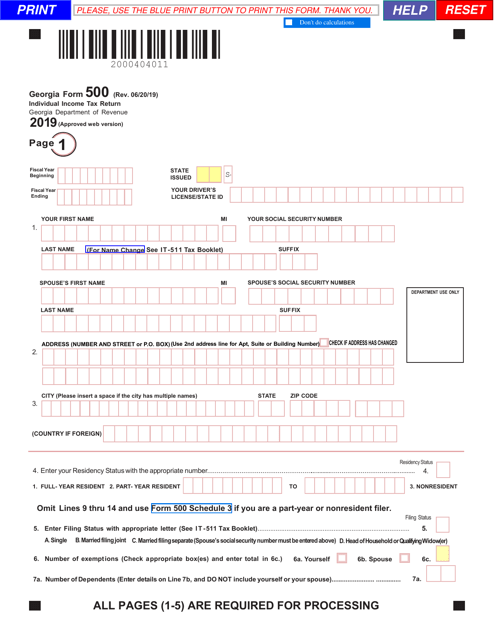

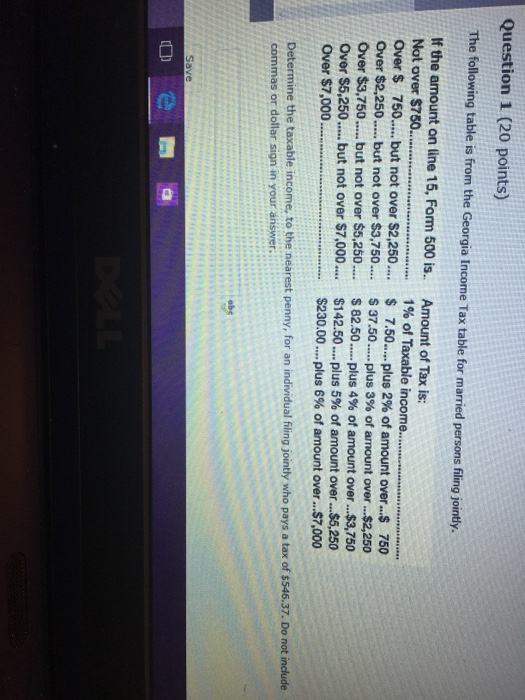

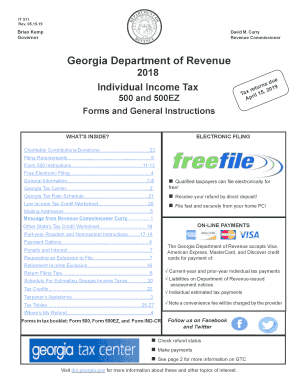

Georgia Income Tax Forms 500

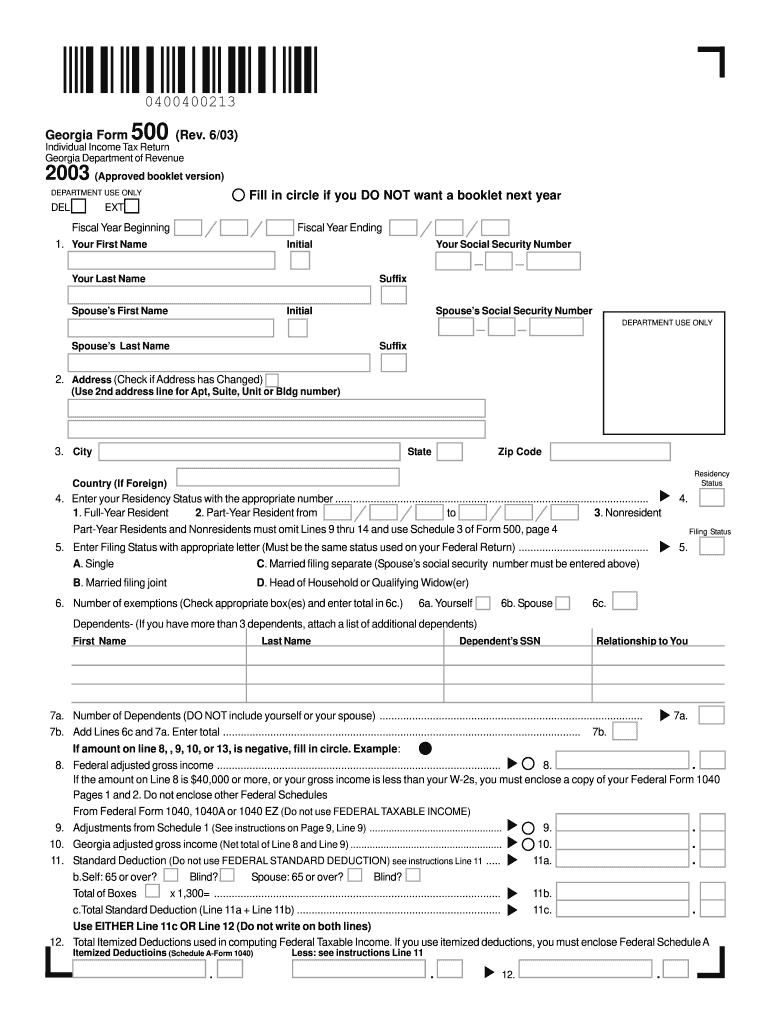

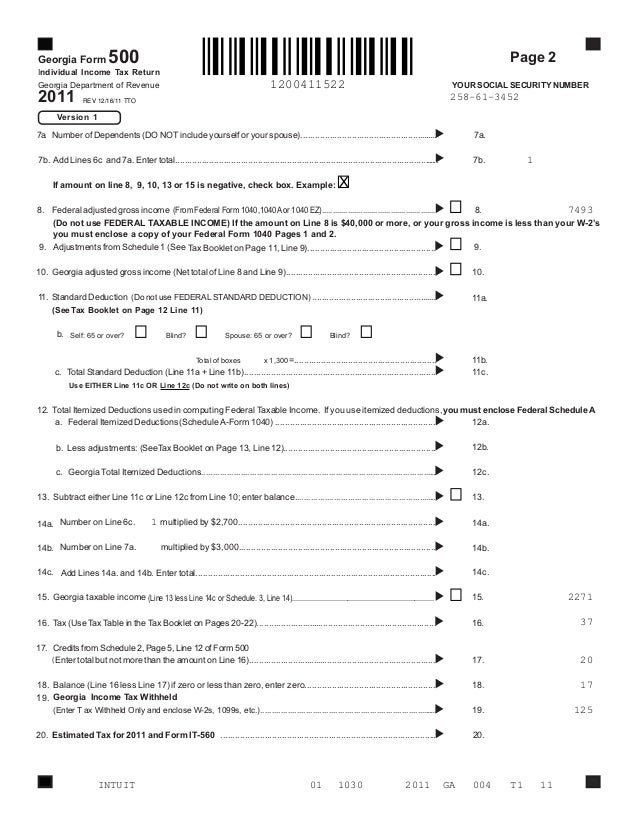

Income tax form 500.

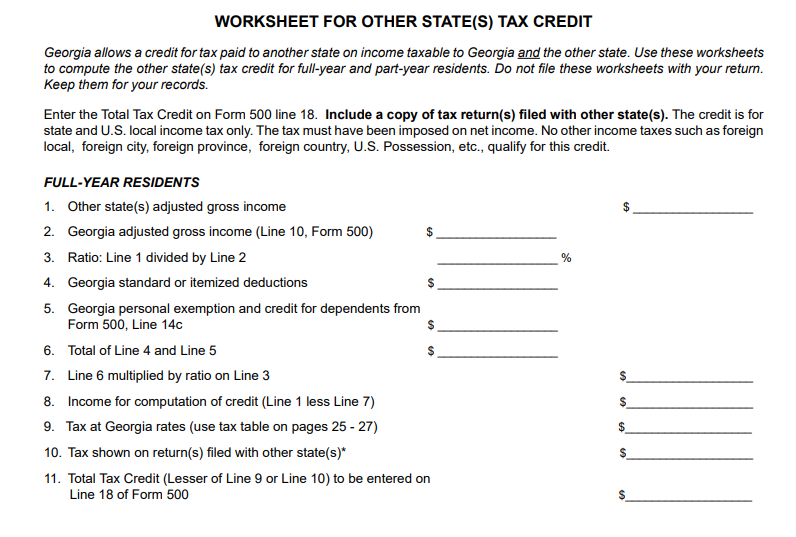

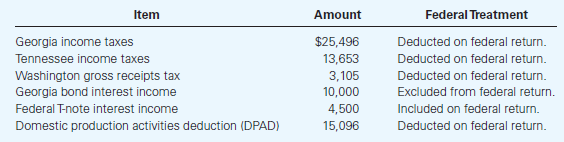

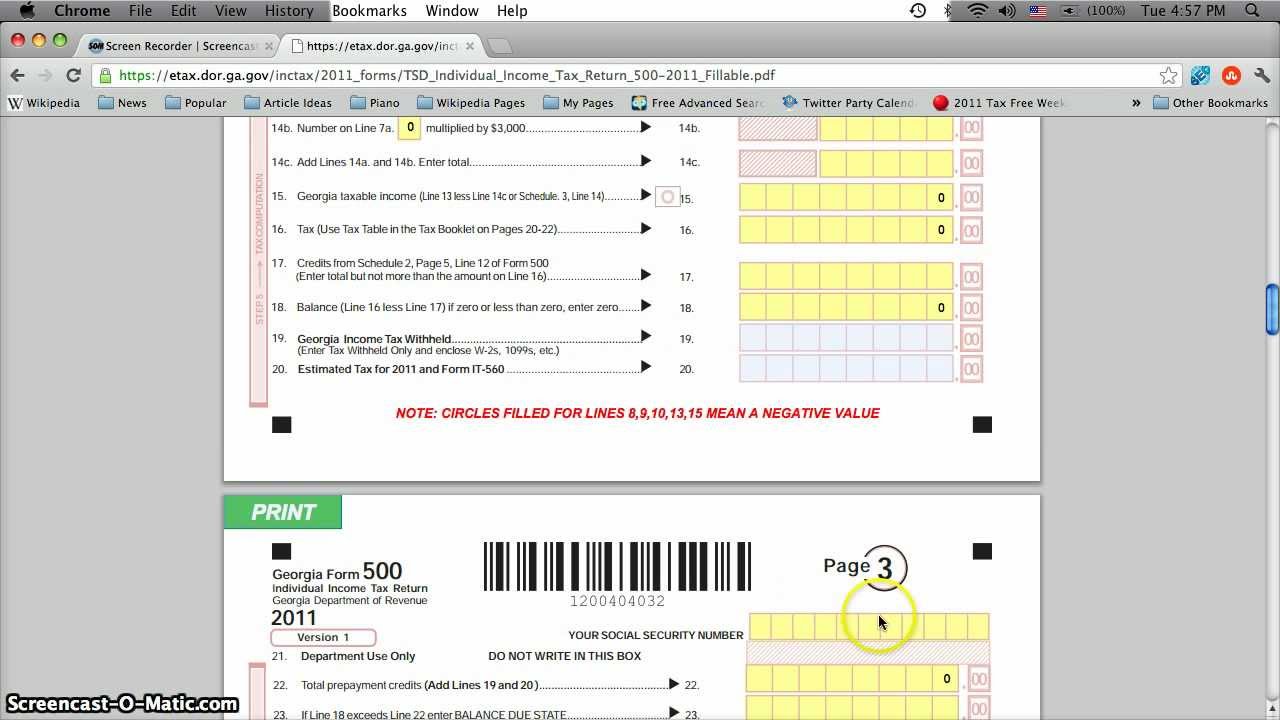

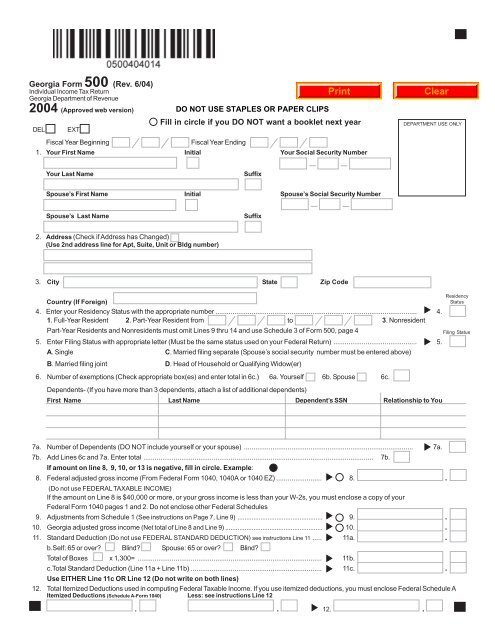

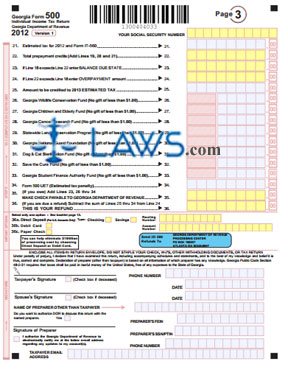

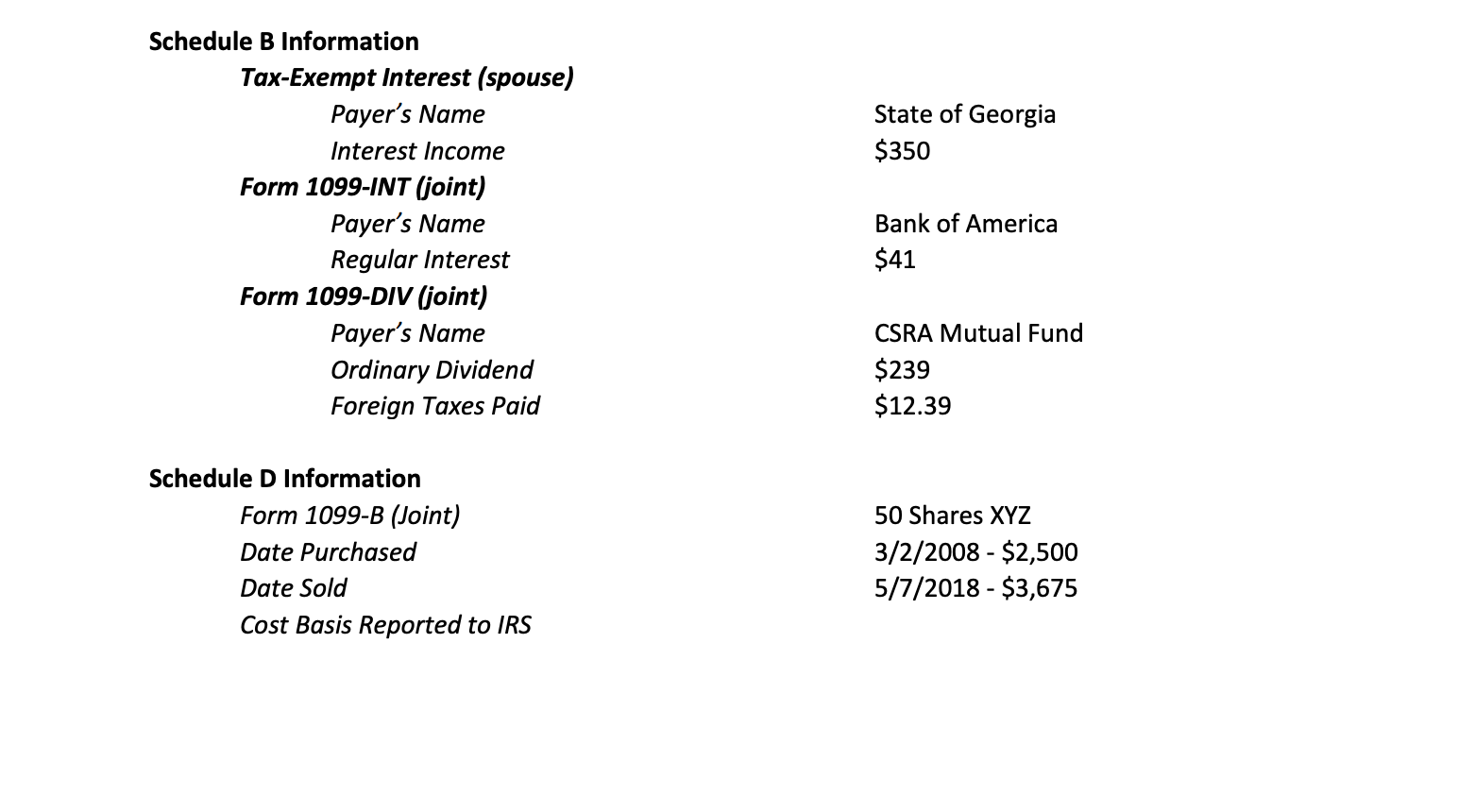

Georgia income tax forms 500. 500 nol net operating loss adjustment this form is for a net operating loss carry back adjustment by an individual or fiduciary that desires a refund of taxes afforded by carry back of a net operating loss. Georgia form 500 is used by full year part year and nonresidents to file their state income tax return. Payment voucher form 525 tv estimated tax payment form 500 es individual income tax credit.

The purpose of form 500 is to calculate how much income tax you owe the state. Georgia tax center help individual income taxes register new business business taxes refunds information for tax professionals. Form 500 is the general income tax return form for all georgia residents.

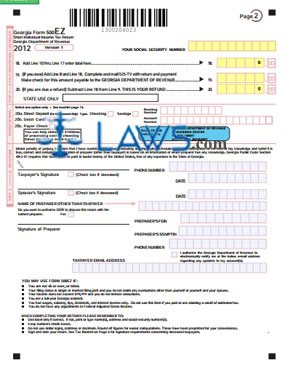

500 ez individual income tax return to successfully complete the form you must download and use the current version of adobe acrobat reader. To successfully complete the form you must download and use the current version of adobe acrobat reader. Your social security number.

Georgia trucking portal forms alcohol tobacco alcohol tobacco enforcement excise taxes online services rules policies. This form is for income earned in tax year 2019 with tax returns due in april 2020. Contains 500 and 500ez forms and general instructions.

We will update this page with a new version of the form for 2021 as soon as it is made available by the georgia government. Download and save the form to your local computer. Taxpayers with simple returns have the option to use ga form 500ez short individual income tax return.

Georgia department of revenue. Income short form 500 ez. Ndividual income tax return.

More about the georgia form 500 tax return we last updated georgia form 500 in february 2020 from the georgia department of revenue.

Https Www Fultoncountyga Gov Media Forms Human Resources Forms Human Resources W4 And Financial Docv2 Final Ashx