Georgia Income Tax Return Status

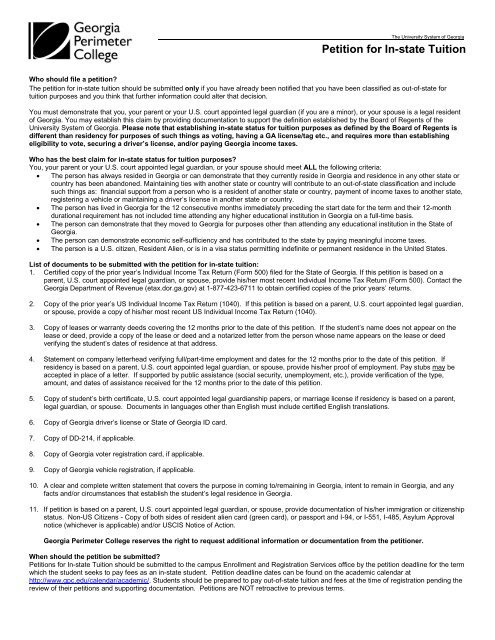

Copy of the death certificate.

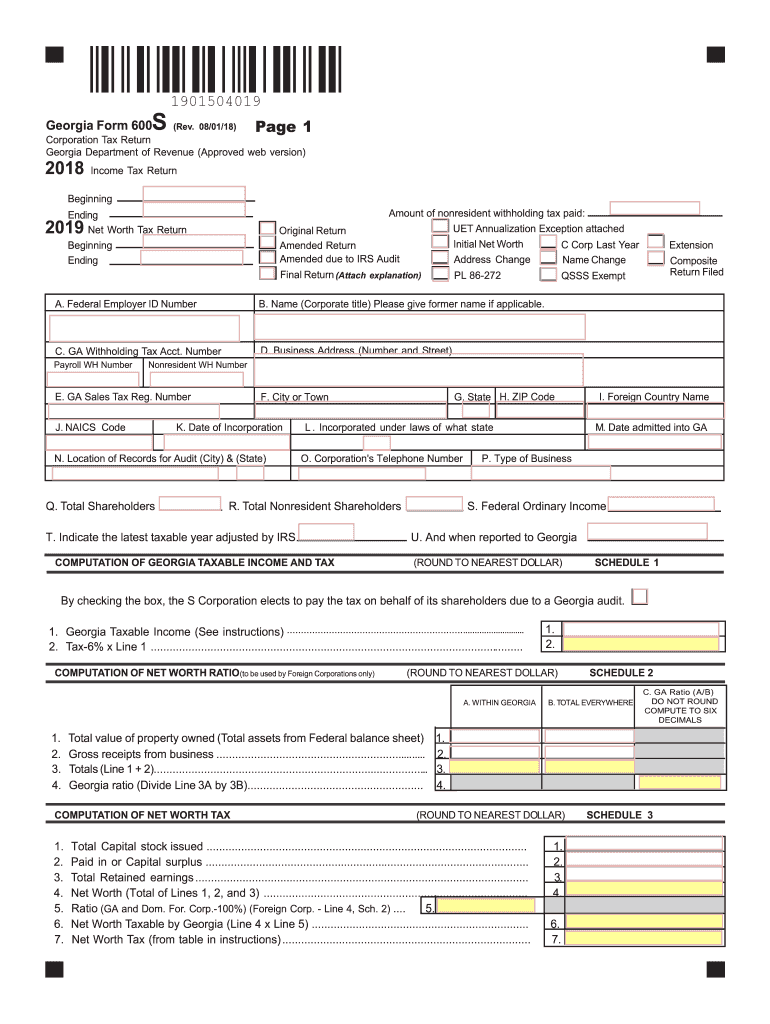

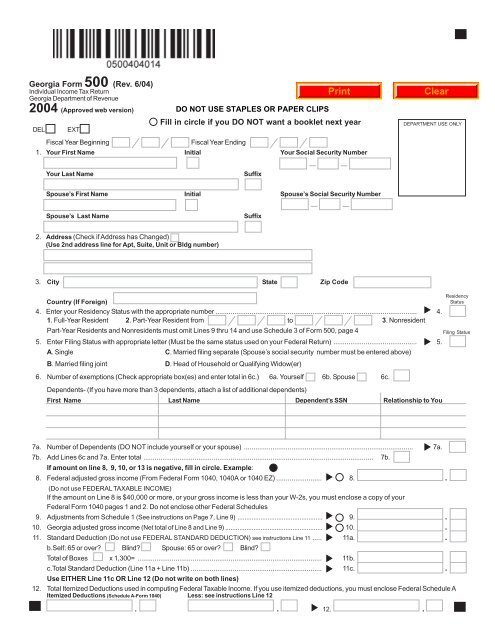

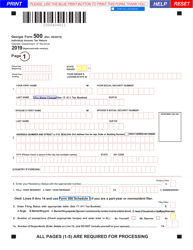

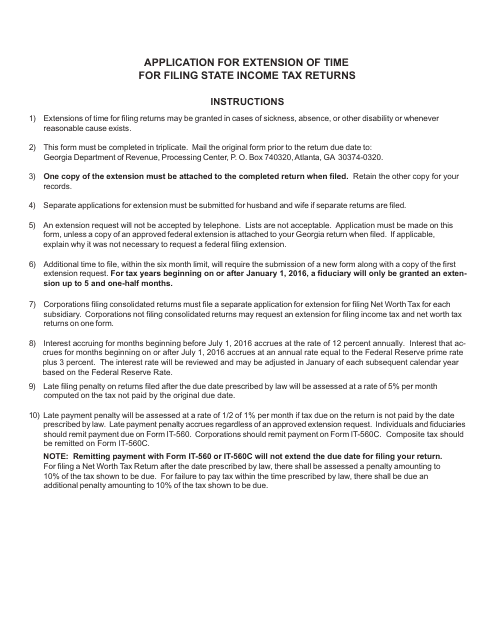

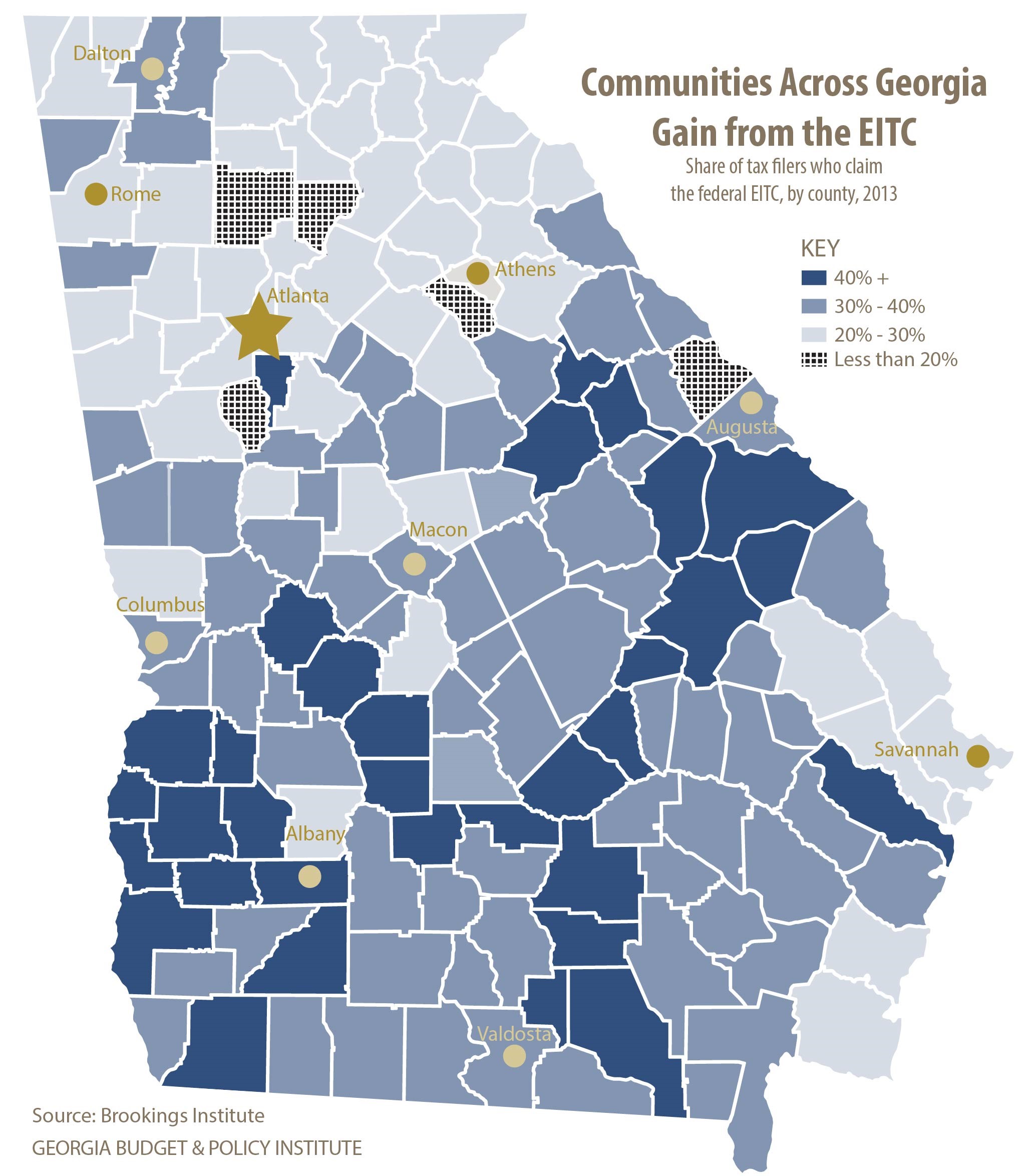

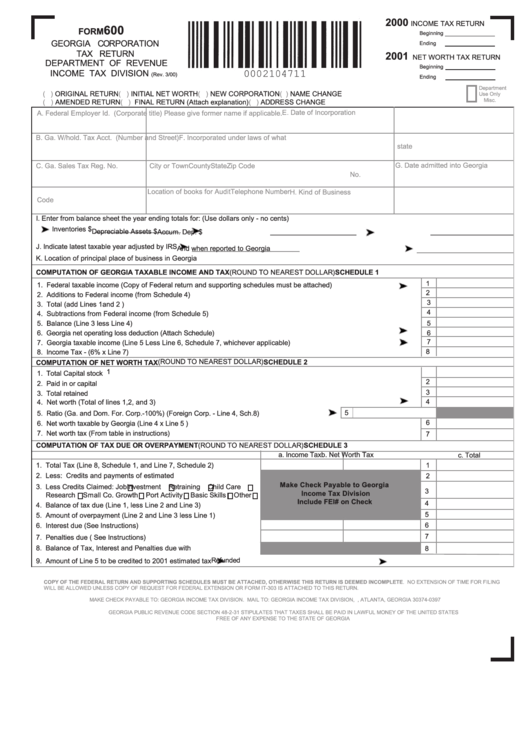

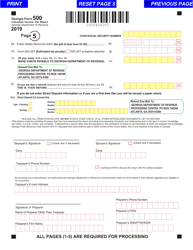

Georgia income tax return status. An income tax return refund is the result of too much tax withholding estimated tax payments by a taxpayer throughout a tax year. It may take up to 90 days from the date of receipt by dor to process a return and issue a refund. When filing use the same filing status and due date that was used on the federal income tax return.

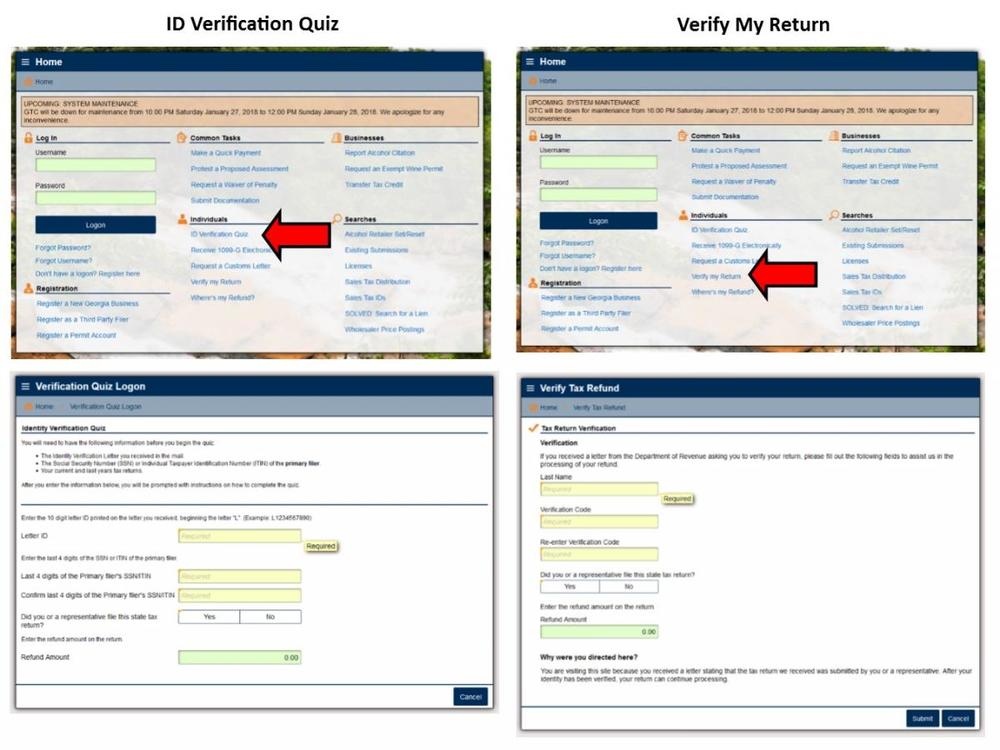

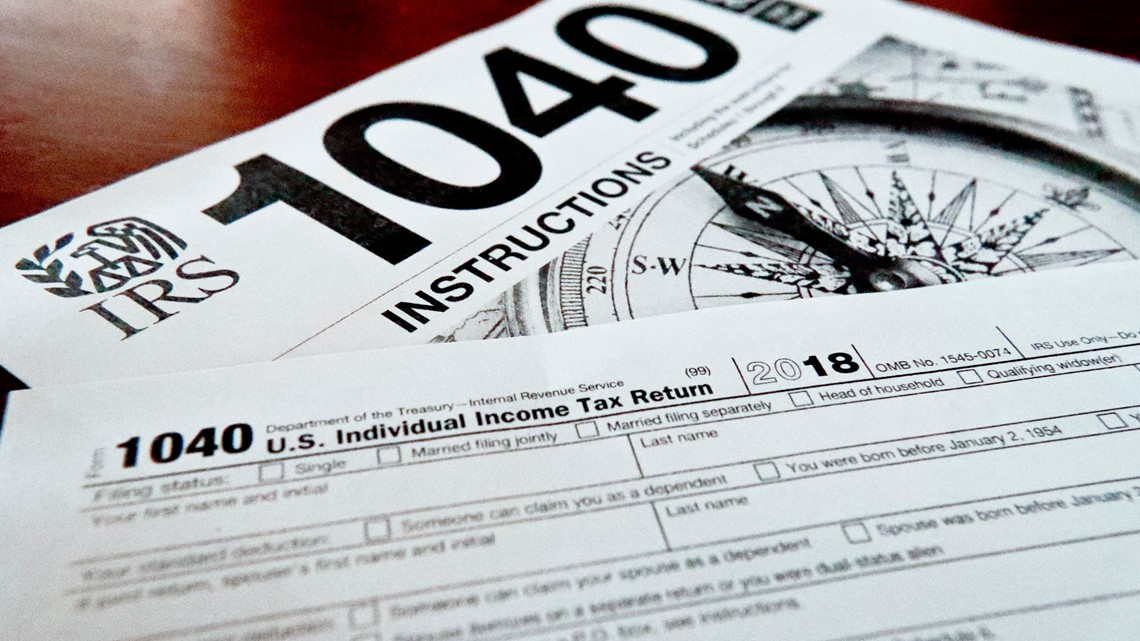

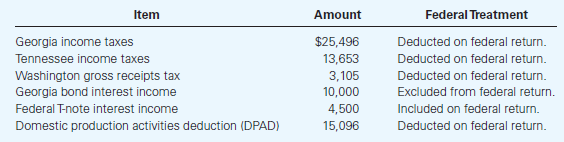

The department of revenue is protecting georgia taxpayers from tax fraud. Income tax return processing will begin february 1 2018. Tax refund processing times vary and depend on the accuracy of the original return but youll get your refund more quickly if you file your return electronically.

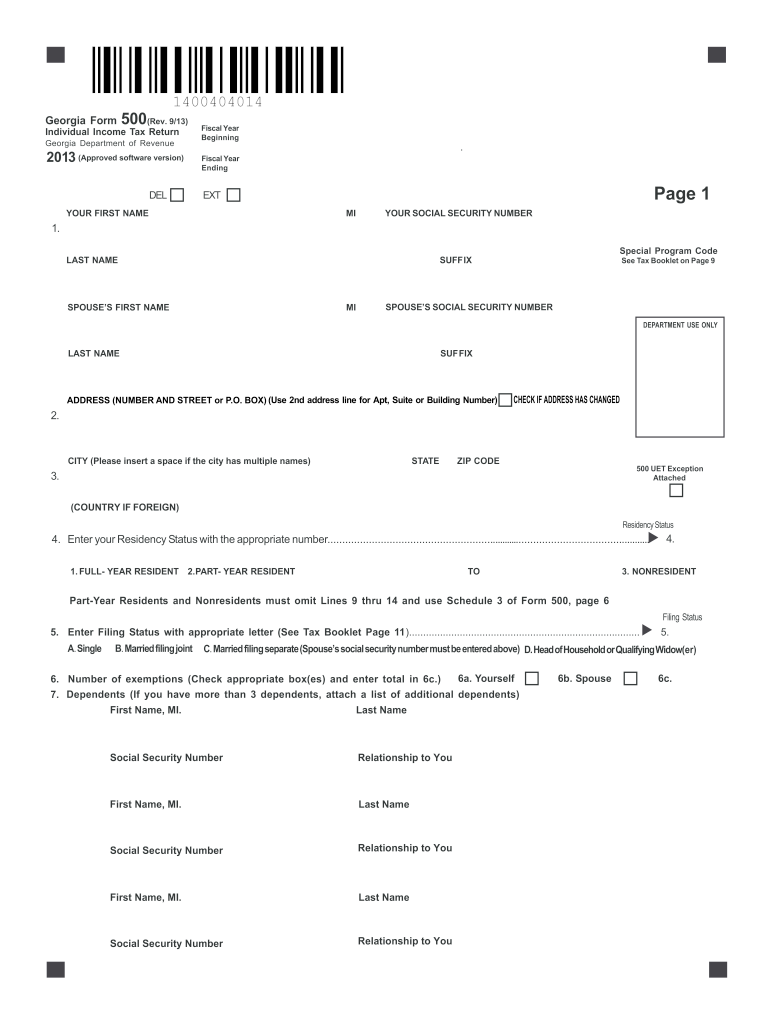

Please complete your federal return before starting your georgia return. Full year residents you are required to file a georgia income tax return if any of the following apply. Completed form ga 5347 deceased taxpayer refund check claim.

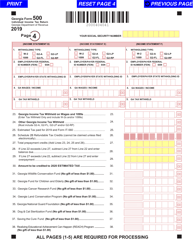

You are required to file a federal income tax return you have income subject to georgia income tax but not subject to federal income tax your income exceeds georgias standard deduction and personal exemptions full year residents are taxed on all income except tax exempt income regardless. The georgia individual income tax is based on the taxpayers federal adjusted gross income adjustments that are required by georgia law and the taxpayers filing requirements. You can check the status of your tax refund using the georgia tax center.

Georgia state tax refund status information. To have a refund check in the name of the deceased taxpayer reissued mail the following to the address on the form. Page last reviewed or updated.

We will begin accepting returns january 27 2020. Please allow 90 business days to process a return and issue a refund. As part of the department of revenue effort to protect georgia taxpayers from tax fraud the following business practices are in effect for 2018.

:max_bytes(150000):strip_icc()/where-s-your-tax-refund-3193203-v4-5b688dc546e0fb004fc28d4e.png)

.jpg)