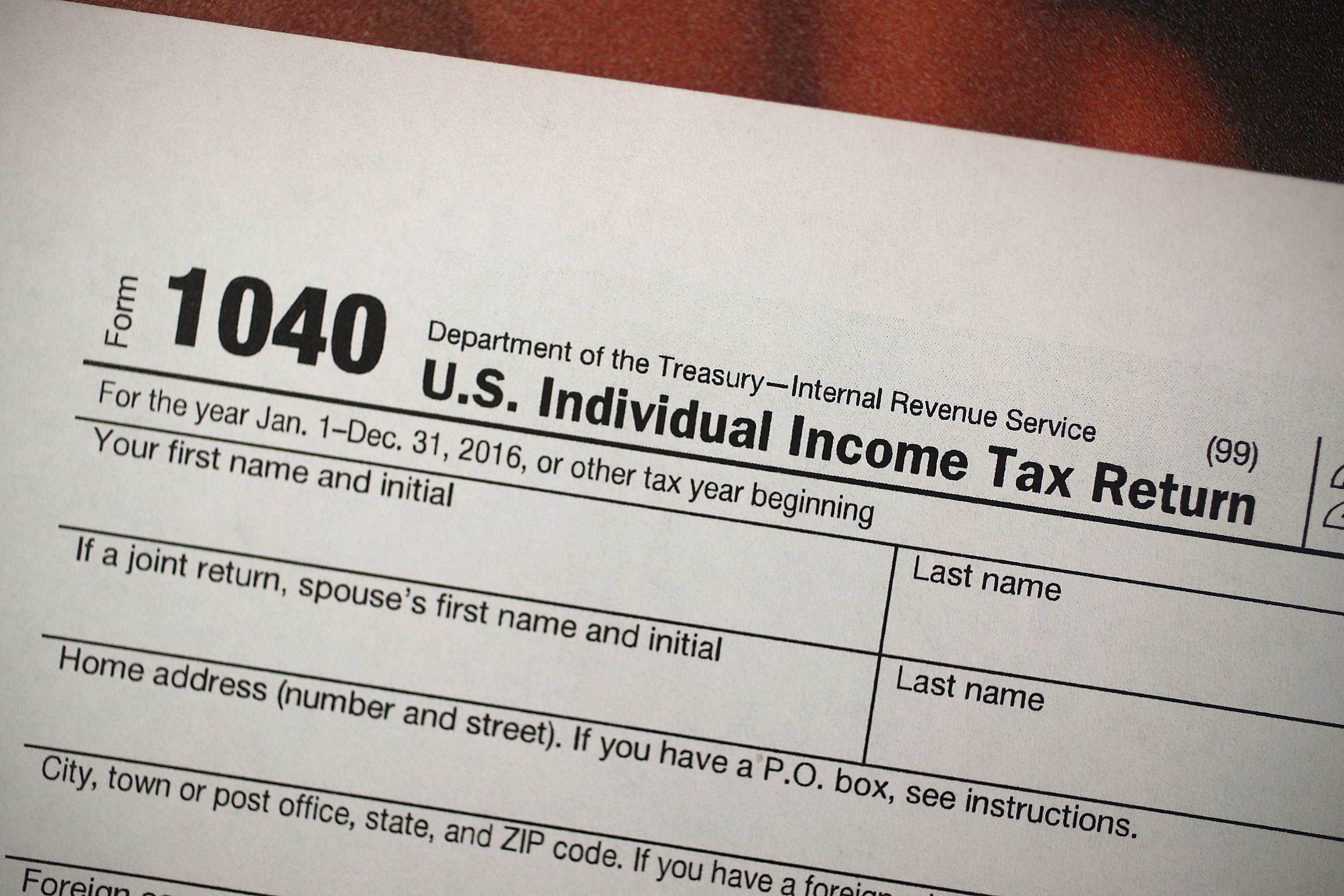

Georgia Income Tax Return Filing Requirements

If your association is not organized for profit write in the net worth tax area of form 600 not applicable exempt homeowners association.

.jpg)

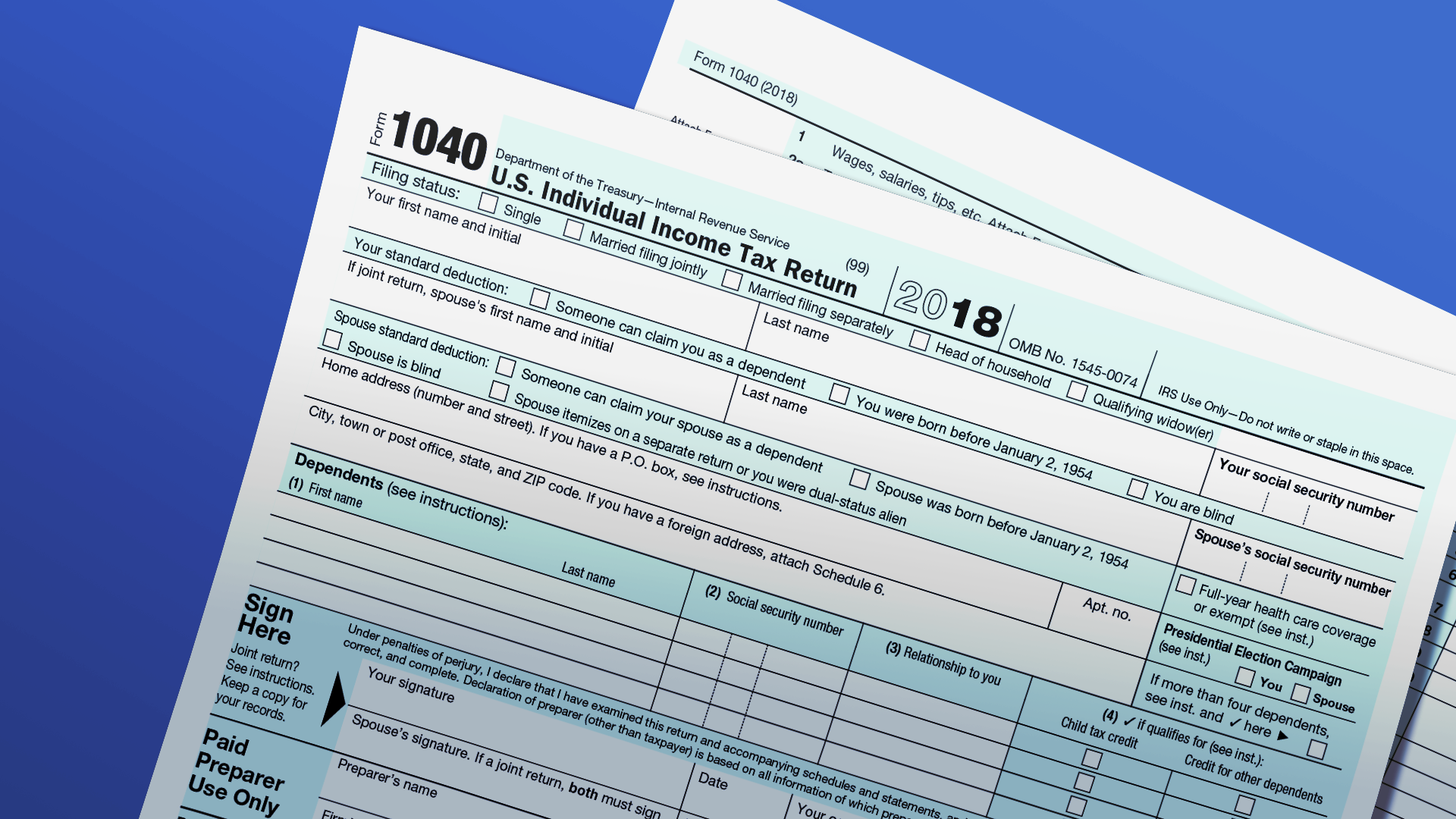

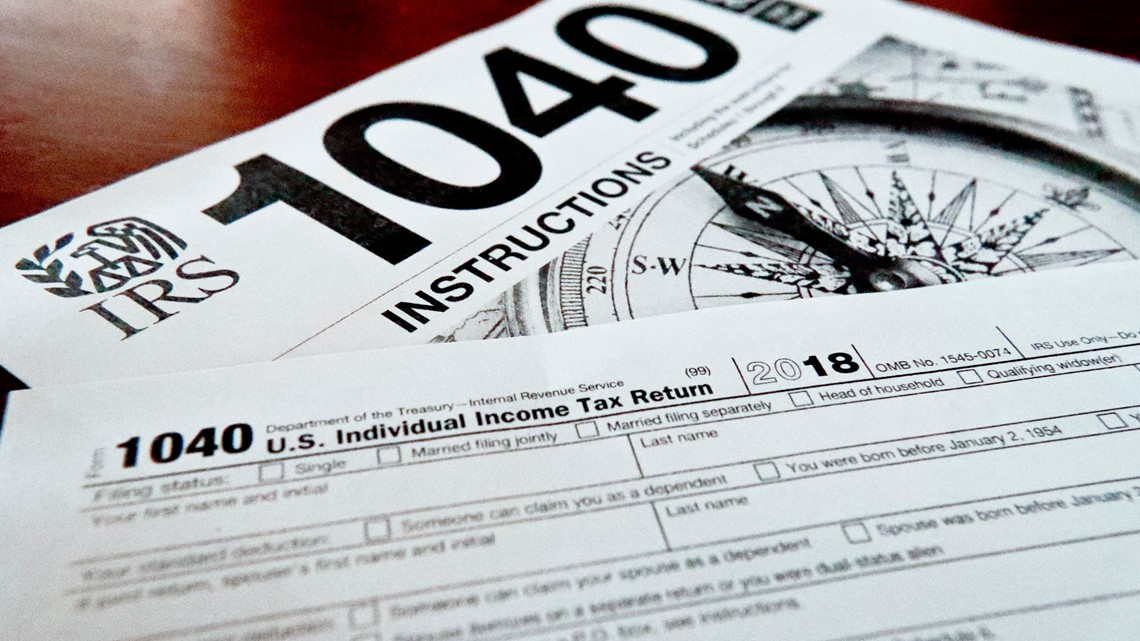

Georgia income tax return filing requirements. For fiduciary income tax returns. If you are single and the head of household you need to file a return if your gross income is greater than 9750. The georgia individual income tax is based on the taxpayers federal adjusted gross income adjustments that are required by georgia law and the taxpayers filing requirements.

It generally has three years from the date a tax return is filed to begin an audit and it has 10 years from the date a tax return is filed to collect a tax. Popular online tax services. Filing state taxes the basics.

You are required to file a federal return. Search for income tax statutes by keyword in the official code of georgia. You are required to file a georgia tax return if any of the following apply to you.

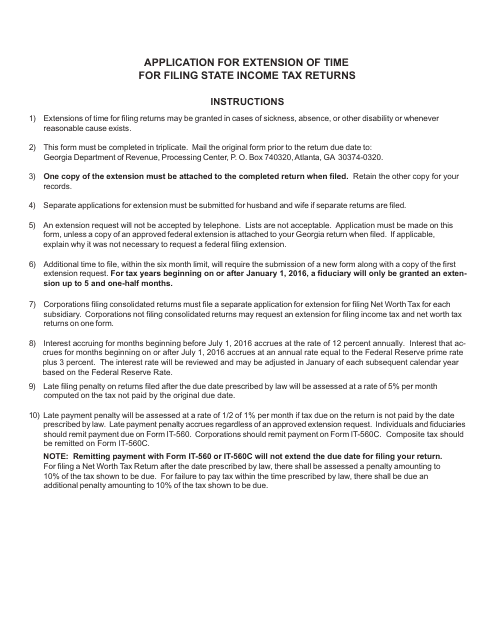

Part year residents if you are a legal resident of georgia for only a portion of the tax year and are required to file a federal income tax return you are required to file. Please complete your federal return before starting your georgia return. Filing requirements for full and part year residents and military personnel.

Wednesday july 15 2020 is the due date for georgia individual income tax tax returns must be received or postmarked by the due date. The gov means its official. You are required to file a federal return you have income subject to georgia income tax that is not subject to federal income tax.

Your federal return contains information necessary for completing your georgia return. We do not have a form equivalent to form 1120 h list only the federal taxable income on form 600 and attach a copy of form 1120 h. State of georgia government websites and email systems use georgiagov or gagov at the end of the address.

Nonresidents who work in georgia or receive income from georgia sources and are required to file a federal income tax return are required to file a georgia income tax return. Local state and federal government websites often end in gov. Filing a return as a precaution.

According to the instructions for form 500 for georgia full year residents are taxed on all income except tax exempt income regardless of the source or where derived. Some examples of georgia source income are wages georgia lottery winnings income from flow through entities s corporations partnerships llcs trusts and estates. Do i have to file taxes with the state of georgia.

The irs has certain time limits called statutes of limitations for issuing tax refunds conducting audits and collecting taxes someone might owe. This years individual income tax forms. If you are married filing a joint return you must file a return if your gross income is greater than 19500.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/315063-00-F-56a938535f9b58b7d0f95b2c.jpg)