Georgia Dept Of Revenue Sales Tax

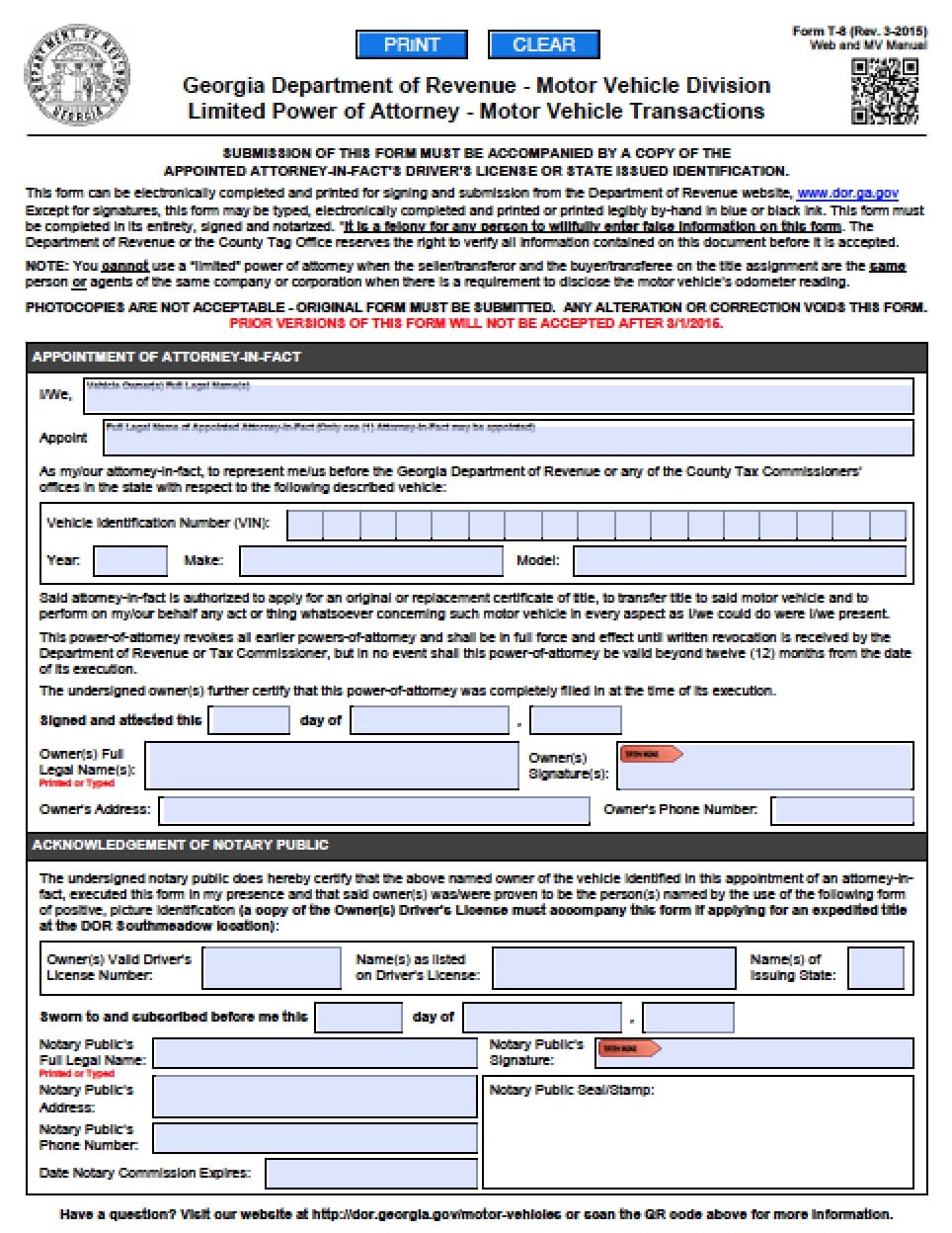

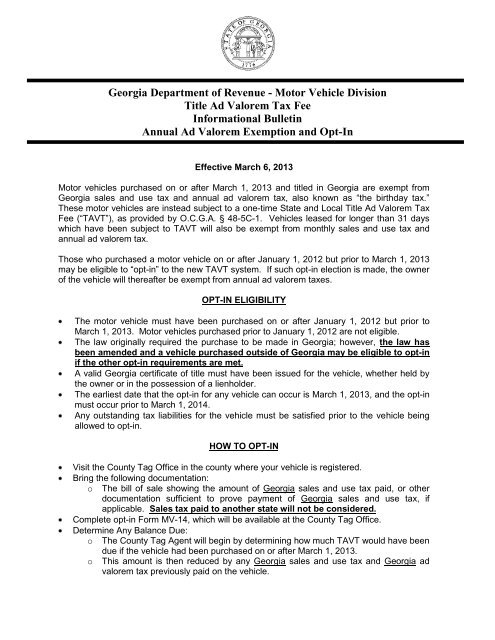

Please visit the webpage when where to register your vehicle for more information about the vehicle registration process.

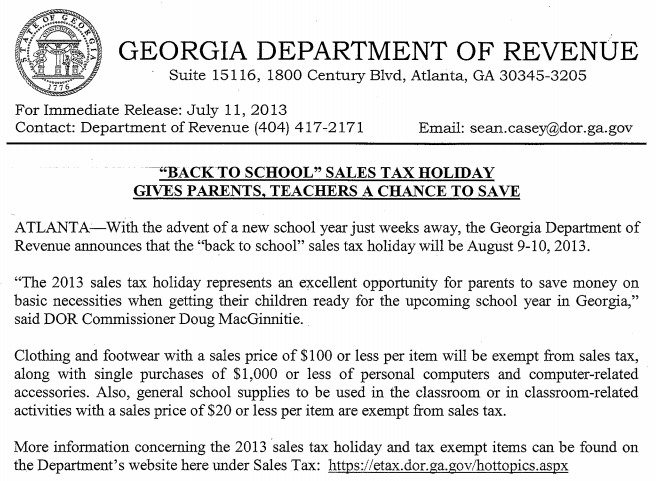

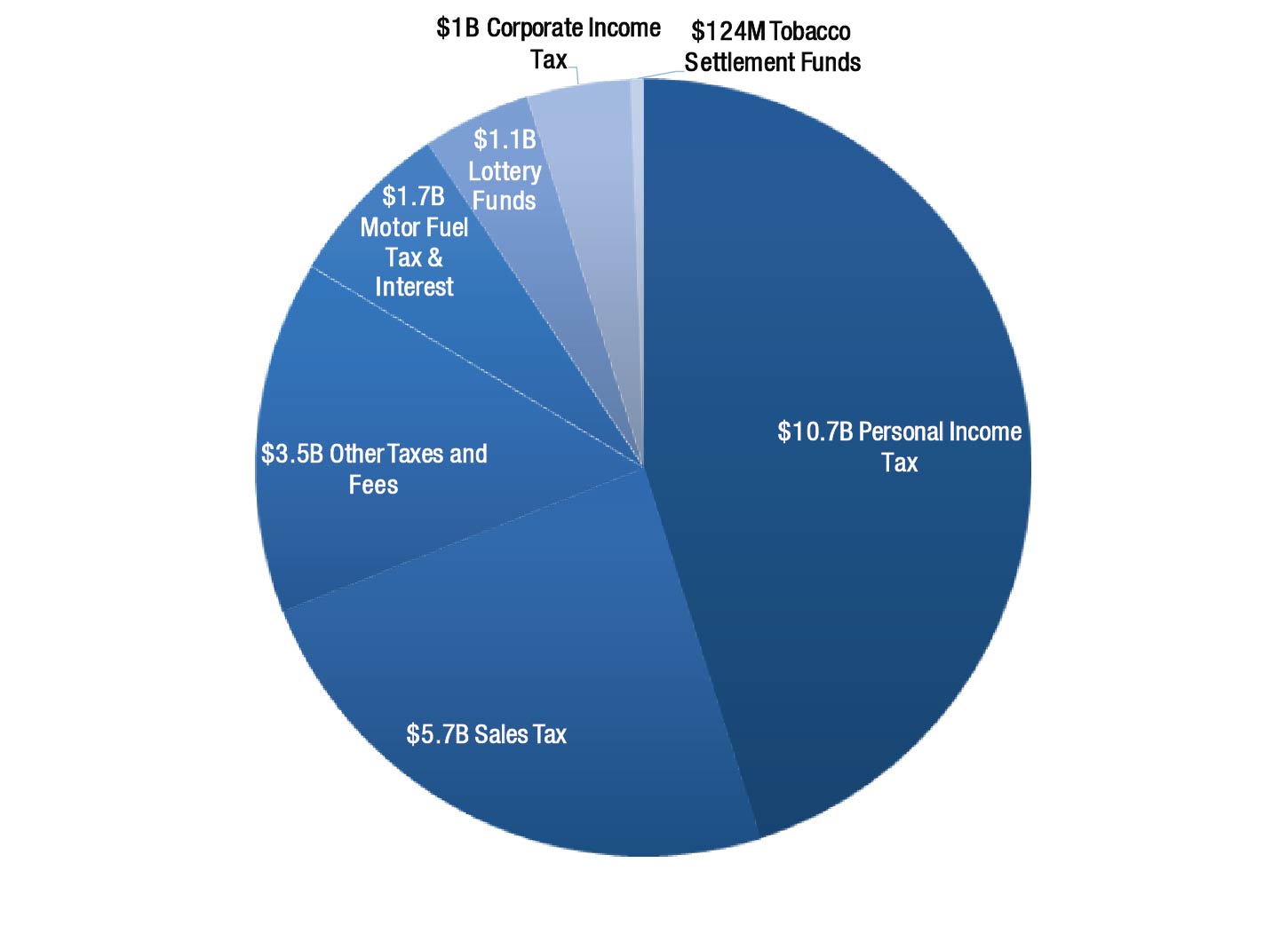

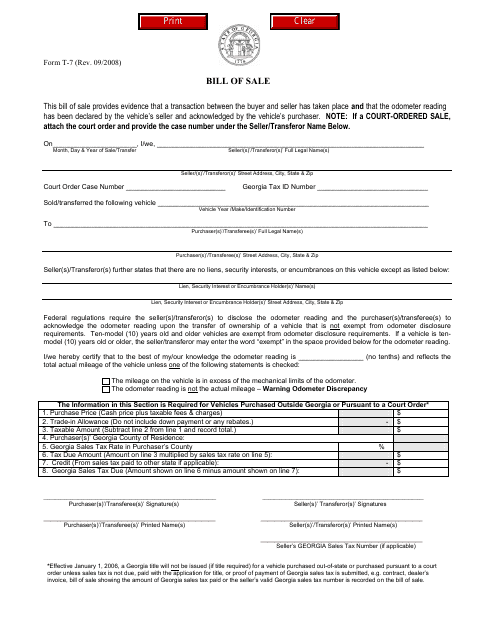

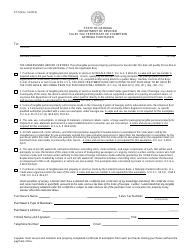

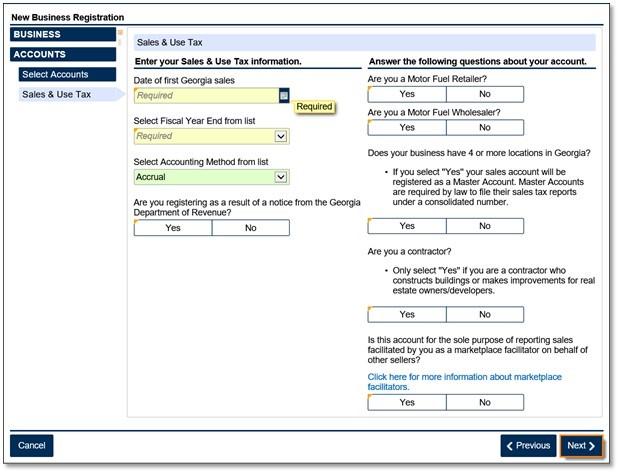

Georgia dept of revenue sales tax. The tax must be paid at the time of sale by georgia residents or within six months of establishing residency by those moving to georgia. Returns and payments are due on the 1st and late after the 20th day of the month following each reporting period. Tips for completing the sales and use tax return on gtc sales use tax import return filing and remittance requirements this is a link to rule 560 12 1 22 on the georgia secretary of states website.

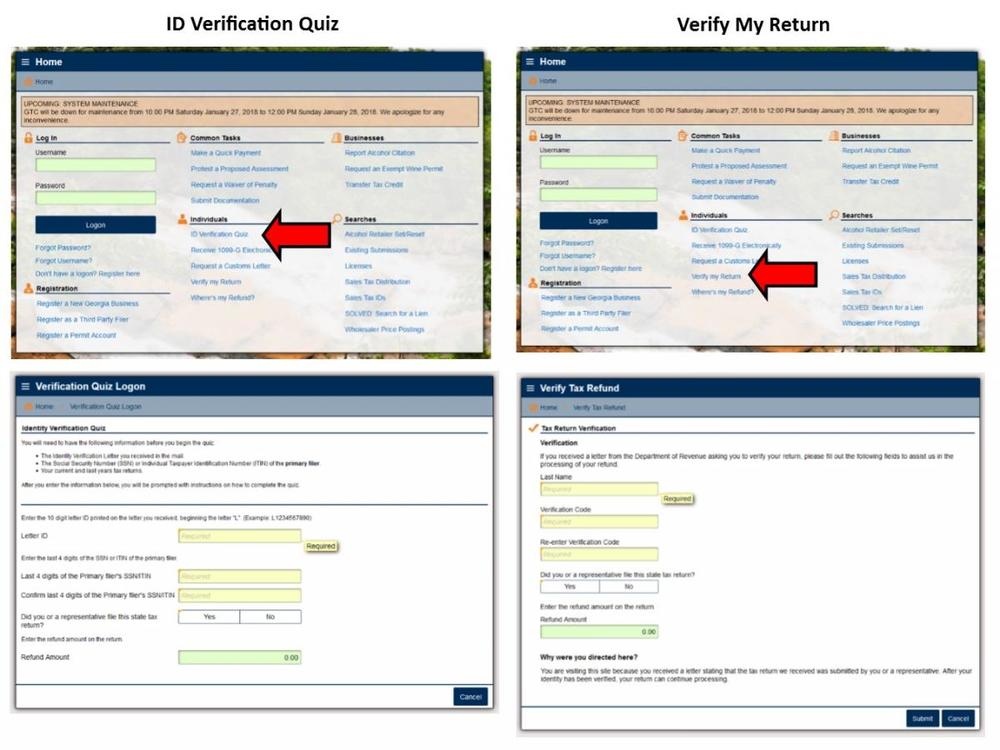

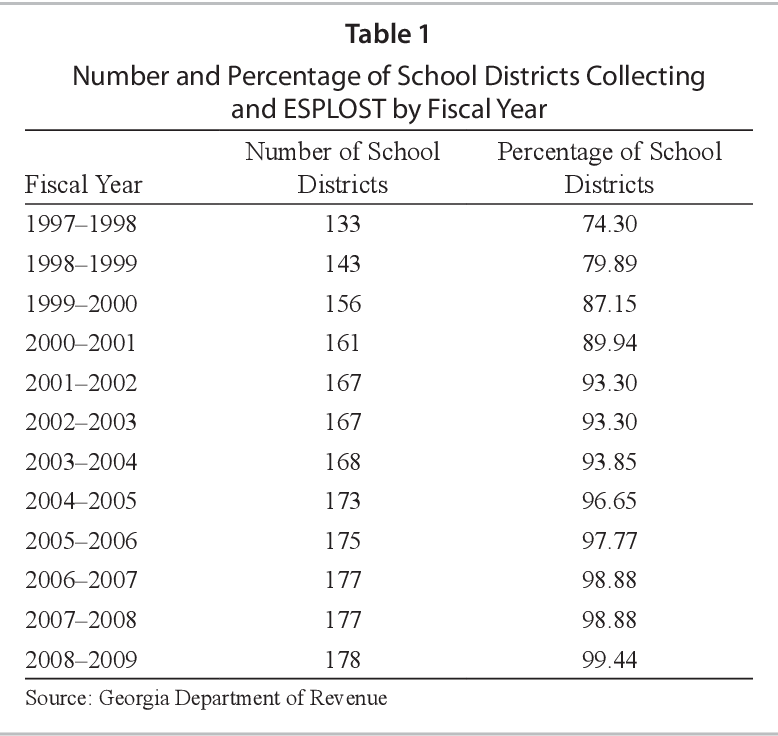

Additionally taxpayers can still conduct all business with the department via online services telephone or designated secure lockbox locations. For additional information regarding sales tax please contact the department of revenues regional office serving your county. The published sales tax rates for counties include the state of georgias sales tax rate.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable serviceslocal taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. Due to covid 19 customers will be required to schedule an appointment. Sales and use tax is reported using a sales and use tax return form dr 15 instructions form dr 15n are availableyou can file and pay sales and use tax electronically using the departments free and secure file and pay webpage or you may purchase software from a vendor.

This tax is based on the value of the vehicle.