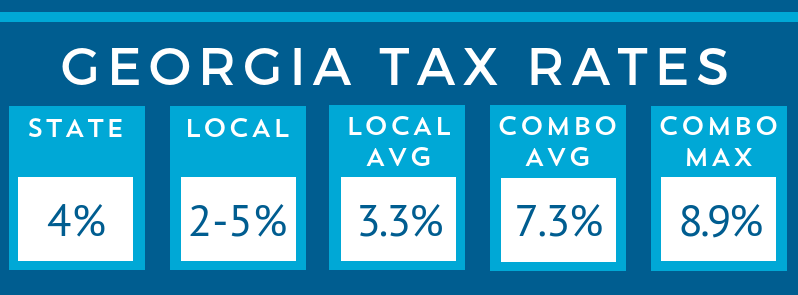

Georgia Dept Of Revenue Sales Tax Rates

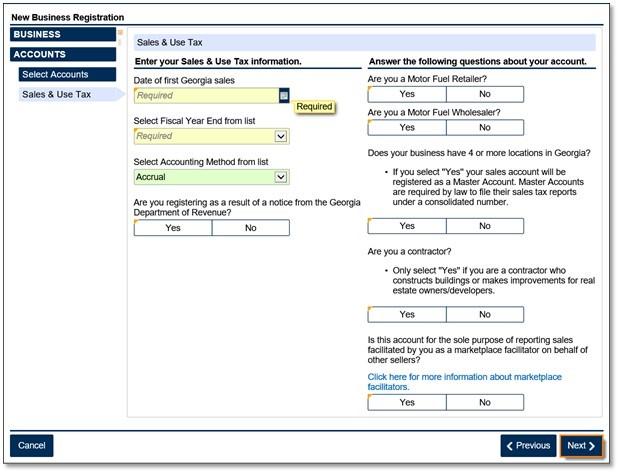

Sales tax rates for energy sold to manufacturers.

Georgia dept of revenue sales tax rates. Local state and federal government websites often end in gov. How can we help. Twitter page for georgia department of revenue.

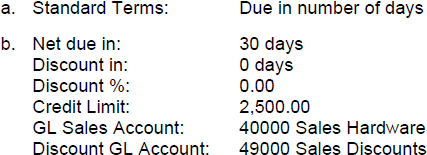

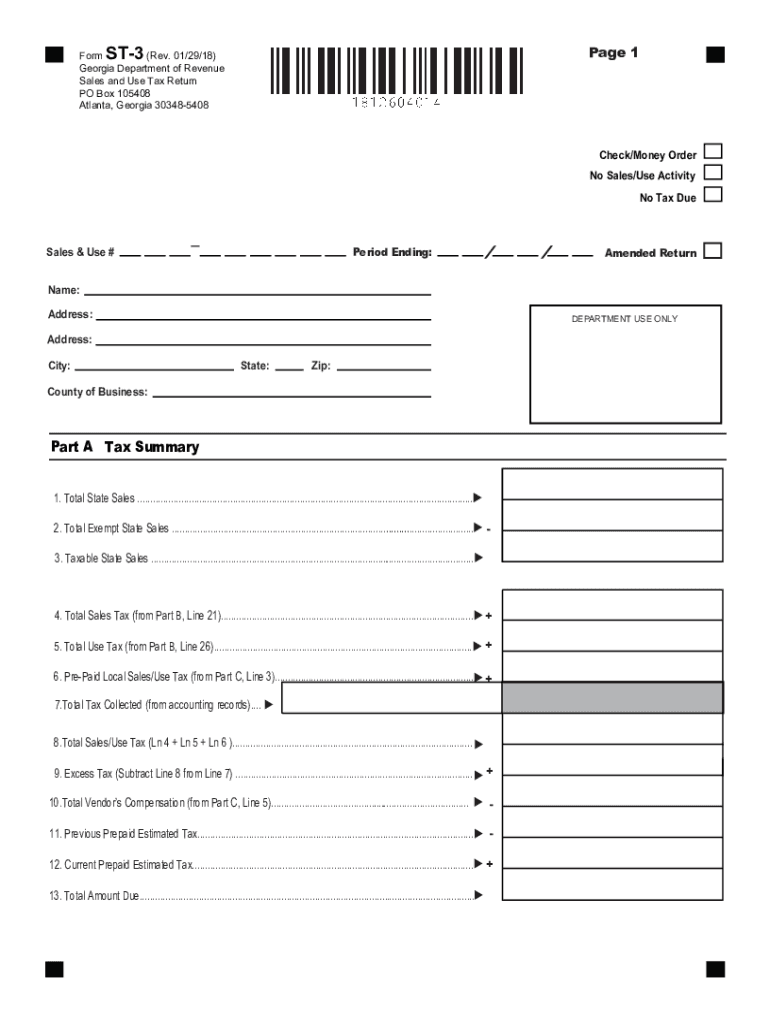

March 2015 historical special clayton county rate change 27951 kb. Historical sales tax chart. Tips for completing the sales and use tax return on gtc sales use tax import return filing and remittance requirements this is a link to rule 560 12 1 22 on the georgia secretary of states website.

The gov means its official. Upcoming quarterly rate changes. July 2020 historical 45752 kb april 2020.

The tax rate for the first 500000 of a motor vehicle sale is 7 because the 1 2nd lost does not apply. State of georgia government websites and email systems use georgiagov or gagov at the end of the address. The generally applicable tax rate in muscogee county is 8 state sales tax at the statewide rate of 4 plus 4 local sales taxes at a rate of 1 each.

Sales tax rates miscellaneous rate codes. State organizations elected officials. Sales tax rates general.

Sales tax rates jet fuel.

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcsc3gs41t6zydfwov1l99kr0qxxbecklilsmvzt Muaifksd Hd Usqp Cau

encrypted-tbn0.gstatic.com

.png?width=800&name=Copy%20of%20Georgia%20Tax%20Rates%20(1).png)

-311932-edited.png?width=800&name=Copy%20of%20Georgia%20Tax%20Rates%20(2)-311932-edited.png)