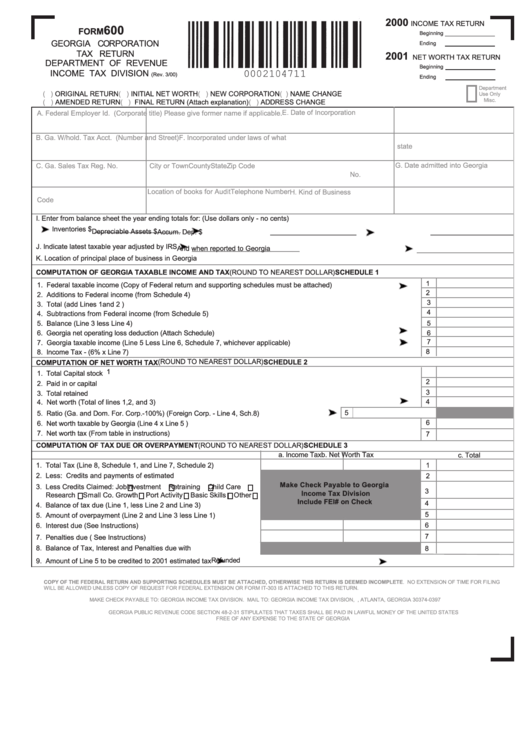

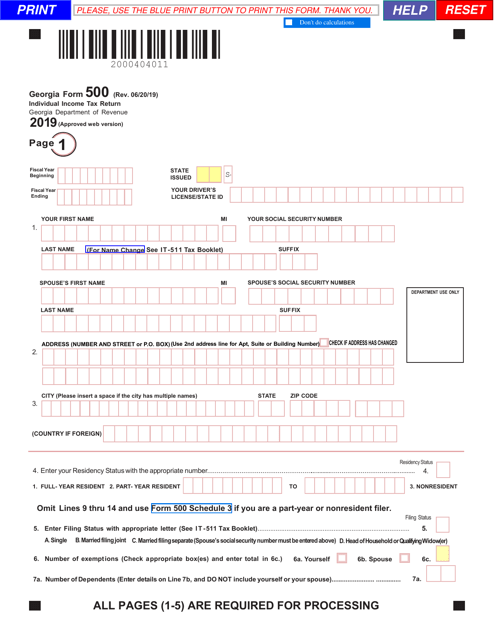

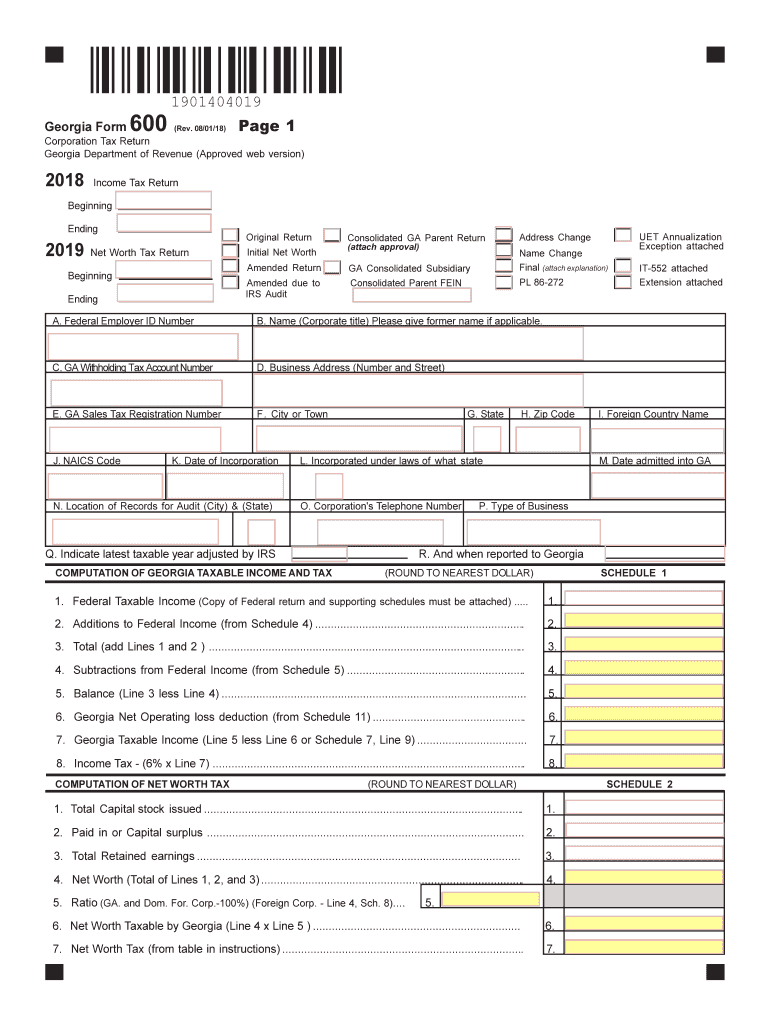

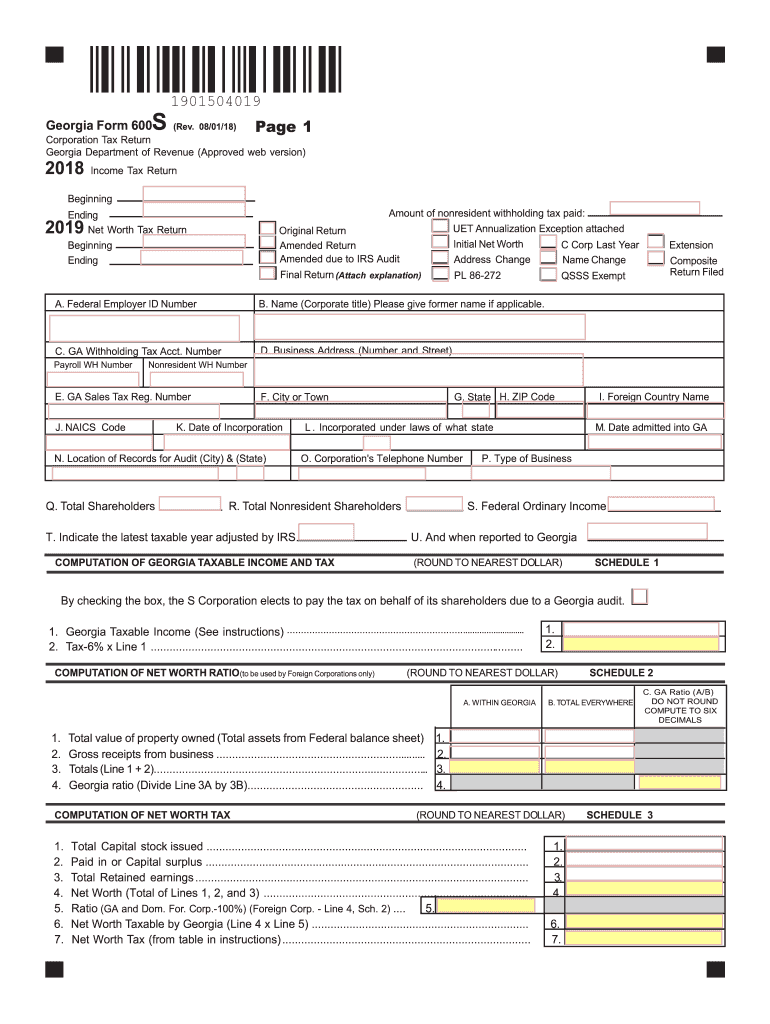

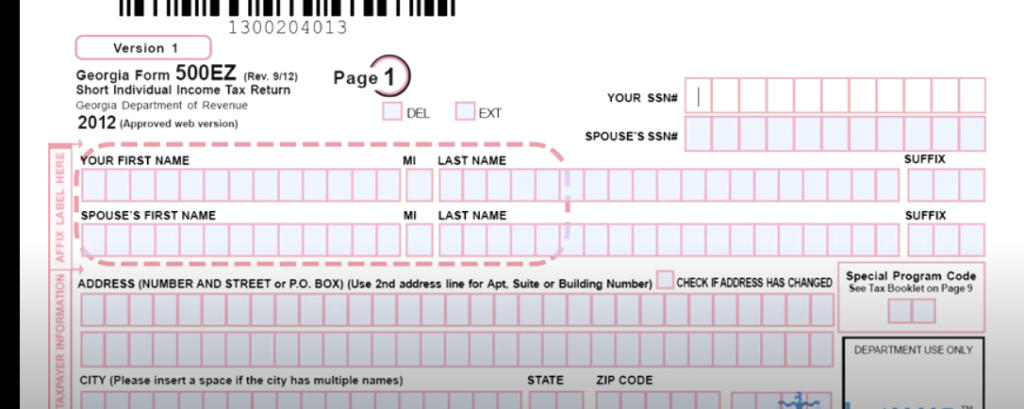

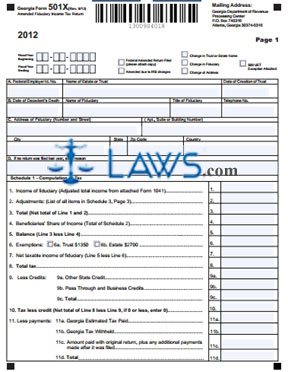

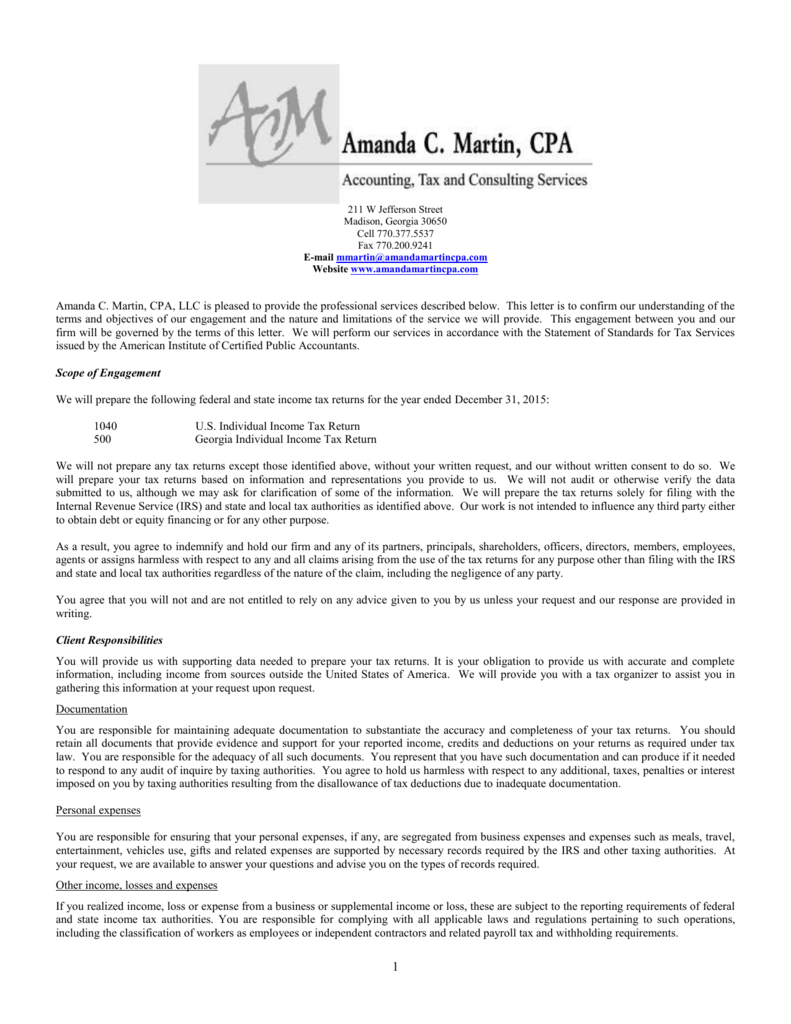

Georgia Income Tax Return

To successfully complete the form you must download and use the current version of adobe acrobat reader.

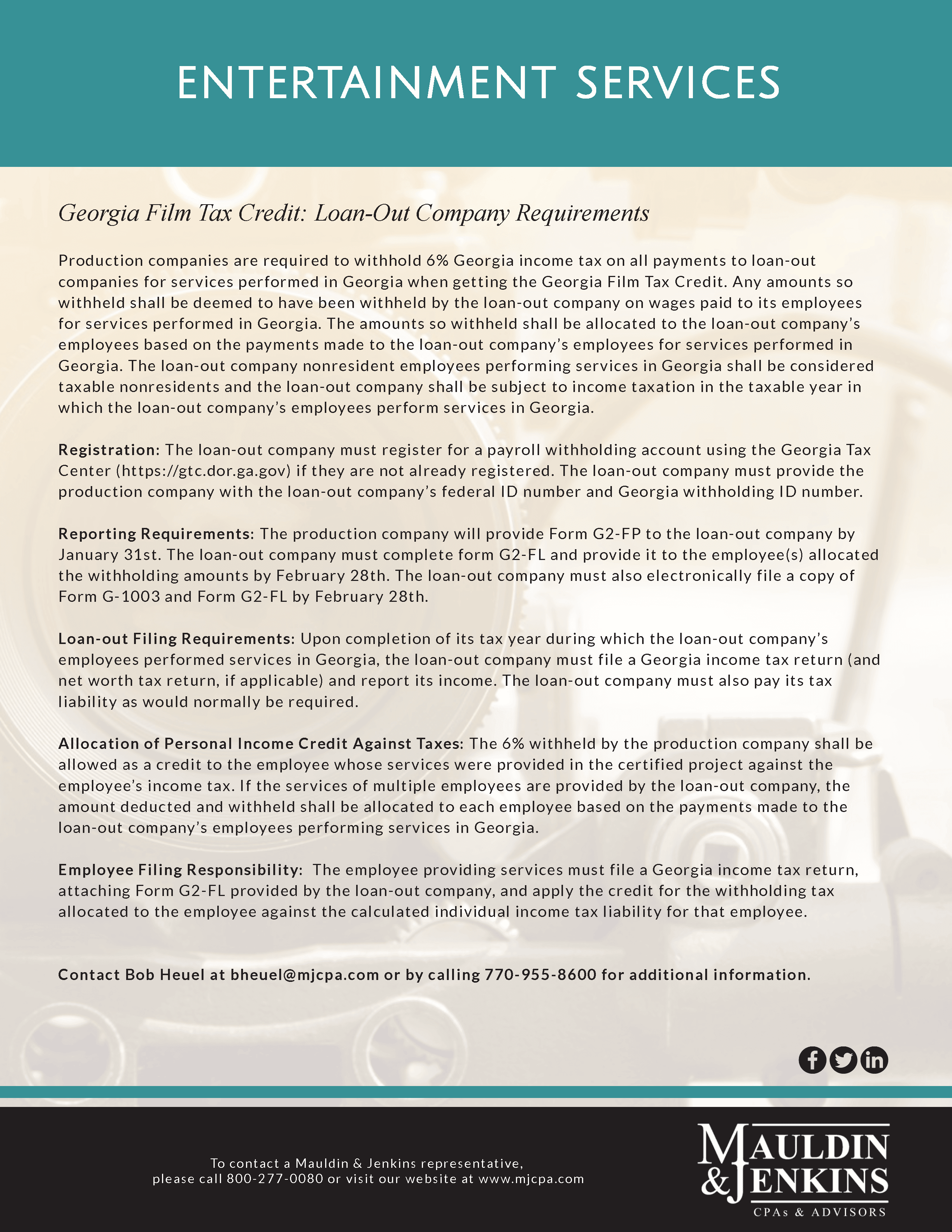

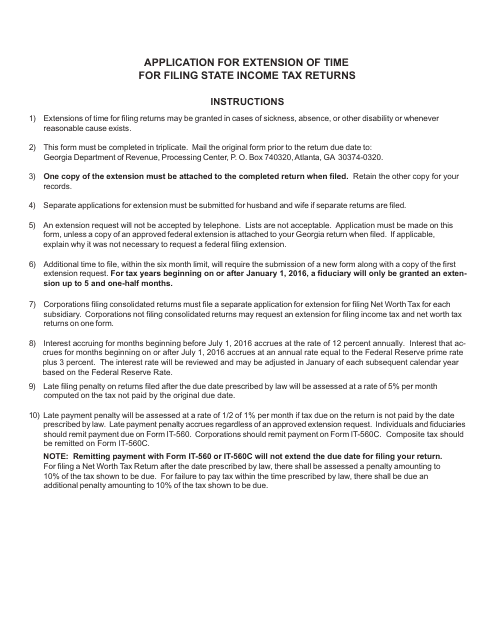

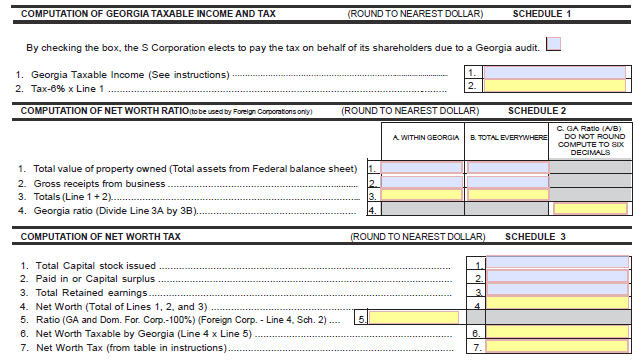

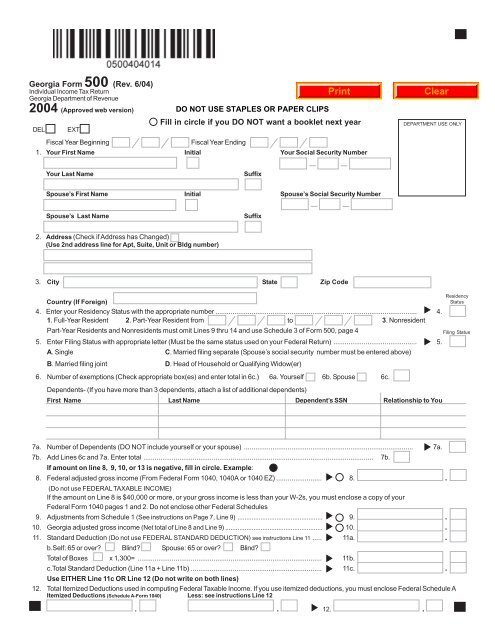

Georgia income tax return. You are required to file a federal income tax return you have income subject to georgia income tax but not subject to federal income tax your income exceeds georgias standard deduction and personal exemptions full year residents are taxed on all income except tax exempt income regardless. The ga tax return filing and payment due date has moved from april 15 to july 15 2020 due to the codvid 19 crisis. 21 days or more since you e filed wheres my refund tells you to contact the irs.

The department of revenue is protecting georgia taxpayers from tax fraud. Please complete your federal return before starting your georgia return. Tax refund processing times vary and depend on the accuracy of the original return but youll get your refund more quickly if you file your return electronically.

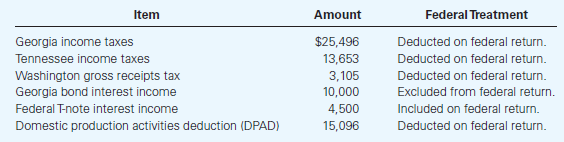

31 2019 can be prepared and e filed now with an irs or federal income tax return. The georgia individual income tax is based on the taxpayers federal adjusted gross income adjustments that are required by georgia law and the taxpayers filing requirements. You can check the status of your tax refund using the georgia tax center.

Georgia state income tax returns for tax year 2019 january 1 dec. You can use the irs tax withholding estimator to help make sure your withholding is right for 2020. Federal tax return deadline detailslearn how to complete and file only a ga state return.

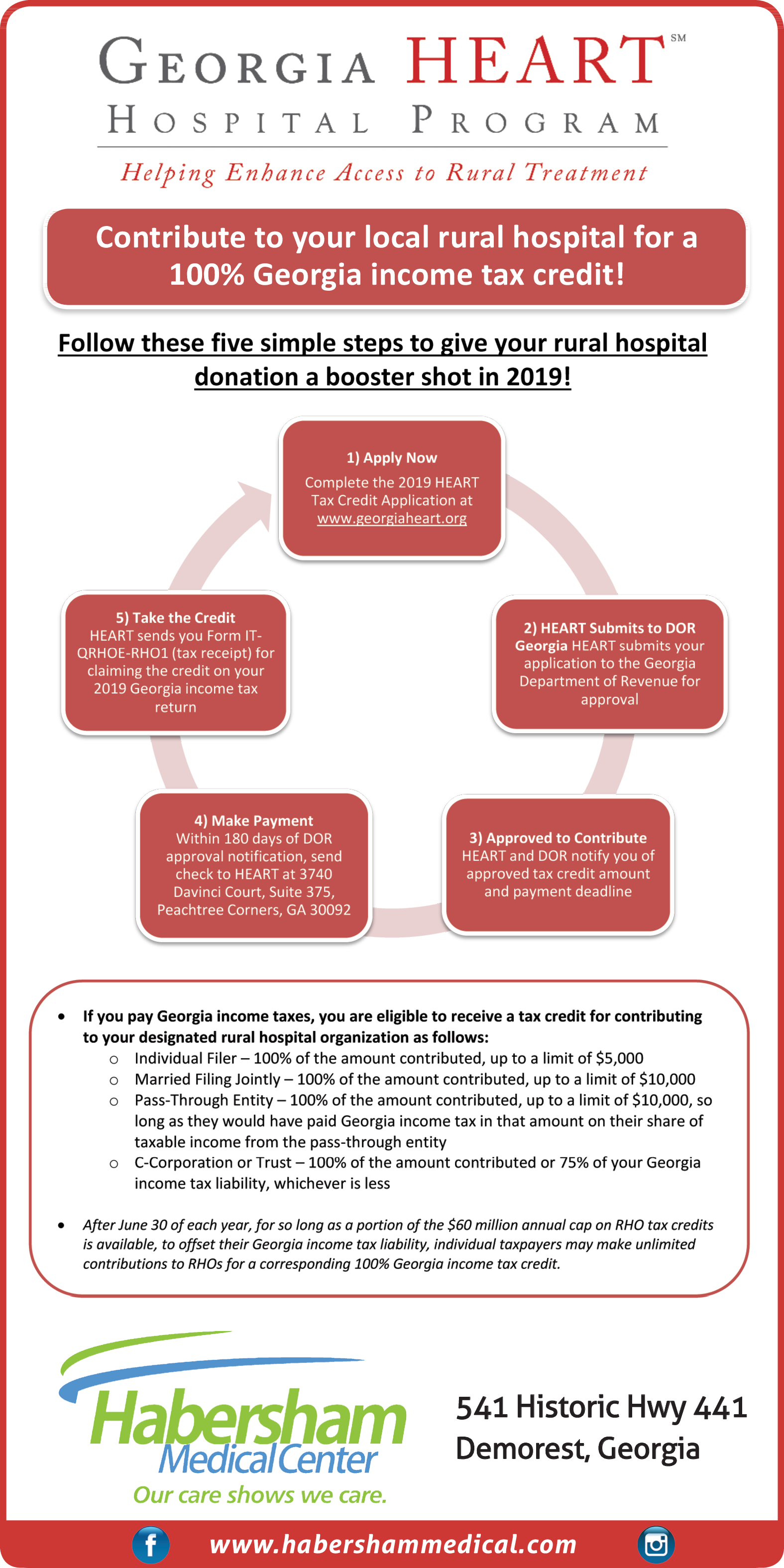

Georgia tax center help individual income taxes register new business business taxes refunds information for tax professionals. You should only call if it has been. 500 individual income tax return.

An income tax return refund is the result of too much tax withholding estimated tax payments by a taxpayer throughout a tax year. Full year residents you are required to file a georgia income tax return if any of the following apply. We will begin accepting returns january 27 2020.

Https Www Fultoncountyga Gov Media Forms Human Resources Forms Human Resources W4 And Financial Docv2 Final Ashx

.jpg)

:max_bytes(150000):strip_icc()/where-s-your-tax-refund-3193203-v4-5b688dc546e0fb004fc28d4e.png)