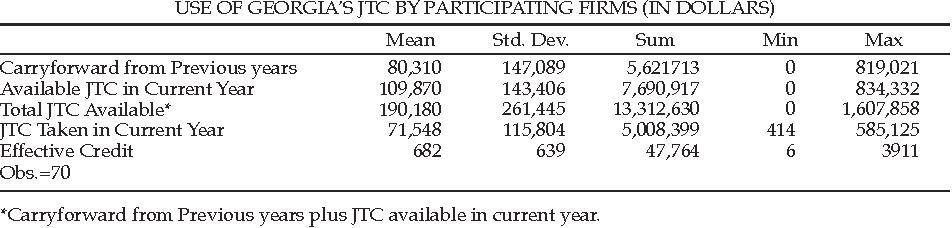

Georgia Jobs Tax Credit Carryforward

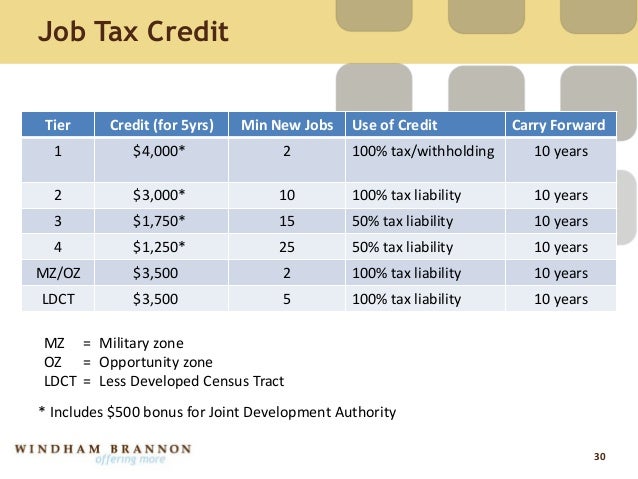

New jobs use of credits carry forward 1 4000 2 100 of tax liability excess to withholding up to 3500 10 years 2 3000 10 100 of tax liability 10 years 3 1750 15 50 of tax liability 10 years.

Georgia jobs tax credit carryforward. Film tax credit electronic it trans submission inside of a gtc login. Overview of jtc benefits tier 2. Overview of jtc benefits tier 1.

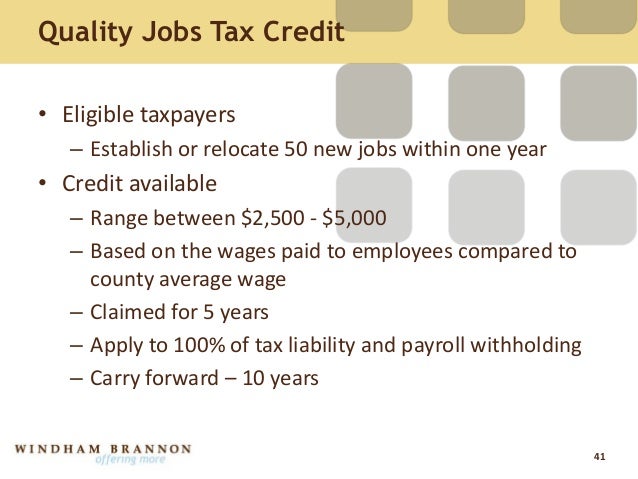

New jobs tier use of credits carry forward. The jobs tax credit retraining tax credit and the quality jobs tax credit must be claimed on an original or amended georgia income tax return within one year of the earlier of the date the original return was filed or the date such return was due as prescribed in subsection a of code section 48 7 56 including any approved extensions. Overview of jtc benefits.

Tax credits are applied to georgia corporate income taxes tier job tax credit for 5 years min. Income tax credit policy bulletins. Tax credits are applied to georgia corporate income taxes mz military zone oz opportunity zone ldct less developed census tract 3500 2 100 of tax liability mzoz excess to withholding 10 years 3500 5 100 of tax liability ldct excess to withholding 10 years job tax credit for 5 years min.

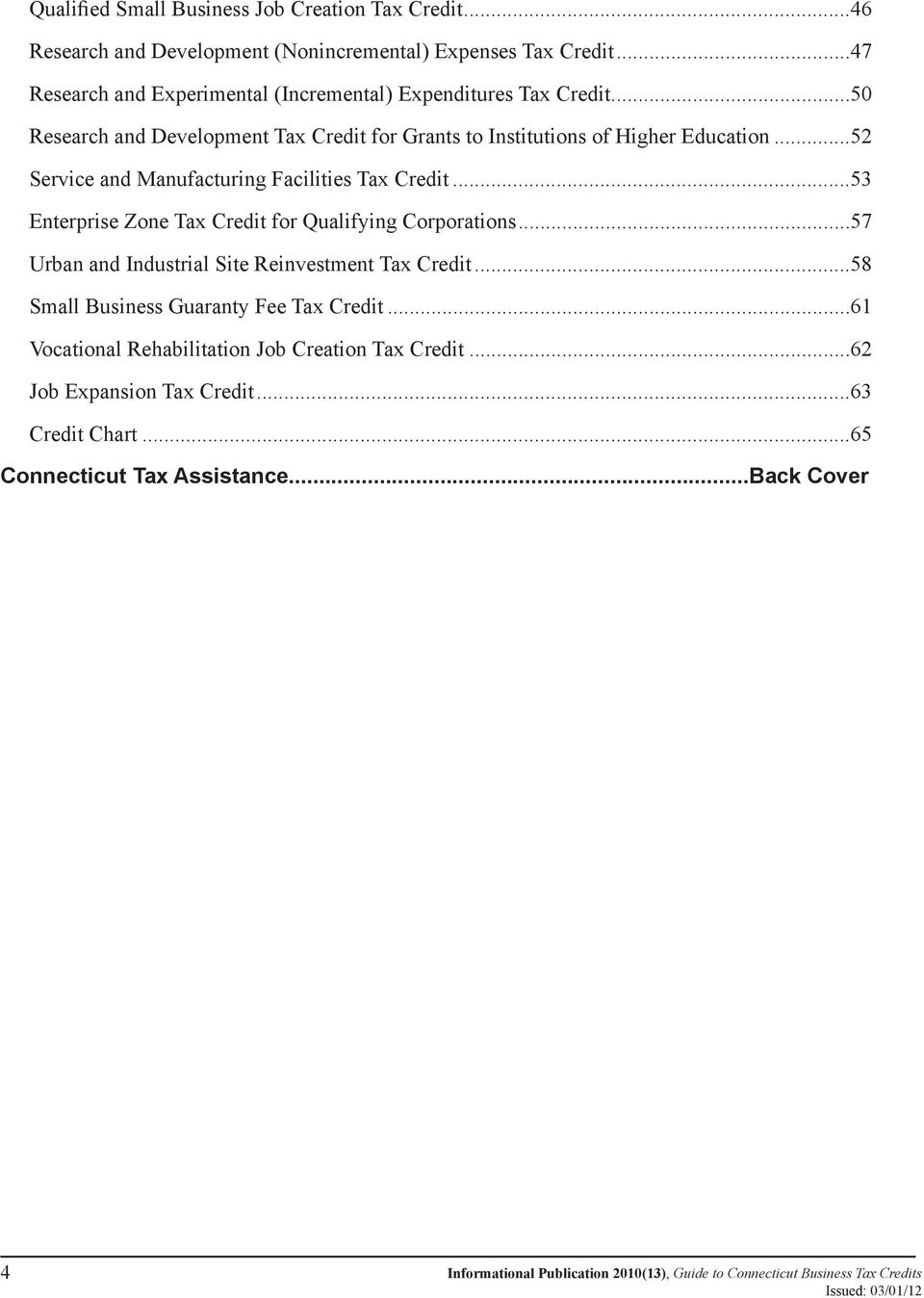

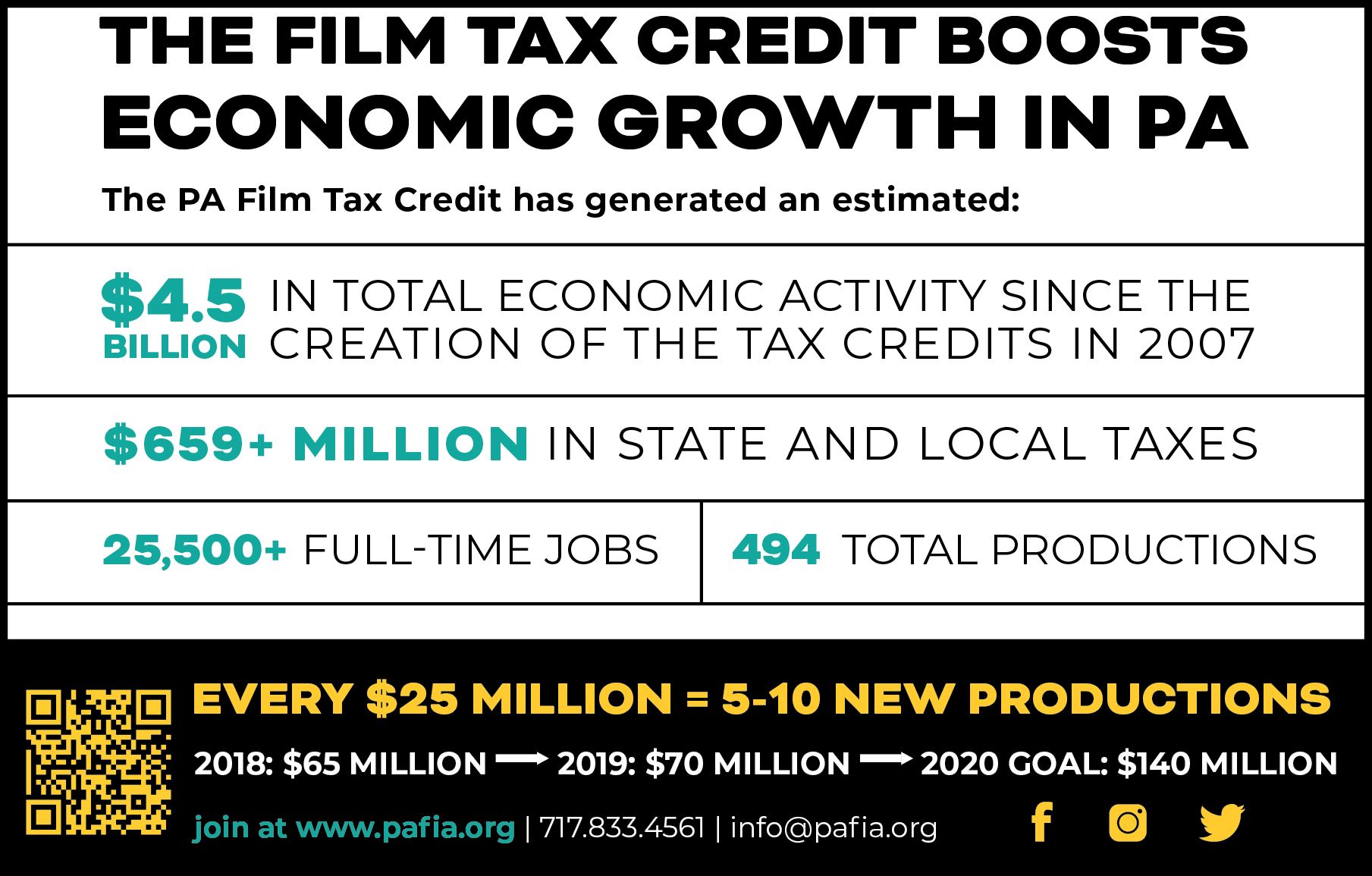

103 employers jobs tax credit. List of film tax credit expenditures. This program provides employers financial incentives when hiring workers from targeted groups of job seekers by reducing an employers federal income tax liability.

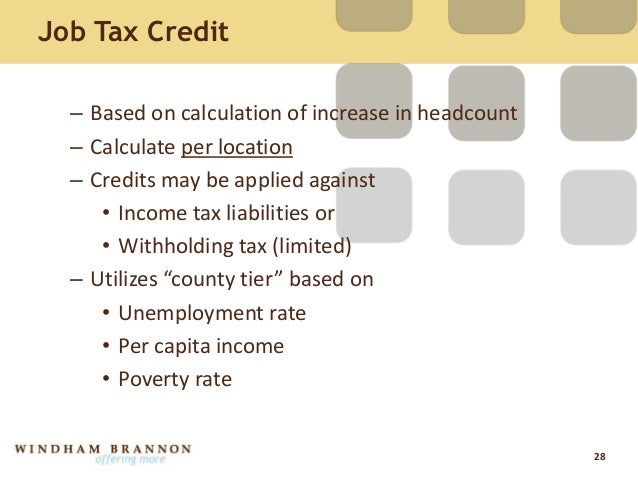

Income tax credit utilization reports. Explanation of the new film tax credit reporting and it trans process. Counties and certain census tracts in the state are ranked and placed in economic tiers using the following factors.

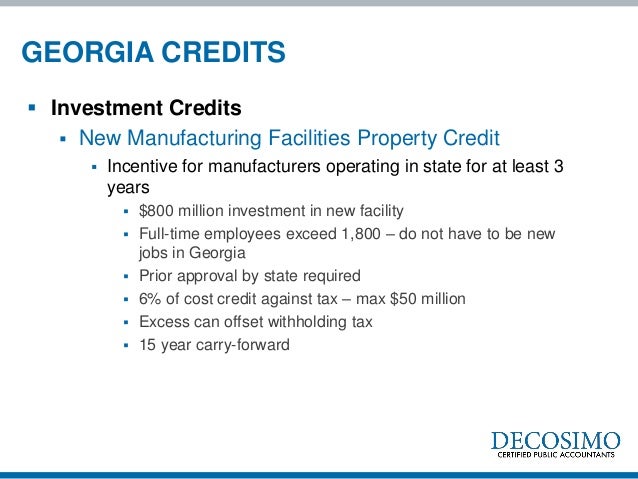

This credit provides for a statewide job tax credit for any business or headquarters of any such business engaged in manufacturing warehousing and distribution processing telecommunications broadcasting tourism or research and development industries but does not include retail businesses. The georgia department of labor gdol coordinates the federal work opportunity tax credit program wotc. Eligibility requirements of jtc.

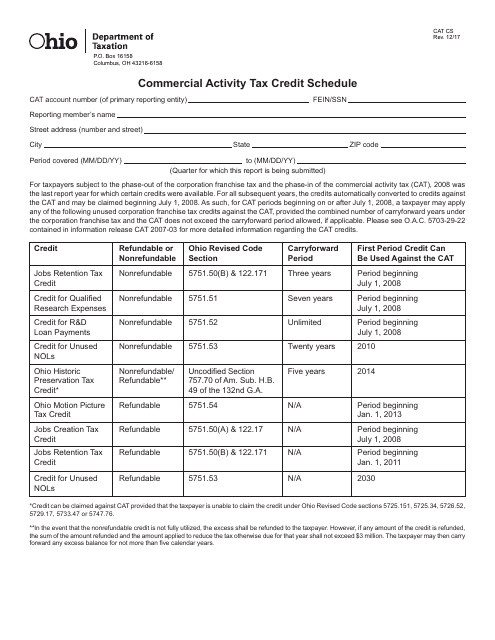

Faq for general business credits. Income tax letter rulings. Georgia tax center information tax credit forms.

Our job tax credit gives you a credit ranging from 1250 to 4000 per year for 5 years for every new job created. The tax credit can be from 1200 to 9600 per qualified employee depending on the target group. Tier 1 counties ranked in the bottom 40.

Voluntary film tax credit audits. If other requirements are met job tax credits are available to businesses of any nature including retail businesses in counties recognized and designated as the 40 least developed counties. Qualified education expense tax credit.

Policy bulletins letter rulings how to directions for film tax credit. Overview job tax credit program jtc job tax credits. Statutorily required credit report.

Rule 560 7 8 45 film tax credit.

/GettyImages-81896553-5754c8ac5f9b5892e8f596d9.jpg)