Georgia Jobs Tax Credit

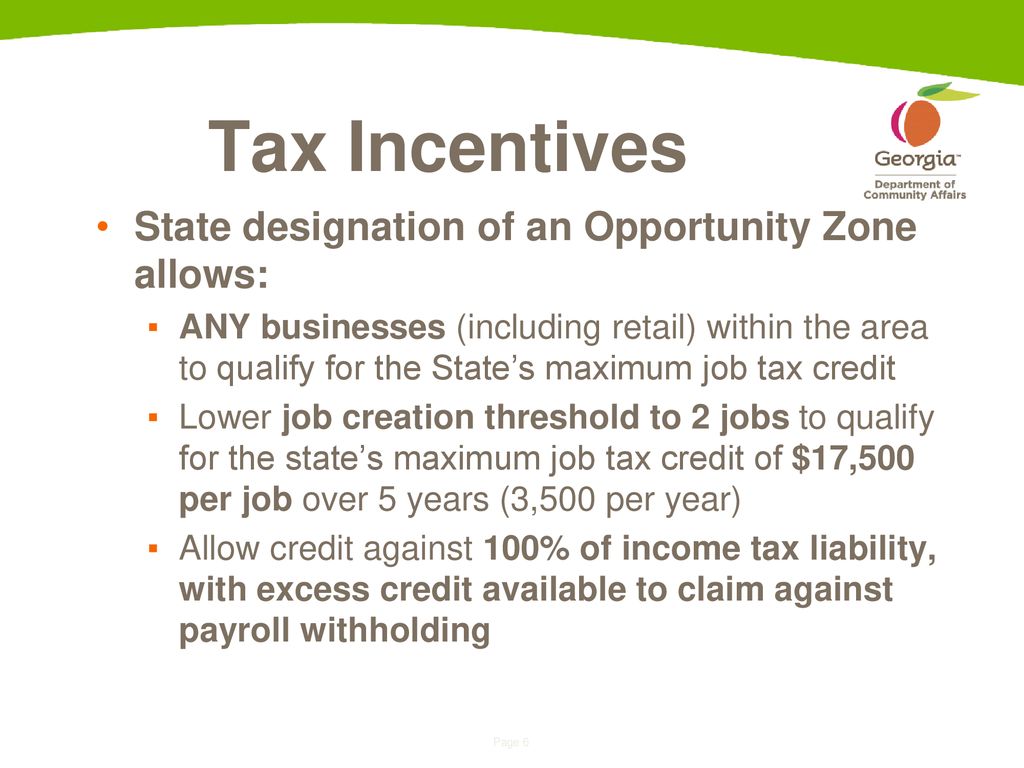

Triciadepadroatdcagagov provides for a statewide job tax credit for any business or headquarters of any such business engaged in manufacturing warehousing and distribution processing telecommunications tourism research and development industries or services for the elderly and persons with disabilities but does not include retail businesses.

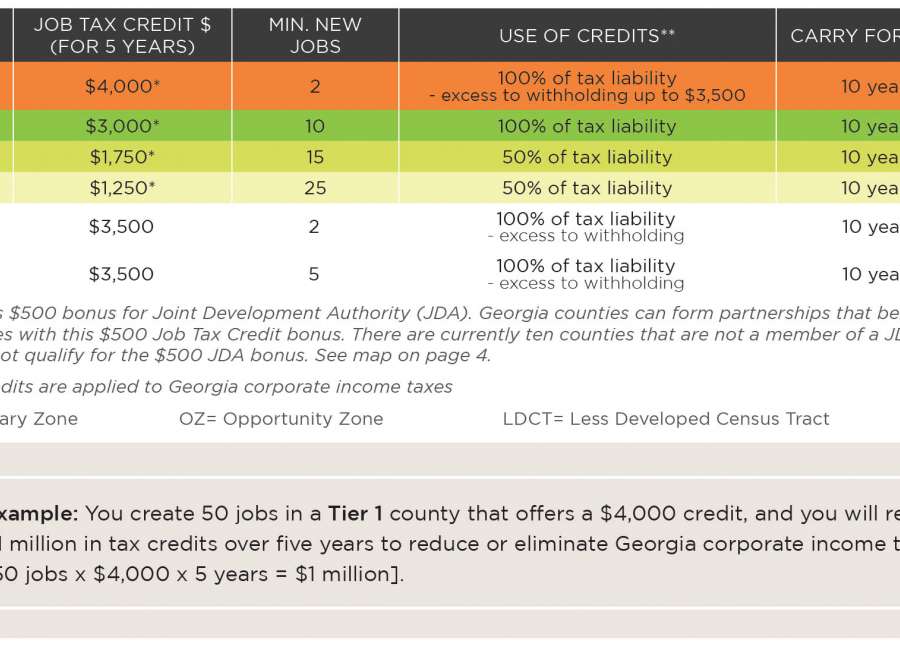

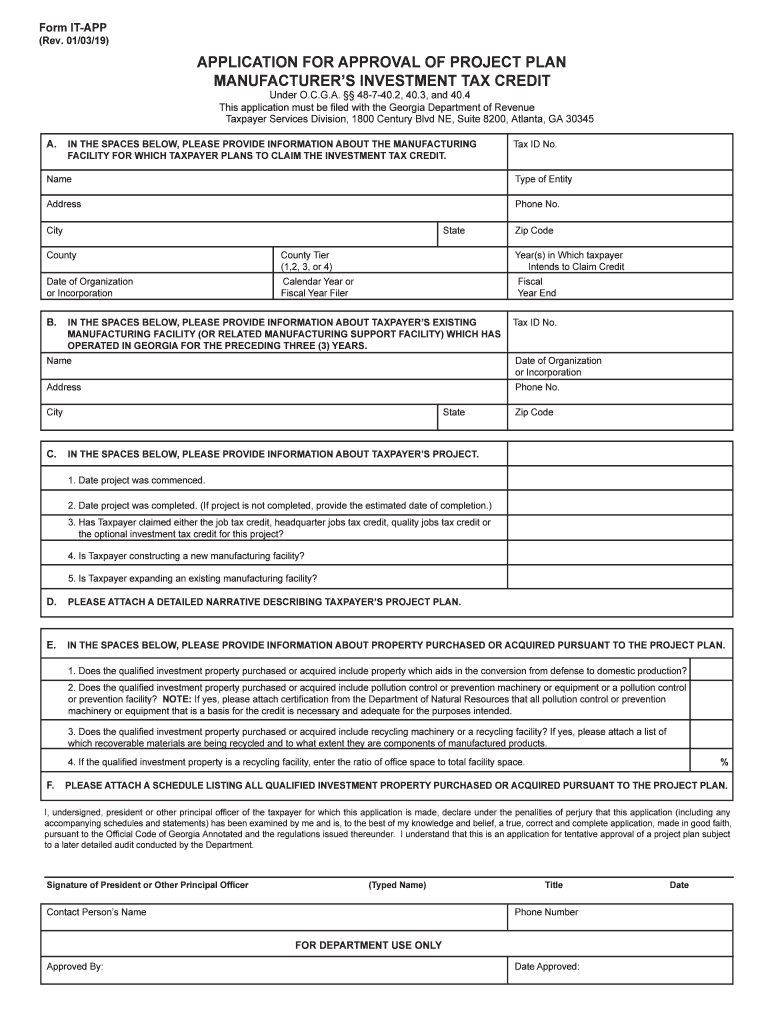

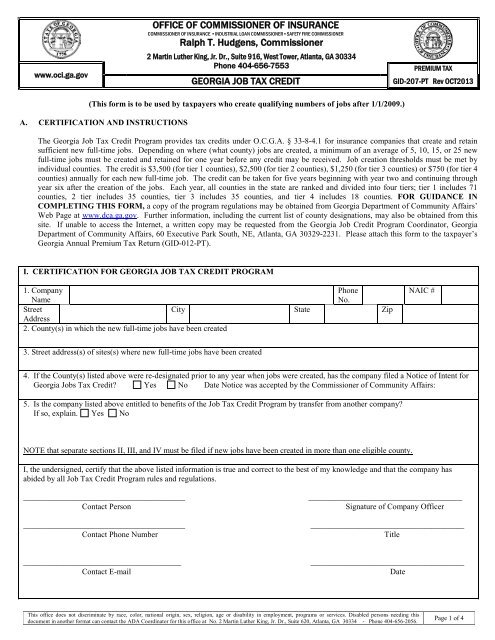

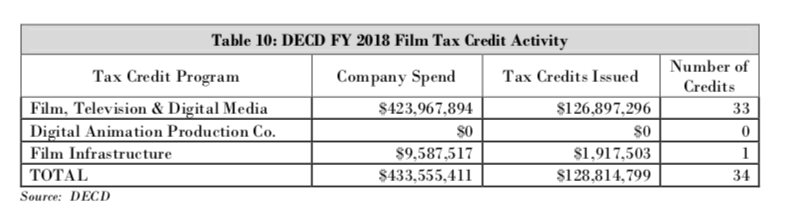

Georgia jobs tax credit. The majority of counties are in a jda. Tax credits are applied to georgia corporate income taxes mz. The georgia job tax credit program provides tax credits under article 2 of chapter 7 of title 48 of the official code of georgia anno tated for certain businesses that create and retain sufficient new full time jobs.

The gov means its official. The georgia department of labor gdol coordinates the federal work opportunity tax credit program wotc. Businesses that may benefit from the tax credit include.

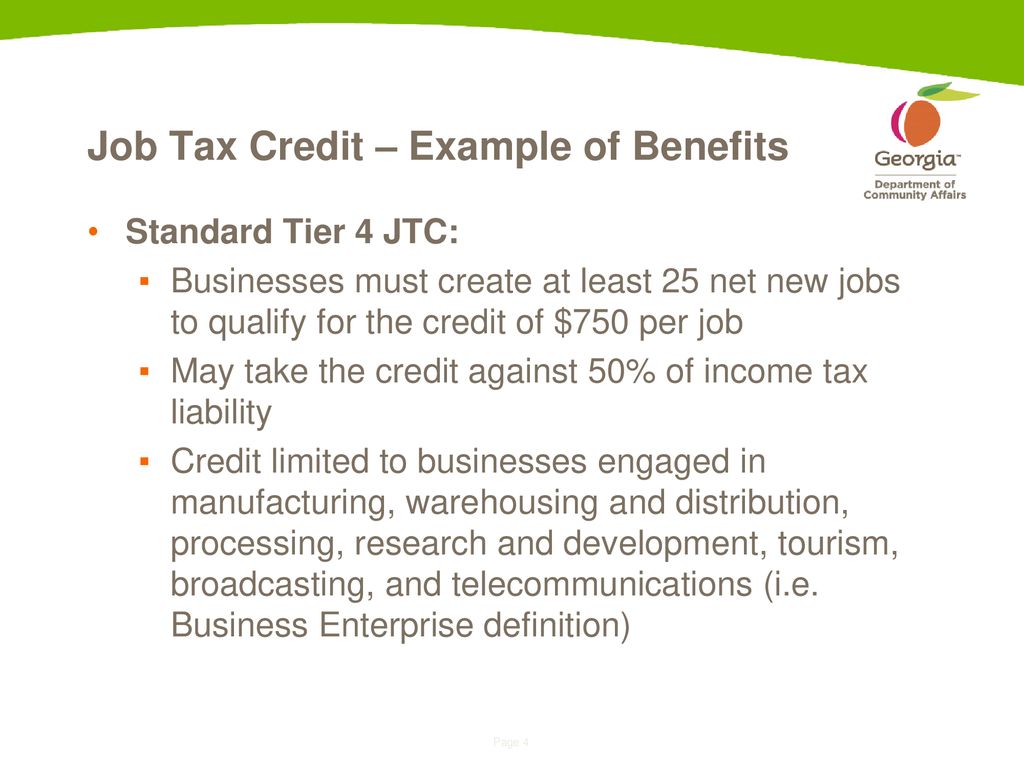

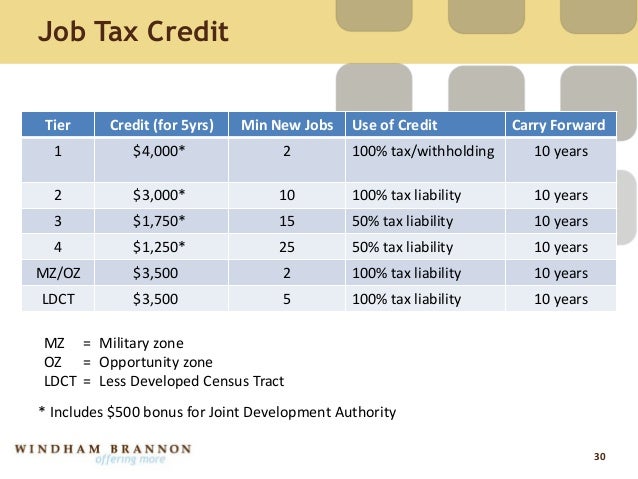

Qualified education expense tax credit. Includes 500 bonus for joint development authority jda. Overview job tax credit program jtc job tax credits.

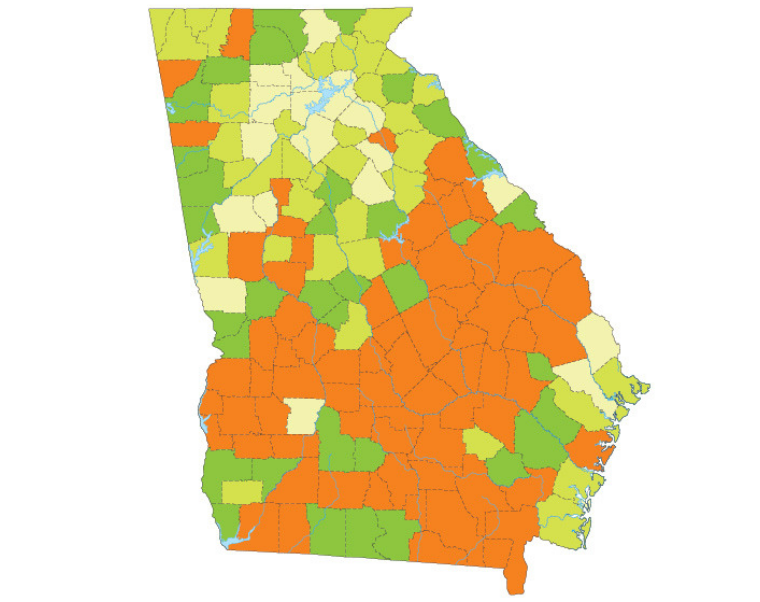

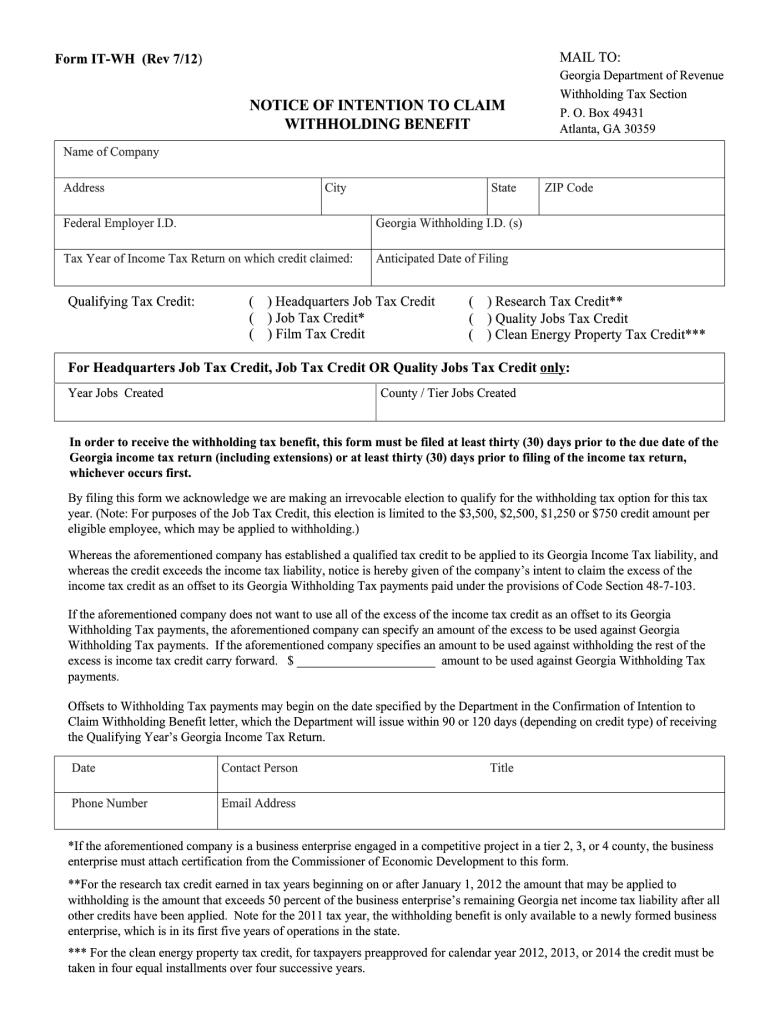

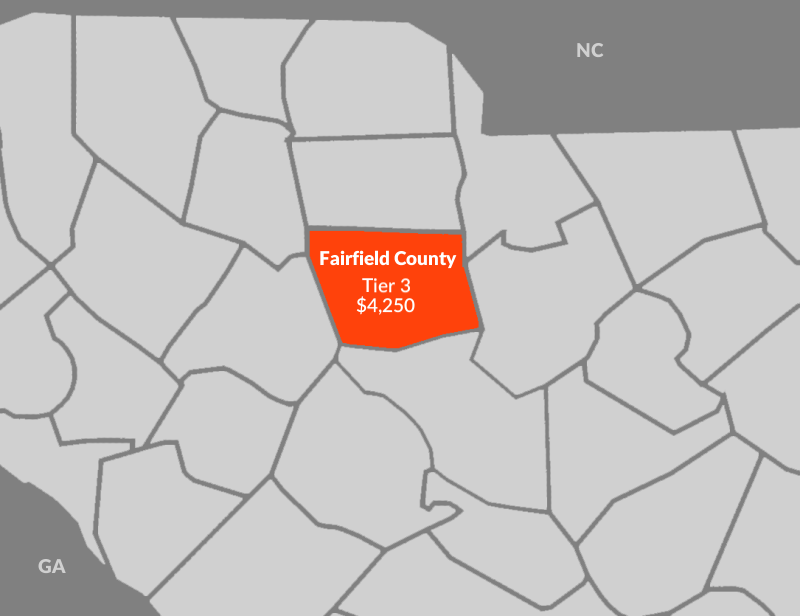

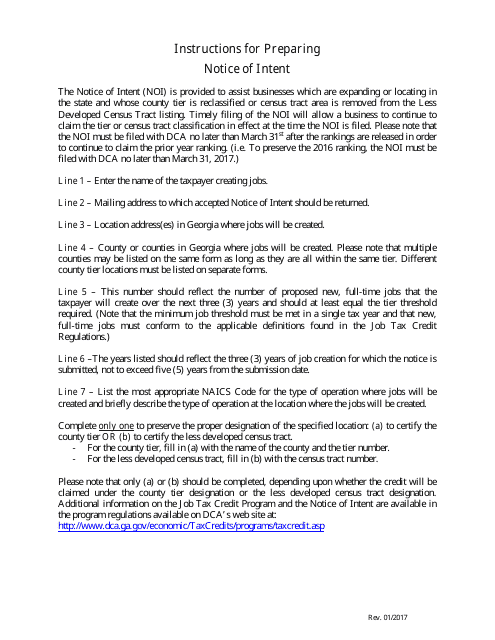

Notice of intent for georgia job tax credit. Overview of jtc benefits. To confirm a countys status please call 4049624931.

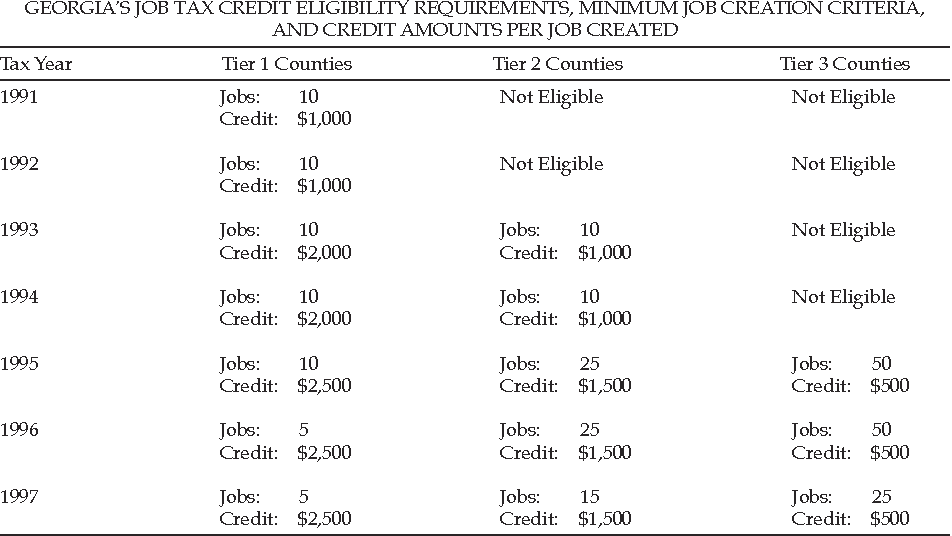

Tier 1 counties ranked in the bottom 40. Income tax credit utilization reports. Financial assistance opportunities for communities.

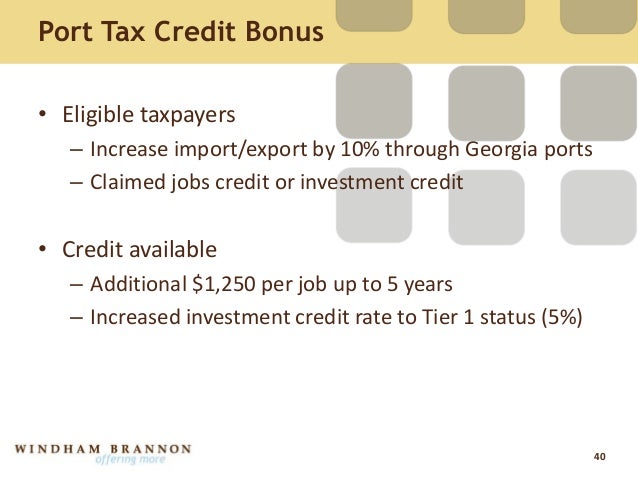

Eligibility requirements of jtc. Georgia georgia port. Creating new jobs in georgia is a good way to reduce and potentially eliminate your companys corporate tax liability.

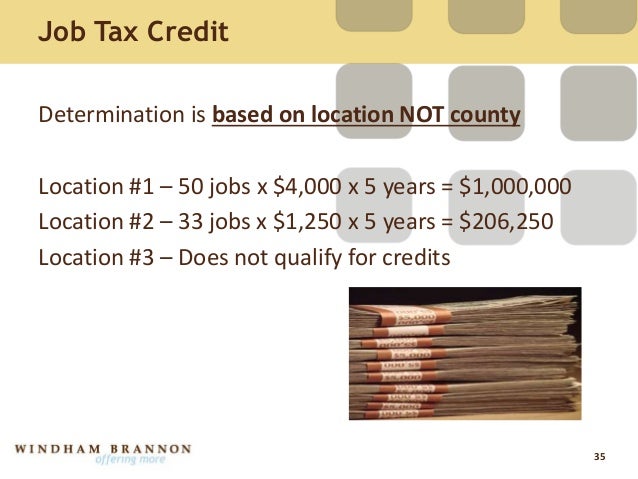

Faq for general business credits. Overview of jtc benefits tier 1. You create 50 jobs in a tier 1 county that offers a 4000 credit and you will receive 1 million in tax credits over five years to reduce or eliminate georgia corporate income tax 50 jobs x 4000 x 5 years 1 million.

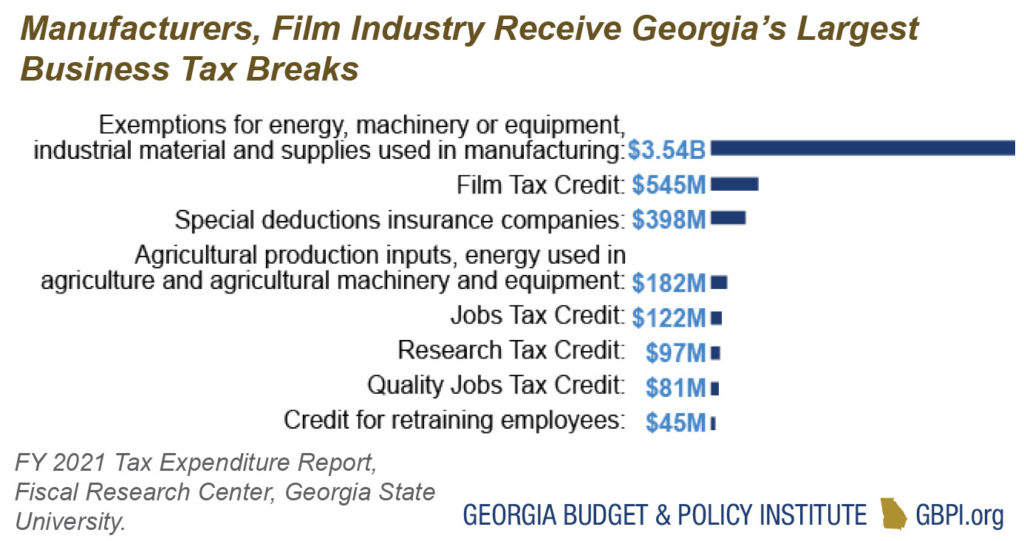

Atlanta ga 30329 404 679 4840. Georgia tax center information tax credit forms. Our job tax credit gives you a credit ranging from 1250 to 4000 per year for 5 years for every new job created.

The tax credit can be from 1200 to 9600 per qualified employee depending on the target group. Statutorily required credit report. State of georgia government websites and email systems use georgiagov or gagov at the end of the address.

Income tax credit policy bulletins. Overview of jtc benefits tier 2. Community economic development.

Research surveys planning maps volunteerism building codes. Local state and federal government websites often end in gov. Income tax letter rulings.