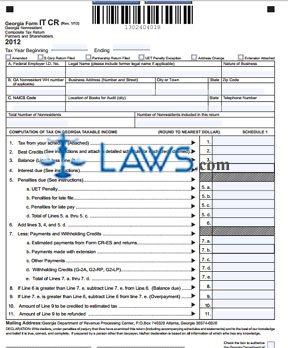

Georgia Income Tax Forms

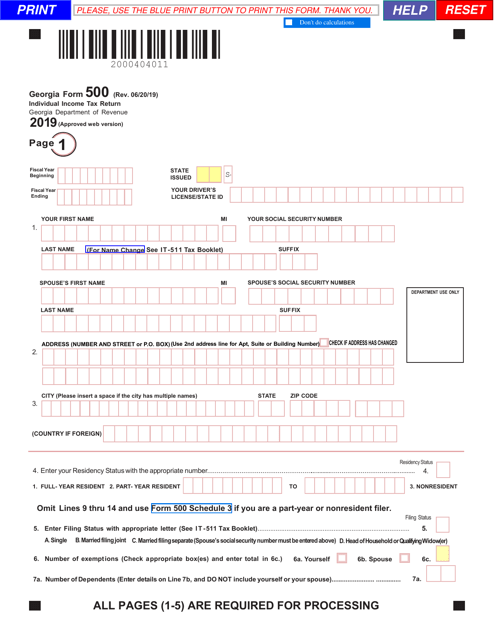

Download 2019 individual income tax forms.

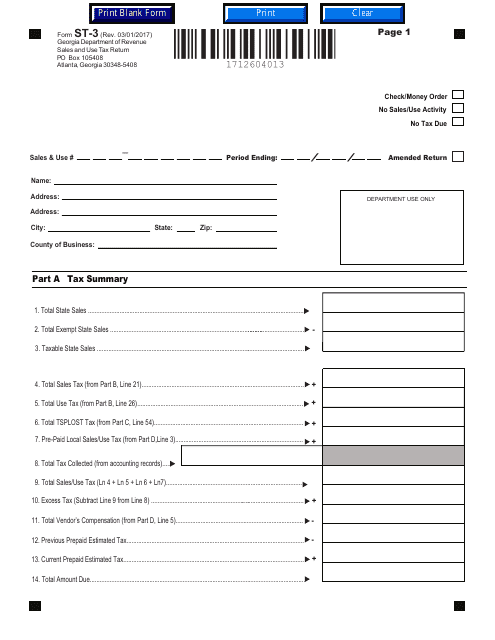

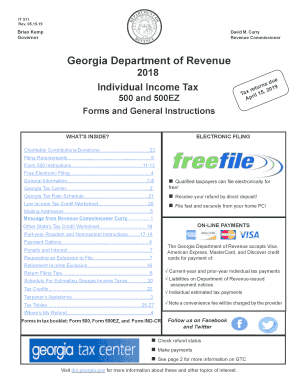

Georgia income tax forms. For all of the tax forms we provide visit our georgia tax forms library or the s tax forms page. Most states will release updated tax forms between january and april. Filing state taxes the basics.

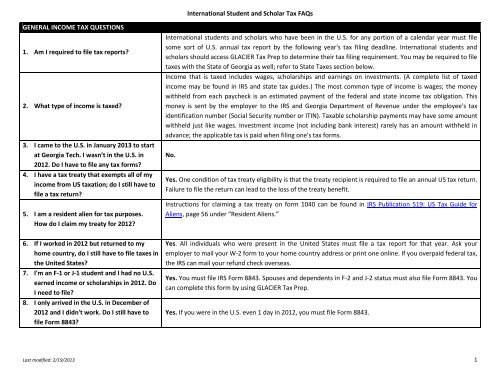

Please complete your federal return before starting your georgia return. Popular online tax services. Complete form w 4 so your employer can withhold the correct federal income tax from your pay.

Dependents if you have more than 4 dependents attach a list of additional dependents. Taxpayers now can search for their 1099 g and 1099 int on the georgia tax center by selecting the view your form 1099 g or 1099 int link under individuals. Form w 4 pdf related.

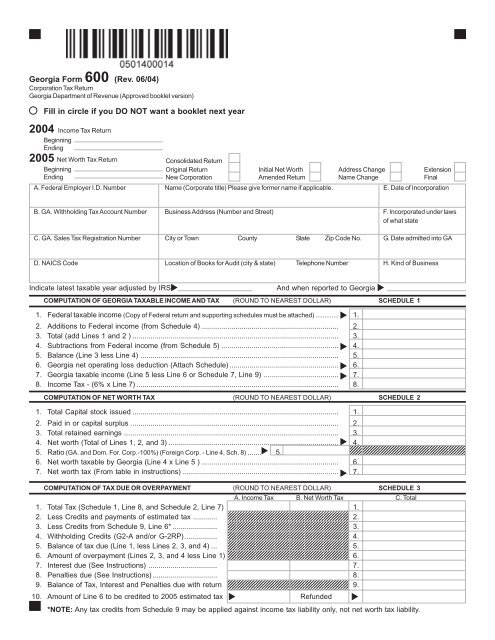

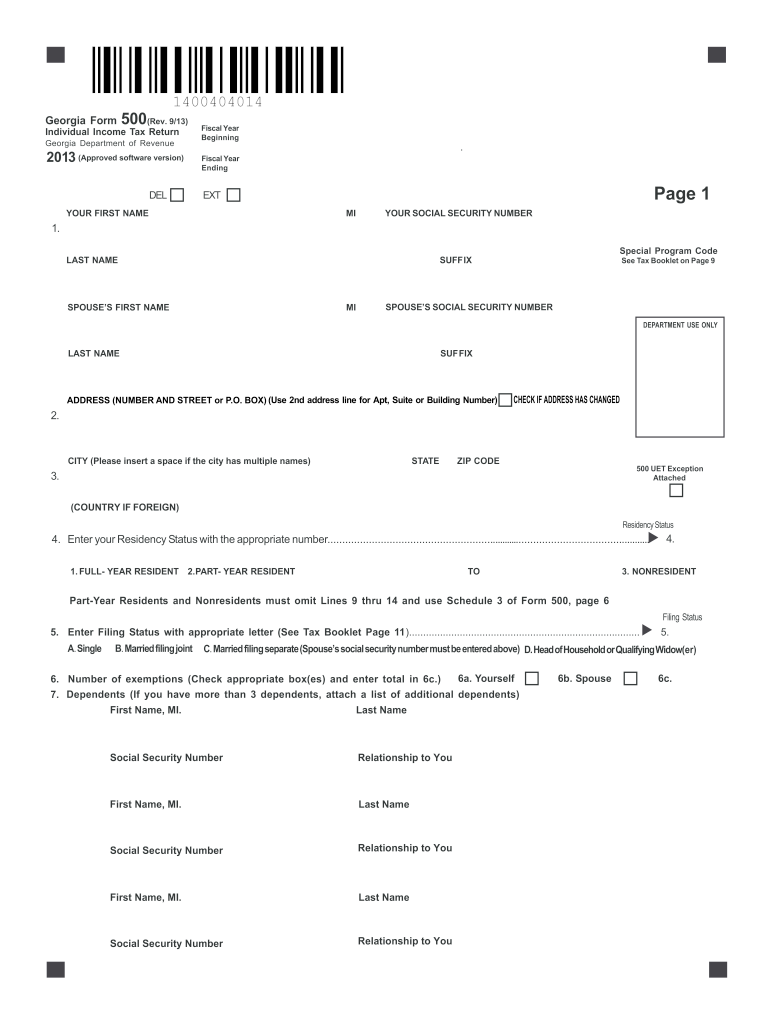

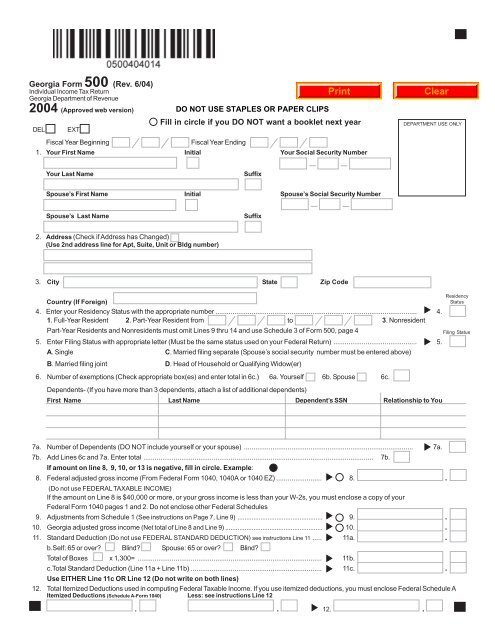

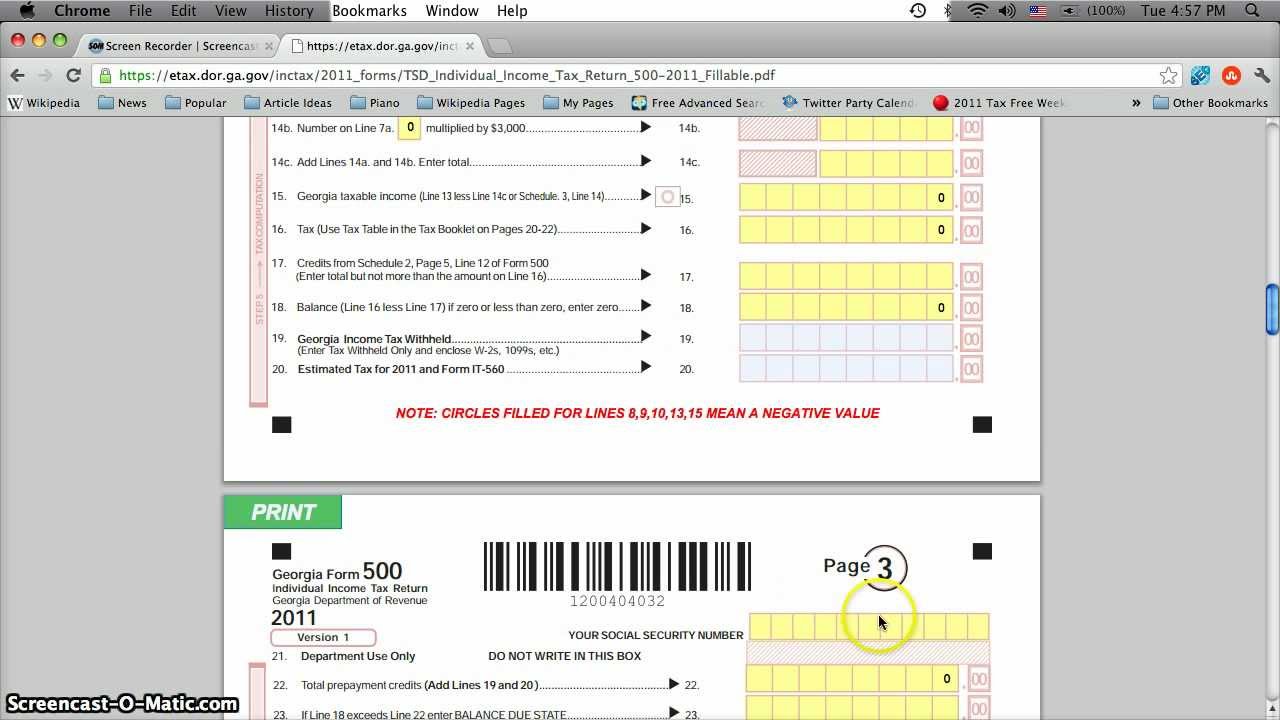

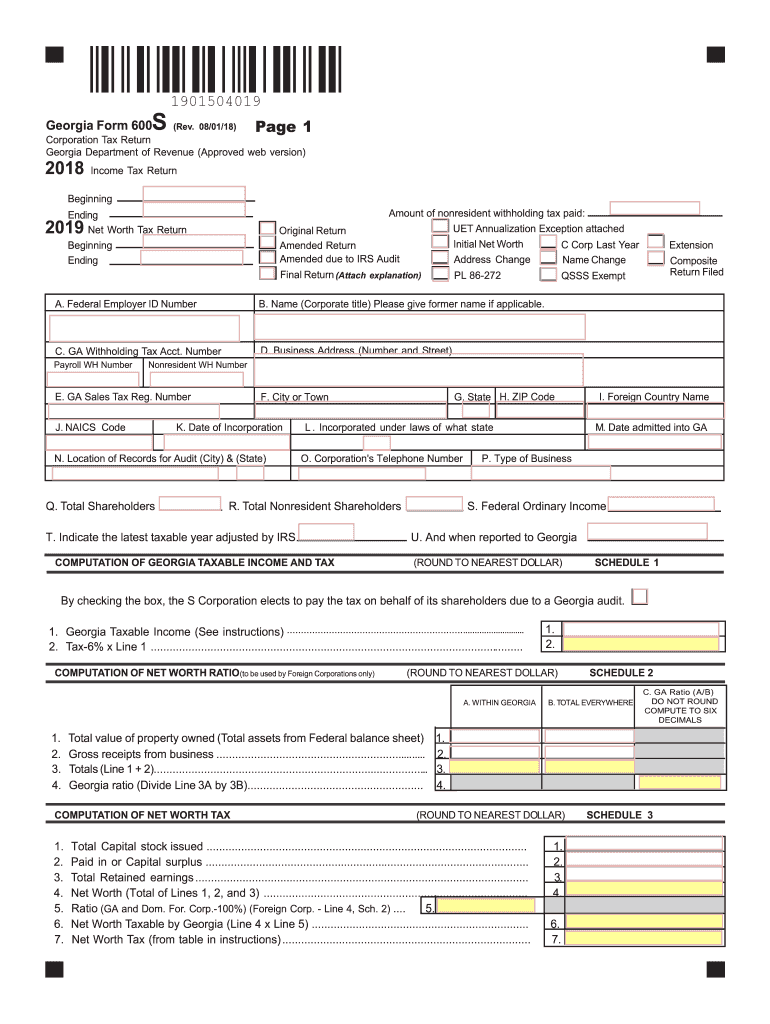

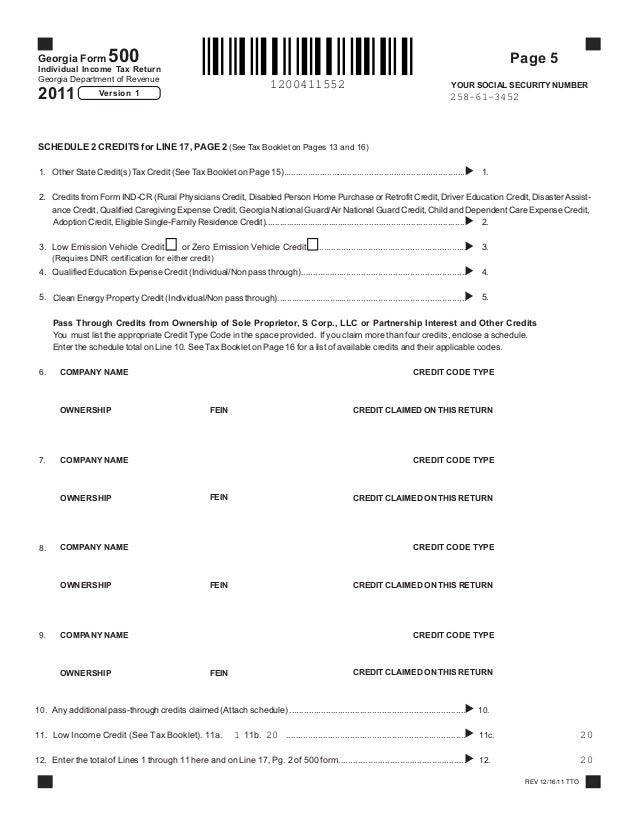

Georgia department of revenue. Georgia has a state income tax that ranges between 1000 and 5750. Form 500 individual income tax return.

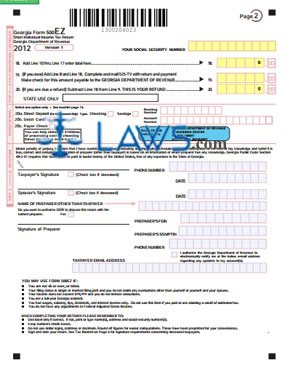

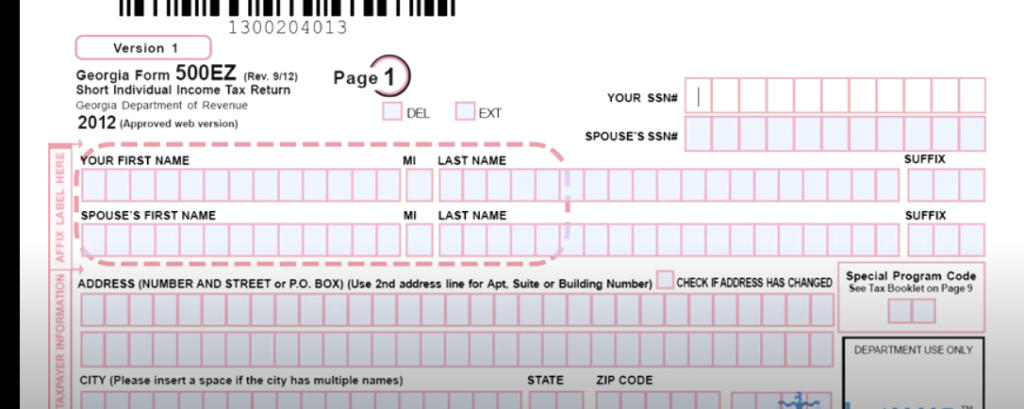

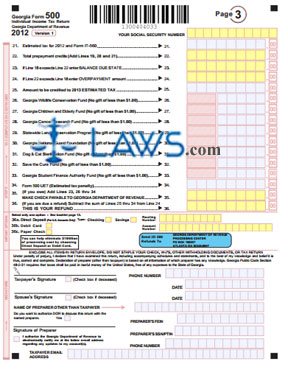

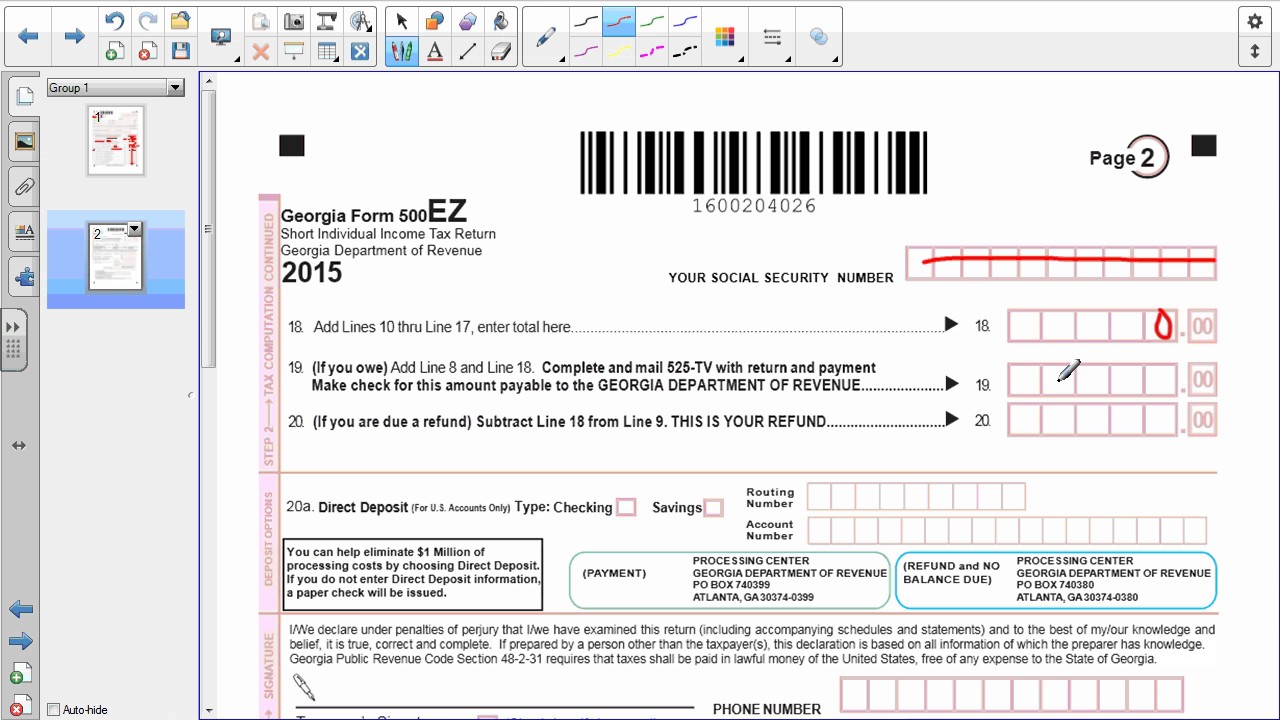

Some internet browsers have a built in pdf viewer that may not be compatible with our forms. Your social security number. Georgia state income tax form 500 must be postmarked by july 15 2020 in order to avoid penalties and late fees.

Estimated tax for individuals. The georgia income tax rate for tax year 2019 is progressive from a low of 1 to a high of 575. Filing requirements for full and part year residents and military personnel.

Income short form 500 ez. Georgia tax center help individual income taxes register new business business taxes refunds information for tax professionals. Ndividual income tax return.

Search for income tax statutes by keyword in the official code of georgia. The current tax year is 2019 with tax returns due in april 2020. For individuals the 1099 g will no longer be mailed.

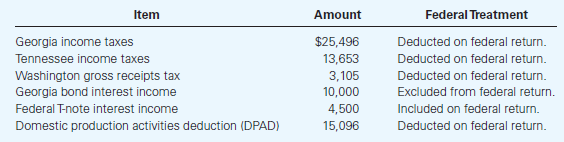

This 1099 g form is for taxpayers who itemized deductions and received a refund credit or offset. This years individual income tax forms. The georgia individual income tax is based on the taxpayers federal adjusted gross income adjustments that are required by georgia law and the taxpayers filing requirements.

This years individual income tax forms common tax forms income tax forms instructions it 511 booklet income tax form 500. Form 1040 es is used by persons with income not subject to tax withholding to figure and pay estimated tax.

.jpg)