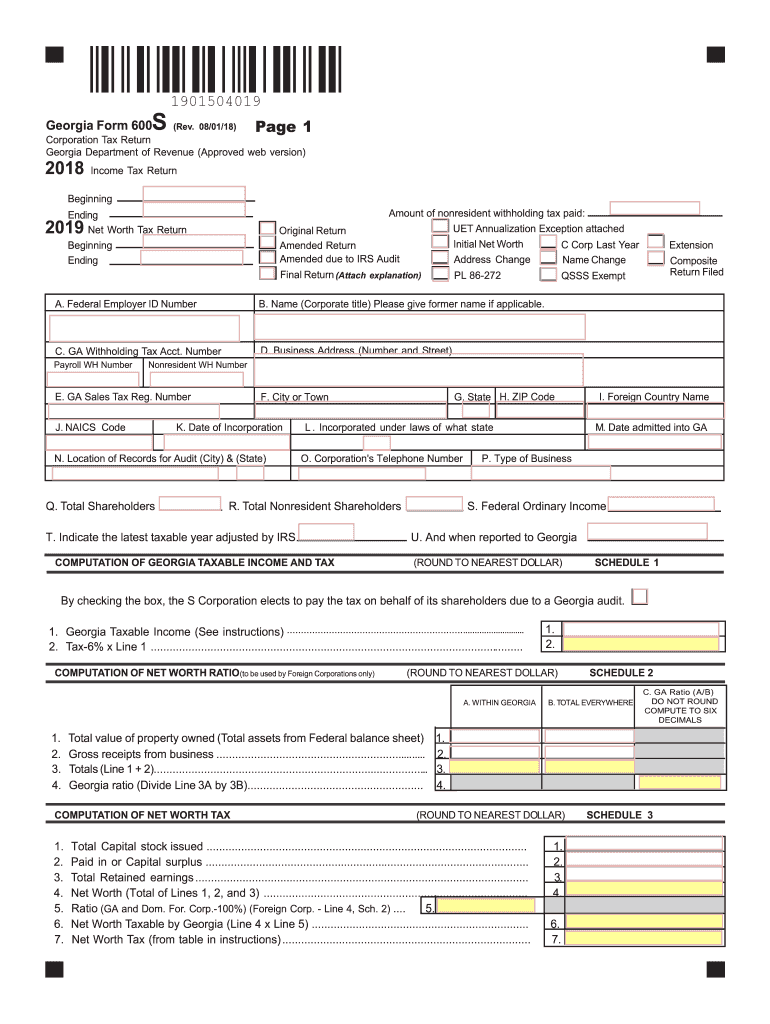

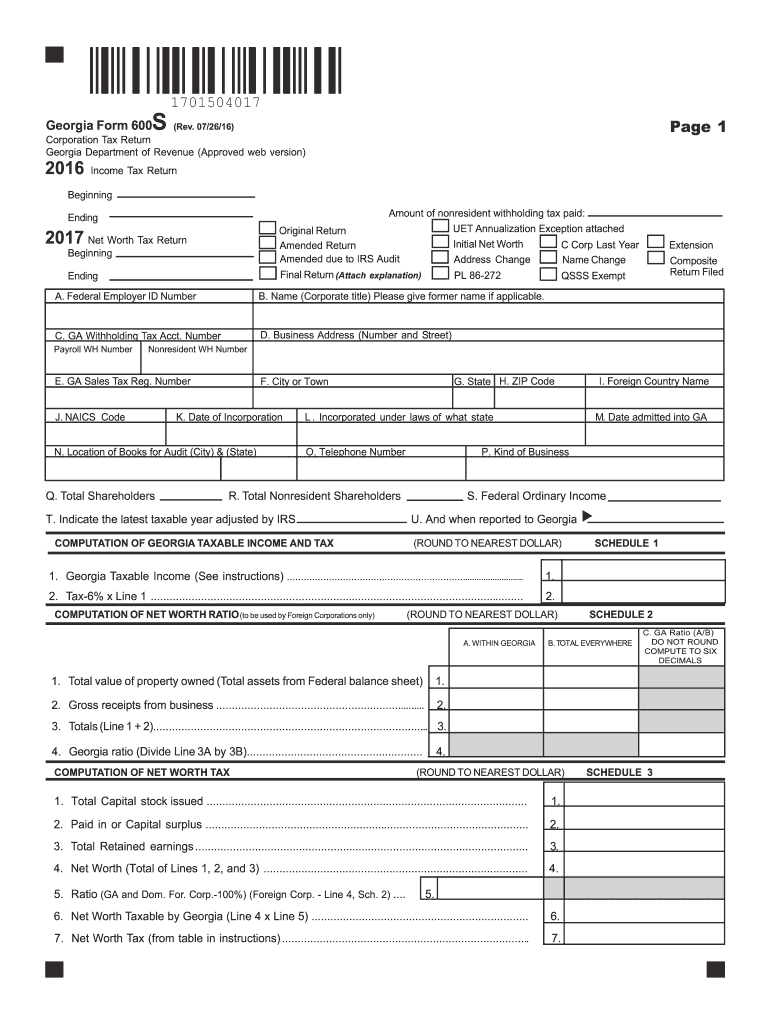

Georgia Income Tax Return Instructions 2019

Corporation income tax general instructions booklet.

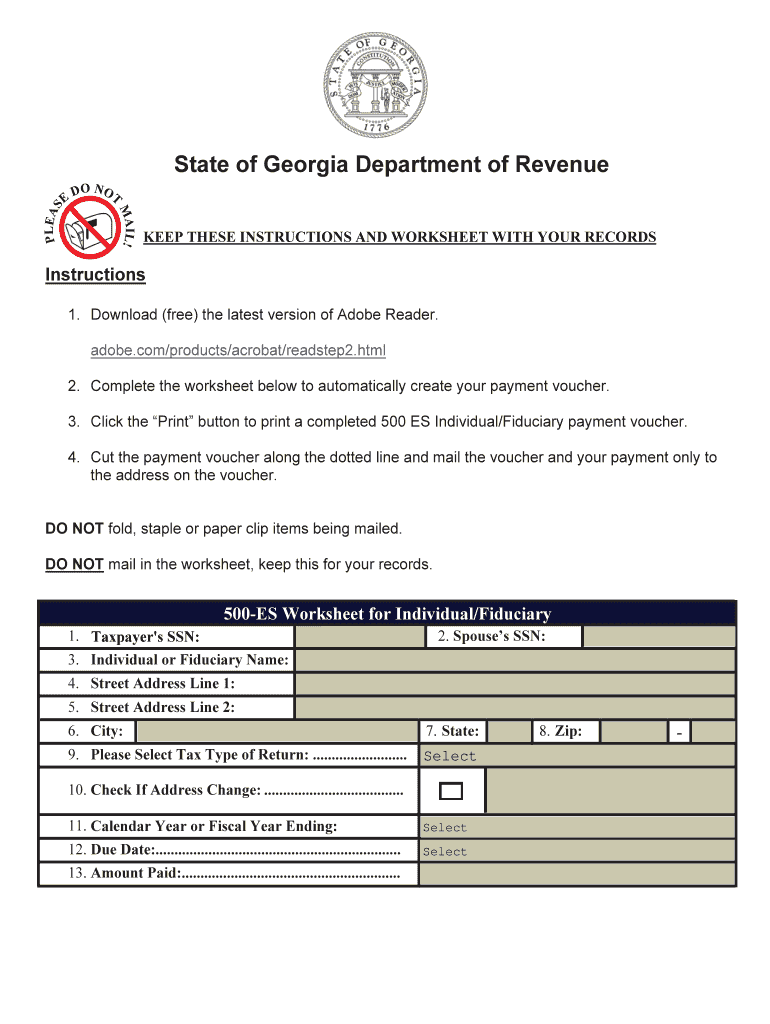

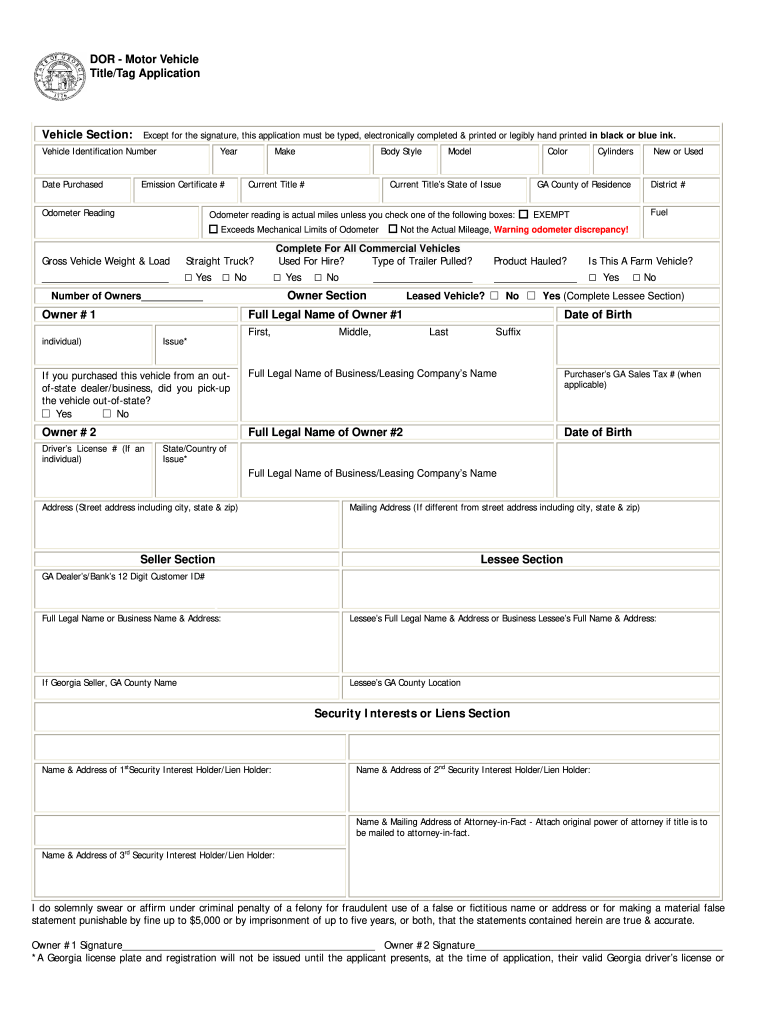

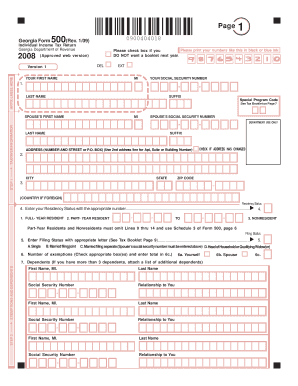

Georgia income tax return instructions 2019. The georgia form 500 instructions and the most commonly filed individual income tax forms are listed below on this page. To successfully complete the form you must download and use the current version of adobe acrobat reader. For fiduciary income tax returns.

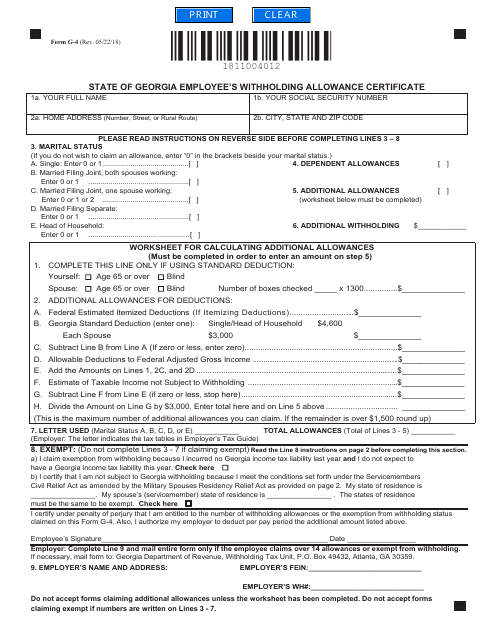

Georgia tax center help individual income taxes register new business. 2019 501 fiduciary income tax return 129 mb 2018 501 fiduciary income tax return 197 mb. Only report income on which georgia tax was withheld.

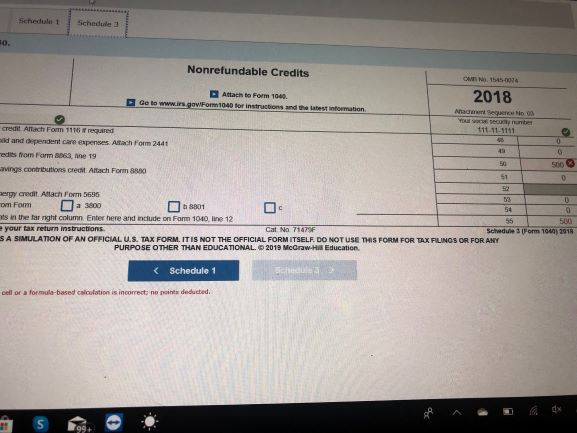

However if your return is more complicated for example you claim certain deductions or credits or owe. The gov means its official. The state income tax table can be found inside the georgia form 500 instructions booklet.

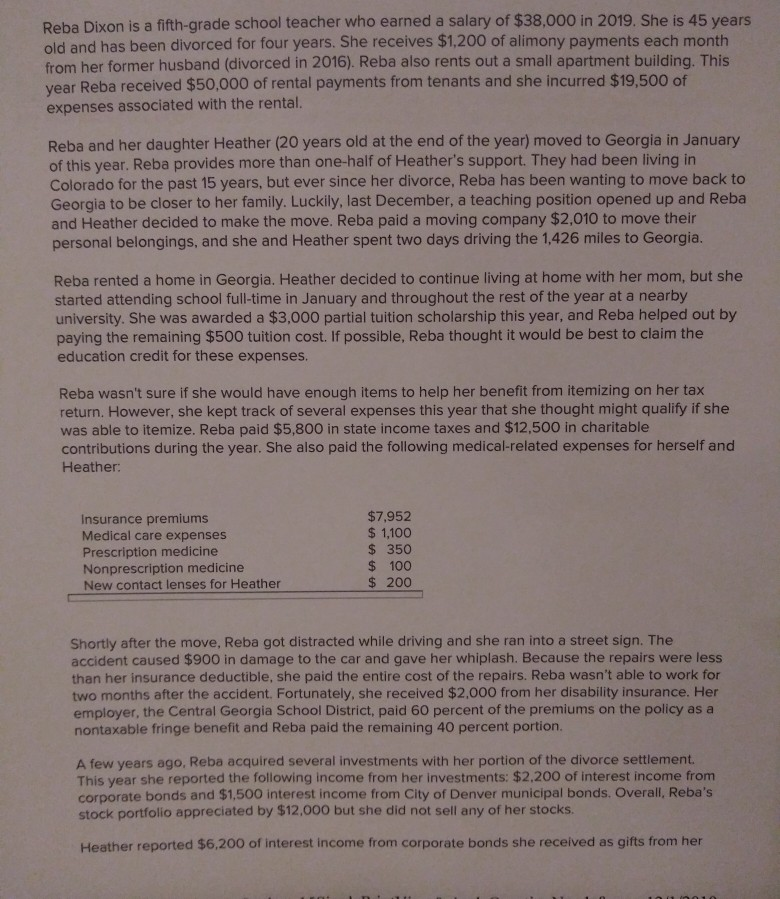

Georgia individual income tax is based on the taxpayers federal adjusted gross income adjustments that are required by georgia law and the taxpayers filing requirements. Please complete the income statement details section. State of georgia government websites and email systems use georgiagov or gagov at the end of the address.

The georgia income tax rate for tax year 2019 is progressive from a low of 1 to a high of 575. Include a copy of these statements with your return or this amount will not be allowed. 500 individual income tax return 500 individual income tax return.

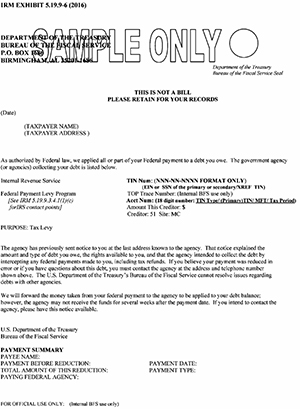

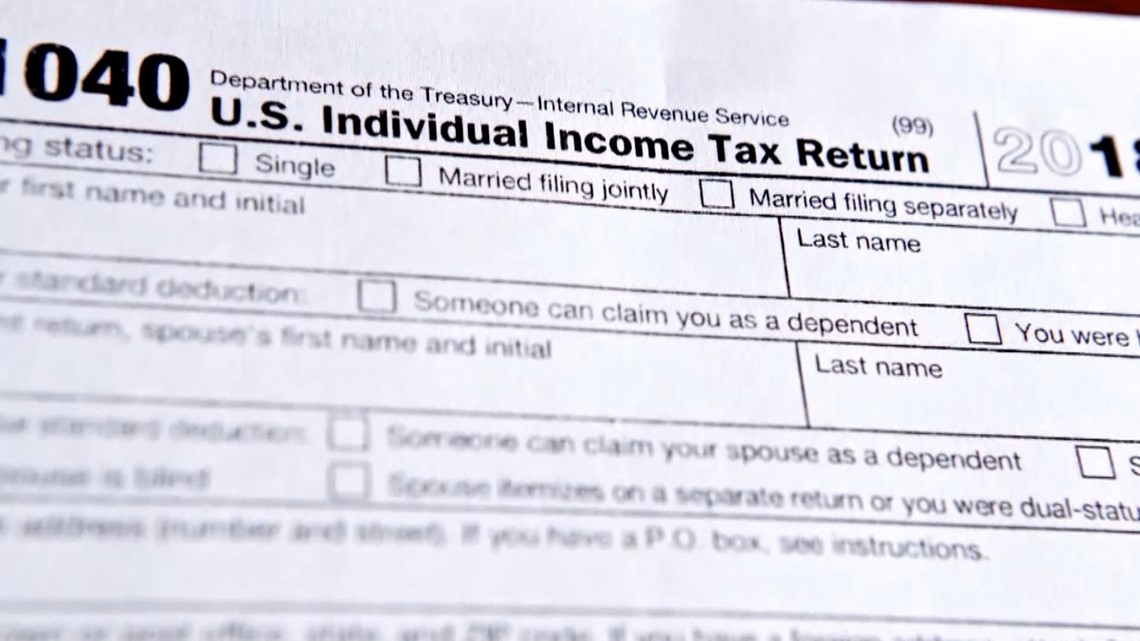

Your federal return contains information necessary for completing your georgia return. What are my payment options. Download 2019 individual income tax forms.

To successfully complete the form you must download and use the current version of adobe acrobat reader. Georgia tax center help individual income taxes register new business business taxes. 500x amended individual income tax return important.

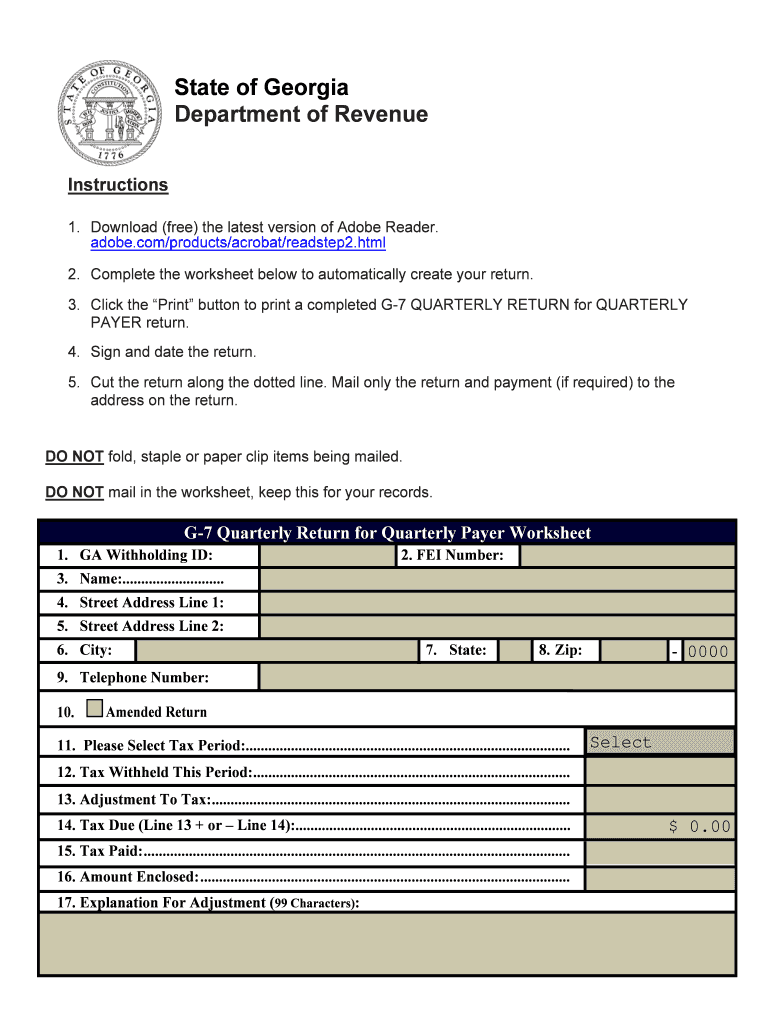

The georgia individual income tax is based on the taxpayers federal adjusted gross income adjustments that are required by georgia law and the taxpayers filing requirements. 2009 it 511 individual income tax booklet 47318 kb 2008 it 511 individual income tax booklet 46006 kb 2007 it 511 individual income tax booklet 2426 kb. Enter w 2s 1099s and g 2as on line 4 ga wagesincome.

Local state and federal government websites often end in gov. Please complete your federal return before starting your georgia return. Enter georgia income tax withheld on g2 a g2 fl g2 lp andor g2 rp.

Georgia tax center help individual income taxes register new business. For 2019 you will use form 1040 or if you were born before january 2 1955 you have the option to use new form 1040 sr. 2019 500 individual income tax return 18 mb 2018 500 individual income tax return.