Georgia Sales Tax On Cars Bought Out Of State

For example a 1000 cash rebate may be offered on a 10000 car meaning that the out of pocket.

Georgia sales tax on cars bought out of state. Georgia collects a 4 state sales tax rate on the purchase of all vehicles. You might have to pay the difference if the sellers state sales tax is lower than your states. In addition to taxes car purchases in georgia may be subject to other fees like registration title and plate fees.

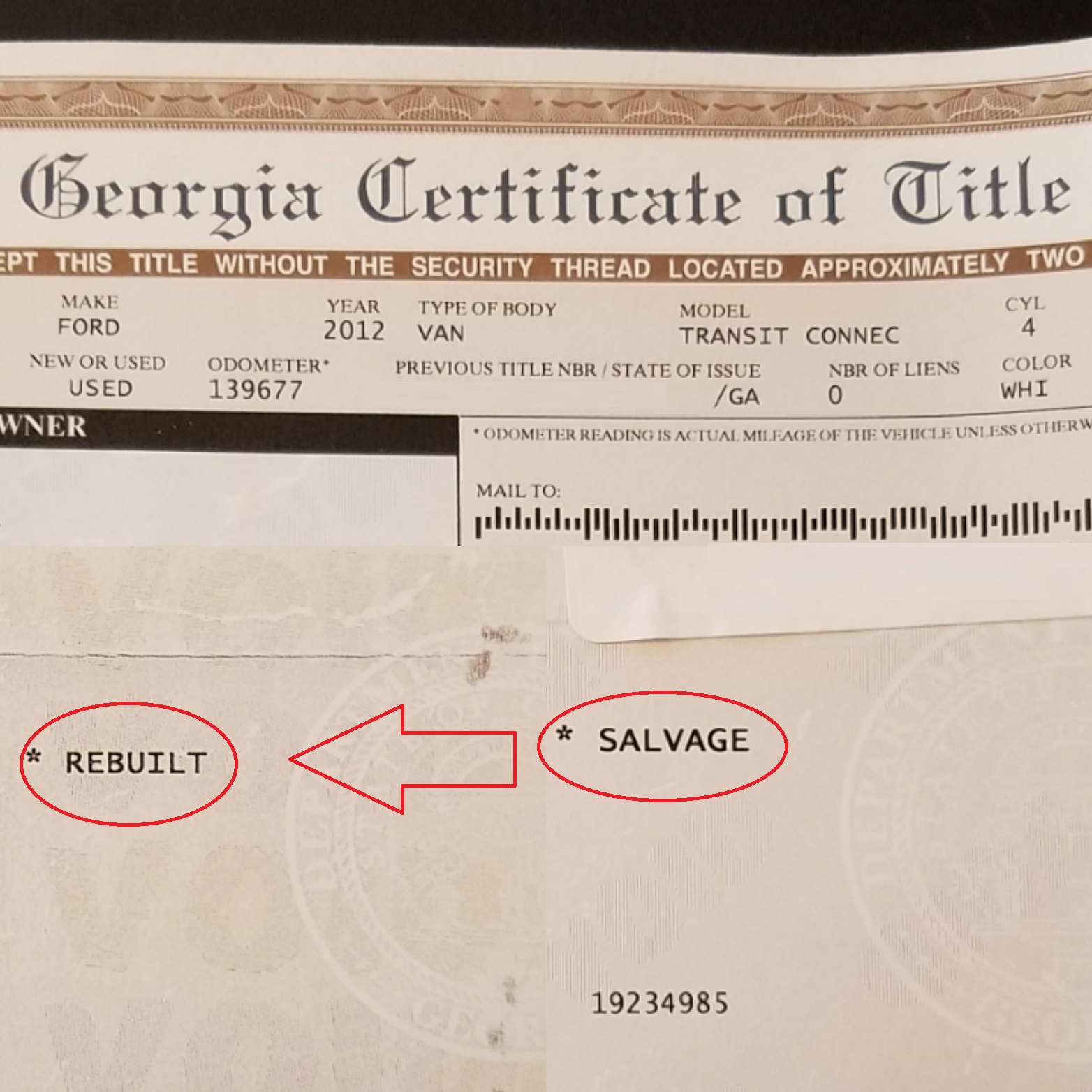

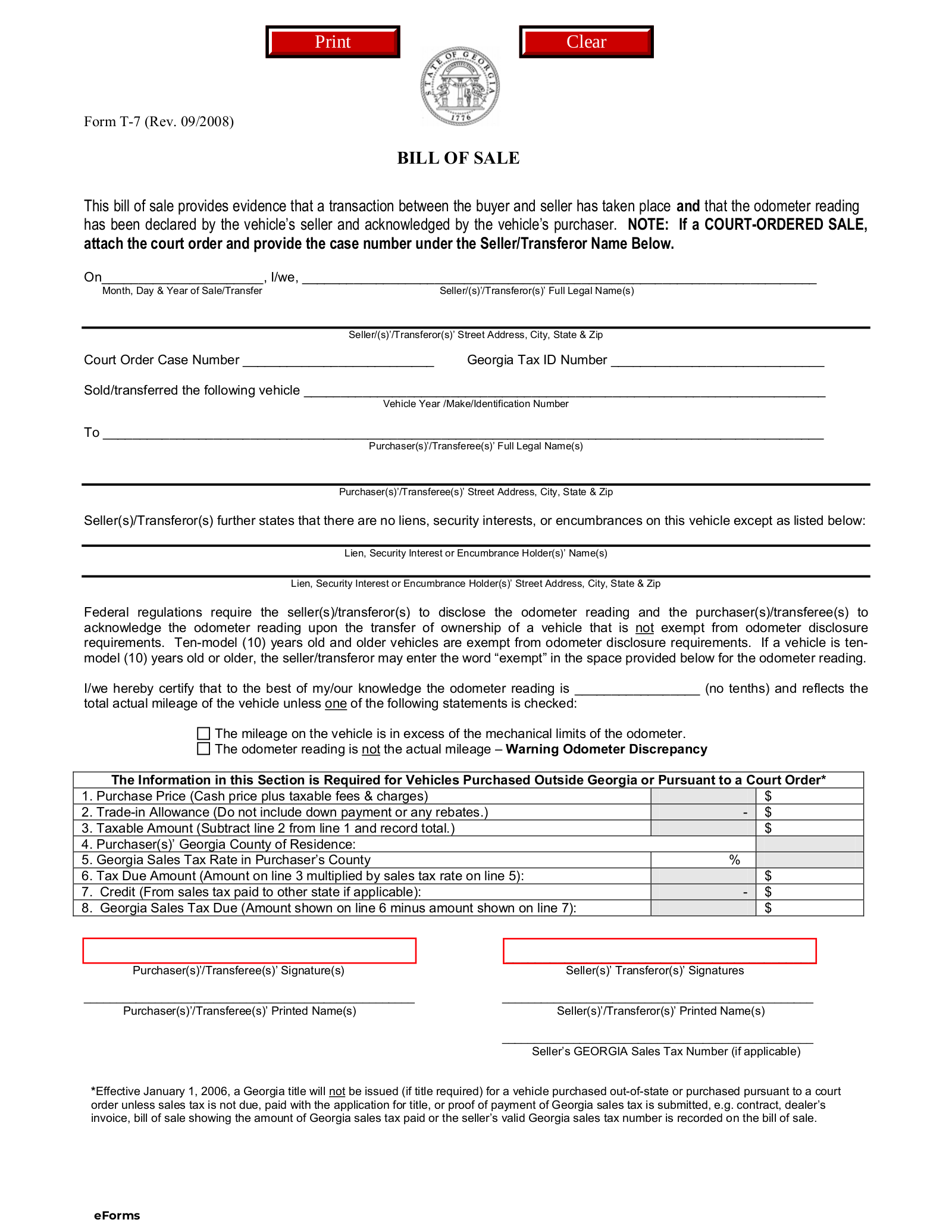

If you buy your car from a private seller instead of a dealer you can pay the sales tax when you register the vehicle in your home state. If you are registering a new title for a car purchased out of state you will still be required to pay the ad valorem tax on the vehicle. The tax must be paid at the time of sale by georgia residents or within six months of establishing residency by those moving to georgia.

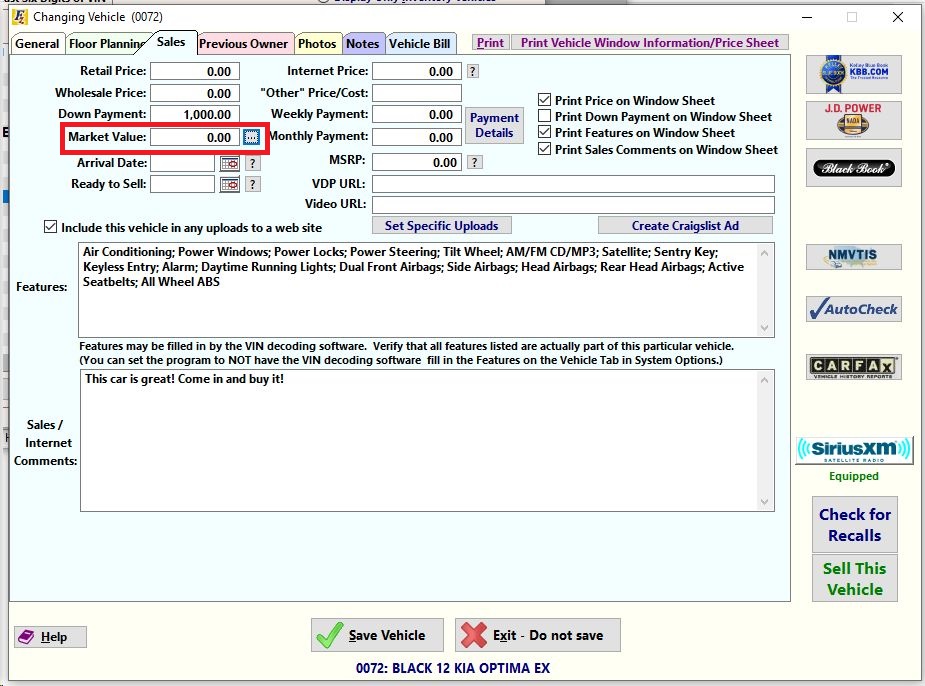

Think twice if youre hoping to save money by buying a used car in a state with a lower sales tax rate. The ad valorem calculator can also estimates the tax due if you transfer your vehicle to georgia from another state. This tax is based on the value of the vehicle.

If you take this approach though the dmv in your home state may need to check the cars vehicle identification number to ensure it matches the out of state title. If youve bought a car from a dealership they will likely collect sales tax and pass it along to the proper agency in your state. The department of motor vehicles dmv is hip to this used car taxes loophole.

There is also a local tax of between 2 and 3. You may also have to pay any applicable local sales taxes. New residents must pay 50 percent of the ad valorem.

So if you live in new york.

/buying-a-car-in-a-different-state-4148015-Final2-1a901895477c4c518d48407644568ce8.png)

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3.png)