Georgia State Tax Rate 2020

Filing state taxes the basics.

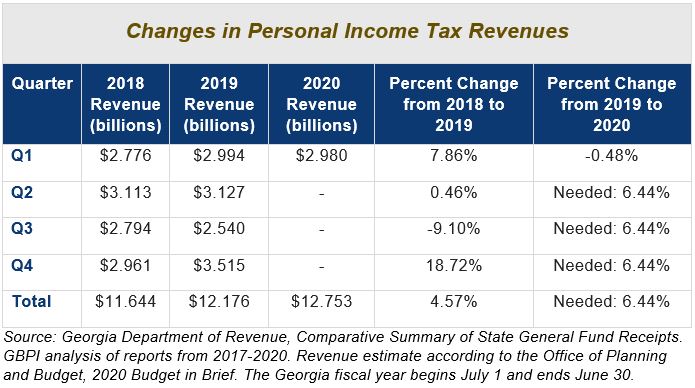

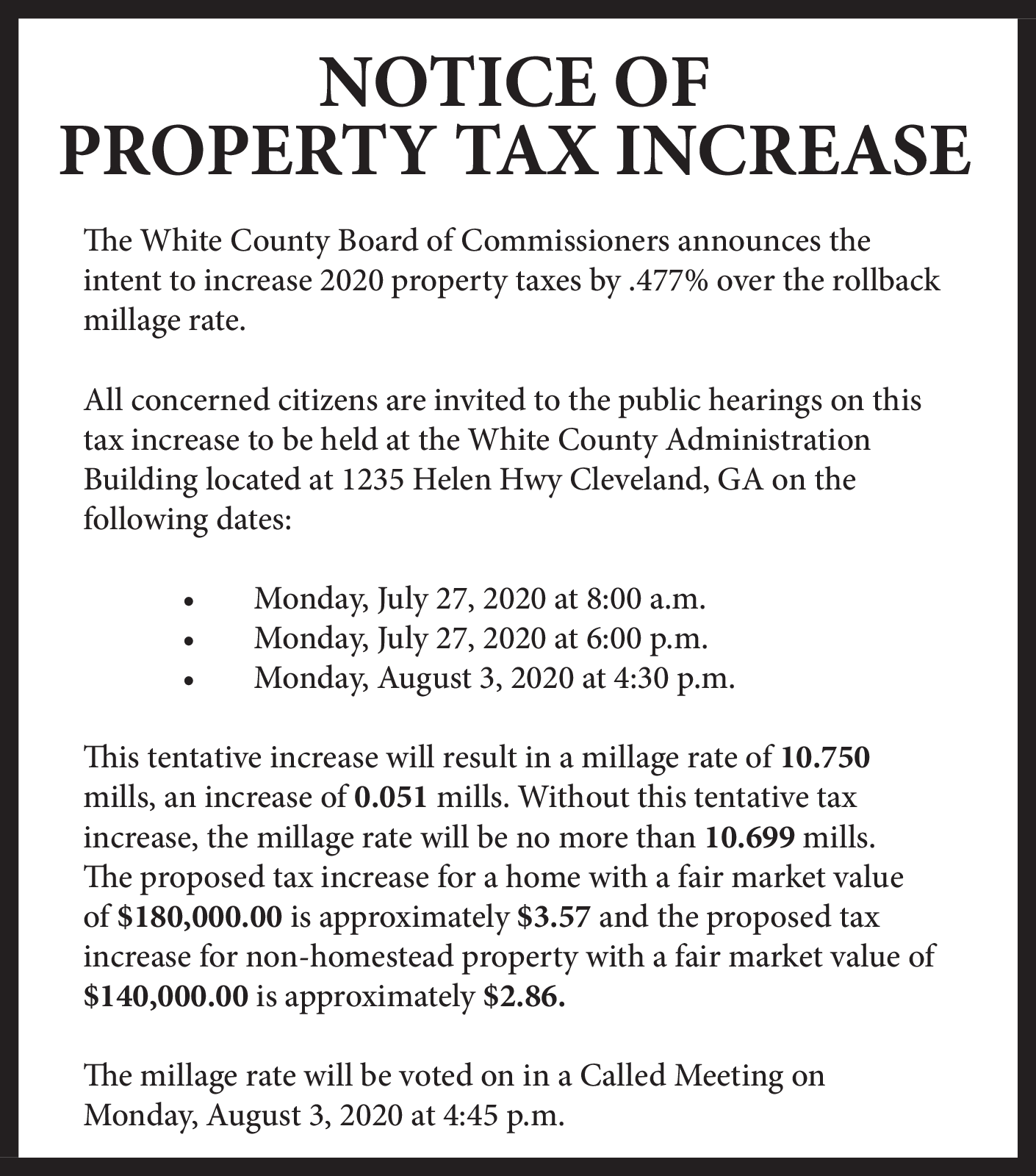

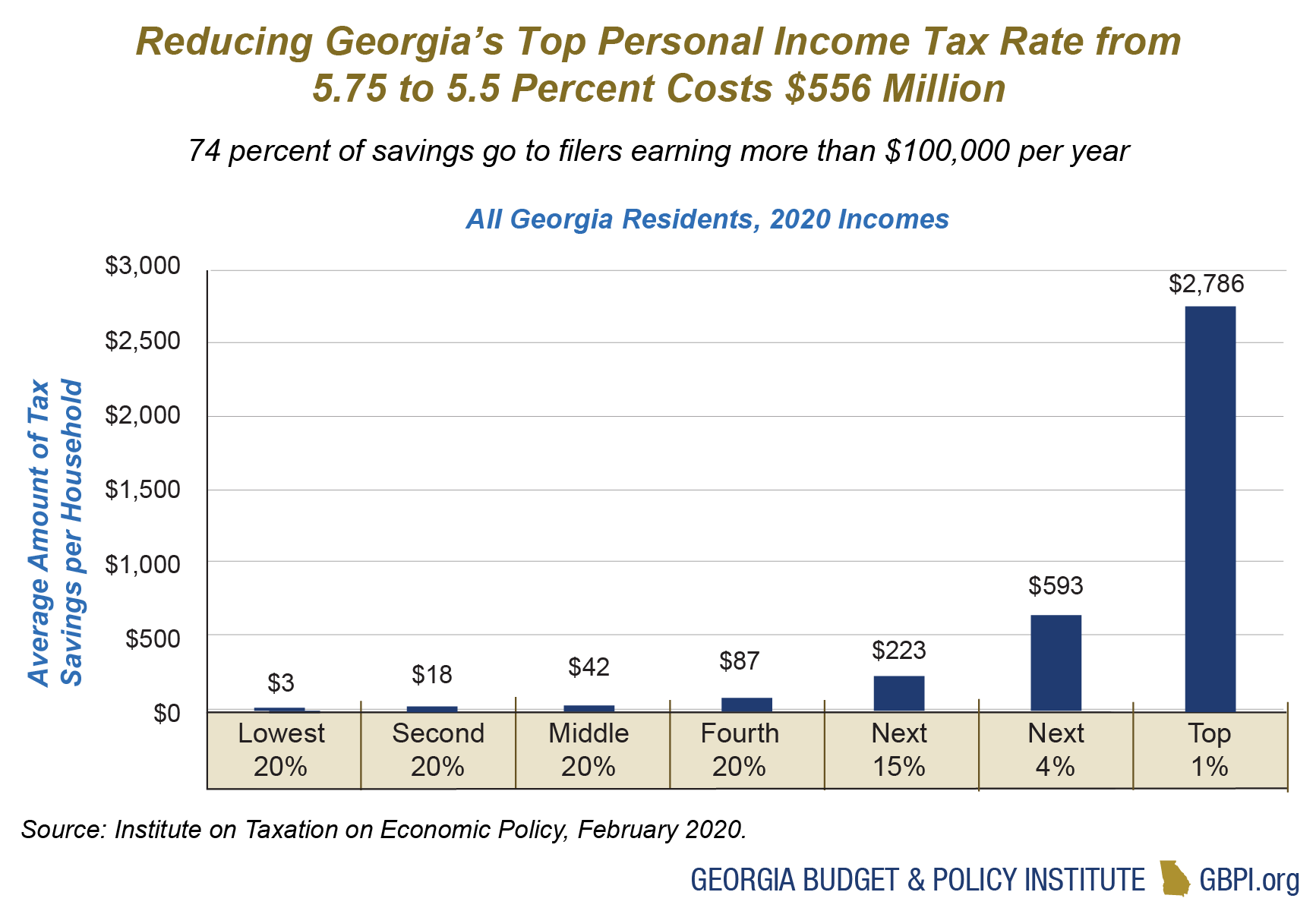

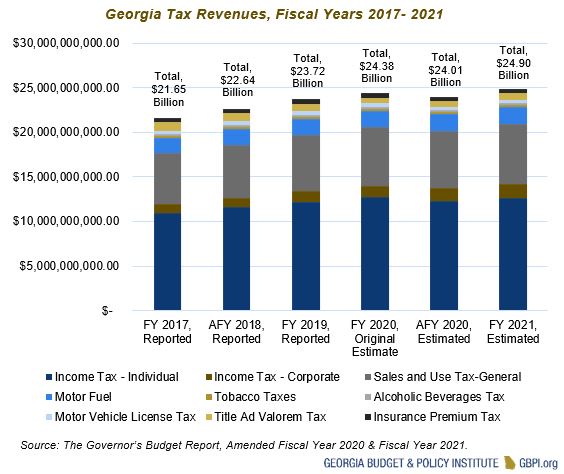

Georgia state tax rate 2020. County rates in georgia range from less than 050 to over 180. The georgia income tax has six tax brackets with a maximum marginal income tax of 575 as of 2020. The 2002 law established a system by which in any year in which revenue growth exceeded a specified baseline the individual income tax rate.

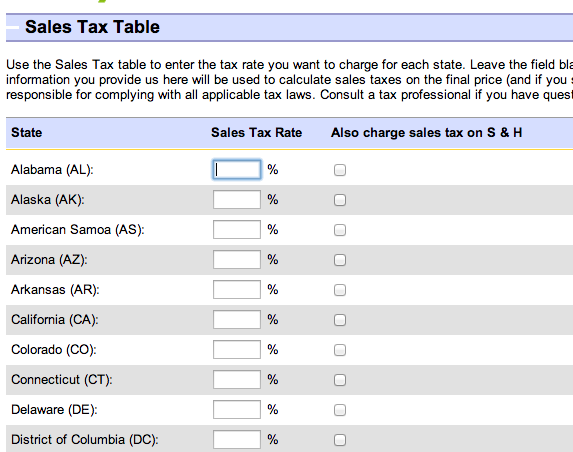

Popular online tax services. Sales tax rates general general rate chart effective beginning july 1 2020 6704 kb general rate chart effective april 1 2020 through june 30 2020 2202 kb. Filing requirements for full and part year residents and military personnel.

Combined with the state sales tax the highest sales tax rate in georgia is 89 in the cities of. The georgia department of revenue is responsible for publishing the latest georgia state tax. Changes from 2019 are highlighted in yellow.

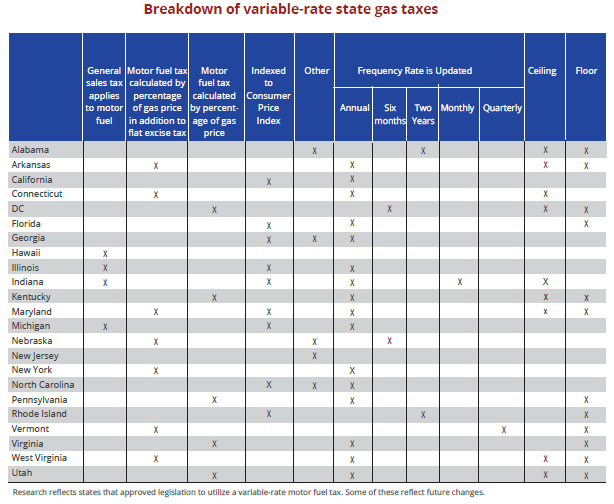

Georgia has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4there are a total of 311 local tax jurisdictions across the state collecting an average local tax of 3491. Effective october 1 2018 the generally applicable tax rate in ware county is 9 state sales tax at the statewide rate of 4 plus 5 local sales taxes at a rate of 1 each. This years individual income tax forms.

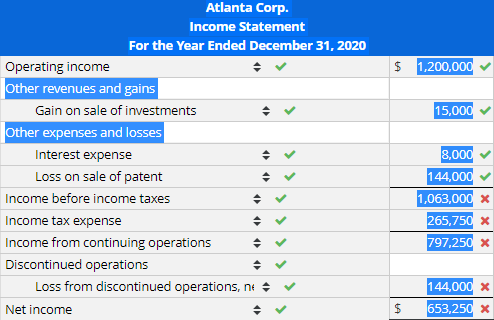

Note that the flat 37 rate applies even if an employee has submitted a federal form w 4 claiming exemption from federal income tax withholding. Start filing your tax return now. There are 30 days left until taxes are due.

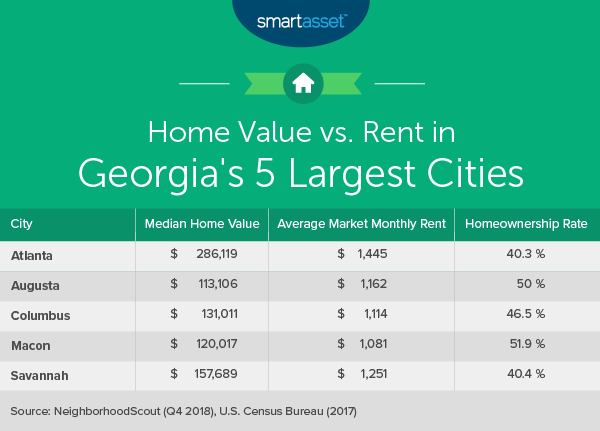

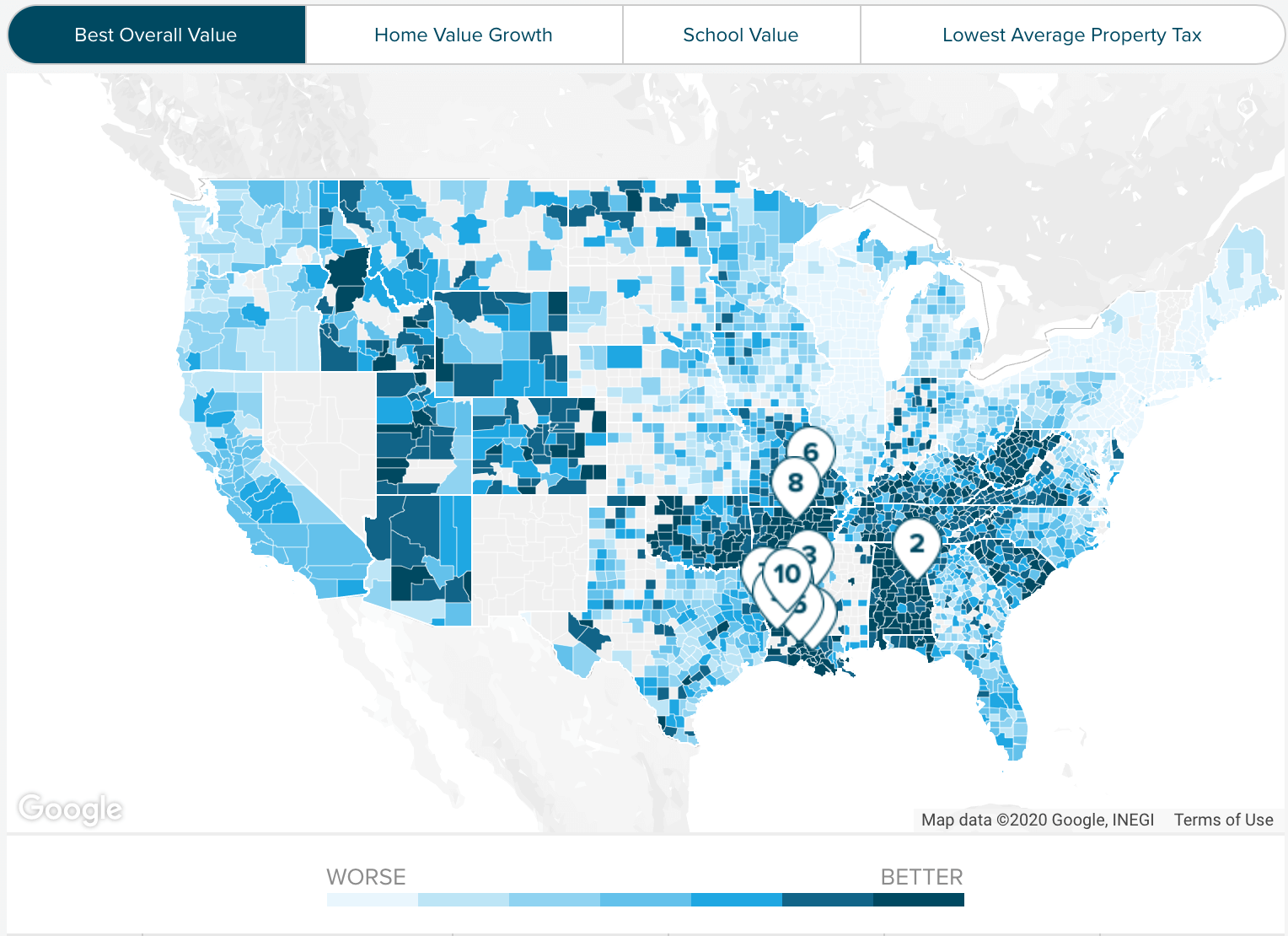

In fulton county the states most populous the effective property tax rate is 103. Click here for a larger sales tax map or here for a sales tax table. If you are considering purchasing a property in georgia or are thinking about refinancing this mortgage guide is a great place to start.

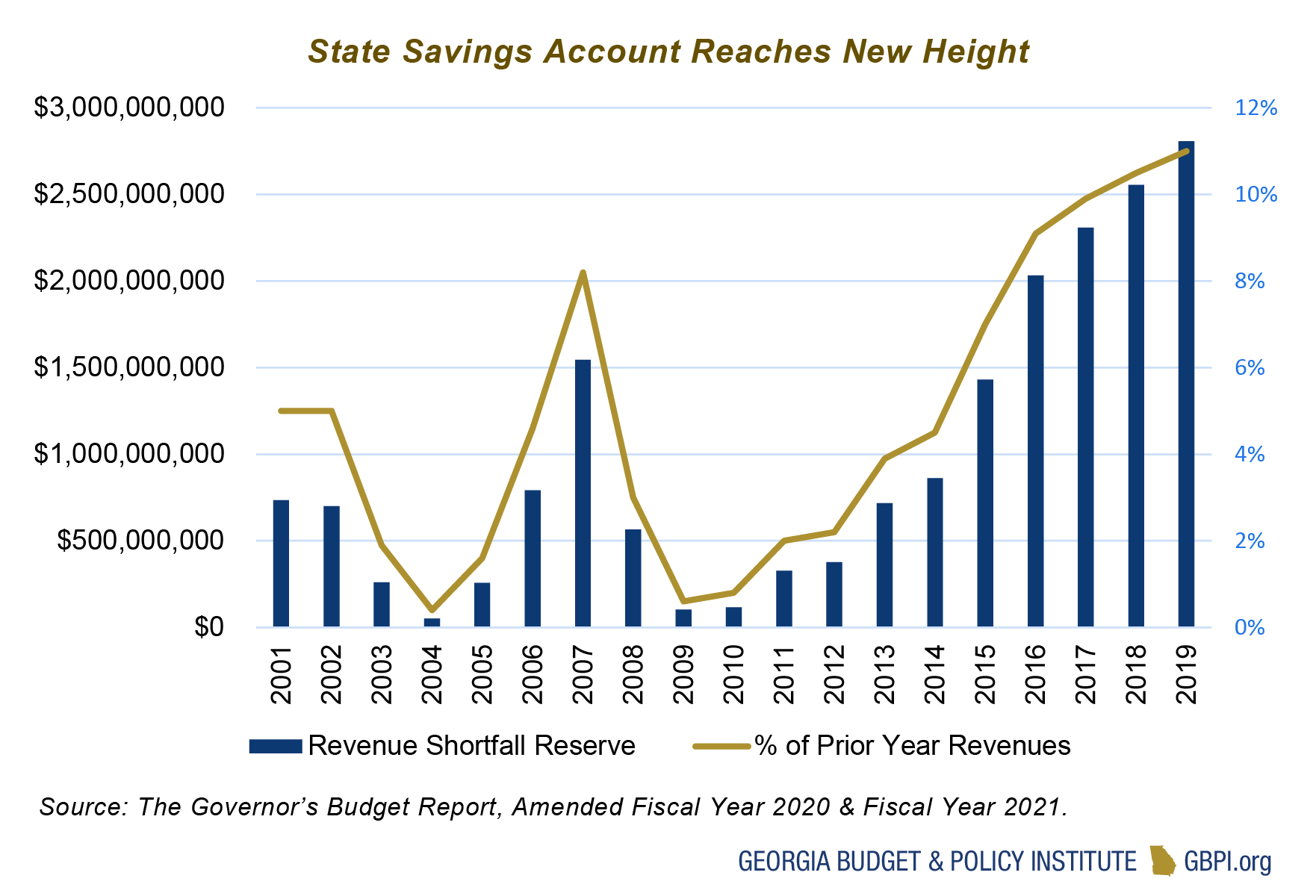

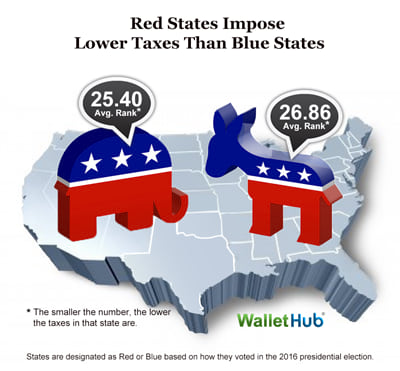

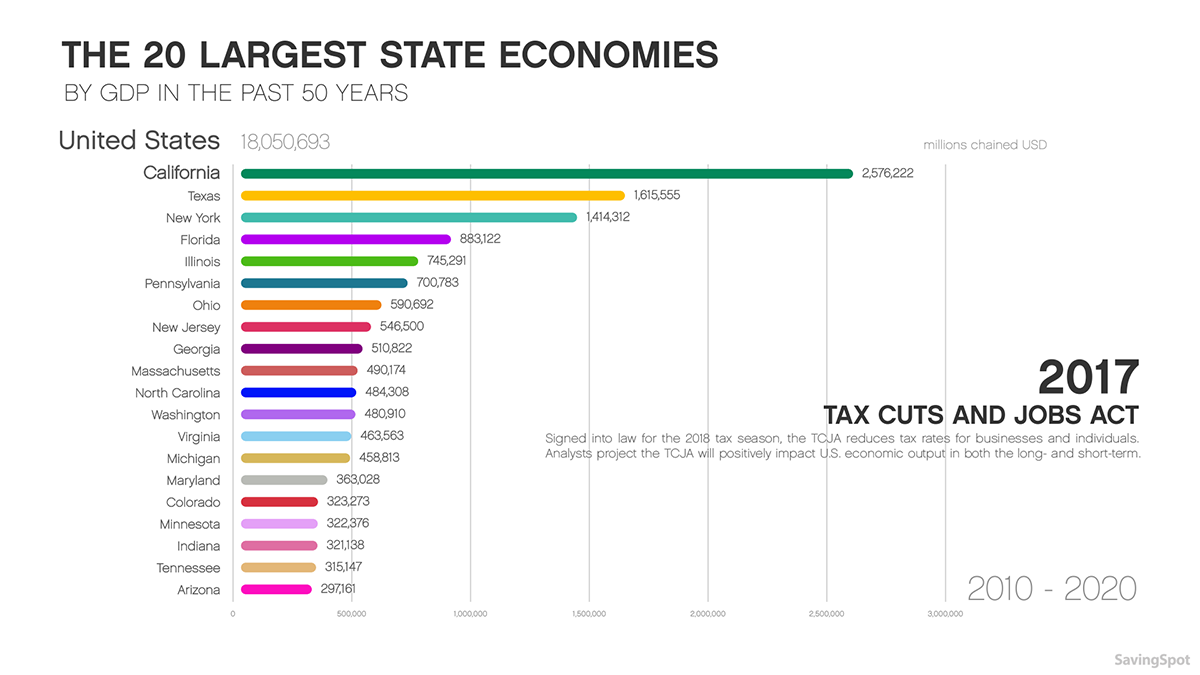

Detailed georgia state income tax rates and brackets are available on this page. Massachusetts single rate individual income tax dropped from 505 to 50 percent for tax year 2020 due to the state meeting revenue targets outlined in a tax trigger law that was enacted in 2002. The georgia state tax tables for 2020 displayed on this page are provided in support of the 2020 us tax calculator and the dedicated 2020 georgia state tax calculatorwe also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for each state.

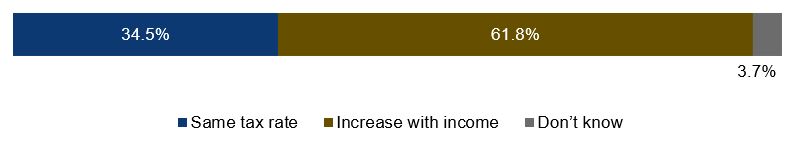

Georgia tax brackets 2019 2020. Search for income tax statutes by keyword in the official code of georgia. We can also see the progressive nature of georgia state income tax rates from the lowest ga tax rate bracket of 1 to the highest ga tax rate bracket of 575.

The state supplemental income tax withholding rates that have thus far been released for 2020 are shown in the chart below.

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3.png)

/best-and-worst-states-for-sales-taxes-3193296_final-5833bed0517f402abab0d55179d65e7d.png)

/2020-federal-state-minimum-wage-rates-2061043-final-d82d14b0792c49c8a7b85e3666d8b6b2.png)