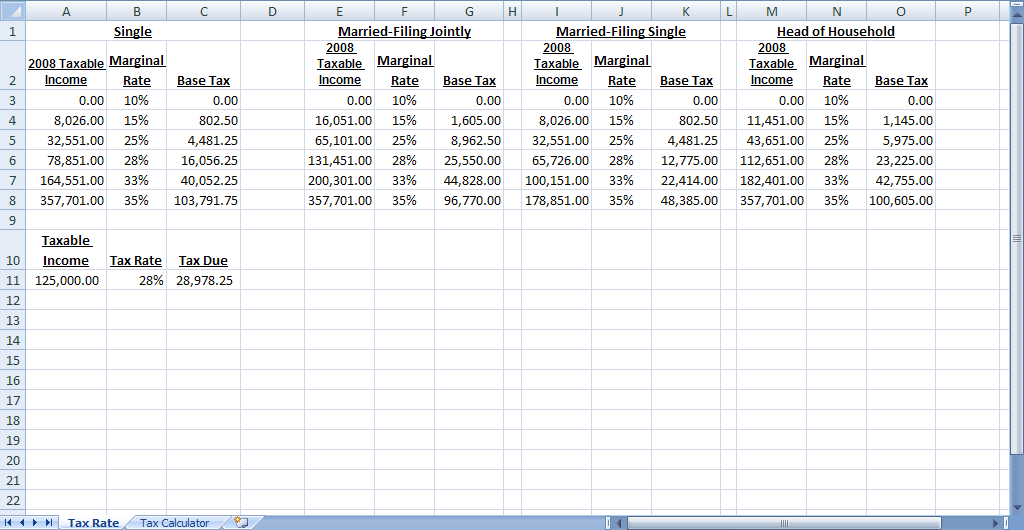

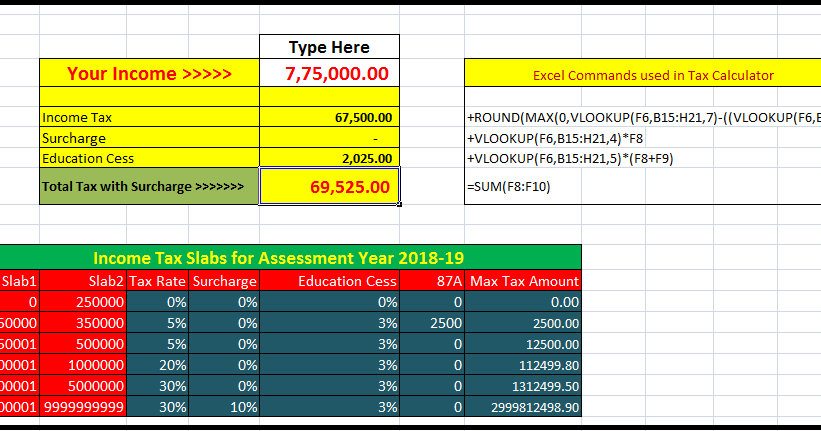

This breakdown will include how much income tax you are paying state taxes federal. Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. Filing requirements for full and part year residents and military personnel.

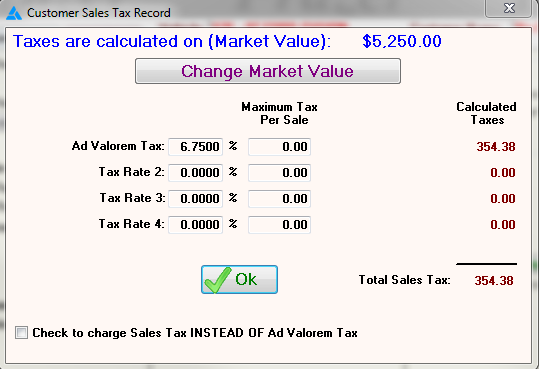

The georgia state tax tables for 2019 displayed on this page are provided in support of the 2019 us tax calculator and the dedicated 2019 georgia state tax calculatorwe also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for each state. Peach state residents who make more money can expect to pay more in state and federal taxes. If you make 55000 a year living in the region of georgia usa you will be taxed 12154that means that your net pay will be 42846 per year or 3571 per month.

Your average tax rate is 2210 and your marginal tax rate is 3565this marginal tax rate means that your immediate additional income will be taxed at this rate. Search for income tax statutes by keyword in the official code of georgia. Georgia residents do pay personal income tax.

Georgia state and local information. Use the georgia salary calculator to see the impact of income tax on your paycheck. The georgia department of revenue is responsible for publishing the latest georgia state tax.

Detailed georgia state income tax rates and brackets are available on this page. The georgia state state tax calculator is updated to include. The georgia tax code has six different income tax brackets based on the amount of taxable income.

Also we separately calculate the federal income taxes you will owe in the 2019 2020 filing season based on the trump tax plan.