Georgia Income Tax Calculator 2020

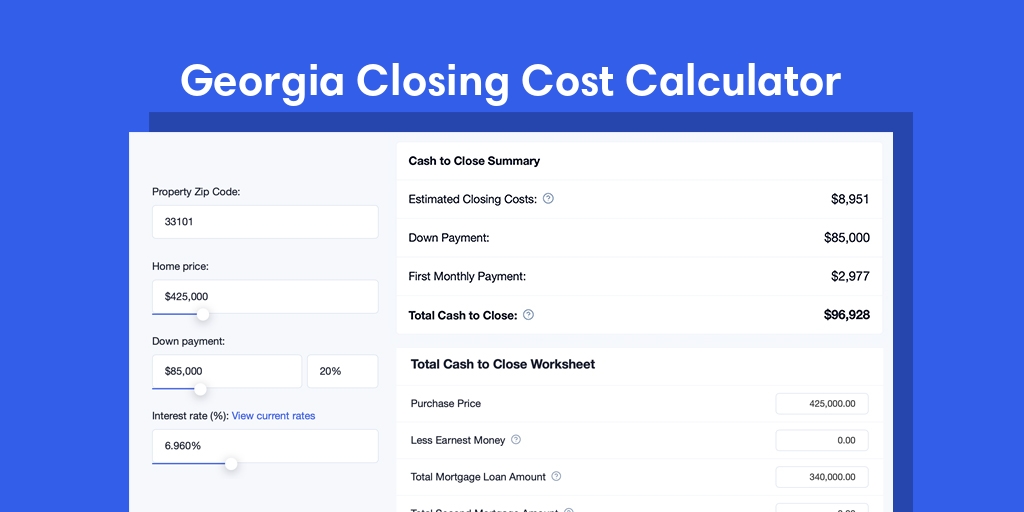

Answer a few simple questions about your life income and expenses and our free tax refund estimator will give you an idea of how much youll get as a refund or owe the irs when you file in 2020.

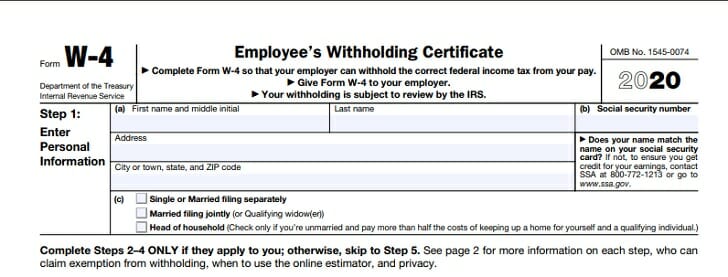

Georgia income tax calculator 2020. The ga tax calculator calculates federal taxes where applicable medicare pensions plans fica etc allow for single joint and head of household filing in gas. Does georgia have personal income tax. The georgia salary calculator is a good calculator for calculating your total salary deductions each year this includes federal income tax rates and thresholds in 2020 and georgia state income tax rates and thresholds in 2020.

For married couples who file jointly the tax rates are the same but the income brackets are higher at 1 on your first 1000 and at 575 if your combined. These services are provided only by credentialed cpas enrolled agents eas or. 2020 georgia tax tables with 2020 federal income tax rates medicare rate fica and supporting tax and withholdings calculator.

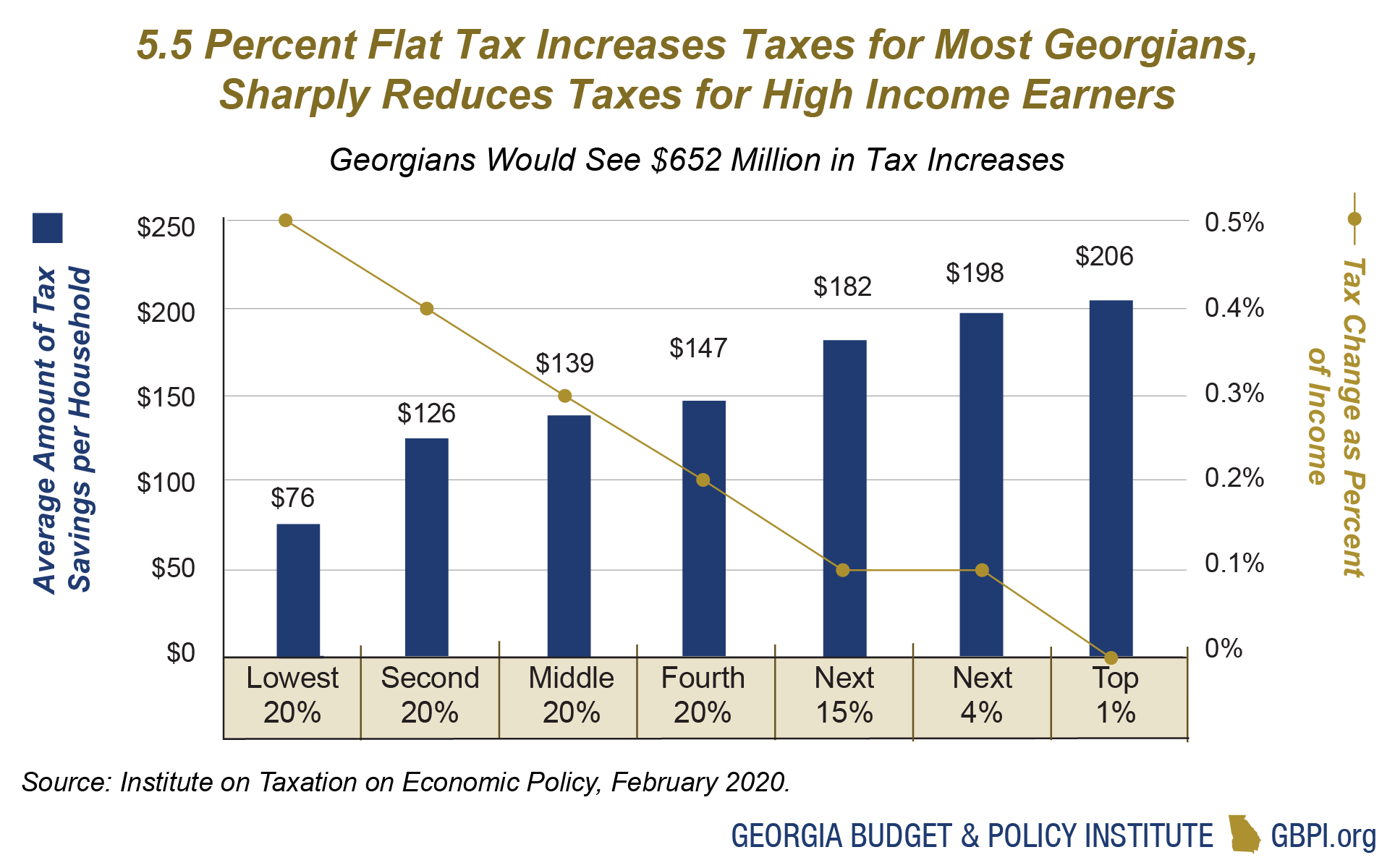

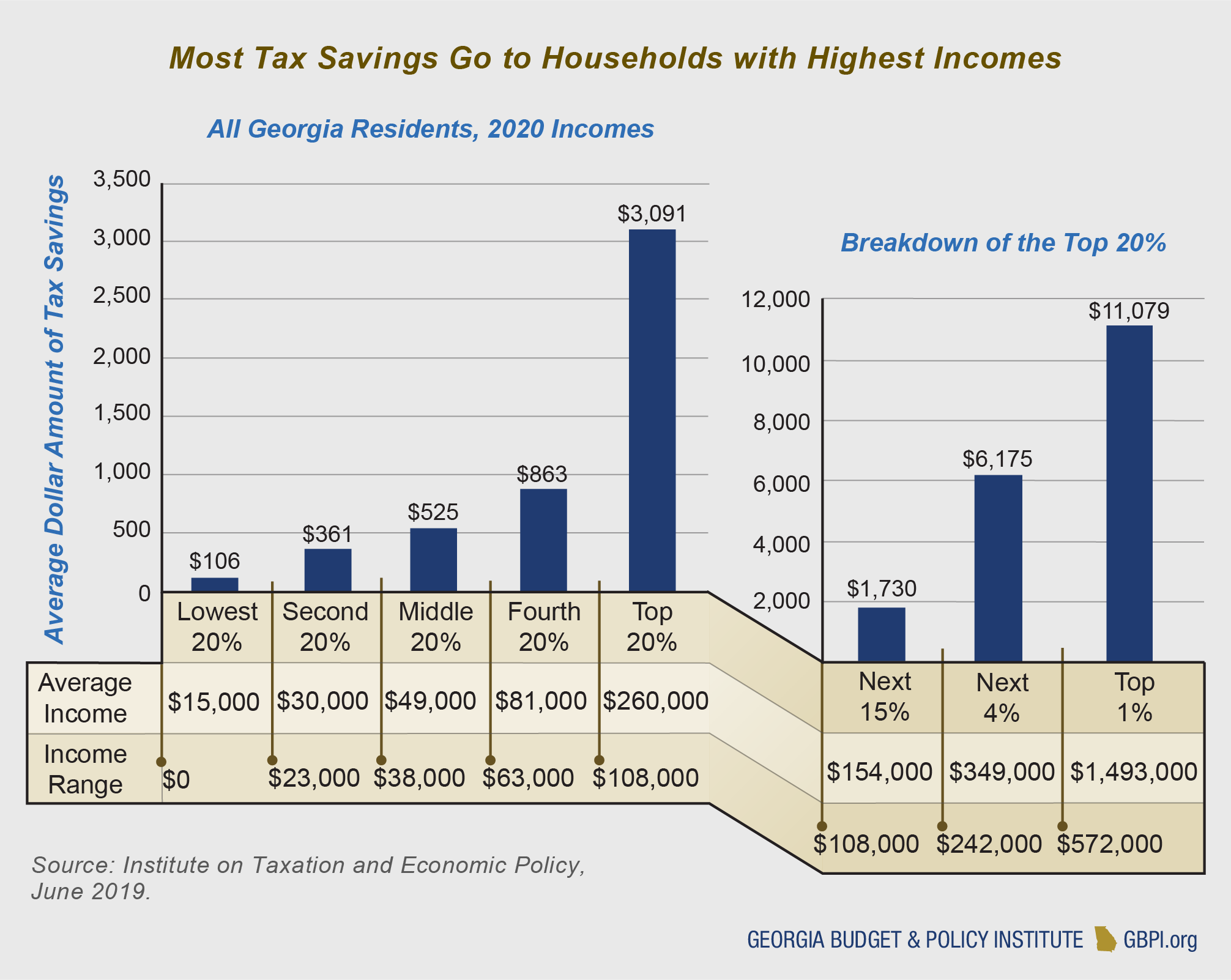

Tax advice expert review and turbotax live. Yes georgia residents do pay personal income tax. Before the official 2020 georgia income tax rates are released provisional 2020 tax rates are based on georgias 2019 income tax brackets.

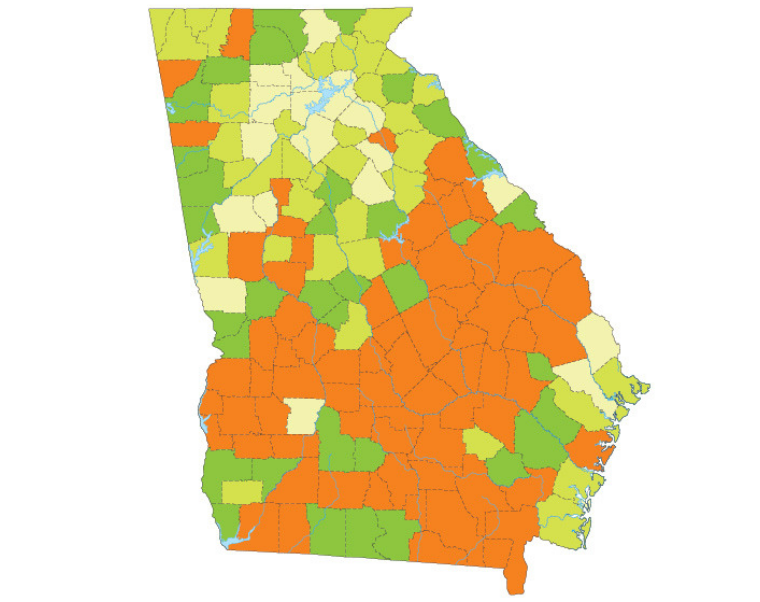

Income tax calculator estimate your 2019 tax refund. The georgia tax code has six different income tax brackets based on the amount of taxable income. Georgia tax forms are sourced from the georgia income tax forms page and are updated on a yearly basis.

Access to tax advice and expert review the ability to have a tax expert review andor sign your tax return is included with turbotax live or as an upgrade from another version and available through december 31 2020. The marginal rate rises to 3 on income between 2250 and 3750. 4 on income between 3750 and 5250.

The 2020 state personal income tax brackets are updated from the georgia and tax foundation data. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Our calculator has recently been updated in order to include both the latest federal tax rates along with the latest state tax rates.

Details of the personal income tax rates used in the 2020 georgia state calculator are published below the calculator. Georgia salary tax calculator for the tax year 202021 you are able to use our georgia state tax calculator in to calculate your total tax costs in the tax year 202021. Use the georgia salary calculator to see the impact of income tax on your paycheck.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Also we separately calculate the federal income taxes you will owe in the 2019 2020 filing season based on the trump tax plan. And finally 575 on all income above 7000.