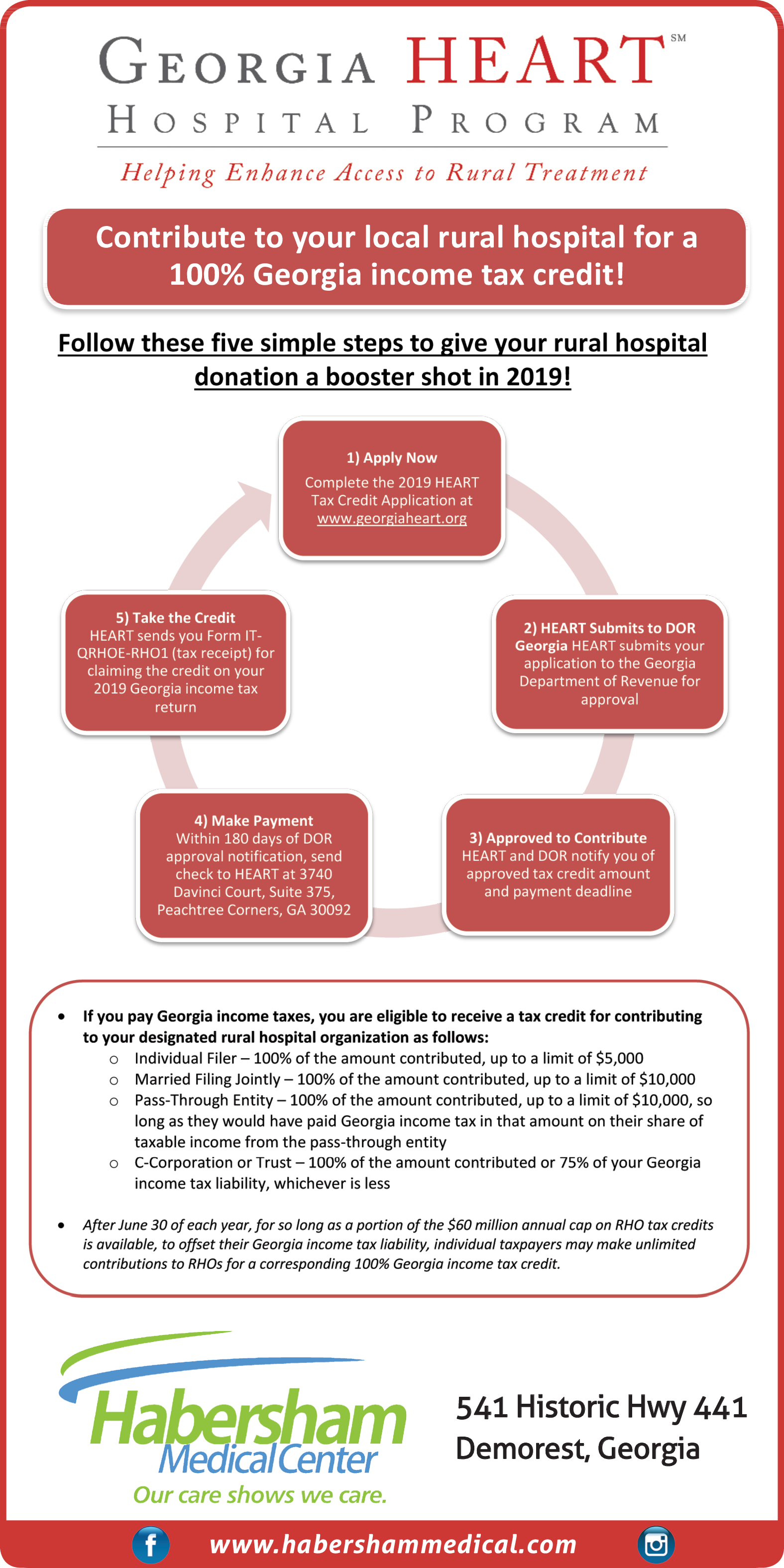

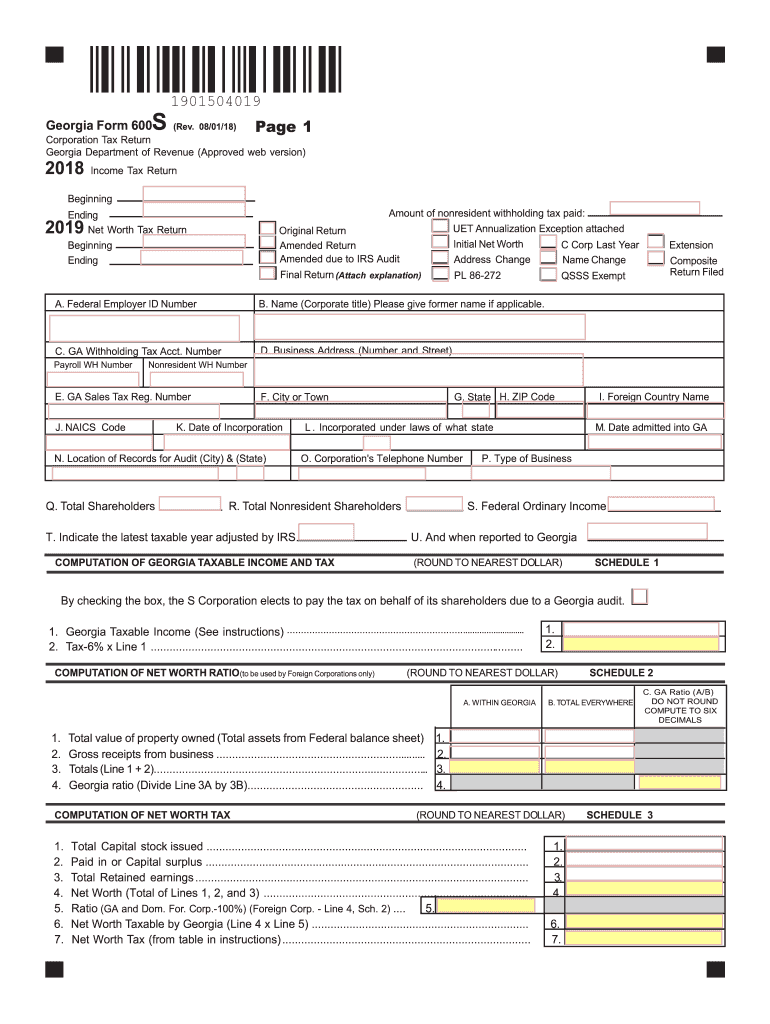

Georgia Income Tax Return 2019

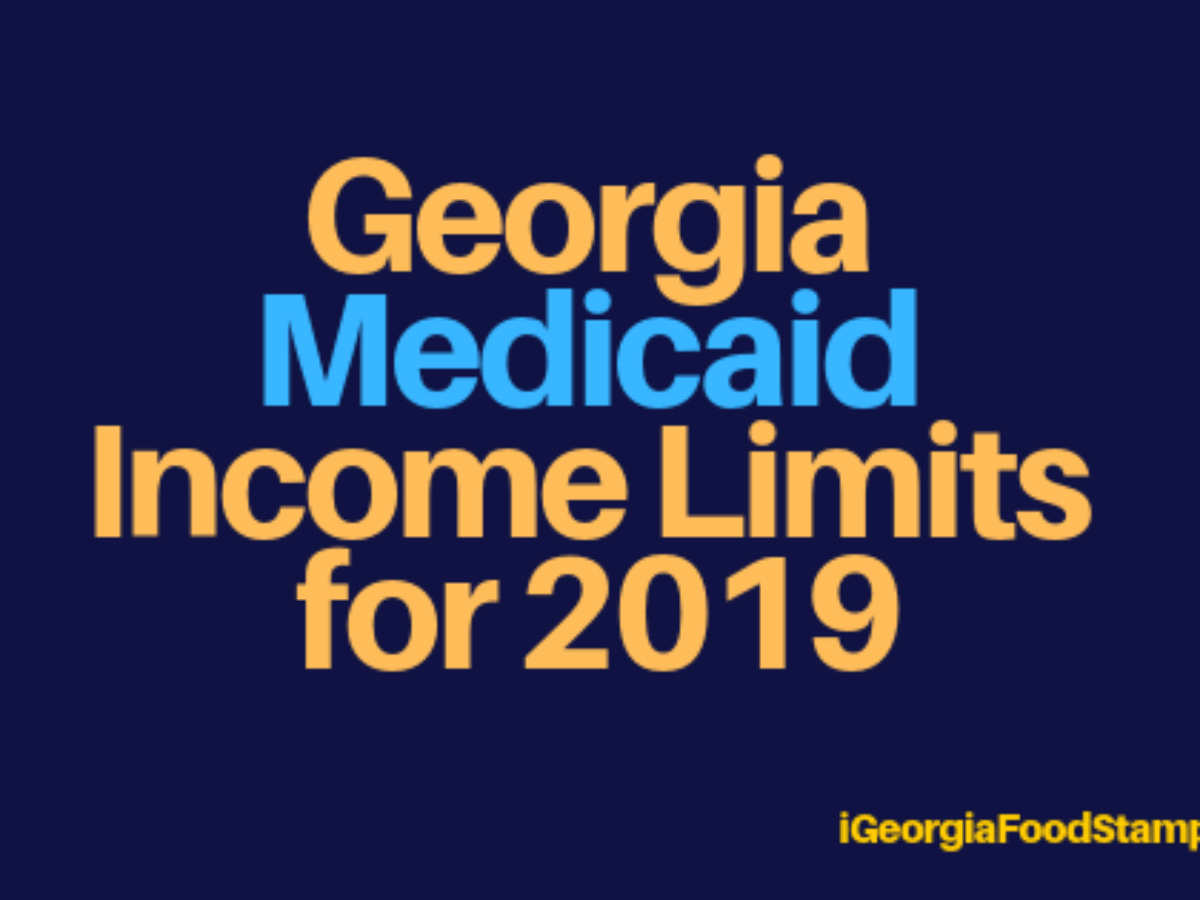

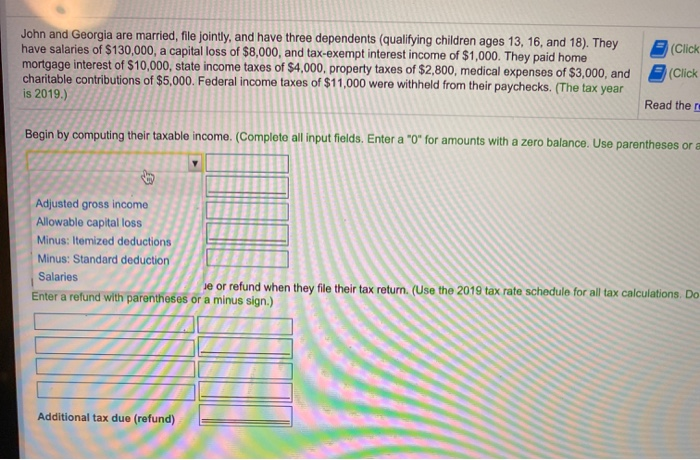

Your federal return contains information necessary for completing your georgia return.

Georgia income tax return 2019. Georgia individual income tax is based on the taxpayers federal adjusted gross income adjustments that are required by georgia law and the taxpayers filing requirements. 21 days or more since you e filed wheres my refund tells you to contact the irs. To successfully complete the form you must download and use the current version of adobe acrobat reader.

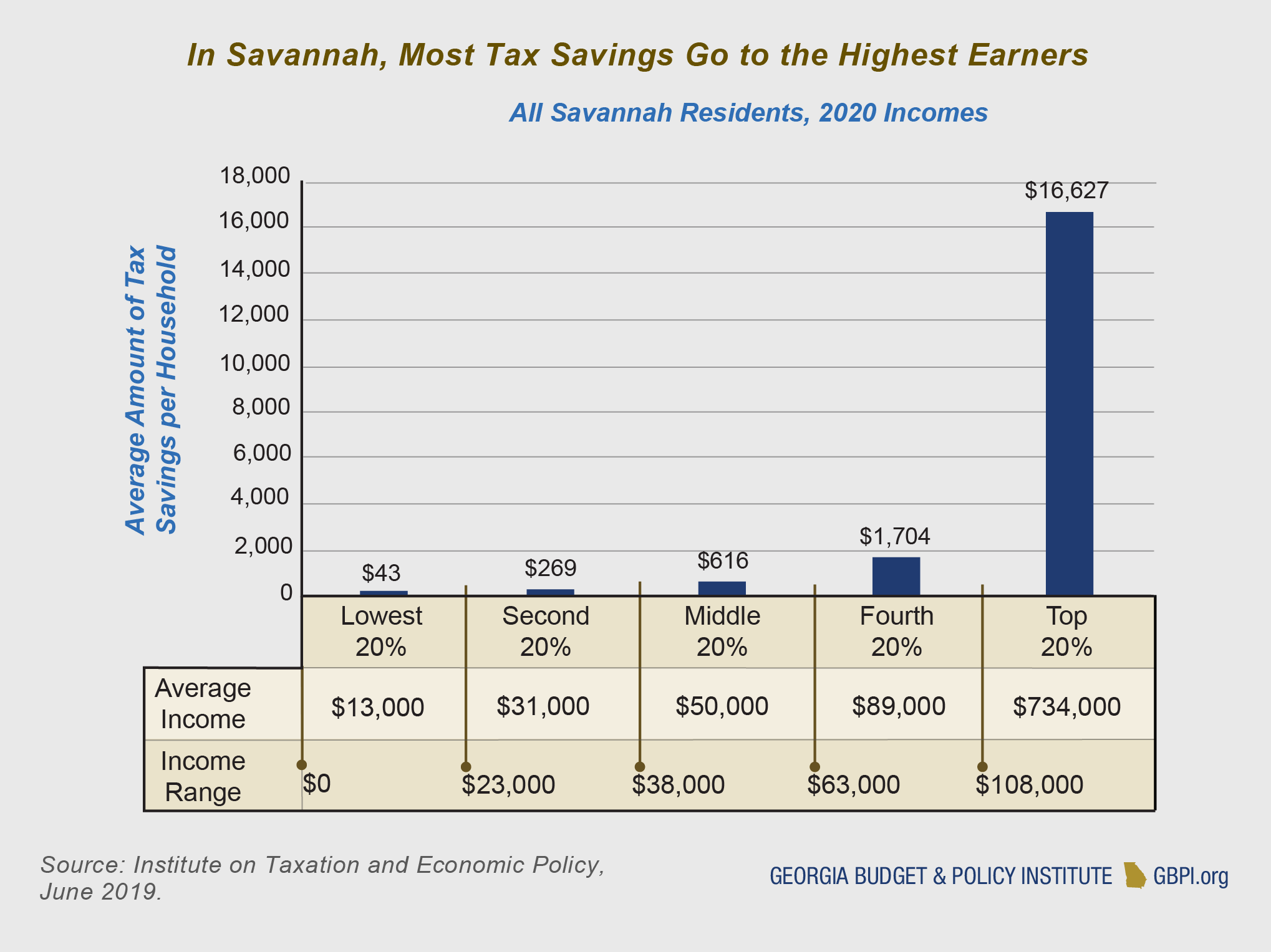

Higher earners pay higher rates although georgias brackets top out at 7000 for single filers which means the majority of full time workers will pay the top rate. Download 2019 individual income tax forms. State of georgia government websites and email systems use georgiagov or gagov at the end of the address.

2019 500 individual income tax return 18 mb 2018 500 individual income tax return. To have a refund check in the name of the deceased taxpayer reissued mail the following to the address on. You should only call if it has been.

You can use the irs tax withholding estimator to help make sure your withholding is right for 2020. File my return instructions forms and more approved software vendors wheres my refund. You can check the status of your tax refund using the georgia tax center.

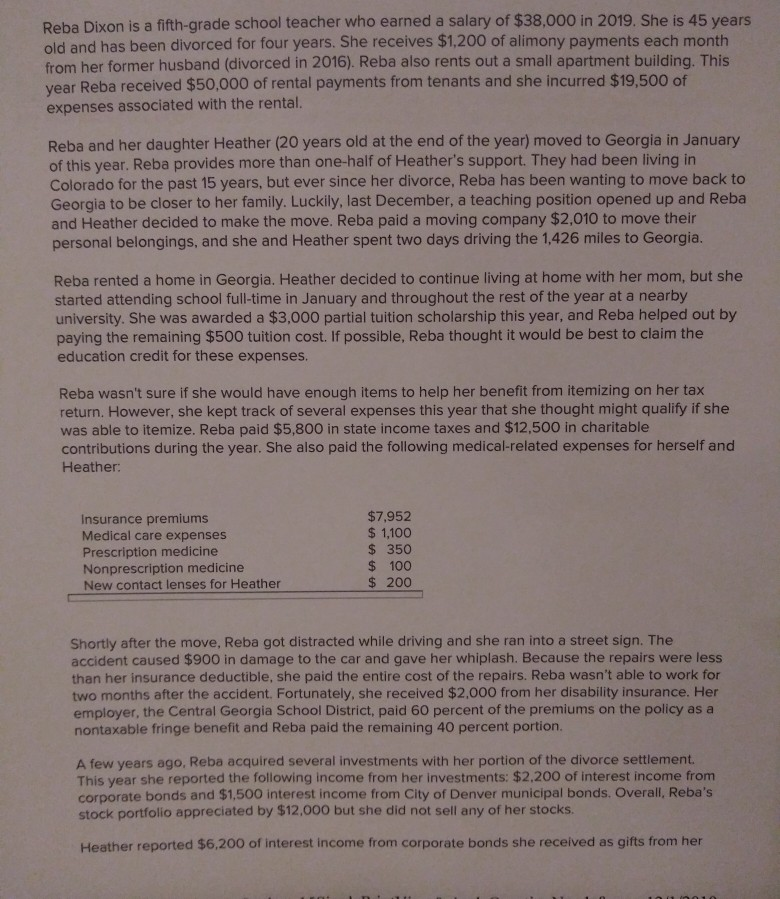

Tax refund processing times vary and depend on the accuracy of the original return but youll get your refund more quickly if you file your return electronically. Expect delays if you mailed a paper return. Georgia tax center help individual income taxes register new business.

An income tax return refund is the result of too much tax withholding estimated tax payments by a taxpayer throughout a tax year. What are my payment options. Local state and federal government websites often end in gov.

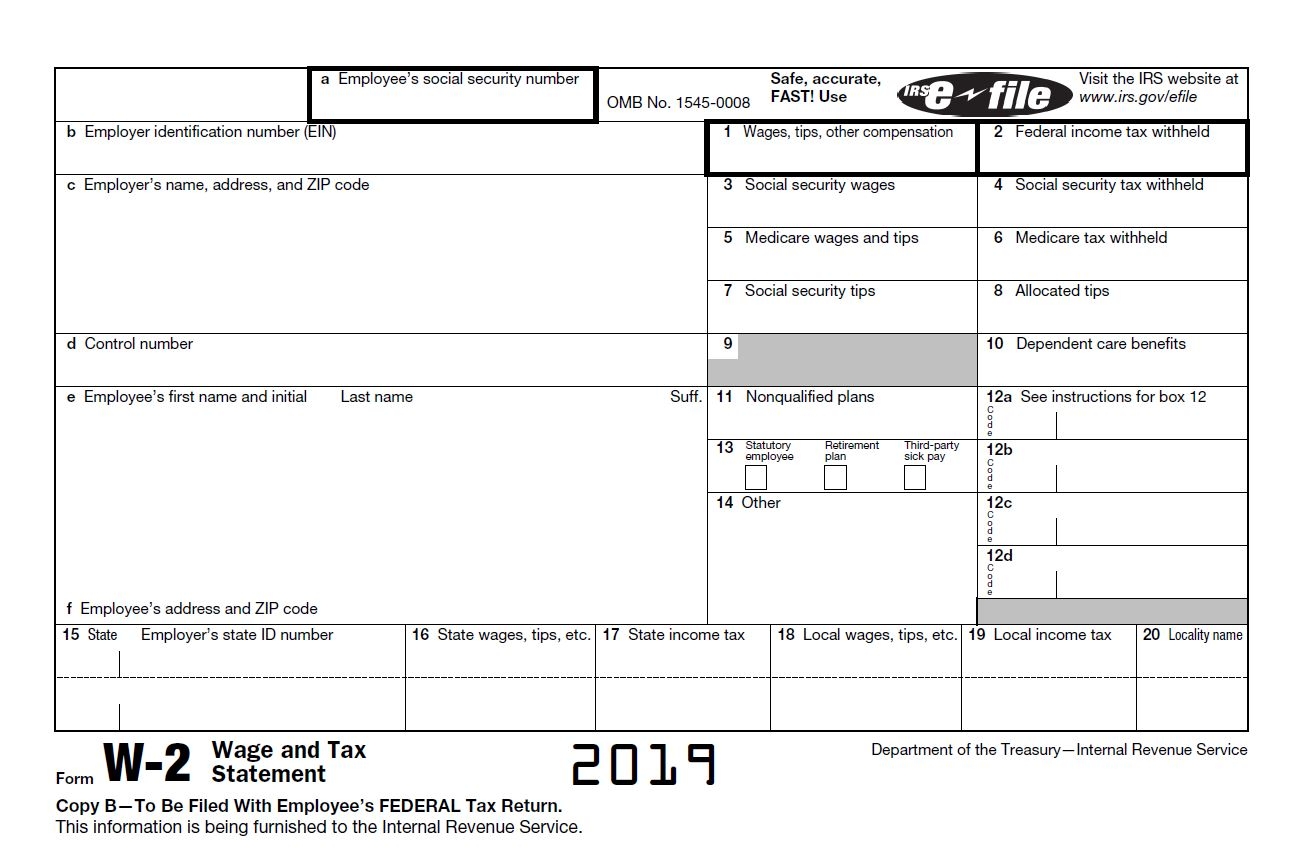

We will begin accepting returns january 27 2020. When filing use the same filing status and due date that was used on the federal income tax return. Please complete your federal return before starting your georgia return.

Georgia tax center help individual income taxes register new business. 500x amended individual income tax return important. Before sharing sensitive or personal information make sure youre on an official state website.

The georgia individual income tax is based on the taxpayers federal adjusted gross income adjustments that are required by georgia law and the taxpayers filing requirements. To successfully complete the form you must download and use the current version of adobe acrobat reader. It may take up to 90 days from the date of receipt by dor to process a return and issue a refund.

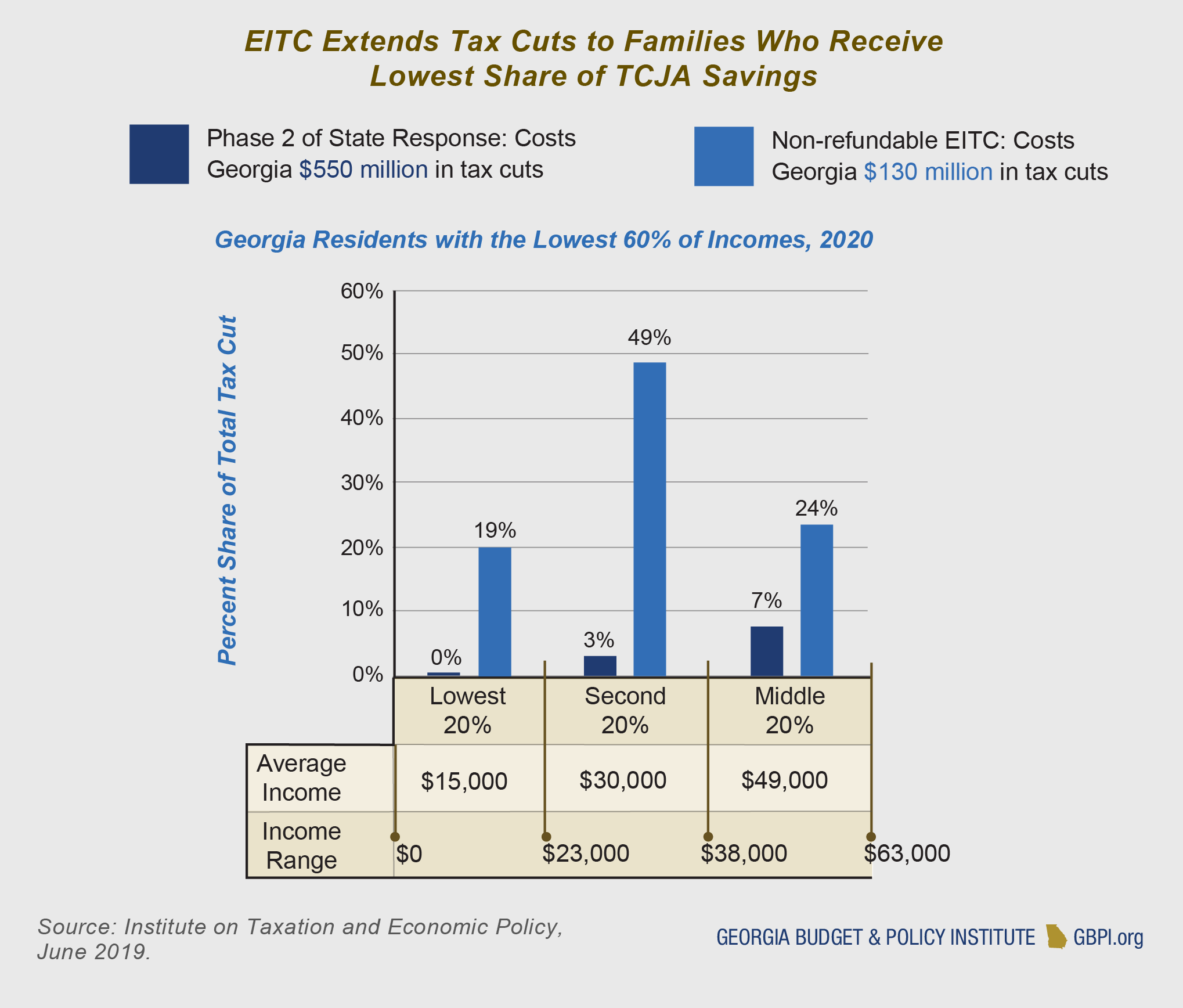

Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575.

:max_bytes(150000):strip_icc()/where-s-your-tax-refund-3193203-v4-5b688dc546e0fb004fc28d4e.png)