Georgia Sales Tax On Cars

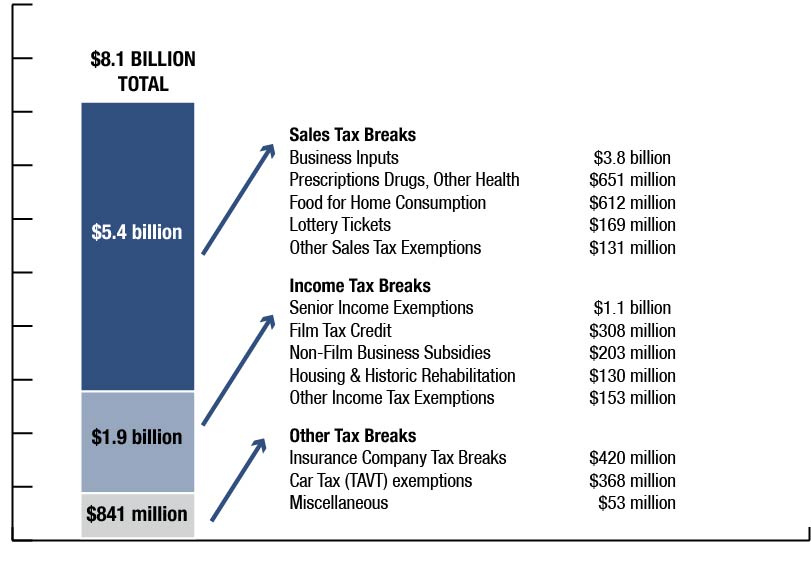

It replaced sales tax and annual ad valorem tax annual motor vehicle tax and is paid every time vehicle ownership is transferred or a new resident registers the vehicle in georgia for the first time.

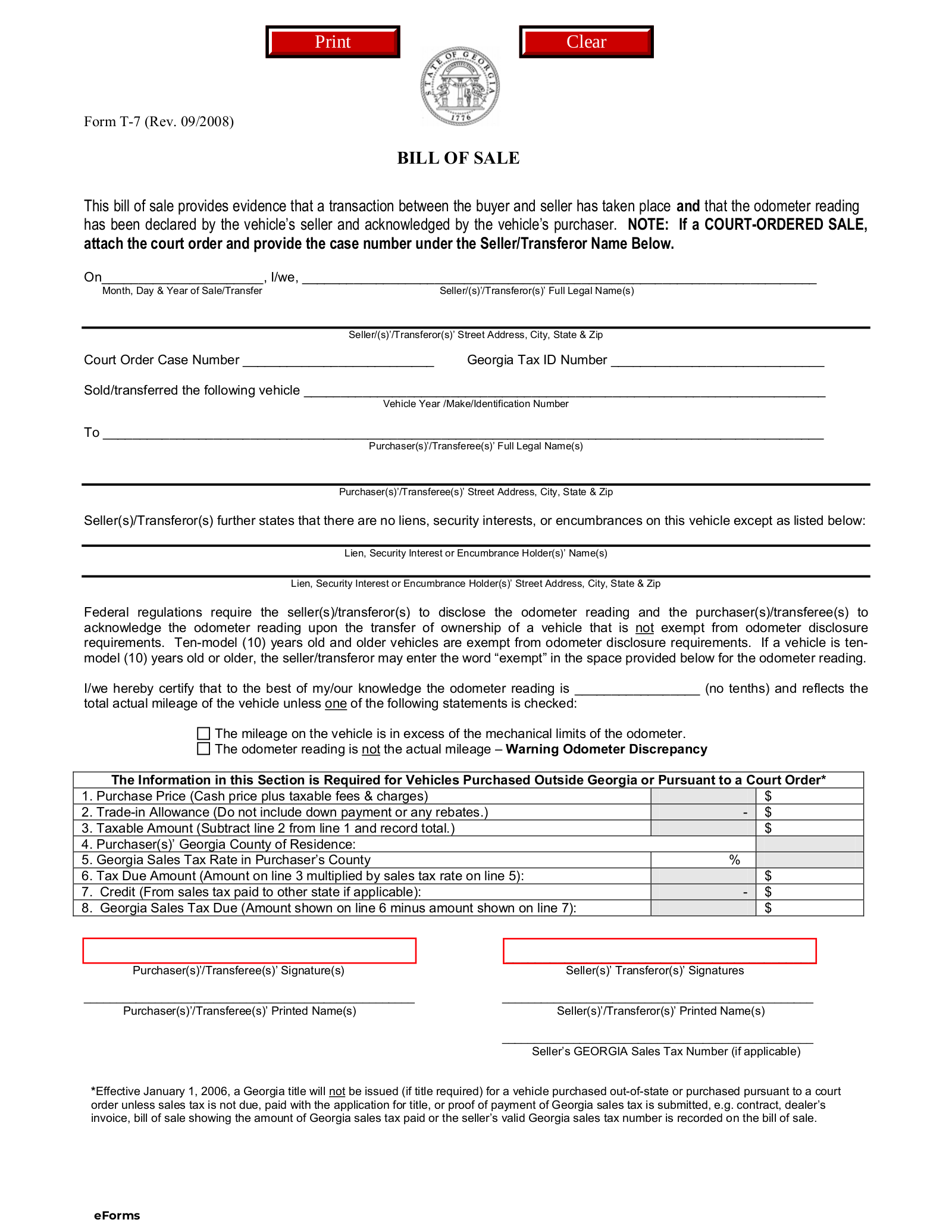

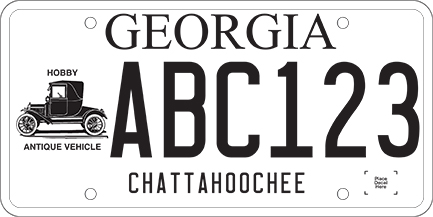

Georgia sales tax on cars. Instead the state enforces an auto sales tax known as the ad valorem tax for vehicle purchases. Sales tax rates general general rate chart effective beginning july 1 2020 6704 kb general rate chart effective april 1 2020 through june 30 2020 2202 kb. A georgia title and license plate will not be issued until any georgia sales tax due is paid.

Average dmv fees in georgia on a new car purchase add up to 38 1 which includes the title registration and plate fees shown above. For more information go to georgias tavt faqs. The tax must be paid at the time of sale by georgia residents or within six months of establishing residency by those moving to georgia.

Ad valorem title tax tavt people who purchase a new or used vehicle pay a one time ad valorem title tax. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. Complete a vin check selling a car.

The owner of the vehicle must. The amount of sales tax due is based on the vehicles purchase price or the vehicles fair market value if a sales invoice is not submitted. No matter how you are acquiring a vehicle its always a good choice to check for a title brand before determining if its the right vehicle for you.

This tax is based on the value of the vehicle. The published sales tax rates for counties include the state of. Transfer ownership using the form on the back of the title read more about the sellers responsibilities.

However this retail sales tax does not apply to cars that are bought in georgia. The ad valorem calculator can also estimates the tax due if you transfer your vehicle to georgia from another state. Tips for completing the sales and use tax return on gtc sales use tax import return filing and remittance requirements this is a link to rule 560 12 1 22 on the georgia secretary of states website.

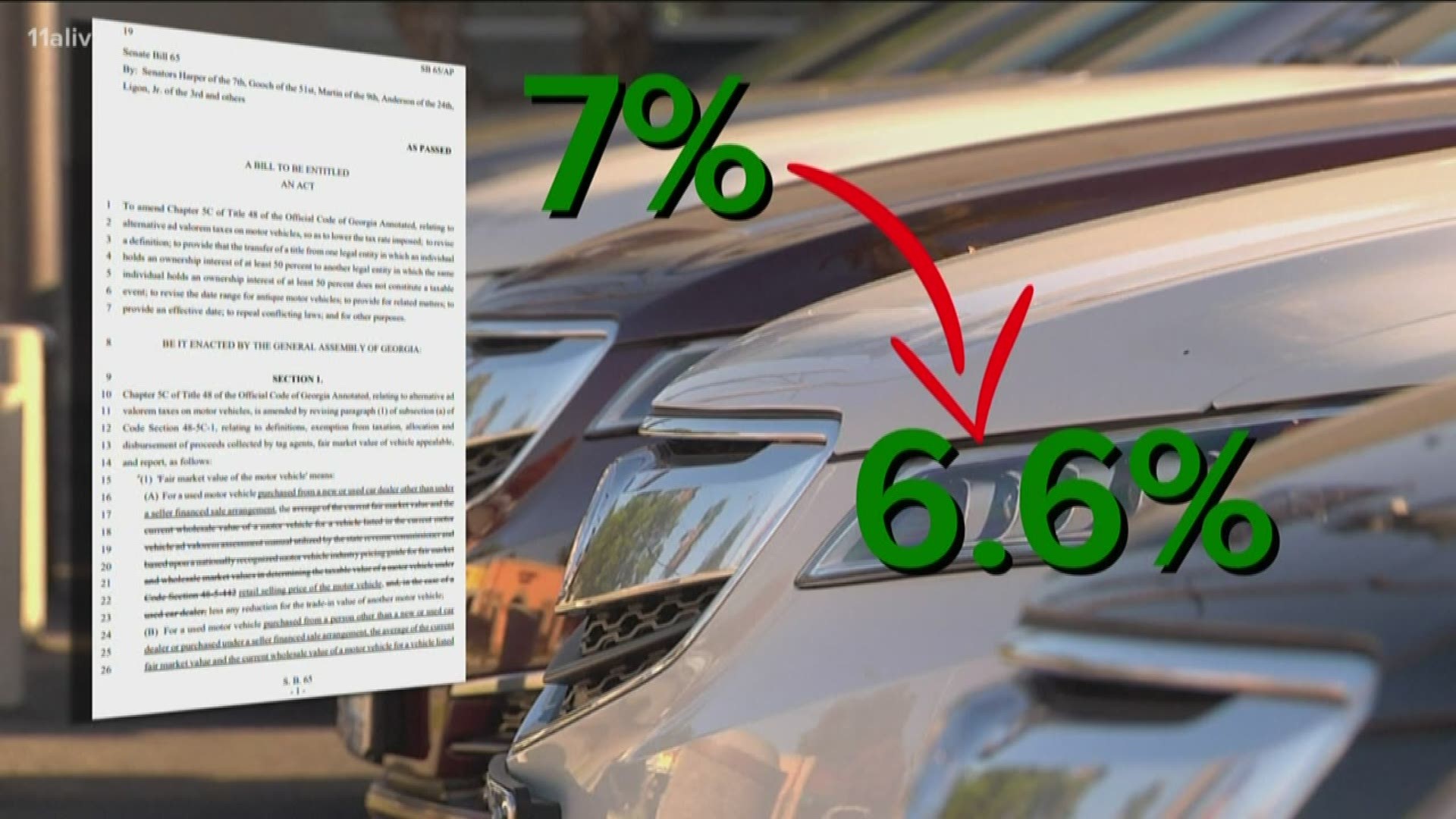

The current tavt rate is 7 of the fair market value of the vehicle in most georgia counties. Title ad valorem tax tavt became effective on march 1 2013. Tavt is a one time tax that is paid at the time the vehicle is titled.

These fees are separate from the taxes and dmv fees. The tax rate on all car sales is dropping from 7 to 66 which amounts to a savings of about 100 on a new car sold for 25000. But some used car buyers will have to pay more in taxes overall.