Georgia Income Tax Calculator

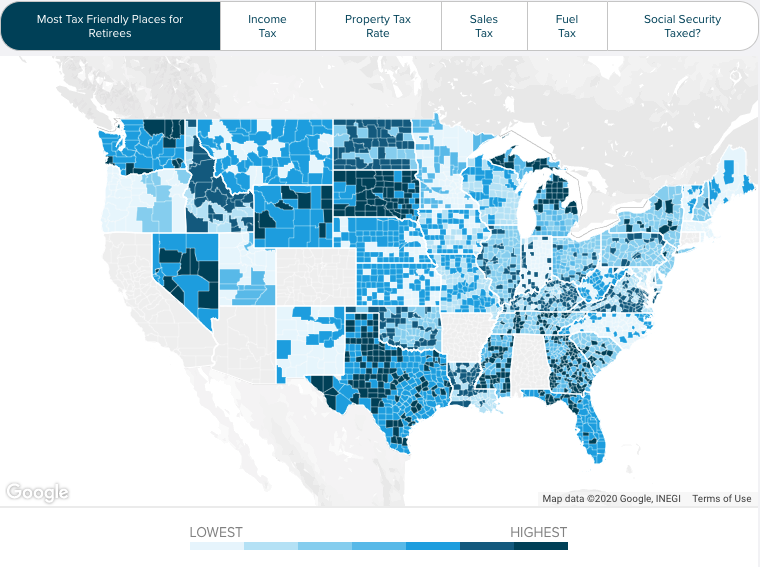

Al ak az ar ca co ct de fl ga hi id il in ia ks ky la me md ma mi mn ms mo mt ne nv nh nj nm ny nc nd oh ok or pa ri sc sd tn tx ut vt va wa wv wi wy.

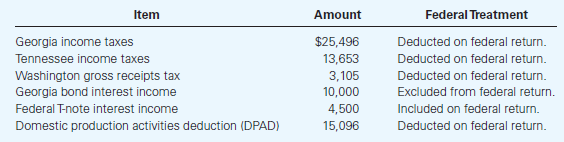

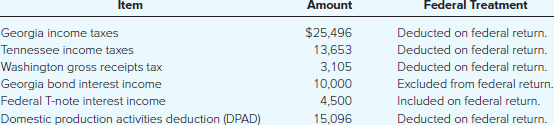

Georgia income tax calculator. Using deductions is an excellent way to reduce your georgia income tax and maximize your refund so be sure to research deductions that you mey be able to claim on your federal and georgia tax returns. Yes georgia residents do pay personal income tax. Using our georgia salary tax calculator.

Answer a few simple questions about your life income and expenses and our free tax refund estimator will give you an idea of how much youll get as a refund or owe the irs when you file in 2020. Search for income tax statutes by keyword in the official code of georgia. This years individual income tax forms.

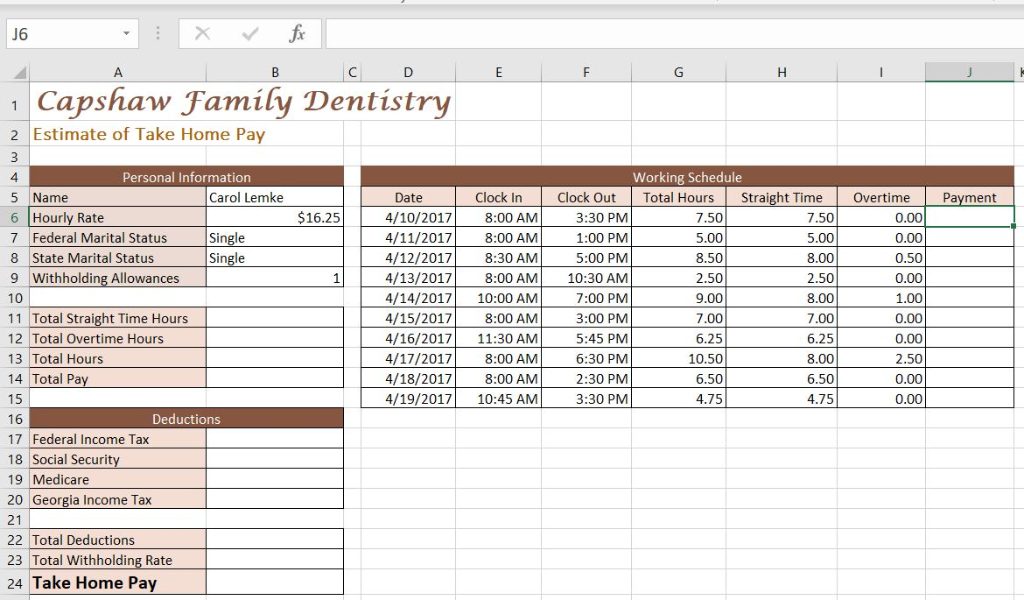

To use our georgia salary tax calculator all you have to do is enter the necessary details and click on the calculate button. After a few seconds you will be provided with a full breakdown of the tax you are paying. Your average tax rate is 2210 and your marginal tax rate is 3565this marginal tax rate means that your immediate additional income will be taxed at this rate.

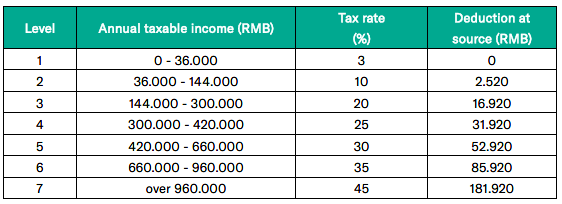

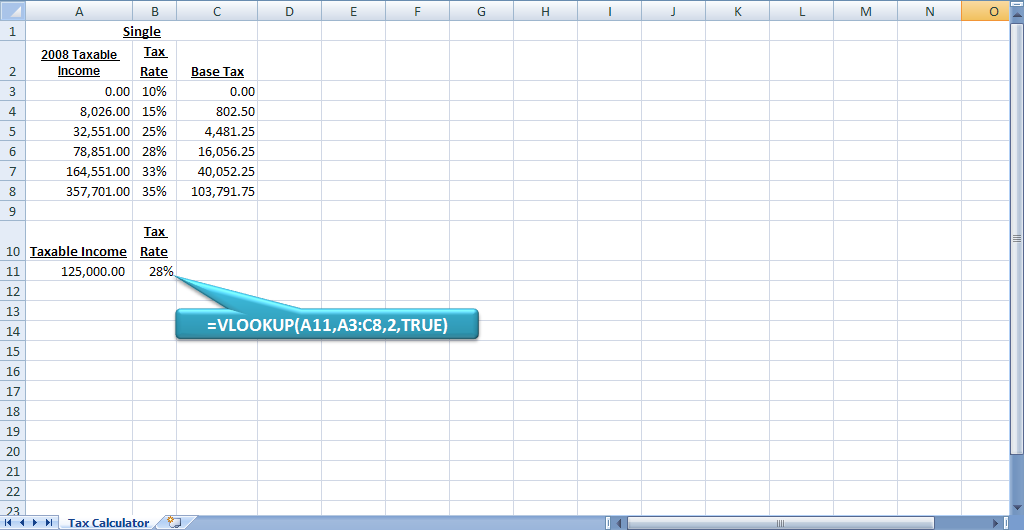

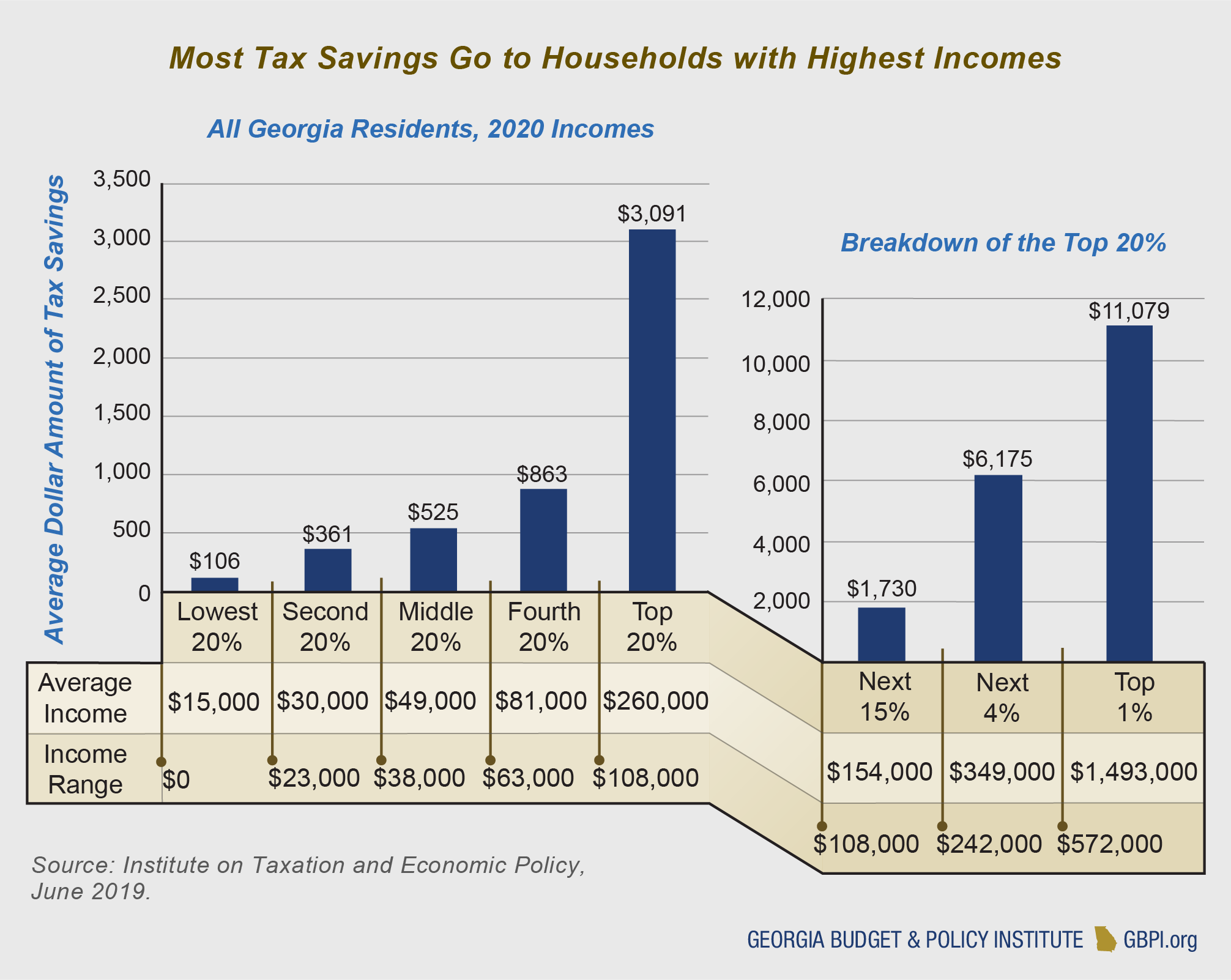

Income tax calculator estimate your 2019 tax refund. Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575. Filing requirements for full and part year residents and military personnel.

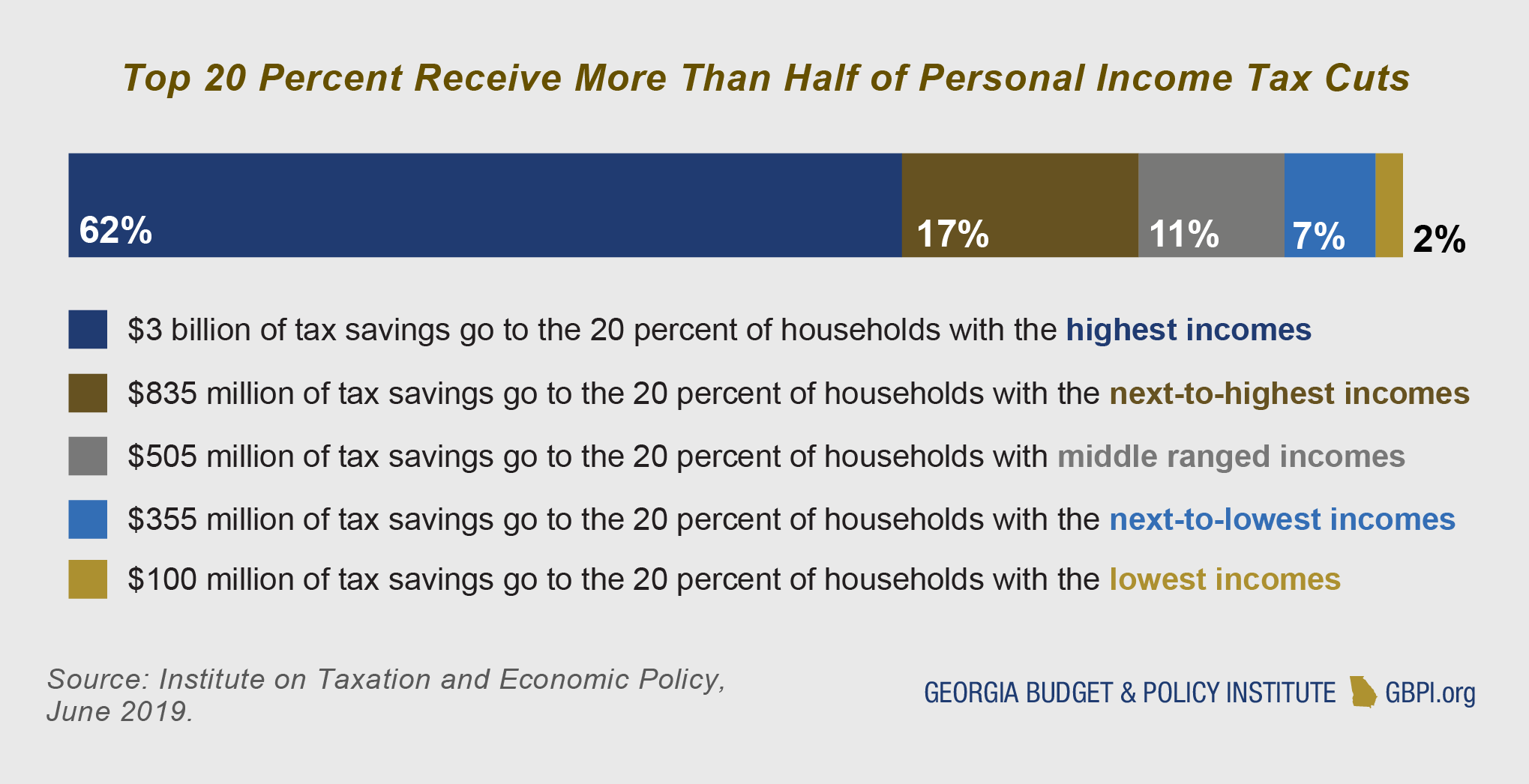

Peach state residents who make more money can expect to pay more in state and federal taxes. Use the georgia salary calculator to see the impact of income tax on your paycheck. This breakdown will include how much income tax you are paying state taxes federal.

There are no local income taxes in georgia. Georgia utilizes a relatively simple progressive income tax system with rates ranging from 100 to 575. Does georgia have personal income tax.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. If you make 55000 a year living in the region of georgia usa you will be taxed 12154that means that your net pay will be 42846 per year or 3571 per month. Filing state taxes the basics.

Higher earners pay higher rates although georgias brackets top out at 7000 for single filers which means the majority of full time workers will pay the top rate. The georgia income tax calculator is designed to provide a salary example with salary deductions made in georgia. You can choose an alternate state tax calculator below.

2019 georgia tax tables with 2020 federal income tax rates medicare rate fica and supporting tax and withholdings calculator.