Georgia Dept Of Revenue Sales Tax Login

The dor has online tools to help you open an account and file your taxes.

Georgia dept of revenue sales tax login. Sales use tax import return filing and remittance requirements this is a link to rule 560 12 1 22 on the georgia secretary of states website sales tax id verification tool. What is the georgia tax center. Florida department of revenue the florida department of revenue has three primary lines of business.

For individuals the 1099 g will no longer be mailed. It is recommended that you change your email spam filter settings to not treat emails for dorgagov as spam. Returns and payments are due on the 1st and late after the 20th day of the month following each reporting period.

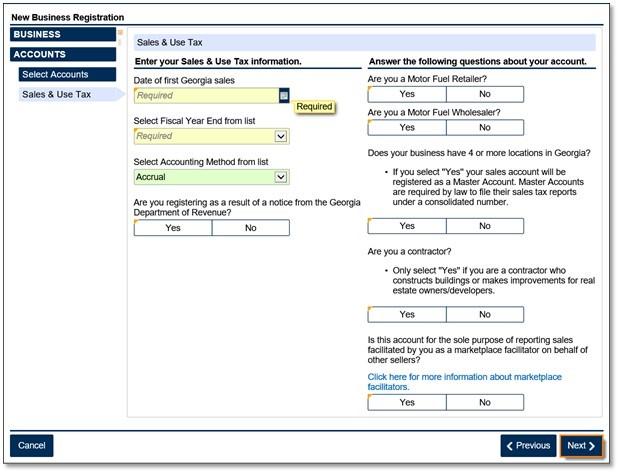

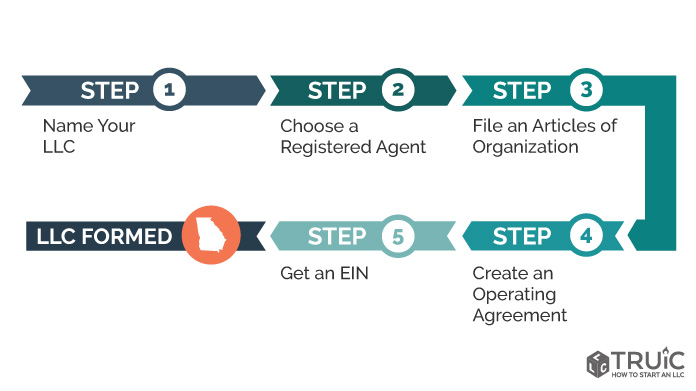

You are required to file and pay electronically if you owe more than 50000 in connection with any return report or other document pertaining to sales tax or use tax required to be filed with the department even if some payments for those tax types subsequently fall below 50000. Depending on the type of business you may need to register with the department of revenue dor to collect and periodically pay various types of business taxes. Learn more about gtc.

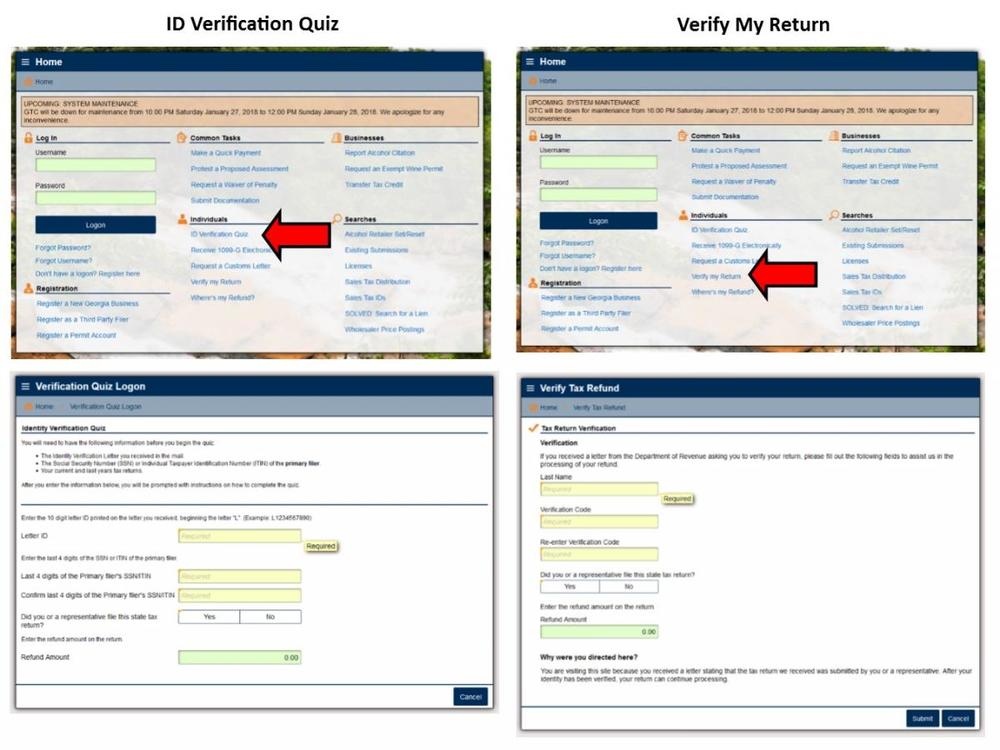

Taxpayers now can search for their 1099 g and 1099 int on the georgia tax center by selecting the view your form 1099 g or 1099 int link under individuals. 2 enforce child support law on behalf of about 1025000 children with 126 billion collected in fy 0607. The georgia tax center gtc is your one stop shop for electronic filing and paying taxes.

Sales and use tax international fuel tax withholding income tax motor fuel 911 prepaid wireless fees alcohol and tobacco licensing motor fuel excise taxes pay fiduciary only available online. You can file and pay the following taxes and fees. Sales and use tax is reported using a sales and use tax return form dr 15 instructions form dr 15n are availableyou can file and pay sales and use tax electronically using the departments free and secure file and pay webpage or you may purchase software from a vendor.

If you have not received the emails from georgia department of revenue with your temporary password please check your email spam folders. 1 administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. You may now close this window.

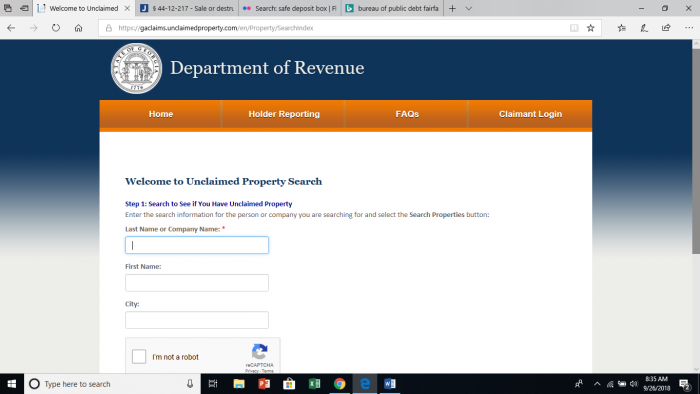

Visit the georgia tax center gtc gtc is an accurate and safe way for individuals and businesses to take care of their state tax needs. Please visit the georgia tax center to file your sales and use tax return electronically. You can access the georgia tax center to register your business or manage business tax accounts.

3 oversee property tax administration involving 109.